Ethereum is a blockchain-based decentralized open-source technology. You've undoubtedly heard of the versatile Ethereum, second to none other than Bitcoin. Because of its many unique features, Ethereum has become a household name in the crypto world. In fact, Ethereum is one of the most searched crypto terms in search engines.

The only thing that most people know about Ethereum is that it's a cryptocurrency that has seen significant growth in recent years. Ethereum, on the other hand, is not just a cryptocurrency; rather, it's a platform that acts as a foundation for most of the industry. It serves as the powerhouse for the creation of many fungible and non-fungible tokens, many decentralized applications, and the development of smart contracts.

Regardless of its widespread popularity and large community, many new traders are still skeptical about Ethereum as an investment. In this post, we'll explore some of the unique features of Ethereum and why it's so promising for the future. We'll also answer the question, "Is Ethereum a good investment?"

How Ethereum Has Performed Since Launch & in 2022

So, is Ethereum a good investment? As is the case with all investments, it is wholly dependent on the individual investor and the level of risk that they are willing to take. Since Ethereum's network went online in July 2015, its value has been subject to a great deal of volatility throughout the course of the past few years, but overall it has seen a steady increase in value. Its popularity started to pick up steam in 2017 as the price of Bitcoin and the crypto industry skyrocketed. Having a better grasp of its price performance over the past few years will help you make better decisions on whether Ethereum is a good investment or not. So let's get into it.

Price History and Analysis of Ethereum

2013-2015: The Ethereum idea

The desire for a more sophisticated blockchain platform that would enable the development of decentralized applications led to the creation of an idea in 2013 that became Ethereum. Vitalik Buterin, co-founder of Ethereum, and his team of developers aimed to create a more versatile platform that went beyond just currency transactions. In 2014, development began, funds were raised, and in July 2015, the first Ether (ETH) was mined. From that point on, Etherium experienced a number of milestones.

Ethereum, much like the majority of other cryptocurrencies that were in existence in 2015, spent the majority of its first year trading for less than $1. It did, however, break $1 multiple times in 2015, the first time being August 11. Although price movement was mostly silent, Ethereum had started to slowly catch the interest of investors.

2016: Speed bumps and hard forks

Ethereum continued its slow movement into 2016 and found a strong footing above $1 in January. By the end of January, it had doubled to over $2. This rising pace continued slowly, with Ethereum crossing $20 for a brief while in June.

In the same June, a security breach occurred when $50 million worth of ETH was stolen from a decentralized autonomous organization called The DAO. This led to a hard fork split where the theft was erased on the new blockchain. The new chain retained the Ethereum name while the original version was renamed Ethereum Classic. Ethereum subsequently forked twice in September/October to deal with denial of service (DoS) attacks, and its price was hovering around $8 by the end of the year.

2017-2018: Surging interest

Ethereum’s steady stride became more volatile in 2017. Its use cases had started to get the attention of traders, establishing itself as a major player in the process. Although ETH started the year trading at less than $10, it has seen tremendous interest and spiked to reach $400 by the middle of the year. The subsequent months were marked by highs and lows until December, when a bullish run emerged. ETH managed to close 2017 above $770 and maintained its upward trend into 2018.

On January 13, 2018, as the popularity of the entire cryptocurrency market surged, ETH reached its then all-time high of $1,396. This bull run was very short-lived as the price collapsed in the following months and ended the year below $150.

2019-2020: Slow and steady

Those two years were very peaceful and passed very quickly. Although the crypto market was relatively calm compared to the previous year, ETH continued to demonstrate its erratic growth. It went from a low of 107 USD in January 2019 to a high of 730 USD in December 2020. The spikes in December 2020 were signs of better things to come in 2021.

2021: NFTs and smart contracts

The year 2021 has been ETH's best year so far. As previously mentioned, the Ethereum blockchain is known to be the forerunner of smart contracts. Therefore, as the NFT market grew in 2021 into a multibillion-dollar sector, interest in Ethereum skyrocketed, which in turn contributed to an increase in ETH's value. It went through a long surge in April and May to reach $4,168 on May 11th. Another surge happened in November and it reached its current all-time high of $4,865.57 on November 8th, 2021.

2022: What’s next?

Save for a few uptrends in February and March, ETH has been on a bearish trend since the beginning of the year. It started the year around $3,700 and its current price of $1,100 is a far cry from what it was around July of last year. However, the current downward movement is justified as the general market is currently low on investor sentiment.

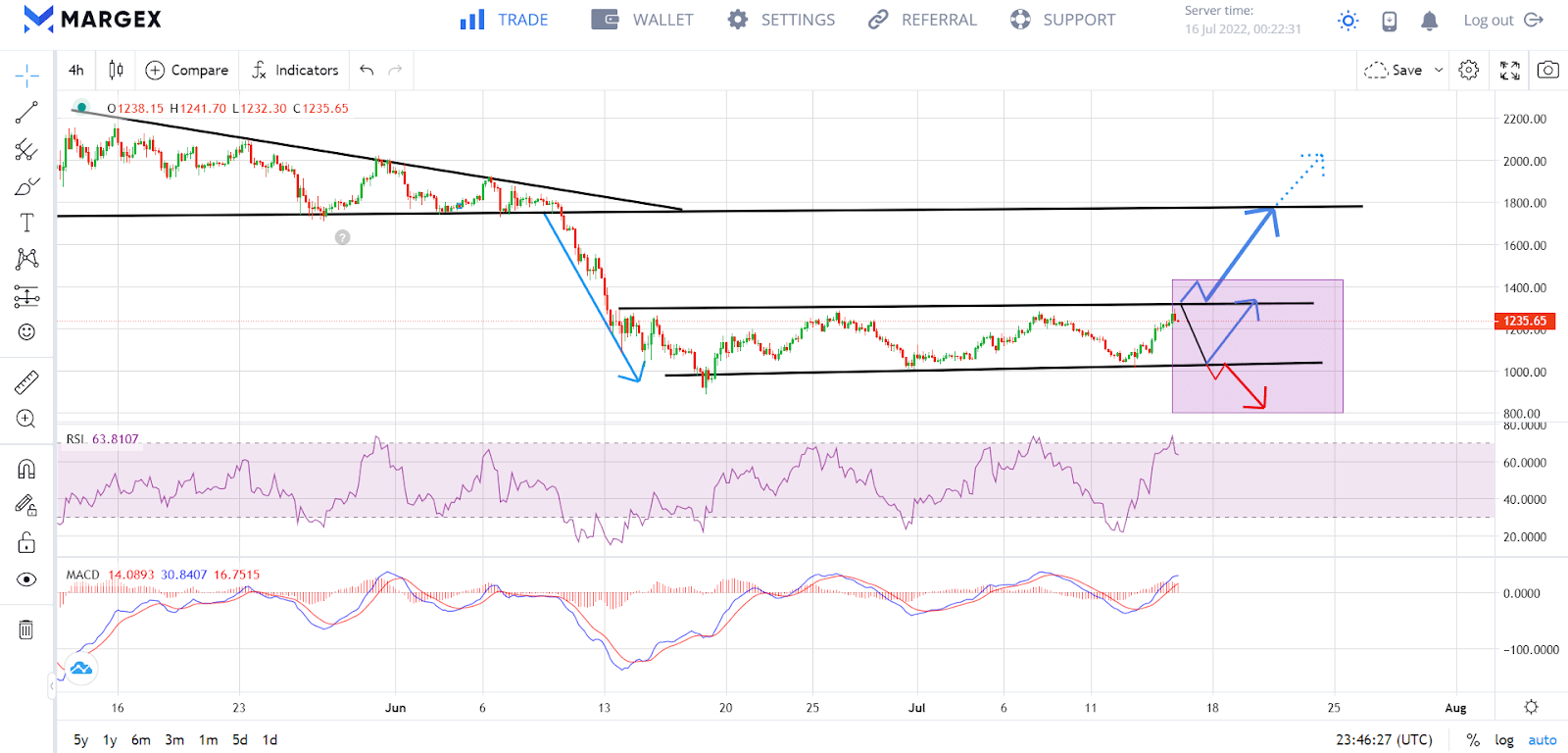

Ethereum Technical Analysis

In the 4-hour timeframe above, the price has formed a triple bottom by bouncing between levels of support and resistance for some time now. The levels of support are located around $1,000 and the levels of resistance are located around $1,300. Going by chart analysis alone, this is a bullish signal if a breakout occurs at resistance. However, other indicators point to the opposite. By now, it's already showing signs of retracements and the inability to cross the $1,300 resistance again. The VWAP line shows a reduction in volume, evident that the buyers are getting tired again. The RSI is also showing the correction of an overbought condition.

ETH Price Prediction

In summary, the ETH technical analysis suggests a drop that may go further below the $1,000 support level, as the bearish trend increases. On the other hand, a bullish reversal could cause the price to rise to $1,300 and even beyond, potentially reaching around $1,800.

ETH Price Prediction By Experts

Many industry experts have weighed in their Ethereum price predictions for the current year and the years to come. Most of them are taking a positive stance, but as expected, some are pessimistic.

Mike McGlone, a Bloomberg intelligence analyst, predicted in January that Ethereum could thrive and surpass the $5,000 threshold this year. According to Wallet Investor, it will reach $7K by the end of the year. GovCapital predicts an average of $2191.991 by the end of 2022 and $4737.212 by the end of 2023. Changelly.com also predicts an average trading price of $2,503.94 in 2022.

Other predictions are less optimistic considering the current market downtrend. For instance, famous Twitter crypto analyst @CryptoCapo_ predicts a clean break below $1,000 as the price continues to test the $1,000 resistance. Experts from TradingBeasts predict a slow trend and year-end with an average price of 1,262.772. However, they also expect a bullish U-turn in the near future.

Ethereum Utility Tokens – Are They Investable?

Apart from Ether, its native token, the Ethereum blockchain allows for the creation of custom tokens. One category of these tokens are called ERC-20 tokens, also known as utility tokens. ERC-20 tokens are the most commonly used tokens on the Ethereum network as they can be used to power decentralized applications (dapps) and projects. They are used to create fungible tokens for payment of services, products, and can also be traded on crypto exchanges.There are hundreds of ERC-20 tokens and some of them have proved to be good investments. Examples are Chainlink (LINK), Basic Attention Token (BAT), Uniswap (UNI), and Aave (AAVE). So, if you're looking to diversify your crypto and Ethereum investments, utility tokens are good options to add to your portfolio.

Ethereum 2.0

Although the Ethereum blockchain has many versatile use cases, it is not perfect, and developers have been planning to launch an update. Ethereum 2.0, commonly known as Serenity or Ethereum consensus layer, is the first major update to the Ethereum blockchain. It aims to raise the Ethereum network's speed, efficiency, security, sustainability, and scalability to handle more transactions.

The Ethereum blockchain currently uses the proof-of-work (PoW) consensus mechanism to validate transactions. This is energy-intensive, as many miners race to solve complex mathematical problems using powerful machines. Ethereum 2.0 hopes to do away with this process by introducing the less energy-intensive proof-of-stake (PoS) protocol.

In PoS, mining is replaced with a validation operation known as forging. Here, validators stake a minimum of 32 ETH to show their interest in validating transactions and adding new blocks. One validator is randomly selected to verify transactions in a block proposal. For the block to be accepted, other random validators must accredit the validity of the block being proposed. The Ethereum Foundation estimates that this validating process will consume 99.95 percent less energy than the current Proof-Of-Work method.

Beacon Chain, the initial phase of Ethereum 2.0 was launched in December 2020. The Beacon Chain will soon be merged with Ethereum's mainnet in the third quarter of this year, and the upgrade will be finished when shard chains are implemented sometime in 2023.

Ethereum or Bitcoin?

So, you're thinking of investing in Ethereum? Great decision! But which is better? Ethereum or Bitcoin? Well, that really depends on what you're looking for. Ethereum offers a number of benefits over Bitcoin, including faster transactions and no limited supply.

Bitcoin was created to replace traditional banking institutions and fiat currency in everyday transactions while Ethereum was created as a platform for the development of applications (dApps). Its goal is to construct a decentralized network that can facilitate the creation of smart contracts and the execution of many applications across a range of industries, which is why it's often referred to as "the world computer."

Both Bitcoin and Ethereum are valuable investments, but Ethereum is arguably a better investment right now because it's cheaper and it has a higher potential for future growth and adoption. Ultimately, it's up to you to decide which way you want to go.

What to Know Before Investing in Ethereum?

Like all investments, it's important to do your research before buying Ethereum. Here are a some things to keep in mind:

- Ethereum is not flawless and it's not as widely accepted as Bitcoin.

- The price of Ethereum is very volatile, so be prepared to experience some highs and lows.

- Ethereum's smart contracts dominance is currently being threatened by other blockchains known as Ethereum killers.

- Ethereum is set to undergo an upgrade that will increase its scalability, transaction processing speed, and environmental friendliness.

Mistakes to avoid before investing in Ethereum

When it comes to Ethereum, there are a few mistakes that you want to avoid if you're looking to invest:

1. Don't buy Ethereum based on hype, speculation, or a fear of missing out (FOMO). Do your research and make sure you understand the technology and what it's trying to achieve before investing.

2. Never risk more than you can afford to lose. Cryptocurrencies are incredibly volatile and subject to fast price fluctuations. Be prepared for the possibility of losing some or all of your investment.

3. Don't forget that Ethereum is still not as stable as traditional money. There is always the risk of technical faults or even a complete crash. An example is the one we've seen in The DAO attack.

5. Don't blindly trust anyone since you're investing your own money in cryptocurrencies. Make sure you do your personal research while taking into account the advice of various sources before making a decision.

Ways To Invest In Ethereum

If you're looking for a way to invest in Ethereum, you're in luck. There are a few different ways you can do this.

Trading

The easiest way to invest in Ethereum is by simply trading the cryptocurrency. Trading Ethereum allows you to take advantage of market volatility and maximize your profits. You don't have to wait for future price increases as you can also make profits by opening short positions during bearish markets. But like all investments, there are risks involved. Ethereum is a highly volatile asset, so it's important to be aware of the risks and take steps to protect your investment. The best way to minimize those risks is to familiarize yourself with the Ethereum market and learn how to trade Ethereum.

Step-by-step guide on how to trade ETH on Margex\

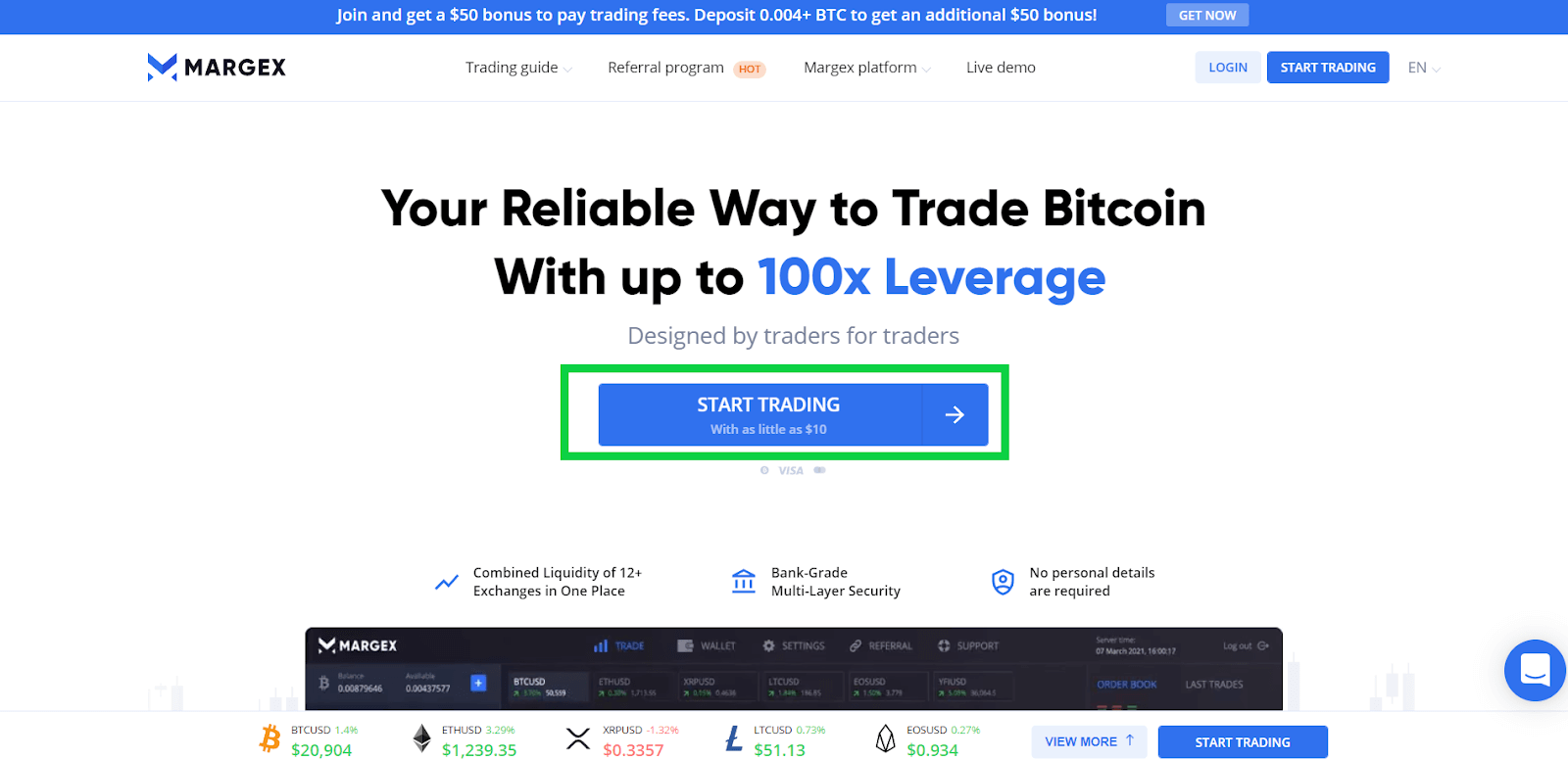

Margex is the best platform for trading ETH because of its modern, easy-to-use user interface. With Margex's 100X leverage, traders can start with as little as $10 and utilize leverage to their advantage.

Step 1: Sign up for a live trading account at Margex.com by clicking on "Start Trading."

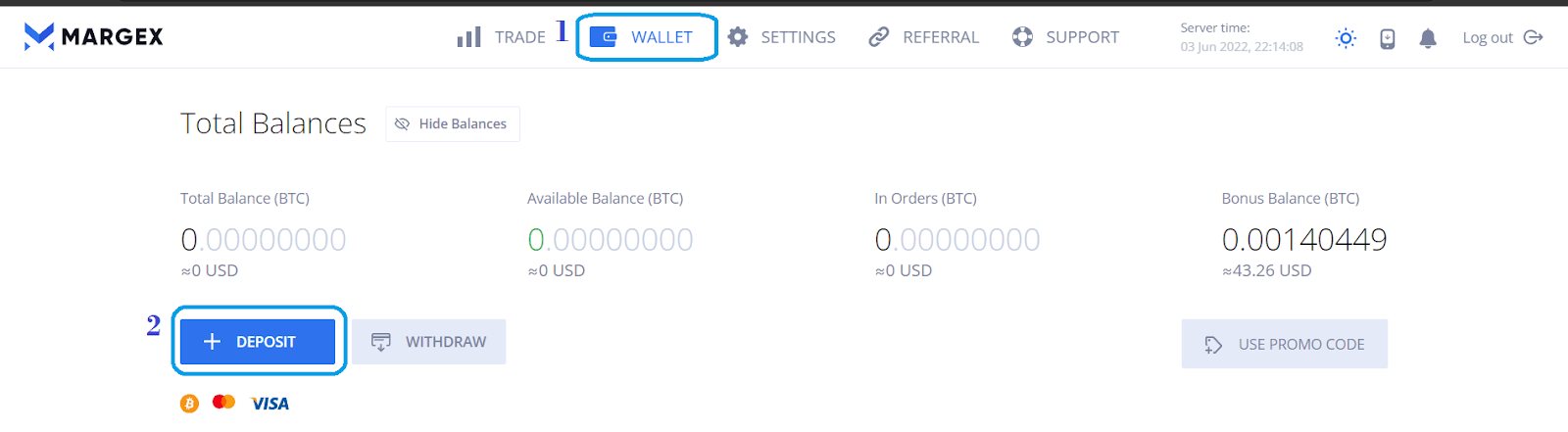

Step 2: You need to deposit to begin trading. Click on the “Wallet page” and select "+Deposit" to buy crypto through Changelly/ChangeNow or by transferring crypto to your Margex wallet.

Step 3: Return to the "Trade" page to start trading. Select ETHUSD to trade ETH. Here you can click on the "Indicators" tab to perform any technical analysis you wish.

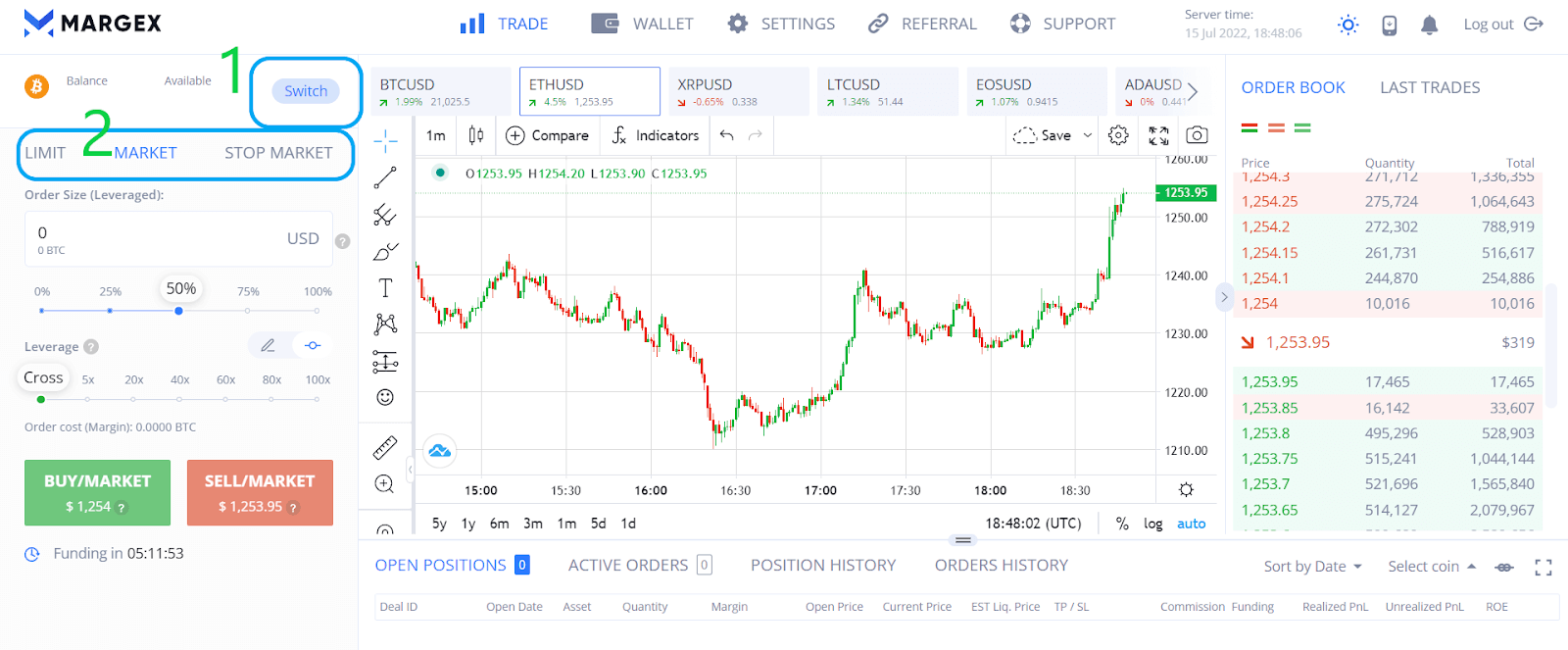

Step 4: Click on "Switch" to switch between the various assets you can use as a collateral for your trades. You have the option to execute a market order immediately or a limit order at the price you specify.

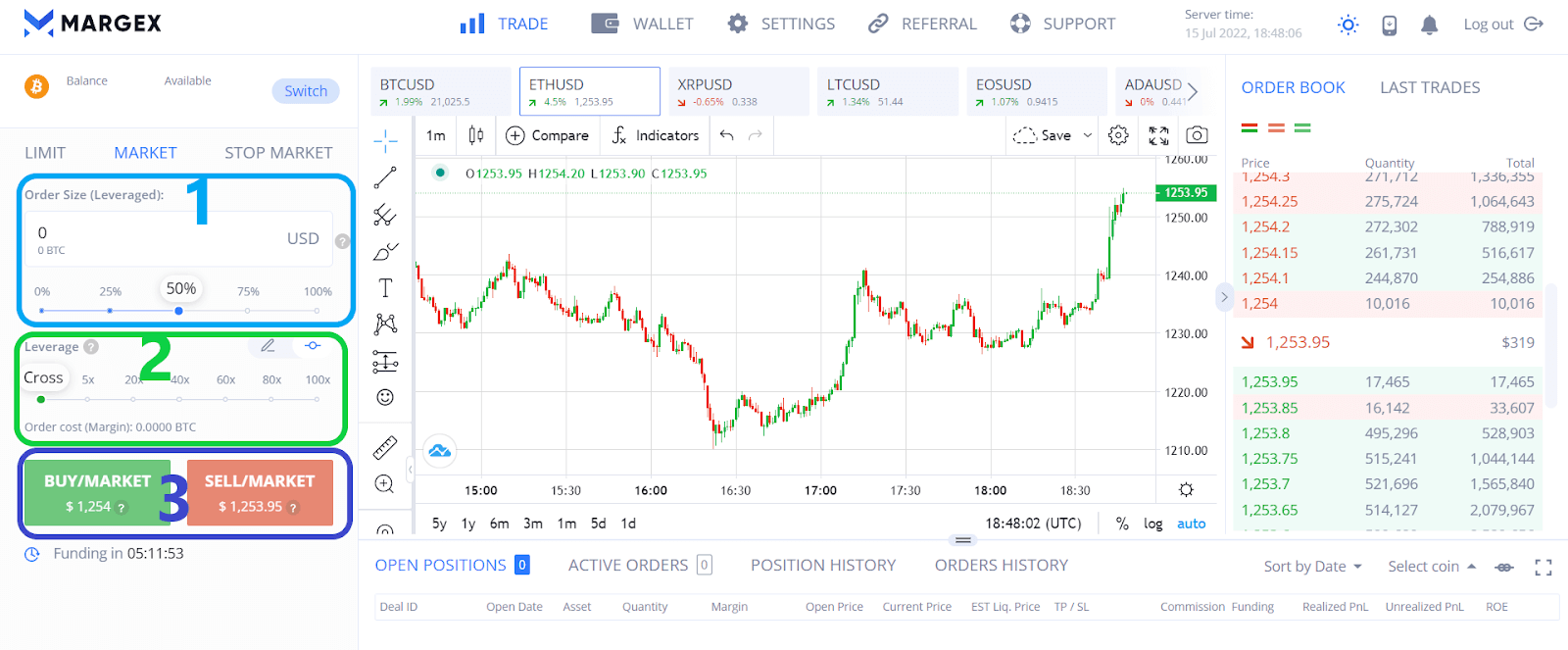

Step 5: Enter your order size. Adjust leverage to your preference and click on “Buy” or “Sell” to enter your trade. Simple as ABC.

Holding

Another popular way of making money through Ethereum is to buy Ether and wait for a substantial future price increase before selling. To do this, you need to have strong faith in the cryptocurrency's future and the team behind it. However, holding cryptocurrencies and waiting for potential profit have proved to be unfavorable in the past year. For example, Ethereum (ETH) started the year at $3,725 and it is now trading around $1,200. This shows that investors who started holding this year are now probably at a major loss. But if you think long-term in terms of years, Ethereum has a lot of potential and could be an excellent investment to hold.

Mining

Ether mining is a less popular way to make money than Etherium, but it is undoubtedly profitable. To mine Ethereum, you must join thousands of powerful computers competing to solve complex mathematical problems. The first miner to solve the problem gets the right to verify transactions and add blocks to the blockchain. In return for their work, they are rewarded with two ETH plus any priority fees contained in the block.

While mining may have been relatively easy in the early days of crypto, it has now grown to become a highly competitive business. Another way to invest in Ethereum mining is by investing in Ethereum mining companies.

Staking ETH 2.0

As previously mentioned, the planned Ethereum update will replace the mining process with a less energy-intensive proof-of-stake (PoS) protocol. In contrast to mining, staking doesn't require any special hardware or software. You can do it with a standard digital equipment like a laptop or desktop computer.

In staking, validators stake their personal Ether to show their interest in validating transactions and adding new blocks. In exchange for their efforts, they are rewarded with newly created ethereum tokens.

How to safely and securely store and transfer ETH

Now that you're familiar with Ethereum's fundamentals, it's time to learn how to securely store and transfer your coins. The first step is to create an Ethereum wallet. Creating a wallet is free, and it's all done online.

You can either store your coins using a hardware or software wallet. A hardware wallet is a physical device that stores your private keys in a secure hardware device offline, while a software wallet is a program that you install on your computer. There are a number of different options out there, so do your research and find one that suits your needs.

Here's how to safely transfer your Ethereum:

1. First, make sure you have a wallet that supports Ethereum. There are many different blockchain wallets and brokers available, so don't make mistakes.

2. Once you have a wallet, create a new account on the trading platform you plan to use.

3. Copy the Ethereum address from your wallet and paste it into the "Deposit" field on the trading platform. You can also use the "Withdrawal" field to do this the other way around.

4. Click "Send" and wait for the transaction to be processed.

5. Once the transaction has been processed, your Ethereum will be transferred to your trading account and you can start trading.

Pros and Cons of Ethereum

When it comes to Ethereum, there are a number of pros and cons. Here are some of them you should consider:

Pros

Versatile:

Ethereum is known for its versatility, hence why it is dubbed the world's computer. It allows for the creation of smart contracts. These contracts are self-executing transactions that occur when certain conditions are met. This makes Ethereum a more efficient and trustworthy platform for various real-world cases like DeFi, NFTs, and other blockchain projects.

Strong community and developer team:

Ethereum remains the most actively developed Blockchain protocol, with a consistent rise in the core development team and contribution of developers. As a result, the blockchain protocol is constantly being improved and upgraded.

Market recognition:

Ethereum is the most recognized cryptocurrency in the industry after Bitcoin. Hence, there's better stability than other altcoins.

Cons

Scalability issues:

The biggest downside to Ethereum is its scalability issues. The network can only process 30 transactions per second, which is known to cause transaction delays and network congestion. Ethereum 2.0, on the other hand, promises up to 100,000 transactions per second.

High transaction fees:

The number of transactions made on the blockchain is far greater than 30 per second, which causes network congestion and spikes in transaction (gas) fees. Miners prioritize transactions of users who can pay these higher gas fess.

Fierce competition:

Despite Ethereum's continued reign as the master of DeFi and smart contracts, there are many faster blockchains supporting smart contracts. These so-called Ethereum killers pose a persistent threat to Ethereum's dominance.

Conclusion - Should I Buy Ethereum?

At the moment, buying Ethereum is a smart move. It's one of the most popular cryptocurrencies out there, and its value is only going to continue to rise. Ethereum is not only a cryptocurrency, but it is also a platform for decentralized applications. This makes Ethereum very promising for the future.

That being said, it is possible that it could take some time before you start to realize a significant reward on your investment. So, if you're looking to make quick profits from Ethereum, you should consider trading to take advantage of the current market volatility

Is it a good time to buy Ethereum?

So, is it a good time to buy Ethereum? The short answer is yes. The price is currently lower than usual and the potential for growth is high. If anything, its past price performance is an indication of the heights it is capable of reaching. The price is also expected to increase when the planned Ethereum update is launched. However, as with any investment, this could change at any time. Make sure to calculate and do your own research before investing in Ethereum or any other cryptocurrency.

FAQ

Is Ethereum a good long-term investment?

Yes, but it really depends on your objectives and your level of risk tolerance. Make sure you do your research and are aware of the risks if you're considering investing in Ethereum. And always remember: never invest more than you can afford to lose.

What will happen to Ethereum in 2022?

The price of Ethereum will be affected by a myriad of factors, like the state of the economy on a global scale, the pace of innovation on the Ethereum network, and the overall demand from buyers and sellers.

What will Ethereum be worth in 5 years?

A number of industry experts predict that one Ethereum coin will be valued up to $10,000 within the next 5 years. Although this is purely speculative, it is not completely out of the question for Ethereum to reach this valuation if Ethereum 2.0 is successful and the platform maintains its momentum in terms of popularity and significance.

Is it better to buy Ethereum or Bitcoin?

Bitcoin is still the most popular cryptocurrency and has a much higher market cap than Ethereum. If you're looking for a more established currency with a proven track record, Bitcoin is for you. But if you believe in the versatility of the Ethereum blockchain and its greater potential for appreciation, then it's a better recommendation.

Can Ethereum ever crash?

Anything can happen, but since Ethereum is one of the most established cryptocurrencies in the industry, the possibility of a crash is less than with most cryptocurrencies.