Do you know that you can trade more confidently once you understand the ABCD pattern? This method enables beginner traders to understand movements in crypto charts when making a day trading decision.

The ABCD pattern trading enables you to buy and sell cryptos effectively since patterns serve as a good indicator of price moves. Once you identify the patterns, you can place big or small trades without a doubt.

So, if you’re ready to maximize profits with the ABDC chart pattern, keep reading for more details.

ABCD Pattern Trading: How Does It Work?

Every ABCD pattern trading comes in both bearish and bullish versions. The bearish versions come in an ascending pattern, indicating the opportunity to sell or short trades. On the other hand, when the ABCD pattern descends, it represents the bullish version, which signifies opportunities to go long or buy.

Each ABCD pattern turning point indicates a high or low of a trend on a price chart. The points come in three legs and show consecutive trends or price swings. The pattern legs are AB, CD, and BC (the correction or retracement).

In the bearish ABCD chart pattern, when there is an uptrend, it signals a bearish market reversal to the lower points. If you're an aggressive trader, you will consider initiating a short trade near point D and placing a stop-loss order above point D. For conservative traders; it is safer to confirm a trend change when the price falls below point C before making the short trade.

But when the bullish ABCD chart pattern emerges, the price movement starts to spiral downwards, indicating an upside market reversal. At this point, aggressive traders buy near point D since they believe it's a starting point for an uptrend. But conservative traders will wait for the price to move above point C before buying.

Additional Tip: To gain more from ABCD pattern trading, pay attention to the market reversal signal, which is an increasingly high volume as the market moves from D to the opposite direction of the former trend. Also, when the pattern moves from point C to D, there must be a relatively low volume.

Bullish ABCD Pattern

A bullish ABCD pattern on a trading chart starts from point A, the beginning of a high point, and ends at point D, the lowest point.

In the bullish ABCD Pattern, as shown above, point A will be the starting point of the price movement, which is usually a high swing. Then point B represents the intraday low while point C represents an upward price correction. Finally, the swing arrives at point D, the lower point than B, indicating a buying point.

Note: when the ABCD chart pattern is bullish, a trader can place the stop-loss order below point D and stay on the trade until the crypto price reaches point C.

Identifying A Bullish Trend With The ABCD Pattern

A bullish ABCD pattern starts from a high A point. Then the trend comes low to point B, indicating the first low price. From point B, the pattern climbs to C, a high price but not as high as A. Then, the pattern will end at D being the lowest low point where a trader is expected to buy.

A simple indicator is that when the pattern is bullish, Point C is lower than point A and point D must also be lower than point B.

ABCD Pattern Trading Rules For Bullish Trend

- To find AB, point A on the pattern is usually high while point B is always low. Then when the pattern moves from point A to Point B, there won't be a high price trend above A. Also, there will be no low trend below point B.

- You must follow the pattern to find BC if the leg is on AB. Note, point C must be slightly more than A. When the pattern moves from point B to C, there won't be a low price below B, and there won't be a high price above C. Usually, point C is 61.8% of point AB or 78.6%. If the market is strongly trending, leg BC might be 38 or 50% of leg AB.

- If the movement is at BC retracement, draw leg CD. Note that point D on the pattern will be at a lower point than B. When the pattern moves downwards from point C to point D, there will be no high price at C and no low price below D.

To determine the price at point D, the price at CD might equal the price at AB. The time for CD and AB may be equal to identify the time when D will complete.

- Always look out for Fibonacci sequence, trend convergence, and pattern.

- Also, watch out for wide-ranging bars, price gaps, or candles in leg CD when the market movement is approaching point D.

Bearish ABCD Pattern

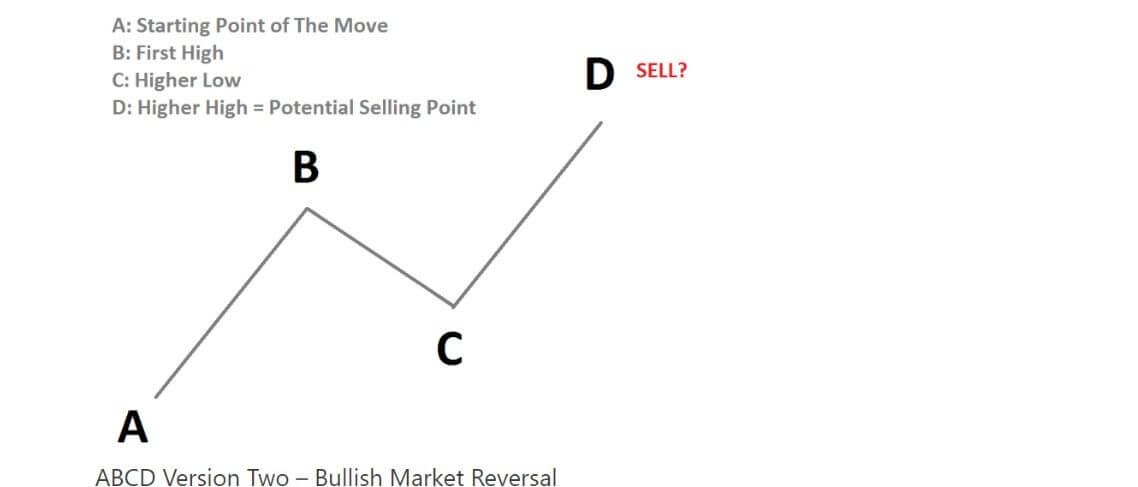

On the graph above, the bearish ABCD pattern starts moving upward from point A and reaches a high intraday price at point B. Then the second leg moves downside from point B to C, representing a low swing higher than point A. Then the final price movement starts from point C to D, a higher swing above B where you must sell.

If the ABCD pattern is bearish, a trader should short the crypto pair. The stop-loss must be above point D, and he must remain there until the crypto price reaches point C.

Identifying A Bearish ABCD Pattern?

To identify the bearish ABCD pattern trading, check the starting point. It moves from point A, which is usually at the lowest position. Then it rises a bit to point B marking the first high point on the graph. From that point, it comes down to point C, the low level, and finally rises to point D, the highest point where traders must sell.

Bearish ABCD Pattern Rules

- To find leg AB, look for where Point A is low, and point B is high. Check the movement from A to a climb up the B point, there won't be low prices below A, and there won't be high prices above the B point.

- To find the BC point after identifying AB, point C will be significantly higher than A, and when the trend is moving from B to low C, there won't be high prices above B and low prices below the C point.

- After identifying BC, you can draw a CD. But note that point D must be above the B point, and when the trend moves from C to the highest point D, you won't find low prices below C or high prices above D.

To identify where the D price will be, both CD and AB prices must be equal. Also, to identify the time when the D point will be complete, CD time and AB time will be equal.

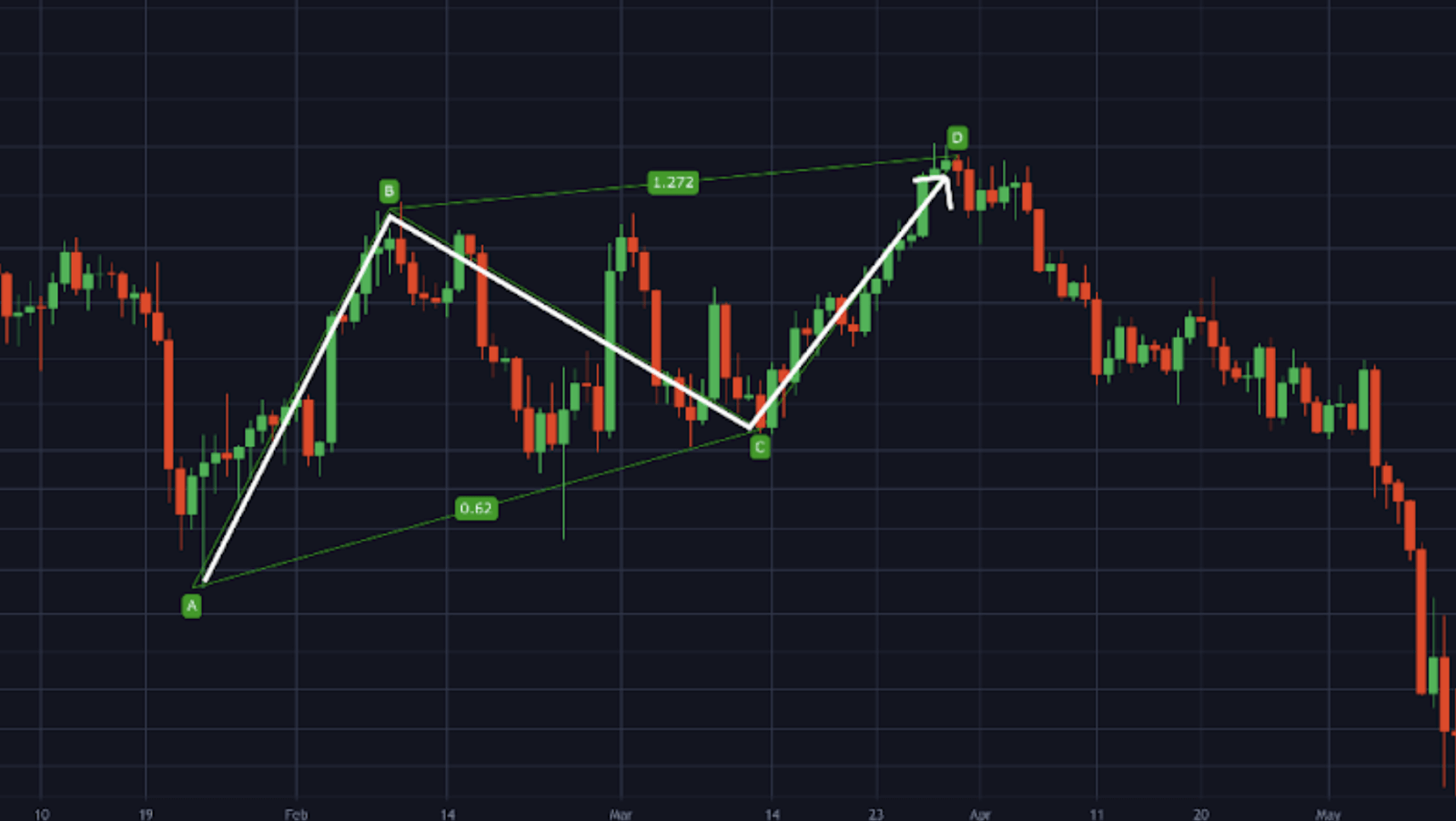

ABCD Pattern Example In Crypto Trading

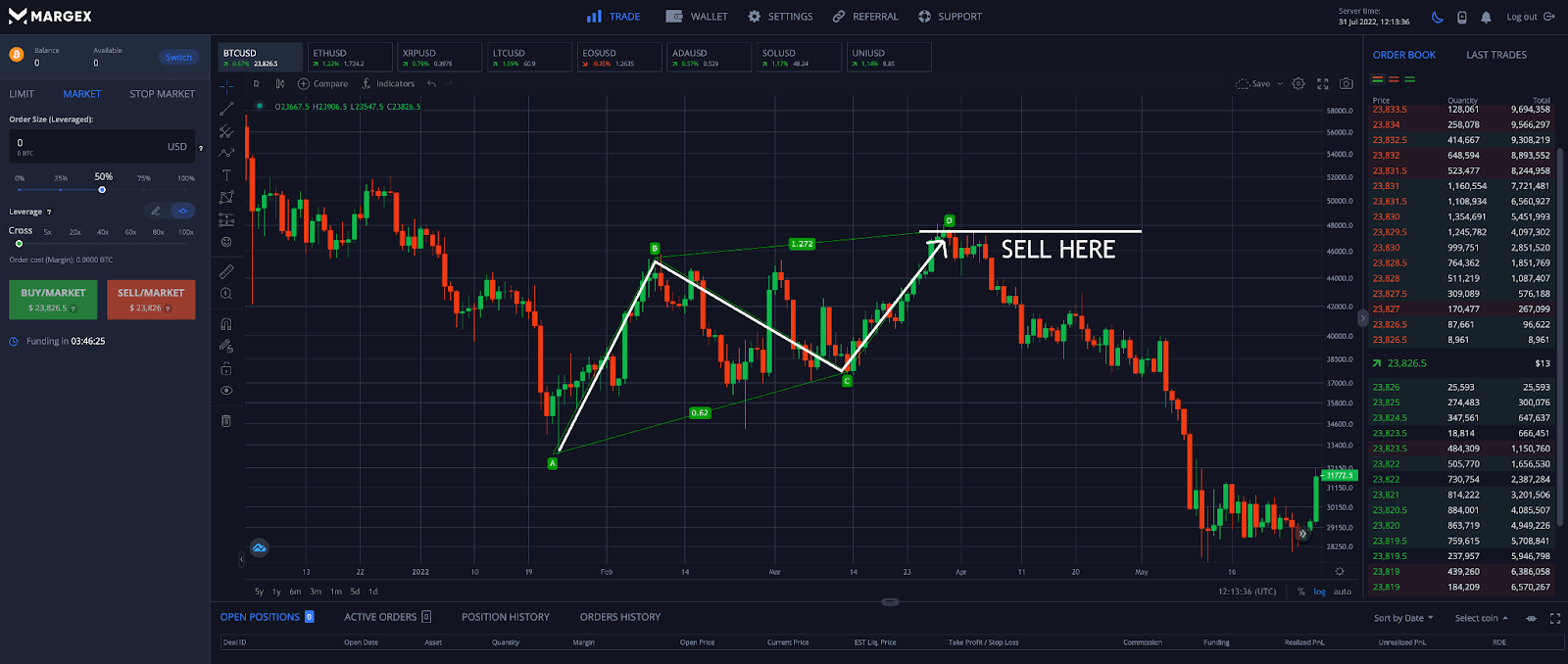

In the below example, the Bitcoin price formed an ABCD pattern at the beginning of 2022. The pattern took a full four months to develop, beginning at the AB wave. Price then retraced via the BC leg, eventually rising to complete the pattern at the conclusion of the CD leg. After the pattern was completed and the Fibonacci ratios satisfied, Bitcoin price plummeted and broke down through the previous trading range.

A Step-By-Step Guide To Using The ABCD Trading Pattern on Margex

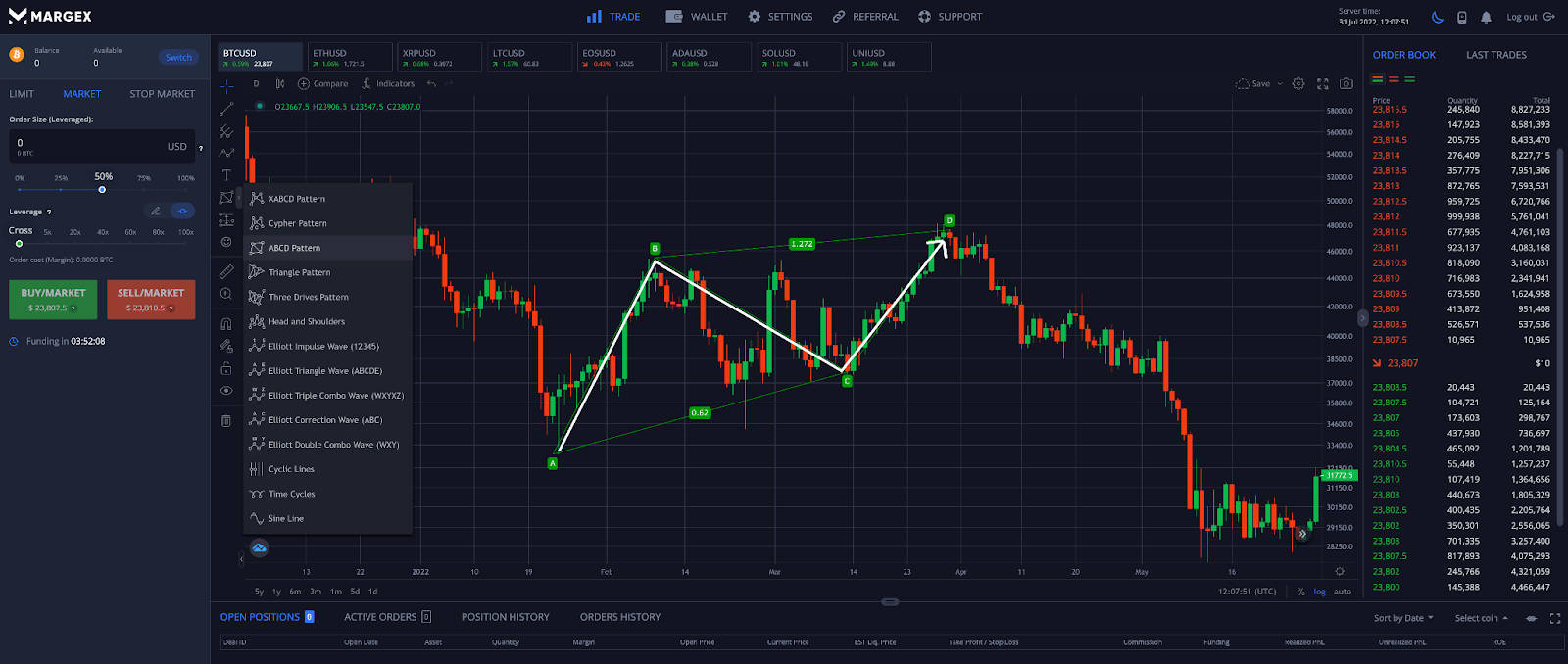

Margex is a beginner-friendly derivatives trading hub for digital assets. Margex offers access to built-in technical analysis tools to allow traders to easily chart the ABCD pattern and potentially take action based on its signals.

Here is how to trade the ABCD pattern with Margex:

Step 1 - Use the built-in ABCD pattern drawing tool to find ABCD patterns in crypto. Ensure that the Fibonacci ratios properly fit the harmonic trading pattern.

Step 2 - With the bearish ABCD pattern properly identified, a trader can choose to take a position. A sell order should be placed after reaching the 1.272 Fibonacci extension at the D point of the pattern.

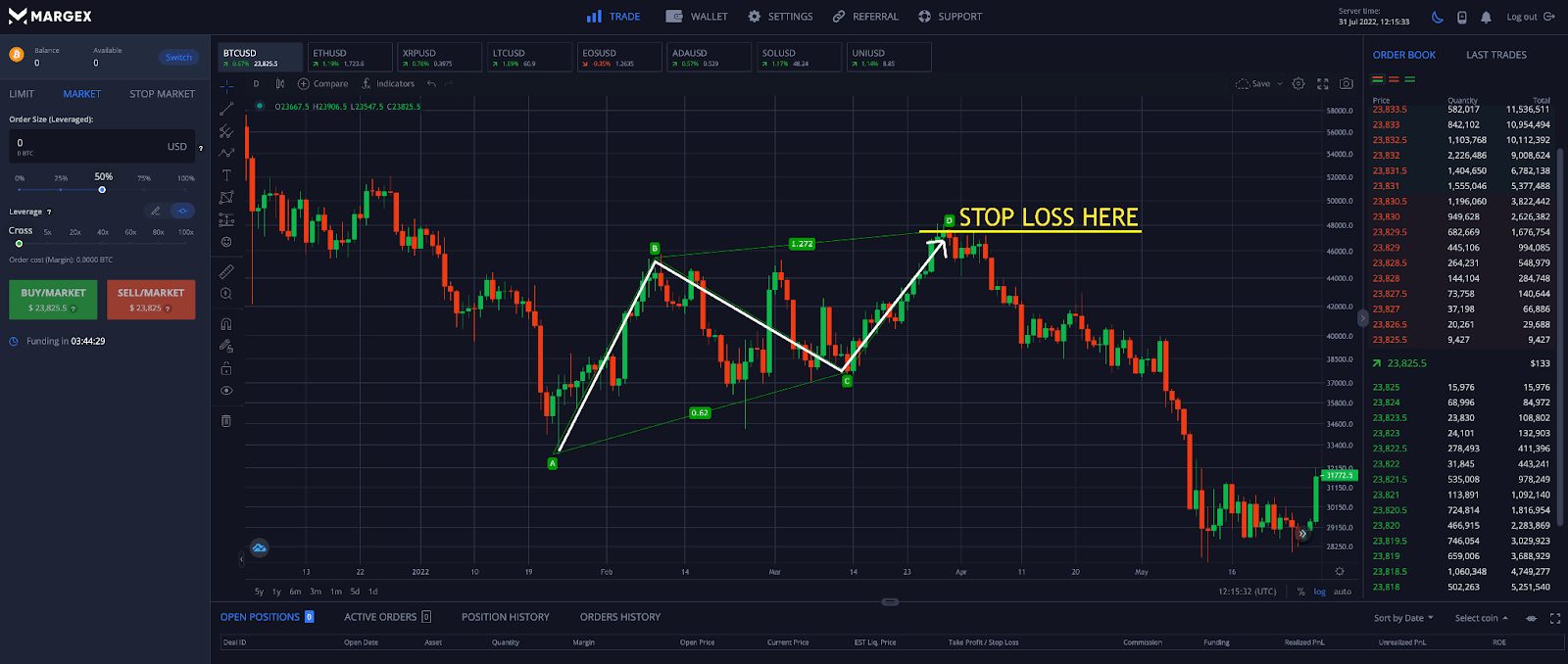

Step 3 - Traders should place a stop loss order above the high of the D-point to protect against unwanted drawdowns in case the market continues to move up and the pattern is invalidated. A stop loss order is a critical piece of any risk management and trading strategy.

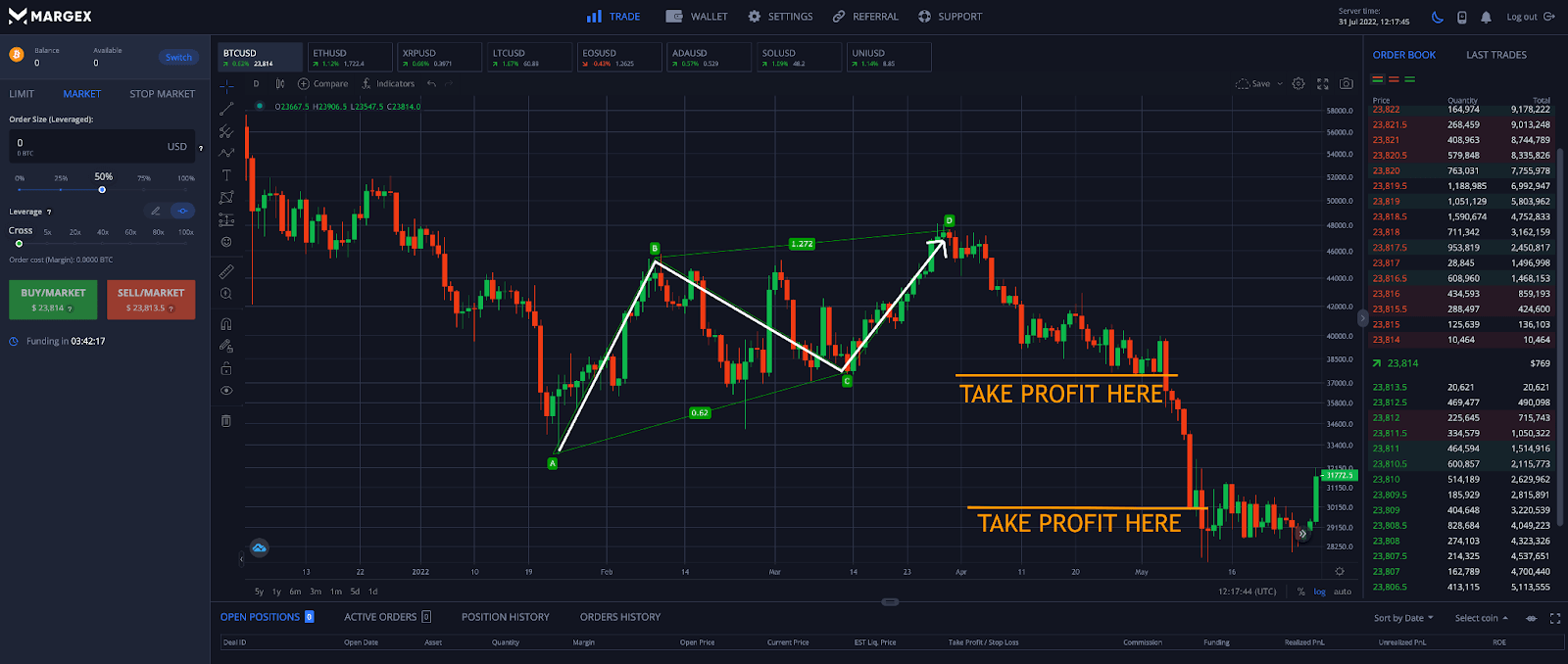

Step 4 - Profit can be taken at predetermined levels for the highest probability of success. The first target of the pattern would be to retrace back to the C-point of the pattern. A more aggressive price target would be beyond the origin of the pattern’s A-point.

ABCD Pattern Trading FAQ

Find the answers to your questions on the ABCD Trading pattern and how to utilize the method effectively.

How do you know a bullish ABC pattern?

A bullish ABCD chart pattern indicates a crypto chart's end of a downtrend. The pattern starts at a high point A and moves slightly lower to point B, which is usually the intraday low. Then the pattern goes upward to point C, where the price corrects a bit but won't get as high as Point A. Finally, the pattern reaches Point D, which is usually lower than B. This point is an indication that the downtrend has ended. Traders are expected to buy at Point D on the bullish trend in anticipation of making a profit as the trend reverses.

How does a bearish ABC pattern move?

A bearish ABCD chart pattern indicates the beginning of an upward trend, indicating an opportunity to sell or short. The crypto pattern starts from a low price at point A and moves upward to point B, a high intraday price. From that point, the price moves slightly to point C, indicating a price correction. But the price movement down won’t get as low as point A. After hitting point C, the trend moves upward to point D, an intraday-high above point B. Here, traders are expected to sell. At Point D also, the uptrend ends and introduces a downtrend, indicating the beginning of a bullish ABCD pattern.

How can I trade an ABCD harmonic pattern?

The first step to trading the pattern is identifying the ABCD chart pattern. Then draw the pattern on the trading chart. Afterward, pinpoint the correct levels for the entry points, take profit orders, and set stop loss.

Afterward, you have to calculate the pattern lines and the Fibonacci ratios, which is where it gets complicated. But luckily, you can use an ABCD indicator, normally integrated into many new trading platforms. The indicator will draw the pattern automatically.

After the drawing, find point D and enter a trading position opposite the CD line. But to be on the safe side, first, analyze the crypto's price action and the prevailing market conditions and conduct other fundamental analyzes before taking a position.

Is the ABCD pattern reliable?

The ABCD pattern is a reliable tool that beginners can depend on when trading in the financial market. It works best when combined with chart indicators and other tools. Identifying patterns on a chart can help a new trader easily recognize buying and selling points.

The pattern shows the time and distance it will take for a price to move from one point to another on a chart. With the Fibonacci chart tool, you can easily identify existing proportions between leg AB and CD. Once you identify these proportions, you can estimate the ABCD pattern path and identify the entry and exit points.

Also, to improve the reliability of this pattern, you can use different momentum-based chart indicators such as oscillators and overlays.