There are a lot of blockchain projects out there and finding a good asset to stick to can be tricky for traders. You may have heard of Cardano, one of the most unique and sophisticated decentralized blockchain projects to enter the crypto scene. Are you thinking of investing in Cardano (ADA)? If so, you need to read this first.

In this post, we'll take a look at what Cardano is and how it works. We'll explore the unique features that set Cardano apart from other blockchains. We’ll look at some Cardano price predictions. Lastly, we’ll answer the question, “Is Cardano (ADA) a good investment?”

What is Cardano (ADA)?

Launched in 2017 by Charles Hoskinson, a co-founder of Ethereum, Cardano prides itself as one of the most unique and popular blockchains in the world of cryptocurrencies. It's unique in that it's built on scientific philosophy and peer-reviewed academic research.

Cardano, like every other blockchain, has its own native token called ADA that is used to send and receive digital funds, as well as execute smart contracts on the platform.

With a market cap of more than $15 billion, ADA is the largest cryptocurrency that uses a proof-of-stake algorithm at the moment.

ADA operates on the settlement layer within the Cardano platform. This layer operates like Bitcoin and keeps track of transactions. The second layer is the computation layer which allows smart contracts and applications to operate on the platform.

What Are The Uses Of Cardano (ADA)?

According to a tweet by Charles Hoskinson, Cardano is an open platform that seeks to provide economic identity to the billions who lack it by providing decentralized applications to manage identity, value, and governance.

Cardano's primary application is in decentralized finance. Since the introduction of smart contracts in Cardano in 2021, ADA has been used in the development of many decentralized applications. Other use cases of Cardano include various sectors like education, retail, agriculture, government, finance, and healthcare.

In the education sector, for instance, Cardano's Atala PRISM grants students ownership and control over their academic credentials. It also uses blockchain technology to help governments and financial institutions provide better systems for the issuance and verification of credentials.

In the healthcare and retail sectors, Cardano's Atala SCAN provides a tamper-proof system to counter counterfeit medicines and other products.

Last but not least, the agricultural sector can also use Cardano's Atala Trace and EMURGO's proprietary traceability solution for transparency in supply chains.

Fundamental Analysis Of Cardano (ADA)

When it comes to Cardano, there's a lot of speculation going on as to whether or not it's a good investment. So, let's take a closer look at the fundamentals and see what we can determine.

Since the birth of its concept in 2015, the Cardano team has done quite well with creating a sustainable, secure and scalable blockchain that can be used by businesses and governments around the world. ADA is essential to achieving this goal, and the team is working hard to make it a valuable asset for anyone looking to use blockchain technology.

The Cardano blockchain provides an excellent framework for the development of smart contracts, decentralized apps, and the creation of fungible and non-fungible tokens. However, unlike other blockchains, tokens on Cardano are not created with smart contracts. Instead, they exist on the ledger as native tokens.

Another perk is that its community members can get their project proposals funded through Cardano's Project Catalyst Ideascale. Other members can earn ADA rewards by voting on proposals and delegating ADA to existing pools. These are excellent factors that contribute to the cryptocurrency's intrinsic value.

Technical Analysis Of Cardano (ADA)

When it comes to the technical analysis of Cardano (ADA), there are a few key things to keep in mind. For one, ADA's price is largely influenced by market sentiment. In other words, when traders are feeling positive about Cardano's prospects, the price will go up, and vice versa.

ADA's price history reveals a number of distinct trends and patterns. However, we will examine this in greater detail during the price analysis.

Cardano’s Development

Every successful project in the crypto world needs to have a solid team behind it. Cardano’s team, led by Ethereum co-founder Charles Hoskinson, is focused on building a better blockchain by addressing the issues that plague Bitcoin and Ethereum. Some of the key development goals for Cardano include scalability, security, and interoperability. By designing Cardano for sustainability and future-proofing, the team hopes to create a more versatile cryptocurrency that can be used by businesses and individuals around the world.

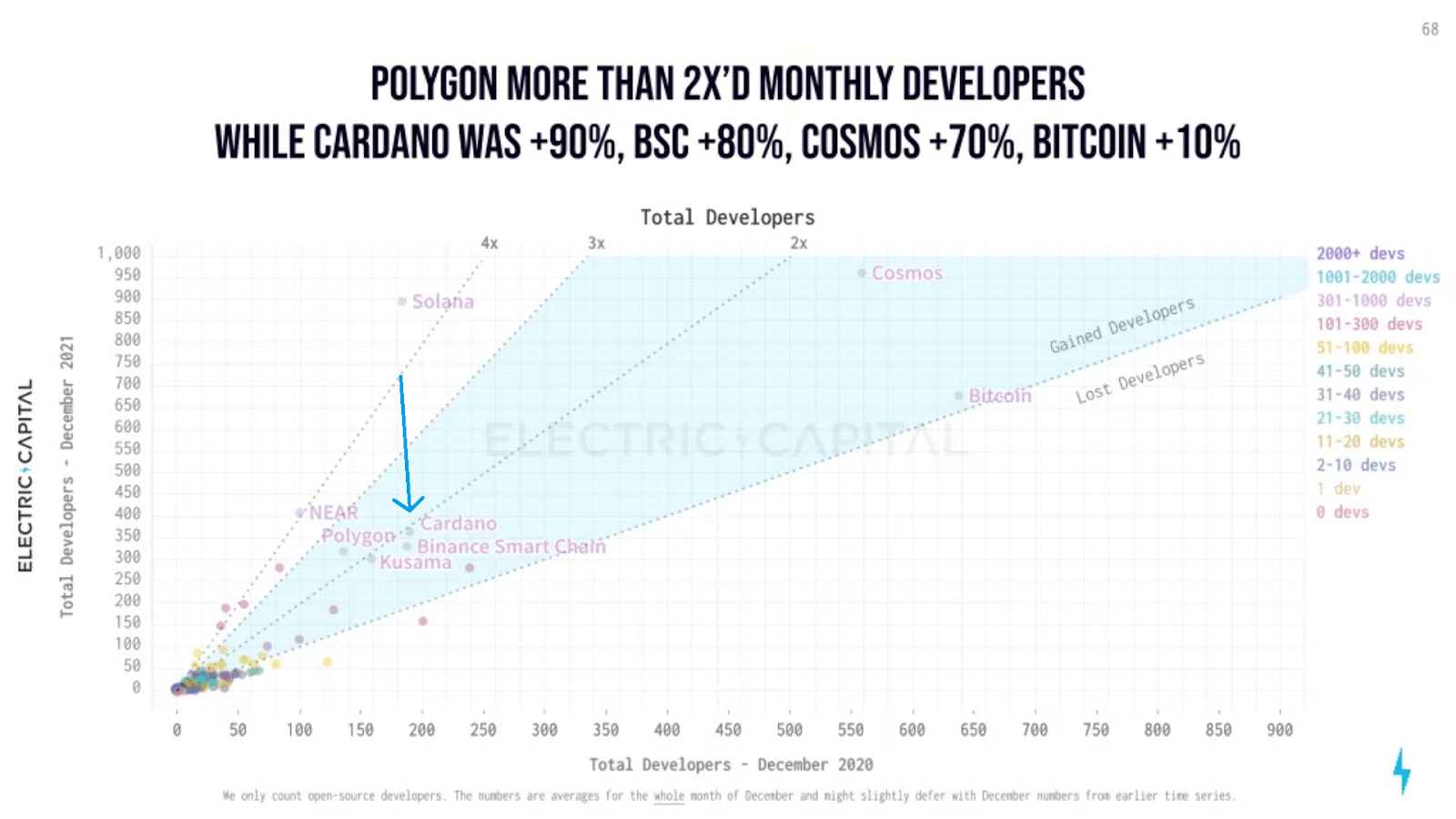

According to a report published by Electric Capital on blockchain developers, Cardano had 250+ monthly active developers in 2021. Although this might sound like much, it is small when compared to other ecosystems like Polkadot and Solana mentioned in the report. Its developer portal also has around 100 contributors.

Cardano’s Smart Contracts

Smart contracts have been the focus of attention for quite some time now. They are self-executing contracts that allow two or more parties to agree on a set of terms and conditions that will automatically be executed when the conditions are met.

Cardano joined the list of blockchains with support for smart contracts after implementing decentralized finance (DeFi) services on September 12, 2021. Cardano uses an extended version of the UTXO ledger model (EUTXO) to facilitate smart contracts. These smart contracts are built on Plutus, the smart contract platform of the Cardano blockchain. It allows users to build decentralized applications (DApps) with Haskell, the programming language for Plutus contracts.

Haskell is a complex programming language and this has led to a lack of developer interest when compared to other blockchains. However, this has not halted the development of decentralized applications (DApps). Cardano Cube, a tracker for the Cardano ecosystem, reports that there are hundreds of projects and decentralized applications (DApps) in various stages of development in the ecosystem.

The Ouroboros Protocol

Cardano is built on a blockchain protocol called Ouroboros, which is designed for security and scalability. Ouroboros is the first blockchain protocol of its kind to be empirically tested and mathematically proven to be secure against attackers. It is also the first blockchain protocol to be based on peer-reviewed research.

The Ouroboros protocol uses a unique proof-of-stake algorithm that rewards participants who hold ADA tokens in a special wallet called a slot leader. Slot leaders are elected randomly from several staking pools. If a pool has a larger stake, it has a better chance of getting voted as a slot leader and validator to produce a new block that is accepted into the blockchain. In exchange for their contributions, slot leaders are rewarded with additional ADA tokens. This ensures the decentralized nature of Cardano and that no one person or entity can control the network.

"Vasil" Cardano Update

Cardano is known for frequent updates to its network as part of its mission to provide better performance and scalability. The most recent in its line of upgrades is the Vasil upgrade which introduces new features and improvements to its blockchain protocol. The new update promises greater scalability and performance improvements to the network. It will also allow blocks to be transmitted without full validation, speeding up the creation process.

Vasil's new features were supposed to go live on June 29th. However, the date was pushed forward one month by Input Output Hong Kong (IOHK), the blockchain engineering firm behind Cardano. On June 28, IOHK submitted an update proposal to hard fork the Cardano testnet. This was successfully deployed and the upgrade is expected to be available on the mainnet very soon.

Partnerships of Cardano

Partnerships are an important part of Cardano's development. The team is focused on building strong relationships with other companies and organizations that share the same values and goals. This allows them to pool resources and knowledge, which in turn helps them move closer to their ultimate goal of creating a better blockchain.

Some of Cardano's key partnerships include:

- Input Output Hong Kong (IOHK), a blockchain development company that is responsible for the architecture and continuous improvement of Cardano. The company is currently in a partnership with the Ethiopian government to use Cardano in creating a blockchain-based identity system in the country.

- Emurgo, a venture capitalist firm that focuses on integrating and funding startups that are based on Cardano's technology.

- The Cardano Foundation, which monitors the ecosystem and acts as the legal custodian of Ouroborors.

Price History and Analysis of ADA

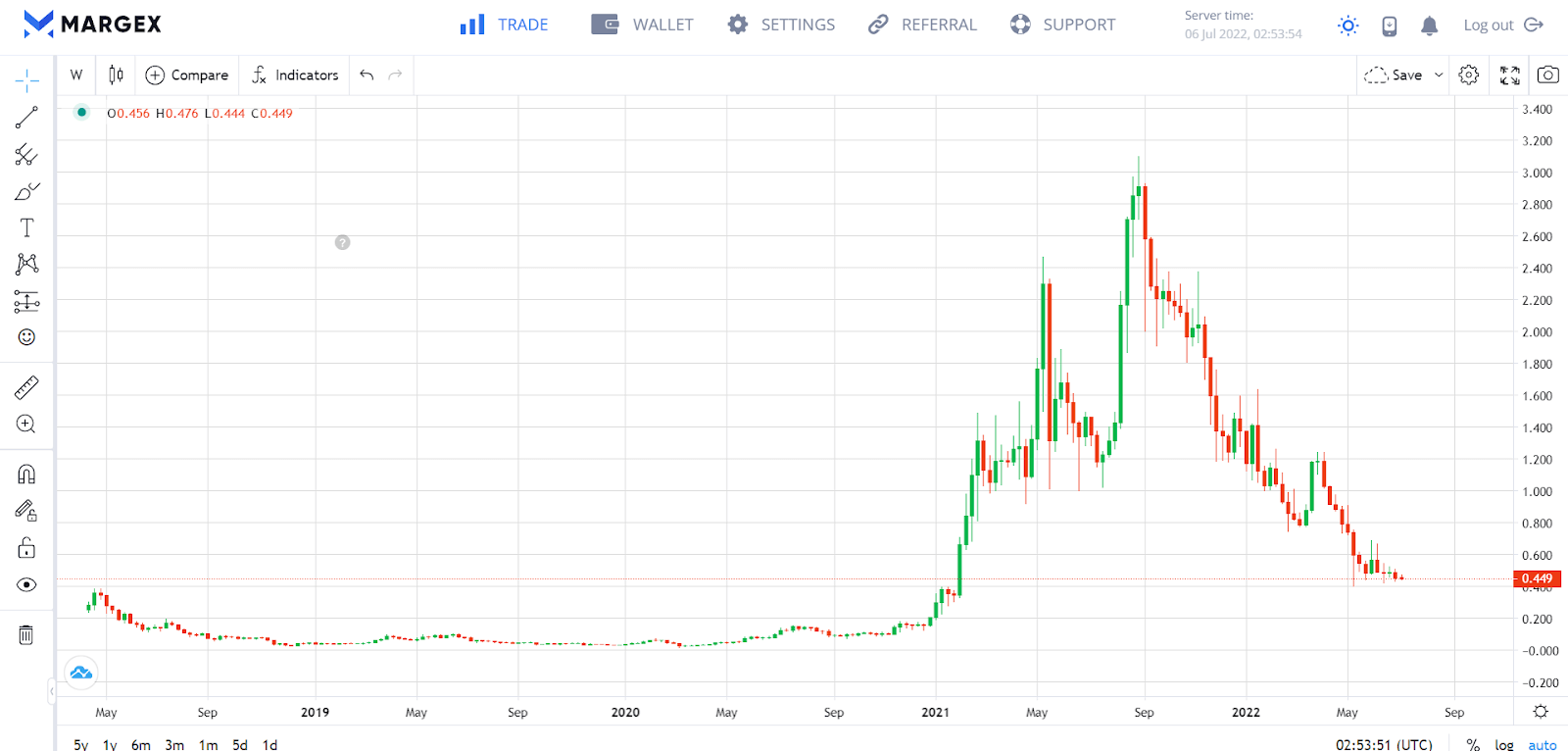

Cardano's market price has surely seen better days than most. After its debut in 2017, it started at roughly $0.02 to $0.03 for one ADA coin. Throughout the entire year, it experienced steady growth until the crypto bull run in January 2018 when it surpassed the $1 threshold and topped at $1.11. But this bull run was short-lived. In the months that followed, the whole cryptocurrency market plummeted and ADA ended the year below $0.048.

The following two years, particularly 2019, were rather quiet for ADA. The price fluctuated within the $0.03–$0.06 range, although it spiked in July 2020 to $0.155 in response to the Shelley hard fork of its mainnet. It also saw some action in the last quarter, closing the year at $0.181.

2021 was when the real action began. ADA's price skyrocketed through the early months of 2021. On February 2, 2021, it crossed the $1 threshold again. It continued this breakout to the $2 mark on May 14 to reach its then all-time high of $2.47 on May 16.

There were a few months of consolidation to around $1 before breaking $2 again on August 12. It continued this run to reach its current all-time high of $2.9675 on September 3 during the Alonzo upgrade which introduced smart contract support to Cardano's blockchain. It then declined steadily following the crypto market trend and closed the year at $1.3.

ADA has been on a bearish run since the beginning of this year, although it did fluctuate around and break the $1 mark multiple times in the first quarter. As of early July 2022, ADA is trading at $0.465. However, if all goes well with the upcoming Vasil upgrade, a realistic Cardano price prediction is between $0.60 to $0.70 for 2022.

What Affects The Price of Cardano (ADA)?

Apart from the amount of ADA being traded on exchanges, there are a few other factors that can affect the price of Cardano (ADA). Some of the key ones are listed below.

Development progress: The price is always affected by how well the development team is doing and how close they are to releasing new features and updates. For example, ADA's all-time high in September 2021 corresponded with the launch of the Alonzo update which introduced smart contracts to the blockchain.

Media sentiment: As always, positive or negative media coverage on Cardano or the entire crypto industry can have a big impact on the price.

Community support: The level of enthusiasm and support from the Cardano community affects the price.

Cardano Price Prediction By Experts

So far, we've looked at Cardano's history and development process, and now it's time to take a closer look at expert price predictions. Some cryptocurrency experts are cautiously optimistic about ADA's future, while others are taking somewhat of a bullish stance over the next year or so.

For example, Wallet Investor predicted ADA ending the year around its current price. LongForecast also predicted a year-end at $0.34. These numbers are far below the expectations of the Cardano community.

Nonetheless, some experts have a positive opinion of Cardano. Gov Capital believes that ADA can reach the best possible price of $0.86825 this year. Changelly.com also predicts that the price of ADA for the rest of 2022 will range between $0.59 and $0.70, with an average price of $0.61.

Pros and Cons of Cardano

When it comes to Cardano, there are a number of pros and cons to consider. Here are some of them.

Pros

Fast and low transaction fee

Cardano can currently execute about 250 transactions per second. However, this number is expected to increase with the Vasil update. Its fees are also around 0.16 to 0.17 ADA per transaction, which is approximately 0.07 USD.

Environmental-friendly blockchain

Since Cardano uses a consensus proof-of-stake based protocol, it requires significantly less energy to mine. This makes it one of the greenest blockchain systems.

Strong developer team

Cardano is backed by serious technological potential, and its development team is constantly introducing new improvements and upgrades. This makes it a potentially good long-term investment.

Practical applications

Apart from smart contracts and DeFi, Cardano is used in other practical sectors like agriculture, finance, healthcare, and education.

Cons

Volatility

Cardano, like all altcoins, is highly volatile, which makes it a less favorable option to Bitcoin and Ethereum.

Low interest from developers

Developer interest in Cardano is weak compared to other blockchains that support smart contracts. This is because the Haskell programming language is quite difficult to learn.

Fierce competition

Cardano currently faces strong competition from blockchains such as Polkadot, Solana and Cosmos. These ecosystems are experiencing tremendous growth and may soon catch up to Cardano.

Cardano vs. Bitcoin vs. Ethereum

Early on, Cardano's primary objective was to surpass Bitcoin and Ethereum by solving their environmental, flexibility, and scalability issues. It was even referred to as the Ethereum-killer. Although its development team is constantly working on new innovations and upgrades, it hasn't derailed interest in Bitcoin and Ethereum. In fact, these cryptocurrencies have shown tremendous price growth and they have more developed ecosystems than Cardano.

The three of them have experienced both large spikes and crashes, but Bitcoin and Ethereum have proven to be more stable. However, since the price of ADA is still considerably lower, investors can buy more units and there's a higher chance of profit if there's a price surge.

Is ADA a better investment than other altcoins?

Altcoins are generally known to be volatile, but volume, market cap, the team behind the coin, and the technology it uses are also very important. In the case of Cardano, all of these factors point to it being a stronger investment than most altcoins. ADA currently sits only behind BNB and XRP in the ranking of tradable altcoins by market cap. The Cardano team is highly experienced and has a proven track record in the cryptocurrency world. The technology behind Cardano is also more advanced than that of most other altcoins, making it a likely solid investment for the future.

Is it too late to buy Cardano (ADA) in 2022?

All things considered, it's still too early to say whether or not it's too late to buy and hold Cardano. The situation could change in either direction depending on market conditions. However, holding cryptocurrencies and waiting for potential profit have proved to be unfavorable in the past year or so. For example, Cardano (ADA) started the year at $1.378 and it is now trading around $0.46. This shows that investors who started holding this year are now probably at a loss.

The best way to profit from cryptocurrencies is by trading to capitalize on their volatility. With a modern friendly and the easiest-to-use user interface in the industry, Margex is the right platform for those interested in trading Cardano (ADA). With Margex's 100X leverage, you can start trading with as little as $10 and make profits faster. Margex is backed by twelve liquidity providers and a capable MP Shield technology to protect traders from price manipulations and unfair liquidation.

No matter which way you decide to go, it's important to keep an eye on the market and make your own decision based on the latest information.

Conclusion - Should I Buy Cardano?

So, is Cardano a good investment? In short, it depends on your goals and what you're comfortable with.

If you're looking for a long-term hold, Cardano could be a great option as its technology is constantly being updated. But, it could take years before you start seeing considerable profit on your investment

The best way to make quick profits from Cardano right now is trading. However, market volatility is a big risk associated with crypto trading.

FAQ

Is it worth investing in Cardano?

Although Cardano is down from its 2021 level and currently on a bearish run, it is definitely worth taking a look at.

Is Cardano a good long-term investment?

Cardano is still one of the top 10 cryptocurrencies in the world, which shows it is on the right track. The team is working hard to build a better blockchain and they have a lot of exciting features planned. It is a good choice if you are primarily interested in a long-term investment.

Is Cardano a good investment in 2022?

Cardano, like the entire crypto industry, is currently lower than it was at the beginning of the year. This bearish trend may continue until next year or until another bullish trend begins. Currently, the best approach is to trade.

How much will Cardano be worth in the future?

This is a difficult question to answer, as it's impossible to predict the future movements of the markets. If all goes well, Cardano might surpass the $1 level again this year.

When should you buy Cardano?

If you're looking to make a short-term profit, then it might be wise to wait until Cardano hits a support level before buying in. However, if you're willing to take on a little more risk and are interested in long-term gains, then now could be a good time to buy.

Why is Cardano so cheap?

Cardano has a large circulating supply when compared to other large cryptocurrencies, hence the low price. Also, the overall market sentiment is currently negative and investors are cashing out of all cryptocurrencies.