The disruptive technologies of blockchain and cryptocurrencies have resulted in increased adoption and applications of its technologies to real-world systems.

The proliferation of users utilizing cryptocurrencies for their store of values capabilities and potential for life-changing wealth checks the boxes for many.

An example can be seen and fact-checked on the successes of Bitcoin, which saw an earth-shattering increase in price value, leaving investors to speculate on the next big cryptocurrency, prime for high returns.

This has resulted in market and expert traders, including cryptocurrency users predicting and speculating beforehand on the prospective prices of various cryptocurrencies.

This article will look in-depth into Ethereum as a cryptocurrency, its price history and past performance, and price predictions and forecasts for the future term.

What Is Ethereum (ETH)?

Ethereum is a decentralized software and application which leverages blockchain technology to create a scalable platform for smart contracts and other decentralized applications built on its network. As a decentralized blockchain ecosystem network, it features a native cryptocurrency called Ether.

Considered the second biggest cryptocurrency by market capitalization and also for its popularity after Bitcoin. The Ethereum native cryptocurrency is a utility token that enables cross-payments between multiple users on its blockchain ecosystem network.

Users and token holders of Ethereum have a leveraged authority to register and become validators on the Ethereum blockchain network.

The Ethereum blockchain network formerly utilized a Proof of Work (POW) consensus mechanism which secures and validates transactions on its unique blockchain ecosystem network. Due to scalability issues and high energy consumption rates of the Proof of Work model and consensus mechanism, the Ethereum community decided it was time to switch to a more effective consensus mechanism and model.

Ethereum successfully merged and switched to a more compatible Proof of Stake (POS) consensus mechanism, which is energy efficient and requires human validators to secure and validate transactions on the Ethereum network.

The Ethereum blockchain ecosystem aims to be fully efficient and scalable attracting developers and projects looking to deploy smart contracts and build decentralized applications.

Ethereum blockchain network provides technical standards for deploying smart contracts and creating digital tokens on its ecosystem network.

Popular technical standards on the Ethereum blockchain network for token creation include the ERC-20 technical standard and ERC-777, among many other technical standards for fungible and non-fungible tokens.

Origin And History Of Ethereum

Ethereum (ETH) was developed and officially launched in July 2015 as a digital software application and as a cryptocurrency, it is used as a mode of decentralized and secure payments.

Ethereum was founded and developed by Vitalik Buterin after Bitcoin's successes in leveraging blockchain technology on its secure payment platform.

The Ethereum blockchain network also consists of many cofounders and contributors, including developers and smart innovators such as Charles Hoskinson, Joseph Lubin, GavinWood, and a few others.

Although, Ethereum took after Bitcoin's steps as a decentralized payment platform but went further in its innovation to build a digital software application that powers and enables various decentralized applications built on top of its blockchain network.

Some few years before Ethereum was officially released, it gradually gained publicity and growing awareness even at its developmental stage when Vitalik Buterin released its whitepaper in 2013 to the public, detailing its roadmaps.

Less than a year after the Ethereum whitepaper was made public, Vitalik Buterin explained the concepts and foundations of the Ethereum blockchain project at a Bitcoin conference in Miami, Florida.

The Ethereum project garnered more attention and raised liquidity via an initial coin offering (ICO) in 2014 by selling out millions of dollars worth of Ether in exchange for funds and capital in furtherance of the Ethereum blockchain ecosystem.

Ethereum native coins purchased by investors in 2014 were not fully operational and functional until the Ethereum blockchain network went live in July 2015.

The launch of the Ethereum blockchain ecosystem in 2015 allowed token holders to transfer Ethereum native cryptocurrencies and interact with the ecosystem.

Since then, the Ethereum blockchain ecosystem has evolved and provides developer-friendly tools and interfaces for software developers deploying smart contracts and building decentralized applications on its blockchain network.

Ethereum's easy-to-use programming software, solidity, is a go-to and one-stop shop for developers to build in an enabling environment and ecosystem.

What Protocol Ethereum Uses

Ethereum, as digital software technology, and a blockchain ecosystem, currently utilizes a unique protocol known as the Proof of stake (POS) consensus mechanism.

The Proof of Stake (POS) consensus mechanism and protocol are highly efficient and scalable compared to the previous Proof of Work (POW) model utilized on the Ethereum blockchain network. This Proof of Stake (POS) protocol and consensus mechanism requires human validators to secure and validate transactions on the blockchain network of Ethereum.

Ethereum users and token holders who become validators on its blockchain network are incentivized and rewarded through native tokens and can earn a sustainable passive income.

To become a validator on the Ethereum blockchain network, owing to its new and recent protocol, users of Ethereum have to stake a significant amount of Ether on the Ethereum blockchain network.

Validators on the Ethereum blockchain ecosystem are chosen randomly after staking, creating an equal ecosystem atmosphere with no monopolization of validator slots and rights.

Validators can also delegate validating rights to other users and split incentives and rewards earned from validating blocks and multiple transactions on the Ethereum blockchain ecosystem. The Ethereum protocol is robust and scalable as it employs layer 2 solutions for increased scalability and throughput on its blockchain network.

Transaction processing fees and rates, also known as Ethereum gas fees, are relatively low and cheap.

What Makes Ethereum Different From Other Cryptocurrencies

Ethereum native token is the second largest cryptocurrency by market capitalization after Bitcoin. Its rankings and market capitalization percentages, when looked into from a global cryptocurrency ranking perspective, makes it stand out from other cryptocurrencies.

Ethereum also stands out by creating digital software applications known as decentralized applications (dApps) for deploying smart contracts and decentralized applications.

Ethereum now runs on a Proof of Stake model and consensus mechanism, which makes it different from other cryptocurrencies, running on different protocols and consensus mechanisms. Its native cryptocurrency, Ether, is used for staking and a diverse means of payments and decentralized capabilities.

Ethereum-based tokens are built on a popular and utilized technical standard known as the ERC-20 on the Ethereum blockchain network.

Factors Influencing Ethereum Price Growth

The growth and price potential of cryptocurrencies traded on globally recognized exchanges and trading platforms are influenced by several factors and price determinants. Ethereum as a powerhouse cryptocurrency is among the many cryptocurrencies traded and faced with numerous factors likely to influence and impact its price growth.

Since Ethereum's development and launch, its native cryptocurrency has experienced a constant price rise and fall. Still, it has moved positively in price, looking back to the price levels it began trading at. Some factors that may influence the price growth potential of Ethereum, now and in the future, can be seen below;

Demand

The level and volume of demand for any cryptocurrency have a bearing and substantial impact on its potential for growth and price increase or decrease.

A cryptocurrency with very high demand from users and investors may likely shoot up the price value of that particular cryptocurrency over time, whereas low demand may do the opposite.

Ethereum is one such cryptocurrency with an active and vibrant community seeking its growth and scalability.

In fact, many cryptocurrency users and market experts keep Ethereum close on the radar and speculate on its potential price growth owing to its utility and application.

On a general note, Investors and traders may need to take into account the level and volume of demand surrounding a particular cryptocurrency when making trade decisions and investments in cryptocurrencies.

Use Case

A cryptocurrency's use cases and utility attract users and investors as they can identify and spot the value attached to it. Ethereum, as a cryptocurrency with several utilities and real-life applications, may interest a broad audience of users and investors.

This drives the overall demand for the cryptocurrency in no time as users and investors stick around its application and value.

A cryptocurrency developed and built with no utility attached may not be welcoming to investors looking to invest as they cannot see the reason behind its creation or the value that it brings. Ethereum is robust when it comes down to its utility and use case in the blockchain industry and also in real-world systems.

Striving to profer solutions to decentralized finance, with its digital software enabling smart contract deployments and the building of decentralized applications, are a few of the multiple use cases that may drive its price growth potential in the long run.

Strategic Partnerships And Visions

A cryptocurrency project with a clear vision and roadmap to achieving set milestones may attract value from users and investors.

Strategic partnerships with other projects addressing real-world problems through innovative solutions can also drive the confidence and value of a cryptocurrency.

Over the years, Ethereum has been a solid cryptocurrency with increased attention to its growth and development.

Ethereum's clear vision of becoming a scalable, decentralized, and secure platform for users and developers constantly evolves in numerous developments.

Strategic partnerships, such as the recent Ethereum merge with the beacon chain, to offer a more scalable consensus mechanism is one of several partnerships the Ethereum project has built.

Cryptocurrency users and investors may pay attention to roadmaps and long-term visions of a cryptocurrency and, if satisfied, may drive their purchase demand.

Ethereum Price Performance In The Past

Ethereum, as a cryptocurrency and decentralized digital software, was created and developed by Vitalik Buterin in 2015. Its native cryptocurrency, Ether, traded on major exchanges at a launch price significantly below a US Dollar in 2015.

Ethereum began to gain more popularity and adoption and in the years 2017 leading up to 2018, Ethereum native cryptocurrency soared in price. The steady price rise of Ethereum's price became more erratic in 2017, and investors began to notice substantial movements of Ethereum when the price rose above the mid-$40 to over $362.

Ethereum price experienced a couple of dips and intermittent downward momentums before reaching another record-high in December, this time $826.

The Ethereum price closed at a price point of $772 at the end of 2017 as traders looked in anticipation of the next trading year.

In January 2018, Ethereum native cryptocurrency experienced the full effects of a bullish market and reached a new all-time high of $1,396.

Cryptocurrency traders back then could not contain the euphoria of the bull cycle as massive gains and returns were derived from their cryptocurrency investments. Ethereum's price, from its all-time high of $1,396, gradually dwindled as the general cryptocurrency markets entered into a bear market and cycle.

Ethereum native cryptocurrency, Ether, dropped significantly to a price traded below $100 in 2018. The years leading from 2018 to 2020 saw the prices of Ethereum ranging in a downtrend with occasional small price pumps.

Ethereum started again to pick up in price in late 2020 leading up to the bull market and cycle of 2021. The bull markets of 2021 saw an increased number of new investors in the cryptocurrency markets and industry.

Ethereum saw a significant increase and price peak as it rose to an all-time high and price point of $4,000 at the end of April 2021.

In May 2021, the cryptocurrency markets saw a significant price crash, with most cryptocurrencies dropping more than 50% in gains.

However, Ethereum rose from its price decline and hit an all-time high of $4,891 in November 2021. Ethereum could not sustain this price for long as a bear market was triggered following a significant drop in the prices of Bitcoin.

Most cryptocurrencies, including Ethereum, started to drop, with some losing 90% of their total worth and price value. Ethereum dropped to a price low around the $800 region between August and September 2022.

The general cryptocurrency markets continued to range in a downtrend bear market with occasional price pumps in some cryptocurrencies, including Ethereum.

The announcement of Ethereum merging to a more scalable consensus mechanism known as the Proof of Stake on September 15, 2022, raised eyebrows for Ethereum, which saw little price pumps. At the time of writing, Ethereum trades at $1,645 across globally recognized cryptocurrency exchanges and trading platforms.

How Is Ethereum Doing Now?

The cryptocurrency market is gradually picking up as many cryptocurrencies traded on recognized exchanges experience small price pumps.

Ethereum, which has been ranging for a couple of months, is now also experiencing small price pumps in the cryptocurrency markets.

Ethereum trades at $1,542 at the time of writing, which is a considerable price pump from where it was in October 2022, where it ranged at the $1,300 price area.

The potential for Ethereum to rally when the general cryptocurrency market picks up may be present, looking at its price performance and movements in the past.

Ethereum Price Prediction Today

Ethereum traded at a 24-hour low of $1,610 and is currently trading at $1,642 at the time of writing. Ethereum's 24-hour high was seen to be traded at $1,654 before it dropped to the $1,607 price mark.

Market experts and analysts came up with Ethereum price predictions for today, February 7th, 2023, and expect Ethereum to trade between $1,650 and $1,700 price region based on Fundamental and technical analysis.

Ethereum Price Prediction For February

The table below shows the Ethereum price prediction for the first week of February 2023 as forecasted by trade experts.

Cryptocurrency traders and investors may be advised to conduct in-depth personal research on cryptocurrencies such as Ethereum before making investment and trade decisions.

Ethereum Price predictions from trade experts and market analysts may not always be accurate as market sentiments change from time to time.

Short-Term Ethereum Price Prediction For 2023

The Eth price predictions for November and December 2022 are shown in the table below.

These Ethereum price predictions are speculative and may change depending on market sentiment at these future dates.

Long-Term Ethereum Price Prediction for 2023

The year 2022 saw a majority of cryptocurrencies decline in price value as the bear markets and cycle affected the growth of the industry. Many traders and investors wait in anticipation to see how the cryptocurrency markets will unfold in 2023.

The Ethereum price predictions in the table below cover the months of 2023 and are only speculations by market analysts. These price predictions of Ethereum may change depending on market sentiments at those future dates.

Long-Term Ethereum Price Prediction For 2023 - 2030

Many traders and investors, through fundamental and technical analysis, peer into the potential price value of Ethereum.

Ethereum price predictions for the long term can be seen in the table below for the years 2023, 2024, 2025, 2026, 2027, 2028, 2029, and 2030.

Long-Term Ethereum Price Prediction By Experts

A number of trade experts and market analysts continue to apply fundamental and technical analysis to the price predictions and forecast of Ethereum in the long and short-term.

Price predictions of Ethereum by experts may vary depending on what trading tools and analysis are used in forecasting and predicting future prices.

Traders and investors are advised to conduct personal research into cryptocurrencies and apply proper risk management when making investment decisions or entering into trades.

Price predictions of cryptocurrencies, including Ethereum, may not always play out as predicted by expert analysts due to market sentiments at that particular time or other factors.

Ethereum Price Forecasts By Price Prediction

Trade experts and research analysts at Price Prediction have a positive perspective on the future prices of Ethereum.

According to fundamental and technical analysis carried out by research and expert analysts at Price Prediction, the price of Ethereum from 2022-2027 is predicted to trade at a minimum price of $1,785, an average price of $5,198, and a maximum price of $12,996 in 2027.

Price Prediction By Wallet Investor

According to expert traders and analysts at Wallet Investor, Ethereum is predicted to trade at a price mark of $4,587 towards the end of 2027.

Price Prediction By Government Capital

Market experts and trade analysts at Government Capital predict the price of Ethereum to trade at $4,042 in November 2023.

Price Prediction By AMB Crypto

Trade experts and market analysts at AMB Crypto have a positive view of Ethereum price predictions both in the short and long term.

Ethereum is predicted to trade at around $7,885 at the end of 2023. AMB Crypto experts have also recorded a long-term price prediction on Ethereum prices in the cryptocurrency markets. They predict the price of Ethereum to trade at $58,049 in 2030.

Price Prediction By Margex

Margex is a bitcoin-based derivative exchange that enables traders to trade with up to 100x leverage size and with the unique staking feature readily accessible by Margex users where users can trade and stake their tradable assets at one with no lock-up periods and rewards are sent to staking rewards daily.

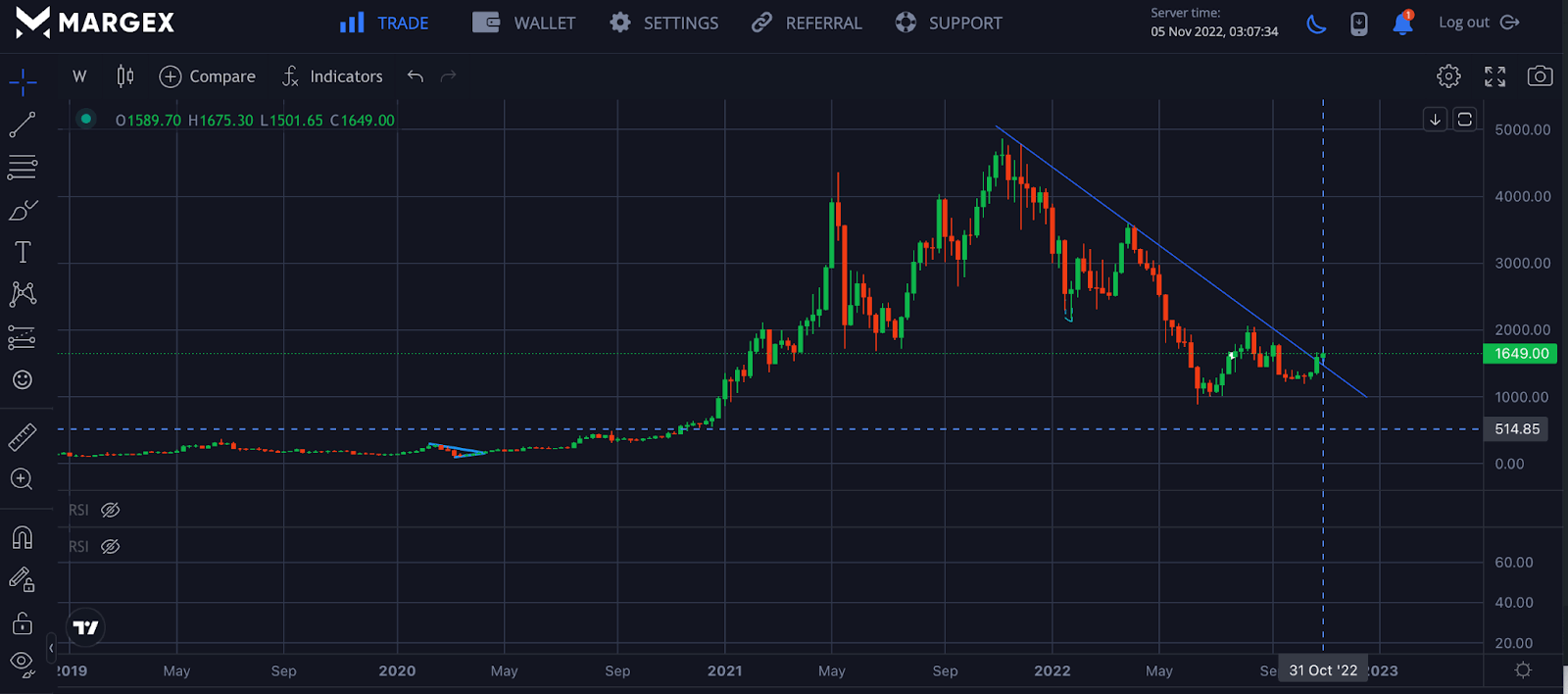

With the current crypto market enjoying a relief bounce across all boards, the price of ETH and BTC continues to show strength. From the chart, the price of ETH has slowed after the price touched an all-time of $5,000.

Expert on Margex has considered past prices and use case of ETH and concluded that in the next market runs, the price of ETH would continue to do extremely well.

Frequently Asked Questions On Ethereum Price Predictions

Will Ethereum (ETH) Reach $100?

Ethereum, as a cryptocurrency, is traded on the global cryptocurrency and financial markets, with many users leveraging it as a store of value. Ethereum reached an all-time high in November 2021 and currently trades at $1542 at the time of writing in November 2022.

Trade experts and market analysts predict a positive price growth of Ethereum in the coming years. However, the chances of Ethereum trading at $100 are slim but not an impossibility from a trading perspective.

What Will Ethereum (ETH) Be Worth In 2025?

Many trade experts have come up with numerous trade forecasts and price predictions for Ethereum.

For most traders and market analysts, price predictions of Ethereum are bullish on the long-term outlook.

It is important to note that price predictions of Ethereum in 2025 or the longer term are purely speculative and may change with market sentiments.

What Will Ethereum (ETH) Be Worth In 2030?

The price of Ethereum estimated to be trading in 2030 are mere speculations and price predictions from market analysts and trade experts.

The average perspective from market analysts on the potential prices of Ethereum in 2030 suggests a bullish price growth.

Traders consulting market analysts on price predictions of Ethereum at a definite timeline may need to also conduct personal research and weigh the choices of investments.

What Will Ethereum (ETH) Be Worth In 5 Years?

Ethereum has seen a massive increase in its price growth, looking back to its developmental stage and the prices it traded at upon launch.

The general cryptocurrency market is notably seen to trade in bull and bear cycles, which may determine the price direction and value of cryptocurrencies.

The price value and worth of a single Ethereum in 5 years may also depend on a number of other trade factors such as demand.

However, trade experts generally have a bullish outlook on prices of Ethereum in the coming years but this should be taken by traders as speculations and not fully base investment decisions on predictions that are subject to change.

Does Ethereum (ETH) Crypto Have A Future?

New beginner traders may sometimes ask questions such as ‘is Ethereum a good investment’ or even question its future growth and existence.

Blockchain and cryptocurrencies, such as Ethereum, are programmed to thrive and be the future of technology and finance systems.

Ethereum as a cryptocurrency is prized by many trade analysts and investors speculating and predicting its future price and ecosystem growth.

Ethereum is a utility cryptocurrency with a bright potential and future, as it offers a wide array of use cases and real-life applications.

How High Can Ethereum (ETH) Get?

The cryptocurrency industry and financial markets have seen mindblowing price growths from Bitcoin and Ethereum, among others.

Ethereum's price history and performance have seen it surpass and record new all-time highs in the cryptocurrency markets.

Ethereum has the potential for increased growth in its price value and its decentralized blockchain ecosystem network.

Sound knowledge of technical analysis may help a trader determine the potential price growth of cryptocurrencies such as Ethereum and how high its price value may reach on different timeframes.