As we come to the end of 2022, which has been a much dreaded year for most crypto investors, many hopes and wishes are for the market to turn better next year. Some investors have already begun positioning themselves for the market next year, while others are wondering if there could be some interesting trading opportunities for them as the thinner volumes in the final weeks of the year could sometimes spring up good two-way price volatilities that could be good for trading.

Since there is still a week to go before the year comes to an end, we decided to take a historical look at Bitcoin price trends at year ends to see what are the chances of this week springing up some good opportunities for traders to make a quick buck.

Bitcoin Performs Poorly in Q4 of Bear Markets

Looking at how the prices of cryptocurrencies have been performing in 2022, it is an indisputable fact that we are currently in a crypto bear market. As such, we looked into the historical price performance of Bitcoin during a bear market year to see how this year could end. While we hate to disappoint, the data does not support either a bullish nor a bearish finish.

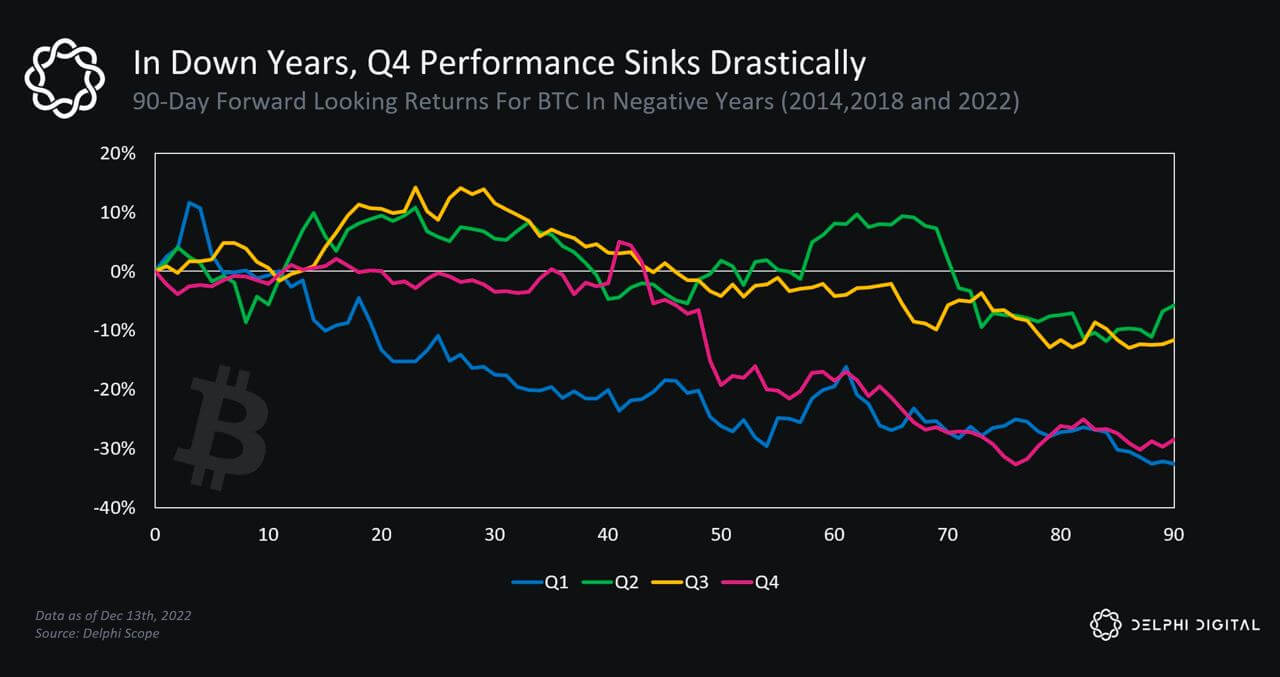

As can be seen in the diagram below, which tracks Bitcoin’s average quarterly price performance during bear market years, the outcome may not be what traders would like to see. The data, as tabulated by Delphi Digital, seems to suggest a sluggish end to the year, with Bitcoin’s price to trend on the weak side beginning December, and then to end the year on a flat note.

Chart Predicted FTX Selloff to a Tee

The chart seems to have accurately predicted the fall in Bitcoin’s price from early November after a flat October as can be seen in the purple line tracking the number of days into the final quarter of the year, beginning from October. This coincided with the FTX-related selldown to a tee, which saw the price of Bitcoin fall from $21,000 to $15,500 early November, before drifting lower into mid-December where price saw a slight increase.

The Selling Has Been Done And We Are Heading Into Boring Days

As we have about eight days before the year comes to an end, which would take us to just about past the 80th-day mark on the chart, should the prediction in the diagram continue to play out, during the period around Christmas, which is right about now, Bitcoin could see its price retreating into $16,000 until the final couple of days of the year before it recovers a tad.

As traders watch media coverage on the indictment of the FTX management team which is showing up more drama each day, many are hopeful that the event could move crypto prices in an equally dramatic way, be it up or down, so that prices could get out of their boring trading ranges and provide some quick trading opportunities to close out the year. However, the above historical data suggests that Bitcoin would continue to be stuck within the narrow range at least until the year 2022 officially ends; this could mean that altcoins could also suffer the same boring fate.

Hence, at least based on the above information, it might be more fruitful for traders to spend the final remaining days of 2022 with their family and friends, enjoy the festive season and recharge themselves for 2023, instead of pining for the market to give them a Christmas or New Year present.

The above information is for educational purposes only and should not be taken as the official view of the Margex platform. They are also not financial advice and should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.