The crypto market is fast-paced and volatile. It offers many opportunities for profit as well as losses. So, if you’re wondering how to make money from cryptocurrency, this article is for you.

Making money with crypto is a function of paying close watch on the market and following the best strategy. The ten proven methods include trading, staking, airdrops, referrals/ affiliate programs, mining, buy and HODL, crypto arbitrage, crypto facets, and lending.

Also, you must start on the right platform to increase your chances with any of the above methods. Keep reading for more details on how to make money with crypto.

Trading

Most crypto enthusiasts believe that day trading is a sure strategy for making money in crypto. However, experts know you must apply the right technical and fundamental analytical knowledge to profit from trades.

One fundamental determinant of your success as a crypto trader is the platform you sign up to. All traders work with indicators and tools on their charts to ensure a successful trade session. Although careful analysis is an obvious way of trading, many traders still risk their portfolios with rash decisions.

Trading crypto successfully on an exchange involves buying crypto assets and doing thorough analysis before you place trades. Margex is the best platform, with numerous listed assets available to make the trading process seamless.

How To Trade On Margex

With Margex, new traders find it easy to sign up and acquire cryptocurrencies before placing trades.

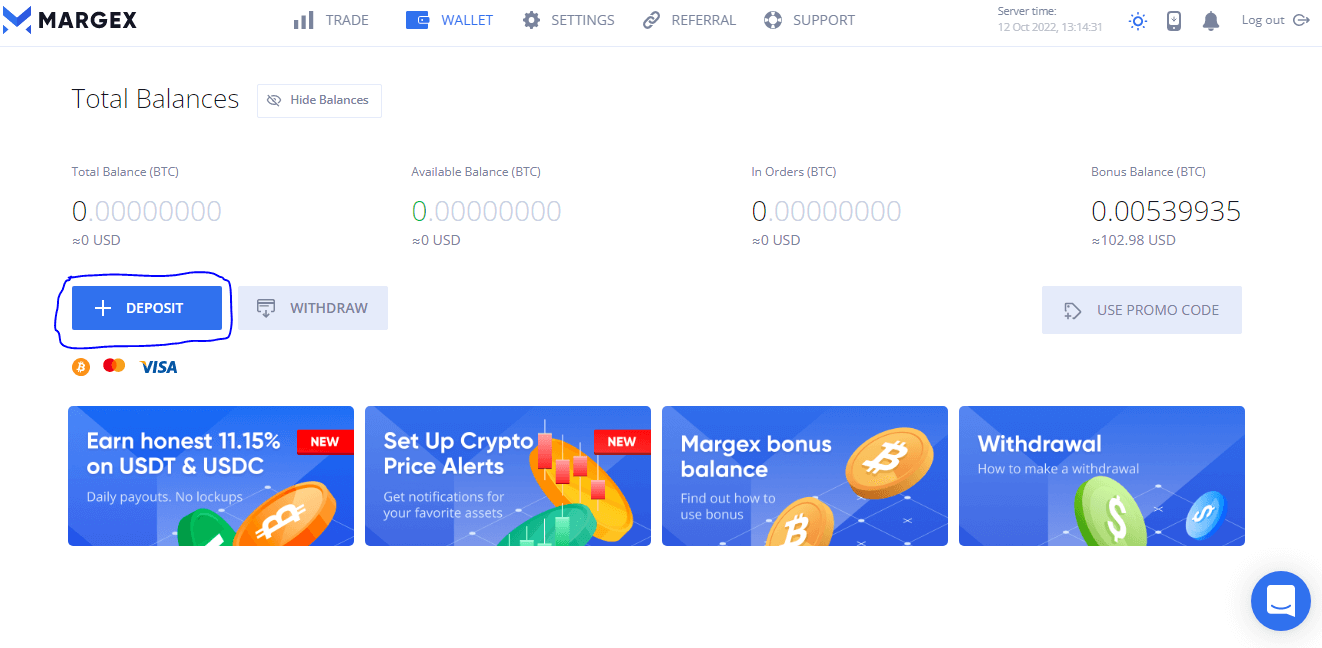

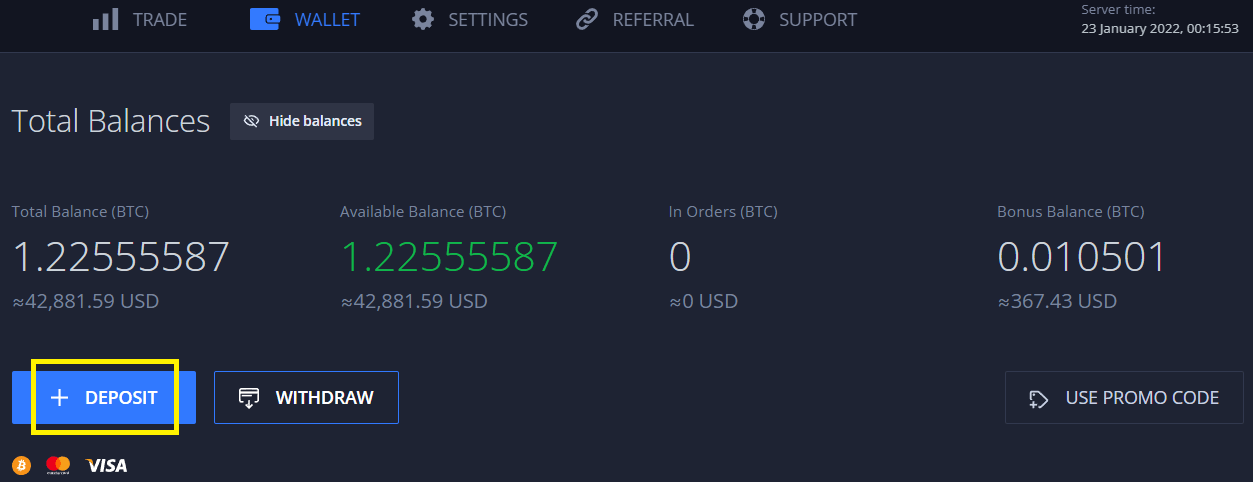

After registration on the platform, the next step is to deposit in your Margex account. Deposits can be made:

- From another wallet address to your Margex wallet

- Direct purchase or crypto with your bank card through Changelly or Change Now

For more information on this, visit this Margex resource.

After a successful deposit, you can place your trades.

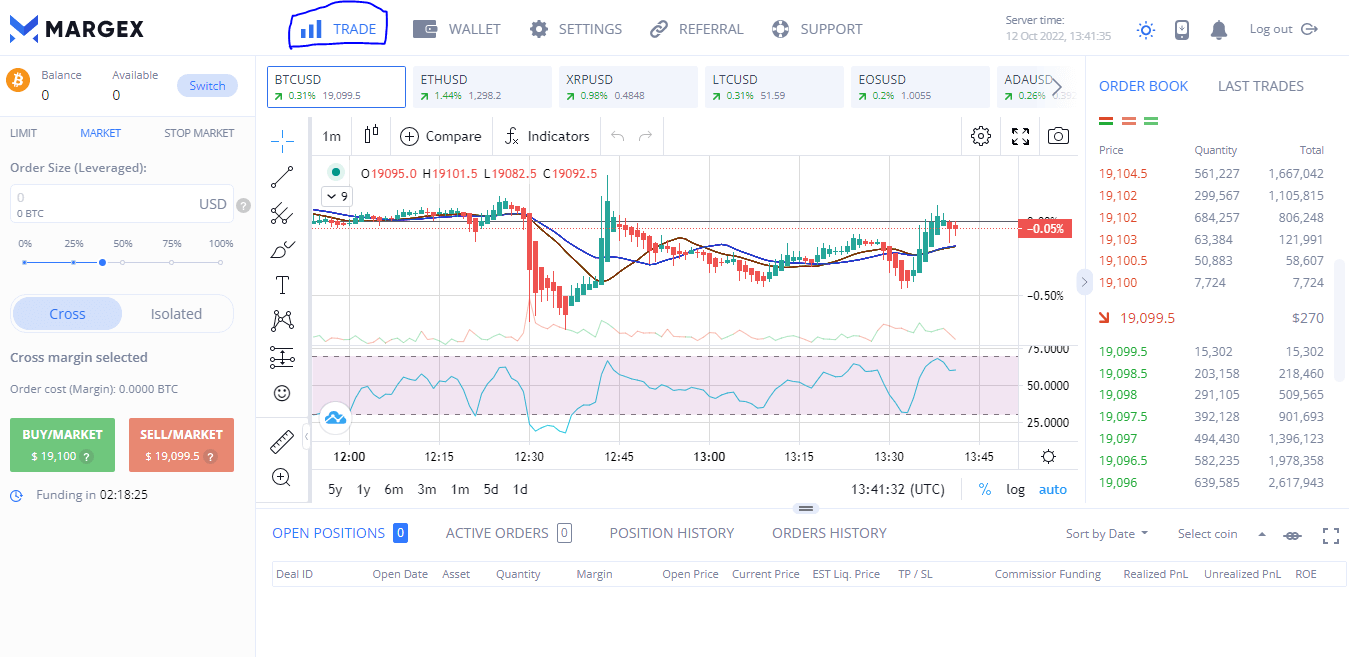

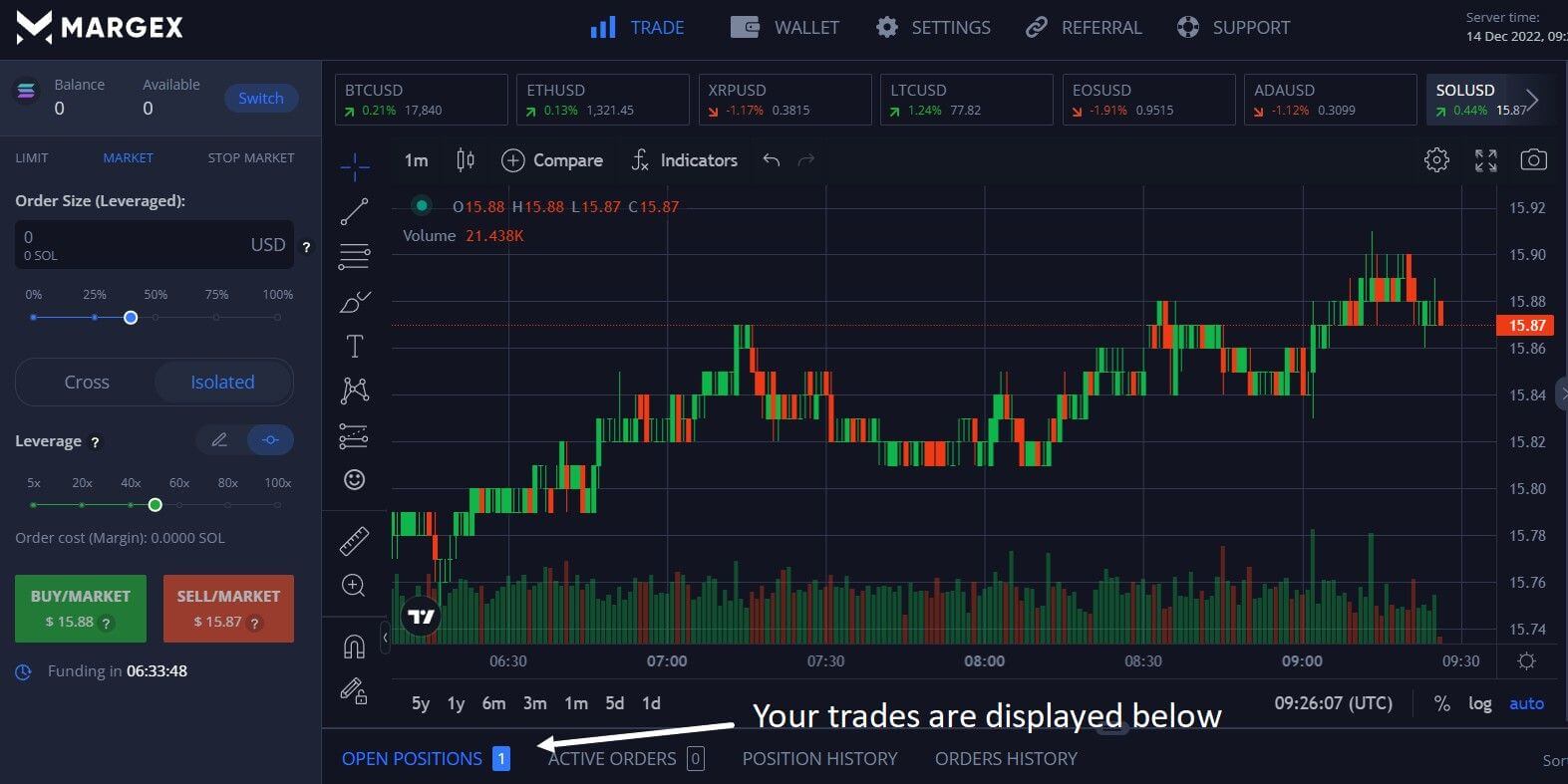

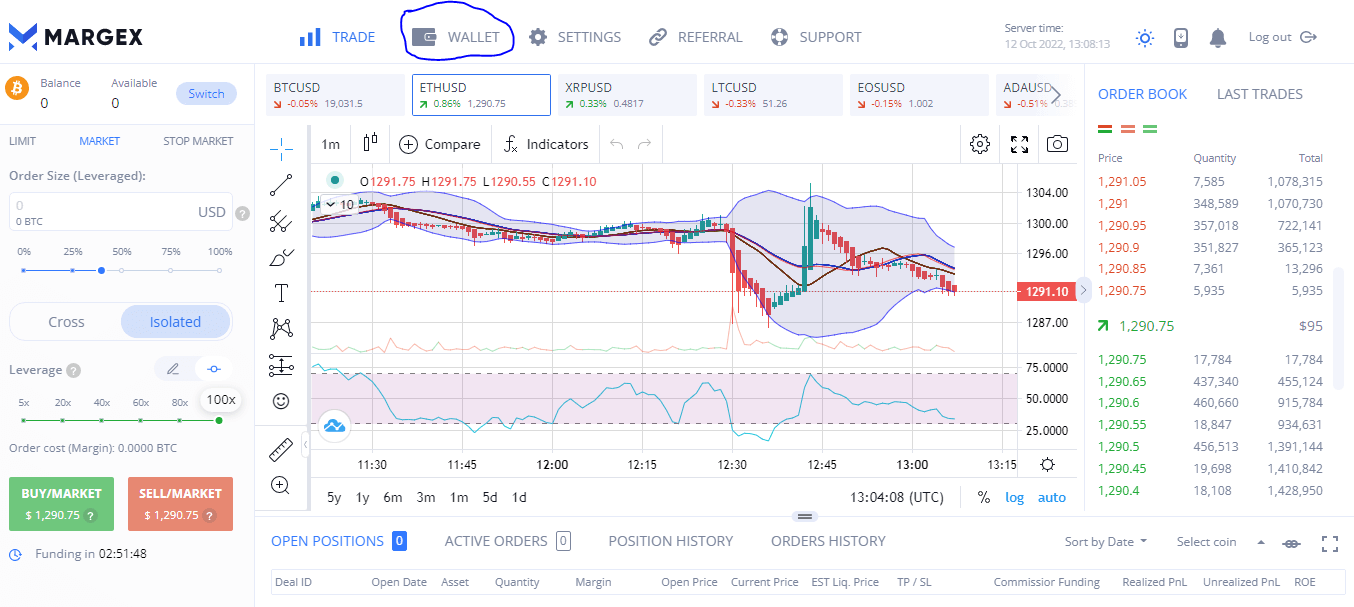

Trading on Margex is easy once you have completed your deposit. Just follow the steps below:

- Go to the Margex trade page.

- Select the order type you want. Click on buy or sell to place a buy or sell order.

- If you select the percentage margin for your trade, your order settings will be automatically calculated.

- Your trades will be displayed here:

- Congratulations! You have successfully placed a trade on the Margex platform.

How to trade and make a profit

Trading could be very risky without proper knowledge of the cryptocurrency field. It will be a bad idea to open positions randomly that you do not know about.

Here are a few things you can do to improve your trading strategy:

- Vary your trades: Do not focus on one coin or market alone. Trade various coins and pairs

to escape sharp price reversals of a particular cryptocurrency. You can trade BTC, for

instance, and once the trend reverses, you switch to Ethereum.

- Reduce your costs: Some platforms charge exorbitant fees or commissions on profit from their users. Choose a reliable exchange that has your best interest at heart.

- Know your timeframes: There are specific times of the day when you must observe a particular market trend. Watch out for such repetitions and know when to place your trade.

- Keep tabs on crypto news and updates: You must always be alert to major news and price movements in the crypto market. Even some government policies and world crises can affect market performance.

For instance, an event like the Ethereum merge immediately affected the price of ETH.

- Use Stop loss for your trades: A stop loss functions like the breaks on a car. During a trading session, a stop-loss can be the only thing that saves your portfolio from total liquidation. Always apply it to all your trades, as the crypto market is fast-paced.

Also, keep your profit-to-loss ratio at 2:1 for a start to ensure you do not lose your capital.

- Start with a small lot size: For beginners, it could be very tempting to "gamble" with your entire trading assets seeking huge rewards. Using such a strategy is counter-productive as it would lead to certain losses.

For instance, if you have 2 BTC, you can place your trade with 0.02 BTC. This will ensure that you won't lose much of your capital in the event of a loss.

- Understand indicators and tools: A trading platform like Margex offers numerous indicators and tools that help to enhance your trade. Ensure you understand each indicator function and apply what works best for you.

Staking

Staking has recently grown more popular due to the volatile nature of the crypto market. This method offers an opportunity to earn through dividend payout and price increments over time. Tokens that users can stake are those that run on the Proof-of-Stake mechanism.

In this process, users save coins in a secured wallet with the potential to earn more when they stake crypto. The users then gain rewards for adding security to a particular cryptocurrency network by validating transactions.

Staking rewards are like interest and returns on your coin for not spending them, but rather you’re lending coins to aid the network security and validate transactions.

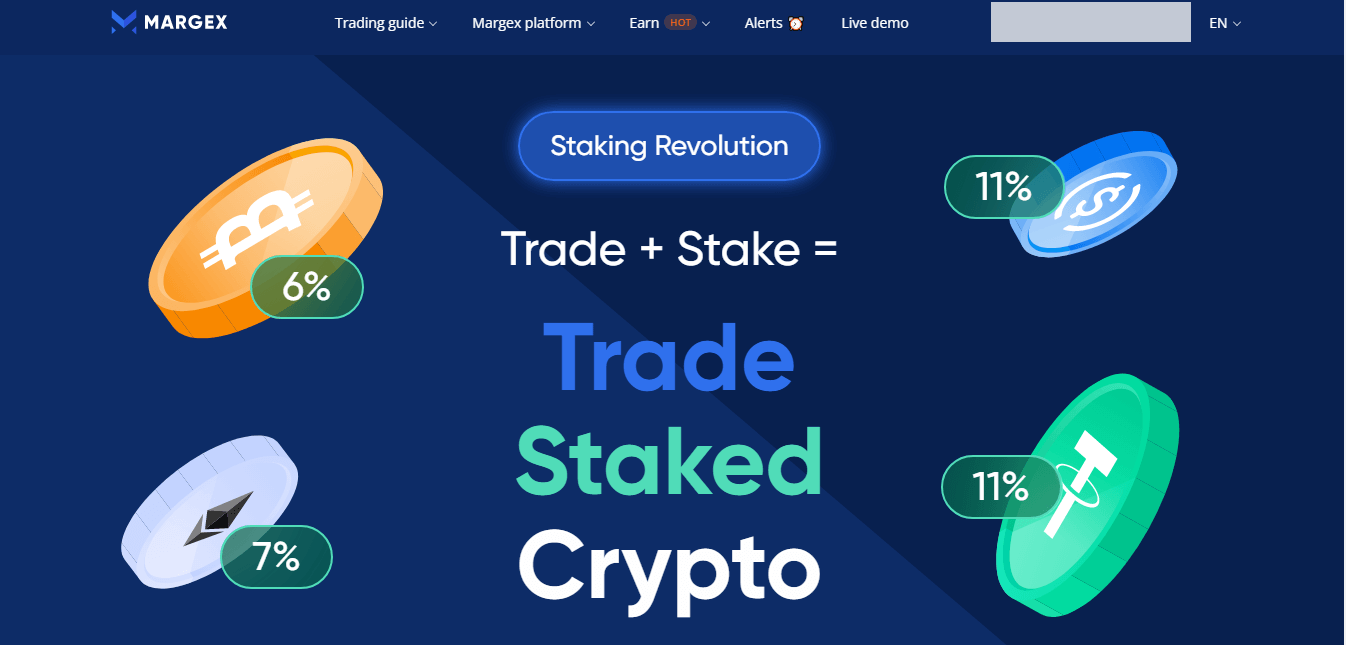

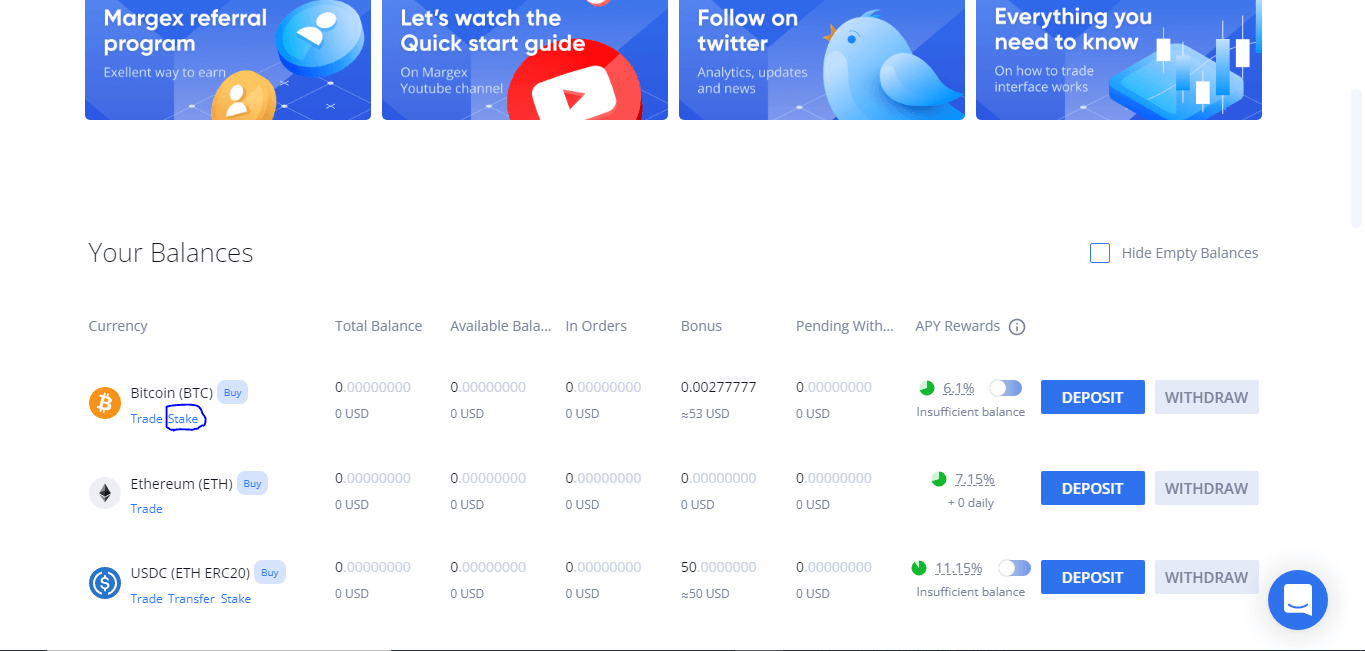

With Margex, users get a unique opportunity to enjoy the highest yield in the market. You can stake your Bitcoin, Ethereum, USDC, and USDT, among others, on the platform.

Here is a list of the APY (annual percentage yield) on offer on the platform:

- USDC – APY 11%

- ETH – APY 7%

- BTC - APY 6%

- USDT – APY 11%

The amazing part of this deal is that you can trade and stake simultaneously on the platform. This gives you an edge over competitors as you can access a highly secured, staked, and traded profit.

Margex shields its clients from price corrections using MP Shield, which enables a high percentage yield from their staking pools. Learn how to stake or unstake your tokens here. You can also stake multiple assets on the platform.

Even for users that have staked all their coins, trading is still possible. With the staked coins acting as collateral, the platform gives zero-interest loans to traders to increase their profit. Staking rewards are credited daily to the wallets of users. This is a good form of passive income.

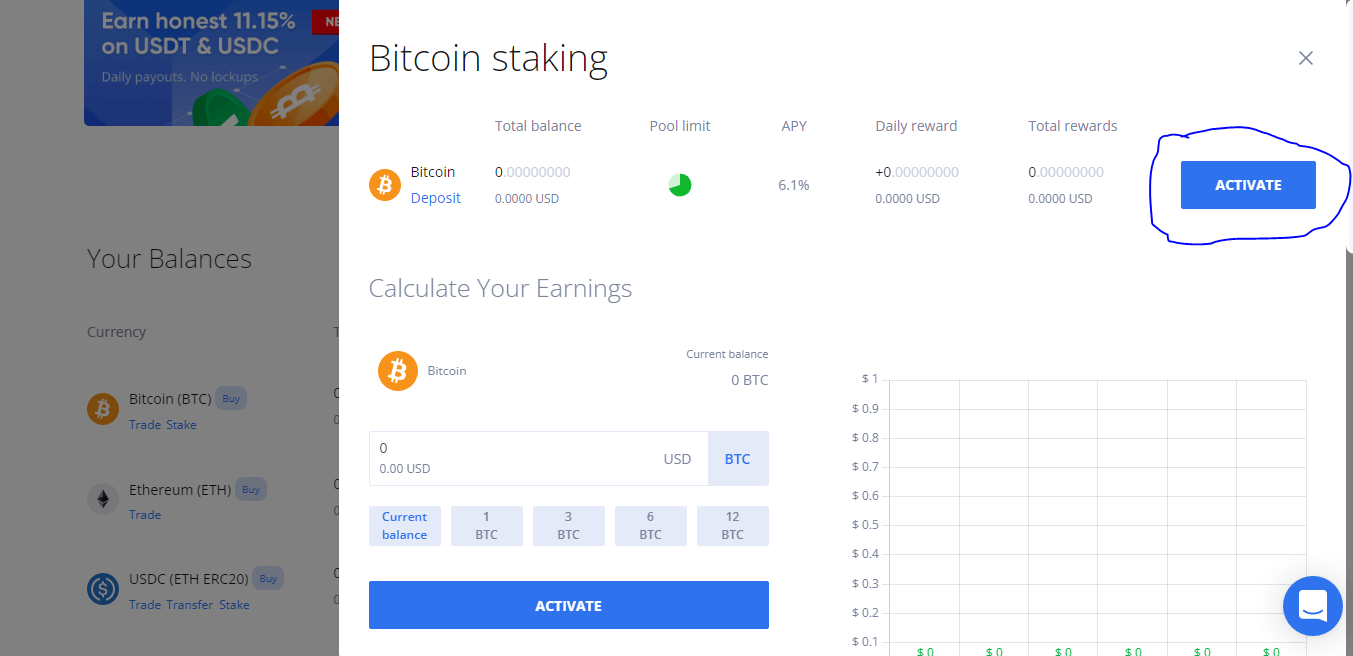

How to stake on Margex

Margex platform supports staking and yield profit on your investments. Follow these steps to stake on Margex.

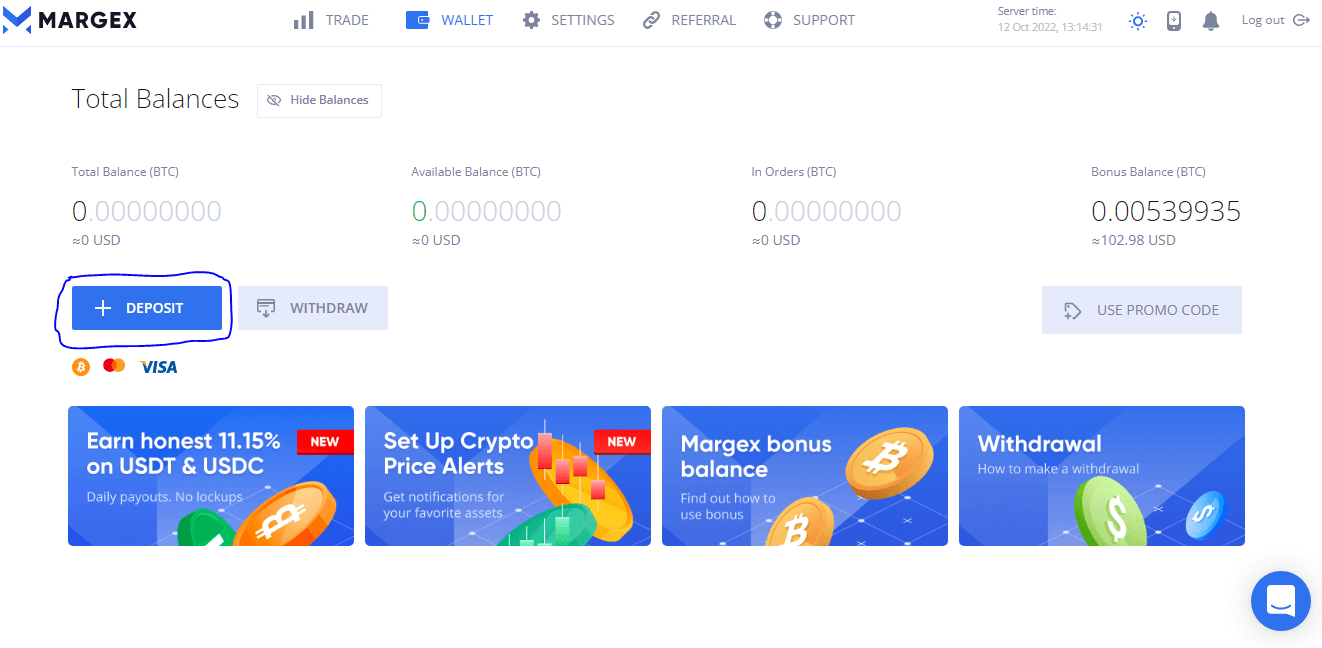

- Login to your Margex account and click on wallet

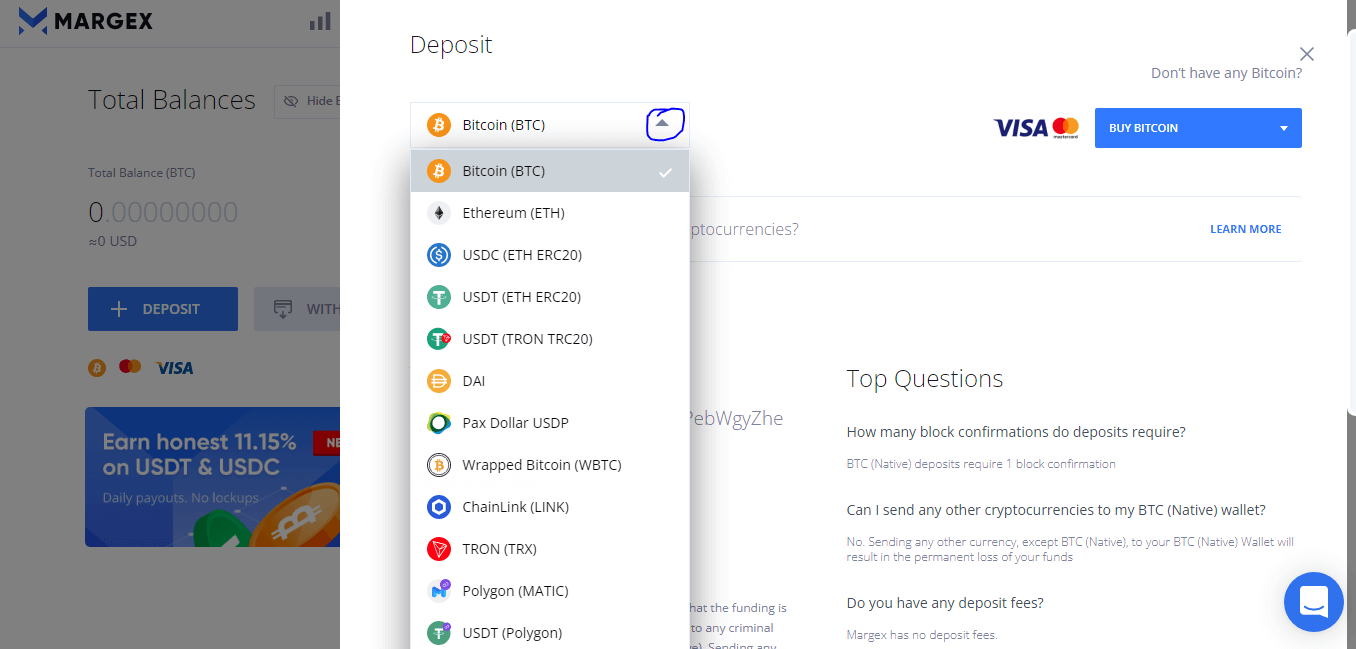

- If you do not have any cryptocurrency deposit in your account. Click on deposits

- Choose how you want to make your deposit and in which cryptocurrency.

- There is a video guide on how to deposit on Margex.

- Once you are through with the deposit, scroll down to see your digital assets and select staking.

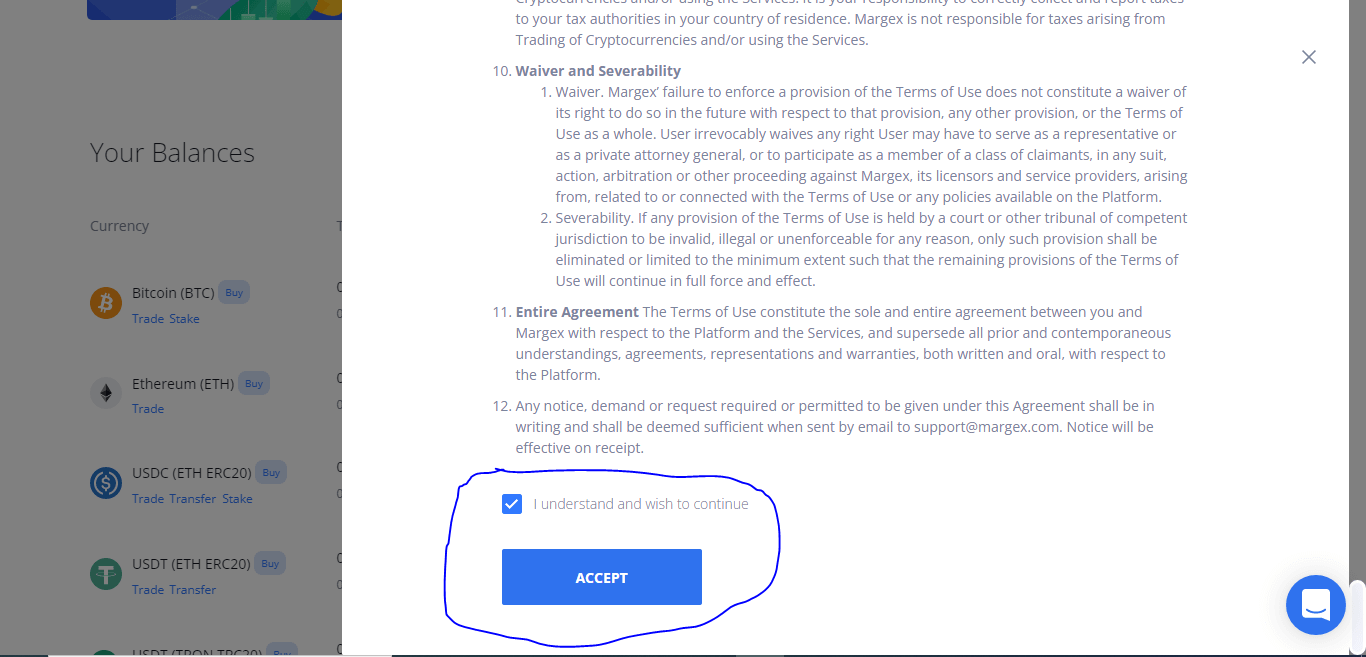

- Click on stake, input the amount you want to stake, then click on activate.

- You will be directed to the Margex terms of use and agreement page. Click on accept.

- Congratulations! You have successfully staked your assets with Margex.

Airdrops

This method of money-making with crypto may look random. However, some users have benefitted from this way of getting cryptocurrency dividends.

Airdrops involve sending a small number of coins or tokens to the wallet address of users. The recipient might have to perform small tasks, or it might be a way of encouraging them to adopt a new coin.

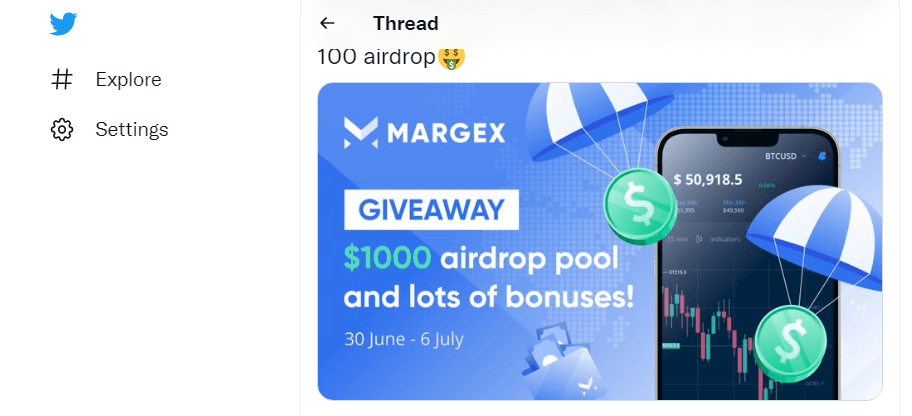

Whatever the case, some users have benefitted massively from this. For instance, Margex recently concluded a round of airdrops on September 20, 2022. The price was set at $1,000 worth of USDT, and ten users received it totaling $10000 USDT!

The platform used the airdrop to usher in its ultramodern crypto price alert app. The airdrop was met with positive reactions across social media platforms like Twitter, proving once again why Margex remains the best.

However, you must follow airdrops on trusted platforms like Margex. Fake airdrops are a tool that hackers users to fleece unsuspecting crypto investors of their real coins.

Referrals/ affiliate program

Referring your friends and associates to join a crypto platform is now a way to make an income on Margex. The platform offers an unbelievable 40% commission rate whenever your referrals make a payment.

You can have as many referrals as you wish and earn a lot of money. Margex provides a unique link to share on your social media handles to get more people to sign up.

This affiliate program offers rates that can easily become a steady source of income for you in no time.

Mining

This is one of the oldest money-making methods in crypto and is still relevant to date. Miners keep making money by creating new blocks using a Proof-of-Work mechanism. For each new block created, they gain several coins. They can store the digital assets in a software wallet like a Trust wallet.

Miners spend a lot to purchase computing power as the process involves supercomputers with great processor speed. The downside is that it is harsh on the environment. The mining equipment size and the noise generated make it impossible to set up in residential areas.

Some miners use cloud mining to rent computing power from a mining pool. In such cases, miners earn rewards relative to their overall stake in the mining pool.

If you want guaranteed earnings, you can run a master node. These nodes are special wallets that play host to the entire network.

Yield farming

Here crypto users deposit cryptocurrency in a pool with other users to increase potential gains. Yield farming depends largely on lending to realize interest, making it a very risky but highly rewarding investment strategy in crypto.

The cryptocurrency in the pool goes into smart contract investments. Most yield farms require users to leave their coins locked in the pool for a specific period to make a profit.

Four steps facilitate yield farming:

- Creation of the liquidity pool: Network users create pools with smart contracts. This contract facilitates all investments and lending.

- Pooling together assets: With a crypto wallet, investors can connect to the liquidity pool and make deposits. It is a form of staking done in a group context here.

- Lending protocols are activated by smart contracts. The smart contract controls all activities here: lending and the addition of liquidity to the pool.

- Claiming of rewards: All yield farms vary on their interest and reward scheme. Users are paid on a fixed date and regularly.

Buy and HODL

Most cryptocurrency investors prefer the buy-and-hold strategy to make gains. Investors go for coins like Bitcoin and Ethereum and even very volatile coins like Shiba Inu. They buy and hold onto the coins till there is a price increase then they quickly sell for profit.

This method, however, requires careful market analysis and can suddenly backfire if the coin suddenly goes on a bearish downtrend. Some investors diversify their portfolios so that they do not lose all their investments if one coin performs badly.

Buying and holding crypto can be short-term investments if the price changes in a short period. However, you might become a long-term investor in a sideways market trend without price changes.

A short-term investor will quickly sell his crypto coins once the price increases.

Crypto arbitrage

This process takes advantage of variations in the value of digital assets across different crypto exchanges.

All the trader has to do is buy from cheaper exchanges and resell where the value is high. The price difference will lead to profit as some platform prices vary between 2 – 30%

The trader using arbitrage will have to sign up for different exchanges and keep a keen eye on the pricing of the target digital currency.

Crypto faucets

Although they do not yield much profit at once, crypto faucets can gradually build up profit for an investor. Bitcoin faucets are more popular as they offer fractions of bitcoin (Satoshi) as rewards for users who complete specific tasks.

These tasks may include playing games or watching ads before the rewards are released. Faucets are not only limited to bitcoin, as other coins also incorporate this method.

Lending

Crypto finance is now the mainstay of the financial world, with most platforms accepting crypto payments. Crypto lending is another avenue where investors have made money across various platforms.

A borrower's coins serve as collateral when taking cryptocurrency loans. There are terms and agreements that both parties must agree on.

Lenders can now regularly profit from borrowing their assets and collecting interest rather than leaving them in their wallets.

There are different types of lending available in crypto.

Centralized: Here, you rely on a lending platform to help you generate income from the interests. You must send your token to the crypto platform to profit from it. The platform decides on the interest rates and length of the lock-up period.

Peer-to-peer (P2P): In this system, users can choose how much they want to lend and decide the conditions for accessing the loans and the type of collateral. The platform used helps to link the lenders with the borrowers.

It is wise, however, for users to store their tokens in the wallet provided by the exchange.

Defi lending: Here, users can interact directly with the blockchain to conduct lending and borrowing services. Users interact with smart contracts that determine the terms and interest rates for the parties.

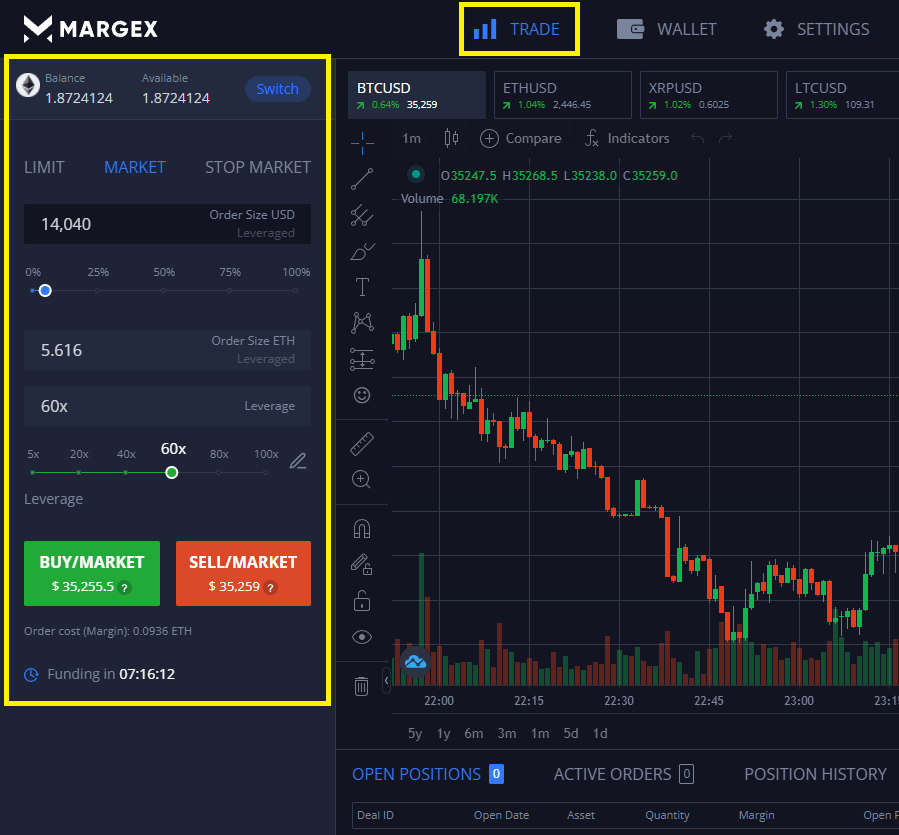

Margin lending: You can also give a helping hand to traders to boost their lot size and trading volume. Using leverage, traders hold larger positions by borrowing and repaying it with interest. Margex offers this interaction smoothly, with the ability to leverage your trade position up to 100x of the original lot size.

- Bonus point: Dividends

You can also earn money from crypto with dividends. These are small payments made to shareholders of a particular portfolio. In this case, you are a shareholder in the cryptocurrency field.

Some cryptocurrencies that pay these dividends include; NEO, Decred, VeChain, and NAVcoin. Cryptocurrencies pay their dividends as extra tokens or coins and not fiat currency.

Although the returns might not be much, it is another way of earning some extra crypto tokens on the side.

How to make money with crypto – investing safely

There is no completely safe investment. The following points will serve as guidelines that will aid you.

- Find the right exchange: It is unwise to entrust your crypto tokens to unknown and unregistered tokens. Do your research and use exchanges like Margex that are licensed and secure.

- Understand the process of storing a crypto currency: After purchase, it is up to a user to decide the storage mode. You might choose a digital wallet online or a cold offline wallet. Each has pros and cons.

- Try different investments: The fall in Bitcoin price has shown that no investment is invincible. Try to diversify your investment portfolio in several cryptocurrencies.

Some altcoins suddenly increase in value for a short period creating the potential for a huge profit. Always spread your capital on several assets to prevent bankruptcy.

- Prepare ahead for the price corrections: Like all investments, there are highs and lows in the crypto market. An asset can suddenly lose all its value, leaving you with nothing. So, do proper research and get educated on crypto.

Also, carry out proper technical and fundamental analysis and understand how to read chart and candlestick patterns.

How Margex Helps You To Earn In The Crypto Market And Keep Your Money Safe

Margex is a platform for now and the future. The platform gives users leverage of up to 100x of their original asset size. This helps traders on the platform to enter trades they normally can’t afford on their own.

On the Margex platform, you gain interest in your crypto assets: when traders use them for leverage. Also, users can trade with staked assets to increase profit which is an innovative idea.

Also, Margex is a highly secured platform with the safety of all crypto assets guaranteed on the site. The platform stores users’ assets in cold wallets to protect them from malicious attacks.

Regular audits are carried out on the platform to identify areas that hackers can infiltrate. There is also a provision for two-factor authentication for additional user security.

Margex offers affordable maker and taker fees to ensure you do not pay much to hold any type of position on the platform. Also, the free deposit option is a win-win situation for traders and investors on the platform.

FAQs-Common Questions On Making Money With Crypto

Discover the most common areas of confusion related to crypto earnings.

How much can someone make with cryptocurrency?

An investor’s earnings with crypto assets vary depending on several conditions. It's possible to make up to $100 daily or even a million dollars over a given period.

Some determinant factors include the type of crypto coin to invest in, its value, and market volatility. Also, the method and the amount of money in your investment will affect how much you make with crypto.

How much should a beginner invest in crypto?

Beginners should follow the 5% rule. The rule says never to invest more than 5% of your capital into risk assets like cryptocurrencies.

The crypto market is pretty volatile and hard to predict. So it is advisable to think of an amount you won't feel bad about losing.

When should I invest in Crypto?

The foremost thing to consider is market timing. The crypto market operates in cycles. There are times when the market booms and when it declines. Look at where the market is in the cycle. Then you'll know the best time or way to invest.

Some people say it’s best to invest when the value is down and wait for the boom to gain more profits on your investments.

Is making money with crypto hard?

It's not hard to make money with crypto assets. You only need to figure out when to invest and the investment strategies to employ. For instance, you can track when the currency value is down, buy and hold until the value reaches desired level before you sell.

Is a $100 investment worth something in Bitcoin?

All investments in Bitcoin, even with $100, are worth it in the future. Bitcoin, as the first cryptocurrency, has received the most attention worldwide. Investment in the token enables fractional holding.

So, if Cathie Wood's prediction for BTC hitting $560,000 in 2026 comes true: your $100 investment could be worth over $50 million.

Which platform should I choose for crypto investment?

Margex platform copes with the high volume of the crypto market. It is efficient and easy to use. On Margex, traders can access all vital information with no hidden details or fees. The platform also protects users’ data and does not divulge any details to third parties.

Also, there is no tedious KYC procedure.

Where can I learn to trade crypto?

Visit Margex blogs and use the numerous articles that will teach you all the essentials of crypto you need to know. Also, with the videos available, you will learn more about trading.