The crypto industry is relatively new compared to other established industries worldwide. Therefore, some aspects of the industry are still vaguely understood or incomprehensible to some.

Naturally, it should not be surprising that even some already immersed in the crypto world still find it hard to comprehend some features, hence the reason for writing guides like this to put them through.

One of the features of the crypto industry that may sometimes seem complicated to both crypto newbies and enthusiasts is Crypto Gas. What is crypto Gas? How does it function? And How can it be of help to you? These questions and some other important ones will be addressed in this article.

What Is Crypto Gas?

Crypto gas is a term associated with the Ethereum network, the second largest blockchain platform, because it's made up of tiny fractions of the cryptocurrency Ether, the native token of the Ethereum blockchain.

These ETH denominations are called Gwei (10-⁹ ETH) and serve as a fee for every successful transaction on the Ethereum blockchain. Gas fees are also applicable to validators as fees for the resources needed to conduct transactions.

The Ethereum Network introduced the concept of Gas to pay miners for securing the Blockchain; recently, however, the Blockchain has made advanced use of Gas fees by making it the reward for staking Ether on the network's staking pool and for participating in validation.

On the other hand, Ethereum is not the only network that charges crypto fees. However, they are the only Blockchain that calls it Gas fees or, in other words, Ethereum Gas fees; Bitcoin, the most prominent cryptocurrency in the industry, charges transaction fees or Miners fees.

Miners are more like the validators on proof of stake protocol. But they function differently because, unlike staking, miners are powerful computers on the Proof of Work model that solves cryptographic equations to create new blocks and mint new tokens.

The miner that solves this equation is rewarded with new Bitcoins. However, this process consumes a lot of electrical energy, and platforms that employ Proof of Stake consensus, like Solana, on the other hand, are cost-effective for network participants.

Nevertheless, like all concepts, there are other terminologies associated with it; for a Gas fee, there is a Gas limit. The gas limit is the estimated network fee for transacting on the Ethereum network; the higher the gas limit, the longer it will take for a transaction to be successfully executed, resulting in more work.

In most transactions, individuals can choose a specified gas price they are willing to spend; however, the higher they pay for the transaction, the faster it is executed and vice versa. Currently, the standard Gas limit on an ETH transaction is 21,000 units of Gas; it costs more if it's a transaction involving Smart Contracts like the minting of NFTs.

Another thing to note is that Gas prices can change with external factors like network congestion. Once the network is congested, the gas price skyrockets due to excess traffic, but they are low and within range, if there is not much traffic during that period.

Recently the transitioning of the Ethereum network to Proof of Stake has made some people expect that the price of Gas tokens will reduce; however, the reverse is the case as prices have skyrocketed even after the merge.

How Is Crypto Gas Used?

Crypto Gas is applied during a crypto transaction like sending, swapping, or exchanging cryptocurrencies from one wallet to another. They are also applicable to transactions involving NFTs; sometimes, a platform may require an individual to pay gas fees if they want to connect their wallet to a dApp.

To further understand how crypto gas works let's consider an example; let's say a crypto trader wants to buy a crypto token and visits Binance to purchase it. But unfortunately, it's not listed, so they buy Ethereum instead and transfer it to their MyEtherwallet. That process will incur a gas fee.

On reaching the wallet, they decided to swap some of the Ethereum for that designated token; that swapping activity will also incur a Gas fee before the transaction can be successfully executed.

That is just a simple example of how Gas fees work in a transaction; sometimes, though, it's possible to overuse or waste Gas when executing a transaction. Other times a transaction may fail because an individual decides to pay less Gas fee for the transaction leading to a timeout.

This may occur if there is a high demand for the token; paying less Gas fee will only push an individual to the end of the queue, placing those willing to pay higher at the forefront, sometimes the transaction may eventually go through after a long time, other times, it fails.

On the Ethereum network, the Gas fee serves as a medium of compensation to Validators who protect the network from spamming by Bad actors; in addition, all who make their Ether available to the platform staking pool receive Gwei as a reward.

Understanding Gas In Ethereum

The Ethereum network invented the term Gas, which is a fee a user is required to pay for the execution of a transaction on the platform. The Gas on the Ethereum network is known as Gwei, a denomination of Ether, the native currency of Ethereum Blockchain; it's also known as nanoether and is currently worth 0.000000001ETH.

When a transaction occurs on the platform, the required Gas fee paid for its execution is used to pay for the computational energy needed to power validation on the Ethereum network. This is due to its employing Proof of Work. However, they transitioned to Proof of Stake in September 2022, but they decided to have another version of Ethereum that runs on Proof of Work, and they named it Ethereum 1.0.

The high computational energy expended on Ethereum 1.0 results from mining activities requiring special hardware to solve mathematical equations. Miners who successfully solve the task receive mint new blocks and tokens; also, for their hard work, they receive an ETH tokens reward.

Further, the cost of Gas on the Ethereum network is influenced by external factors like the type of transactions; for example, it will be easier and cheaper to transfer ETH or ERC-20 tokens from one wallet to another than minting an NFT token or performing a Meta-transaction consisting of many transactions.

High Gas fees can be discouraging, especially for multiple transactions or complex ones that involve deploying a decentralized application; that's why the Ethereum network invented Gas tokens, which can replace Gas when prices are high. Currently, the two gas token projects on the platform are Gas token.io (GST) and Chi token by 1inch, an Ethereum-based platform.

The way the Gas token works are that a storage refund dynamic of Ethereum lets a user mint GST tokens by saving data into its Smart contract storage; once the price of Gas is high, the user can quickly free up the data by returning the token to the Gas token contract resulting in a Gas refund, it's a pretty straightforward process if we carefully look at the steps.

In addition, the GasToken.io team rolled out an upgraded version of GST tokens called GST2. This version opens more avenues to save gas by adding a feature that allows creating and deleting contracts.

1inch also designed Chi token to provide saving and improvement on other Gas token models. Chi/qi is represented in Chinese martial arts as the needed power to run the ch; Chi token also replaces Gas as the required ability to complete a transaction; the way it works is it mirrors the new implementation of GST2 but includes some improvements to make it better, by reducing wise contract address size by a mining a private key with profanity address generator enabling them to reduce the size sub smart contract by 1 byte.

Further, they use Create2 instructions to deploy sub-smart contracts for efficient address discovery during b. Finally, the Chi gas token will fix the ERC-20 incompatibilities of GST2.

Chi Gas token is also 1% more optimized for the minting and 10% more efficient for burning

However, it's only available on the 1inch and Curve platforms, while GST is available on Ethereum and all ETH-based platforms. GST tokens can be minted on Etherscan, and Chi token is available for stamping on 1inch and Etherscan.

This digital asset also applies to Non Fungible tokens (NFTs) on the Ethereum network; it works the same way as other transactions on the platform. Still, its fee is very high compared to transacting other tokens. Minting, selling, and buying NFTs require Smart contracts and, like other transactions, require computational energy by miners.

However, Smart contract transactions consume more power resulting in more Gas fees to be paid; in addition, the speed at which the NFT transaction is to be added to a block by miners also increases the level of prices.

The level of Gas fees for NFT transactions has discouraged a lot of aspiring NFT creators from Minting due to the high cost involved, sometimes the variation in crypto Gas prices results in the Gas fee exceeding the value of minted NFTs; this issue is not peculiar to only creators but also affects collectors who pay high Gas fees for all transactions on the network, even if the transaction is canceled the individual still pays Gas fees.

New sellers or buyers who are ignorant of these fees end up losing funds or not making as much as they ought to make on NFTs transactions. However, having a detailed knowledge of how these fees and transactions work on the Ethereum network will help aspiring creators and collectors make the right choice.

Max Priority Fee For Crypto Gas

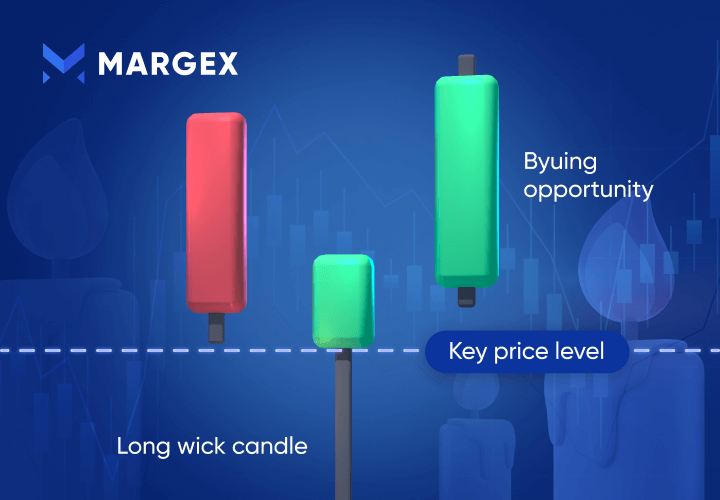

Priority fee is the fee associated with gas fees; they determine the level of priority that will be given to a transaction for its execution. Most ETH-based wallets always help users to automatically select where the priority fee should be set depending on the platform's traffic for the day.

To know the amount of fee that will be charged for a transaction, a user will need to see the base fee, total units of gwei in a Gas, and current Gas price. Every Blockchain has its base fee, which acts as a reserve price; it's determined through the level of supply and demand on the platform and adjusted according to the number of transactions executed on the network.

In other words, the base fee is calculated by the formula that compares the size of the previous block or total gas used for a transaction with the target block size. Gas prices, on the other hand, change according to traffic on the platform.

Max Priority fee, also known as miner fee, is a kind of incentive paid directly to miners for them to include a transaction in a block. Even though it's optional, an individual who decides to pay it along with the base fee and gas limit will pay a minimum of 2.0 gwei to include network participants.

However, some mining pools may adopt an alternative minimum for inclusion but for simple day-to-day transactions like selling and swapping under normal conditions will require less than 2.0 gwei, but on the other hand, when the network is congested, and the marketing needs to be included as soon as possible the Max priority fee may increase so that the transaction will be executed and included without delay.

But note that once the sum of the Max priority fee and Base fee is higher than the Max fee, the Max priority fee is reduced to stay in line with the Max bound of the Max fee. But in the case of such events, the Max priority fee that will go directly to miners may reduce so much that the transactions become less appealing to them.

Calculating Fees

The London upgrade that occurred on the Ethereum network in August 2021 not only prepared them for the long-awaited merge that took place in September 2022 but also changed some things on the platform. One of the things it reformed was how transaction fees were calculated on the Ethereum network. Before the upgrade, calculating costs for transactions involved gas limits and prices.

To make the point clearer let's say Roland wants to pay Bob 1 ETH; during that period, the gas limit is 21,000 units, and the gas price is 200 Gwei. The total fee would be a gas price of 200 Gwei multiplied by the Gas unit 21,000, equal to 4,2000, 000 gwei or 0.0042ETH as transaction fees.

How After the upgrade calculating transaction fees includes Base and priority fees multiplied by total gas units used. The base fee is set by the platform, while the individual charges a priority fee by optional choice to incentivize validators.

Now illustrating with the same example, instead of Rowland paying 0.042ETH as transaction fees, the costs will be calculated as Gas limits 21,000 multiplied by base fee 10 Gwei plus priority fee 2 Gwei equal to 252, 000 Gwei or 0.000252ETH as a fee for the transaction.

In addition, an individual can decide to opt for Max fee or MaxFeeperGas parameters. When going for this option, the max fee will exceed the sum of the Base fee and priority fee or tip; when the transaction is successfully executed, the difference between the three fees is then deducted and refunded to the individual that performed the transactions. Some wallets make it easy on their users by helping them to automatically select Base fees and Tips instead of setting them by themselves.

The London upgrade on the Ethereum network also came with an added feature known as EIP-1559. The implementation of this tool has transformed the way transaction fees are determined on the platform from simple Gas price auctions to a complex mechanism; however, with this tool, it's easy to predict gas fees resulting in a more efficient transaction fee market.

In addition, users can opt for the MaxFeePerGas option conveniently, knowing that they won't pay beyond the required amount and the difference between fees will undoubtedly be refunded to them without delay.

Gas Price Live Data

GAS is a token created on the NEO blockchain to serve as transaction fees on the platform. Neo blockchain is a decentralized crypto platform that aims to revolutionize the world of Web3 and crypto at large with Smart contract functionalities, Oracle systems, naming services, interoperability, a rare consensus mechanism of dBFT (delegated Byzantine Fault Tolerance), and a distributed data storage known as NEOFS.

The platform enables developers to build and manage dApps through Smart Contracts, bringing them to their vision of becoming an open network for the smart economy. Neo employs a dual token mechanism, giving them the power to segregate governance from the utility. Their governance token is a Neo token, while GAS tokens perform utility.

The platform charges GAS for activities like the operation and storage of tokens and smart contracts to prevent the abuse of nodes. The minimum unit of GAS token is 0.00000001, and claiming it does not require staking of NEO, instead most NEO-based wallets include an option to claim GAS with the tap of a button; note that not all platforms distribute GAS token to users who hold NEO.

Validators that play an active role in the governance of the NEO platform are eligible to receive the most significant portion of distributed GAS; all NEO holders interested in having an active vote share need to use wallets that support voting.

Currently, Gas tokens are worth $2.27, ranking 563rd in the crypto market, with a market cap of over $22 million. There is a total supply of 100,000,000 GAS tokens, with a circulating supply of over 10 million tokens. It's presently trading with a 24hr high of $2.29 and low of $2.25 representing a 0.64% decrease in value.

GAS tokens currently have a 24hr trading volume of $3,265, 642 representing a 15.24% decrease, with a market dominance of 0.00%. GAS is down by 0.74% in the past 24hrs and is currently 97.67% below its all-time high four years ago in 2018. However, it still soars high above its all-time low of 0.599 dollars by 278.36%, also having a 27.44% increase in its ROI (return on investment).

Gas tokens can be an issue for so many people; on the Margex platform, you don’t have to pay for gas fees during trading, and with the unique Margex feature, you can stake and trade your tokens simultaneously with an APY of up to 13%.

There are no lockup periods during staking, and all staking rewards are sent to your staking balance daily with the help of the Margex automated system. You don’t need trading experience to earn with the help of the Margex staking feature.

Frequently Asked Questions About Crypto Gas-Explained

Gas fees, priority fees, Base Fees, Max fees, Gwei, and Nanoether, are some terms that are commonly associated with crypto Gas. Most times, people ask questions about these terminologies and crypto Gas itself; in this section, we will highlight some most Common questions that people ask

What Are Gas Fees Crypto?

Gas fees are a concept introduced by the Ethereum network to pay miners for the work they do in protecting the platform from spamming. In addition, a Gas fee is a fee paid by an individual for their transaction to be successfully executed, the Gas cost is within range when the network has low or normal traffic, but prices skyrocket whenever there is congestion or more complex transactions that require Smart contract like NFT minting are involved. Other cryptocurrency platforms call it a transaction fee; for instance, Bitcoin, the largest crypto platform by market cap, reaches its miner's fee.

What Is Gas In Crypto?

Gas is the unit that measures the computational energy needed to execute a transaction on the Ethereum network. In other words, Gas refers to what is used as a fee for every transaction. Gas prices are denoted in Gwei, the short form of Giga Wei, with the term Wei coined by WeiDai, the creator of b-money.

What Is The Market Cap Of GAS?

GAS, the utility token of Neo network, has a current market cap of over $22 million and a fully diluted market cap of over $226 million. Both represent a 0.74% decrease in value according to Coin Market Cap.