When you create a trade order on Margex, you’re establishing an agreement with a counterparty — another trader — to either buy or sell an asset, such as Bitcoin, at a specific price or in a specific price range.

There are a number of different types of trading orders available to traders, each of which perform different functions and provide different benefits when trading cryptocurrencies. It is important to understand each of the three different basic types of trading orders:

- Limit orders allow traders to sell or purchase an asset at a specific price

- Market orders allow traders to sell or purchase an asset at the current market price as fast as possible

- Stop orders allow traders to set up orders that will not trigger until a specific price point is reached

This article will provide an explanation of how each type of order works along with examples of why and when they can be used.

What are limit orders and how do they work?

Limit orders allow exchange users to create an order that will only be executed when an asset reaches a specific price. There are two types of limit orders — buy-limit orders, which execute an order when an asset reaches a specific price or lower, and sell-limit orders, which are executed when an asset reaches a specific price or higher.

In simple terms, limit orders allow traders to minimize price risks when crypto trading. A trader that makes a limit order will ensure that the order will not be executed unless the price of the asset traded meets specific price requirements.

It’s important to note that limit orders are not guaranteed to execute — a limit order will not be executed if the price of an asset does not meet the price set by the trader when making a limit order.

Should a trader want to sell Bitcoin at a specific price, for example, they will create a limit order at the target price they’d like to sell at. Alternatively, a trader may want to purchase Bitcoin when the price drops to a specific amount.

What are market orders and how do they work?

A market order is the most basic and commonly-used type of order and allows a trader to purchase or sell an asset at the current market price. When an order placed on Margex is completed, the order is referred to as “filled.”

Market orders are placed and, in most cases, executed instantly — speed of execution is prioritized over asset price. Traders generally use market orders when seeking to purchase or sell an asset as soon as possible in order to capitalize on profitable movements or to minimize losses.

Market orders are typically most effectively used when rapidly purchasing or selling highly liquid, frequently traded assets such as Bitcoin. A market order placed for an asset that isn’t as frequently traded will typically take longer to fulfill, with execution prices that may deviate from trader expectations.

A trader may want to purchase a specific amount of Bitcoin instantly without waiting for market conditions to change. In this scenario, a simple market order is the easiest and fastest solution.

What are stop market orders and how do they work?

Stop market orders are placed by traders seeking to sell or purchase an asset should the price of the asset reach a specific level. Traders use stop market orders to minimize losses should the market move too far in the wrong direction.

Stop market orders are conditional. A stop market order will not be executed unless the price defined by the trader, referred to as the “stop price,” when placing the order is available. When the stop price is met or exceeded, the order will be executed as a market order.

A trader seeking to minimize potential losses may set up a stop market order if they believe an asset may potentially fall in price, minimizing overall risk.

Limit orders vs market orders vs stop market orders

Traders and investors usually use market orders when they want to enter a trade immediately. A market order is the fastest and simplest type of order that can be executed at the current market price. Other types of orders, such as limit orders and stop orders, provide traders with different advantages.

Market orders are focused on price — the price of the asset traded is less important than the speed at which the order can be executed. Limit orders, however, place higher importance on price over speed. Limit orders ensure that an order will not be executed unless the price of the asset traded is within the parameters of the limit order.

Stop orders and limit orders are similar. The most important difference between the two, however, is the visibility of the order — a limit order is visible to the entire market via the order book, while a stop order is not visible to the market until the order is executed.

Stop loss and take profit orders

Stop-loss orders and take-profit orders are used by traders to minimize risk and unexpected losses, or ensure an asset is sold once it reaches a specific price point in order to generate profit.

Stop-loss orders are functionally similar to stop market orders, with an important difference. A trader will use a stop market order to ensure the trade of an asset when it reaches a certain price. A stop-loss order, however, is a specific type of limit order that ensures the sale of an asset should it fall in value from the original purchase point.

Take-profit orders are orders that sell an asset when it reaches a specific price. When placing a take-profit order, a trader will set the exact price at which an asset should be sold. The order is automatically executed when a specific level of profit is reached for the open position to which the order applies. If the asset does not reach the price defined by the trader within the order it will not be executed.

A take-profit order allows traders to minimize risk by ensuring that a position can be closed as soon as a profit target is reached. Take-profit orders are commonly used in combination with stop-loss orders — a trader may use a take-profit order to automatically close a position for a gain while simultaneously using a stop-loss order to minimize loss should an asset fall in price.

How to set up a limit order on Margex

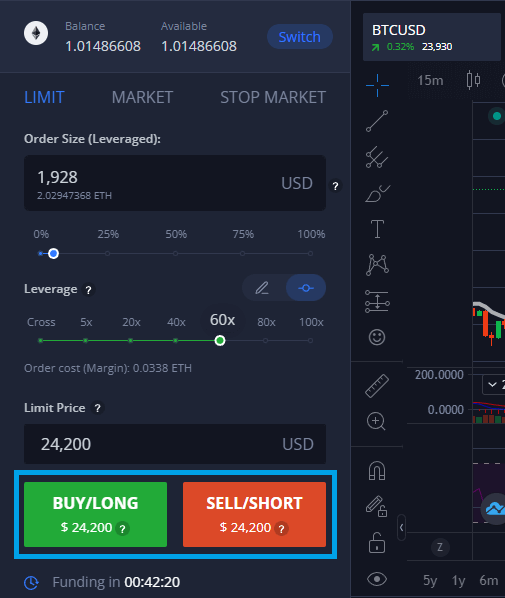

Setting up a limit order on the Margex crypto trading platform is a relatively straightforward process:

1. Log in to your Margex account

Once you’ve logged in to your Margex account, you’ll be presented with the order book, market chart, and, to the left of the market chart, the order panel.

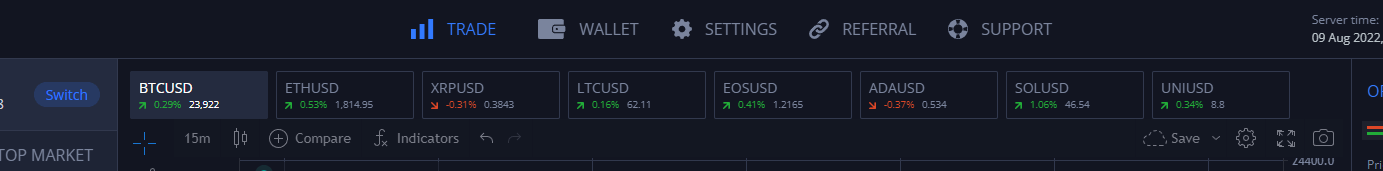

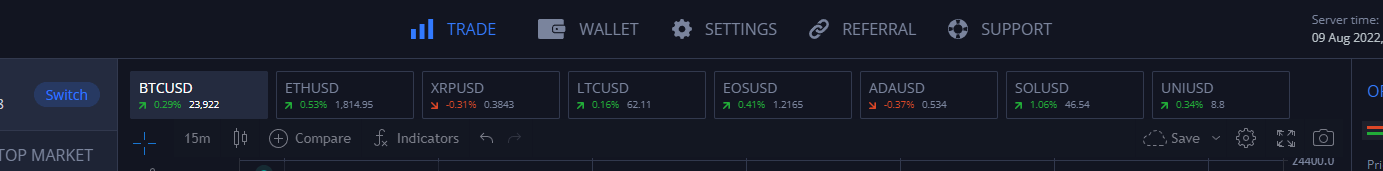

2. Select the pair you’d like to trade and the asset you’d like to use to fund your order

You’ll need to select the trading pair you’d like to trade — use the top menu to select the trading pair you’d like to place an order for.

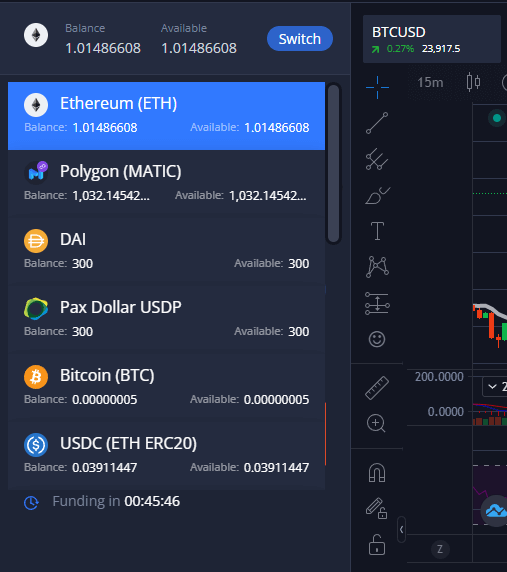

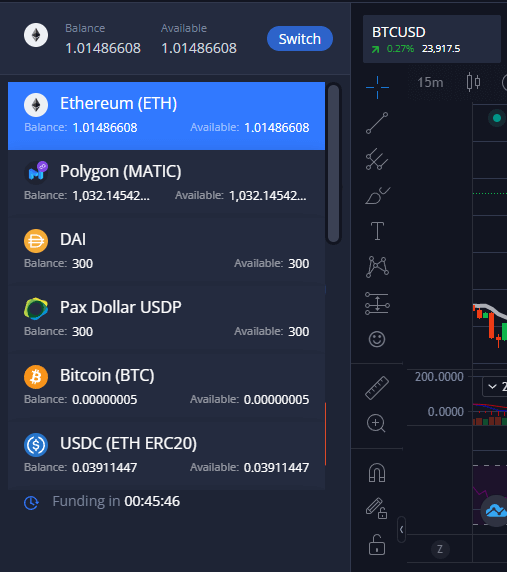

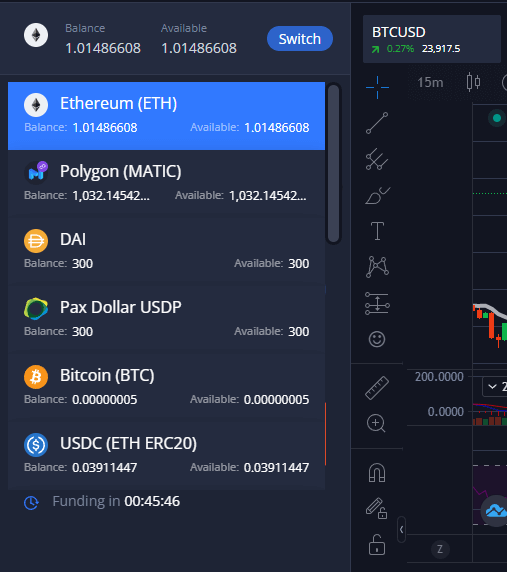

You’ll need to fund your trade — click the “switch” button within the order panel to choose the asset you’d like to use to fund your trade.

3. Set your order size and limit price

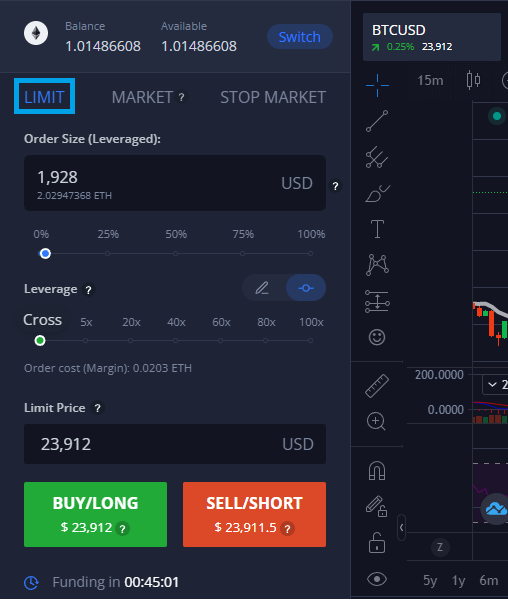

The first section of the order panel provides three options — Limit, Market, and Stop Market. Click the “Limit” option and set your order size in USD.

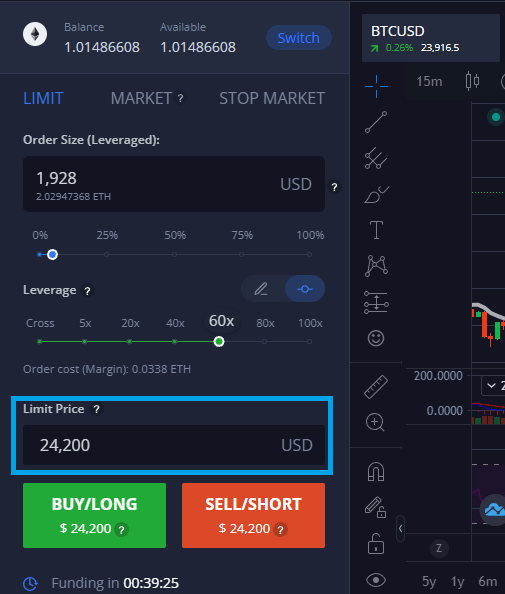

Set your target limit price for the asset you’re trading in the “Limit Price USD” field.

4. Set leverage

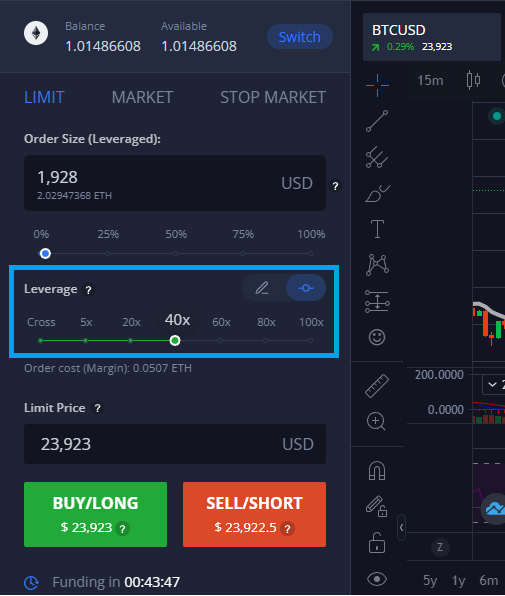

If trading with leverage, you’ll need to set your leverage. Use the leverage slider to select the leverage you’d like to trade with

5. Confirm details and place order

Once you’ve set up your limit order, review the details you’ve set and, when confirmed, select either BUY/LONG or SELL/SHORT.

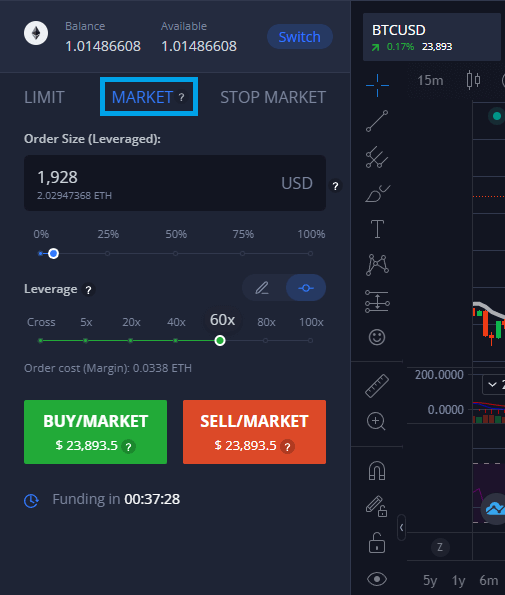

How to set up a market order on Margex

Follow these steps to set up a market order on Margex:

1. Log in to your Margex account

Log in to your Margex account — the Margex trading interface provides traders with an order panel, charting tools, and order book information from left to right.

2. Select the pair you’d like to trade and the asset you’d like to use to fund your order

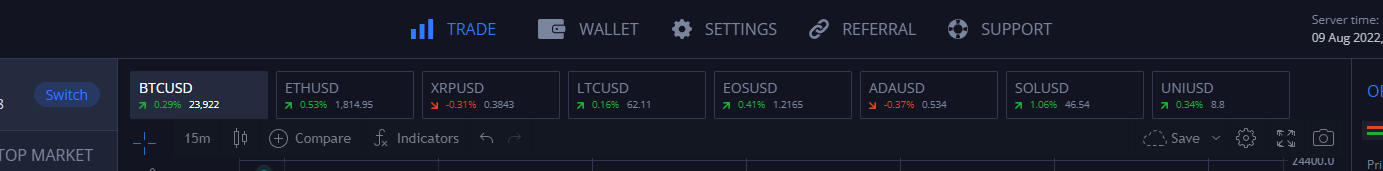

Use the trading pair panel directly above the chart interface to select the trading pair you’d like to trade.

You’ll need to fund your account to start trading — select the asset you’d like to use to fund your order with the “SWITCH” button in the order panel.

3. Set your order size

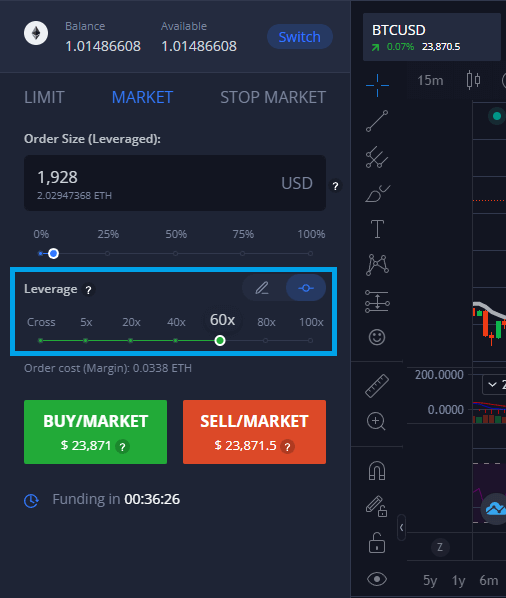

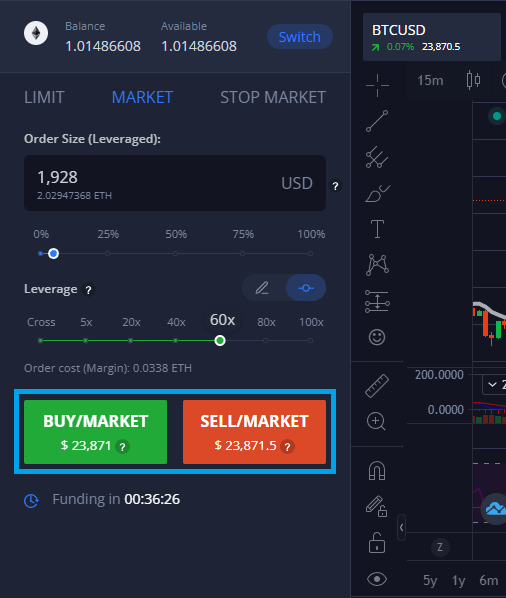

The order panel provides three order options — select “Market” and ensure that it is highlighted in blue.

Enter your order size in USD in the field below the order options.

4. Set leverage

If you want to trade with leverage, you’ll need to select your order leverage size using the slider below the “order size” field.

5. Confirm details and place order

Confirm the details that you’ve entered for your order, then click either BUY/LONG or SELL/SHORT depending on whether you are selling or buying an asset.

How to set stop market order on Margex

Here’s how to set up a stop market order on Margex

1. Log in to your Margex account

Log into your Margex account — to create a stop market order, you’ll need to use the order panel to the left of the charting interface.

2. Select a trading pair and fund your order

You’ll need to make sure you’ve selected the pair you’d like to trade from the trading pair panel directly above the chart interface.

Once you’ve selected your trading pair, you’ll need to fund your trade. Select the “SWITCH” option at the top of the order panel to choose the asset you’d like to trade with.

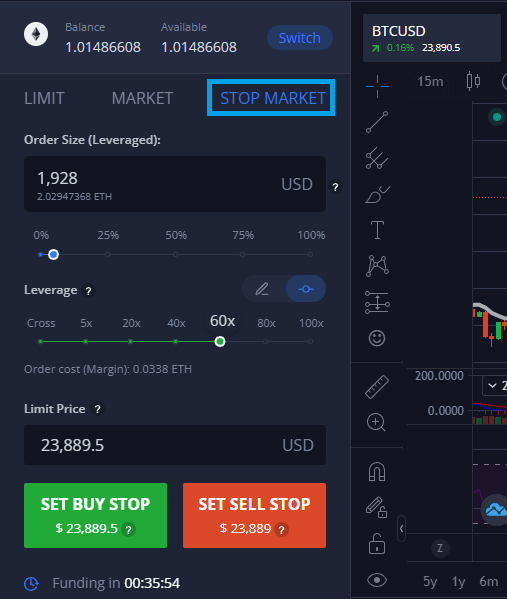

3. Set up your stop market order and set your order size

To set up your stop market order, you’ll need to click “STOP MARKET” from the three order type options directly below the balance section of the order panel.

Set your order size in USD using the field directly below the order types.

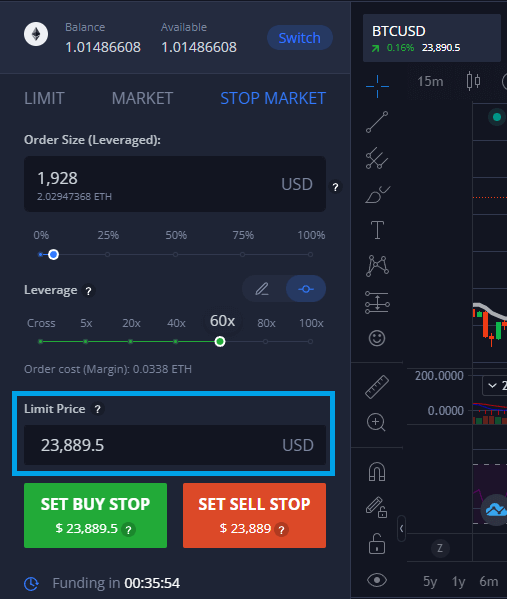

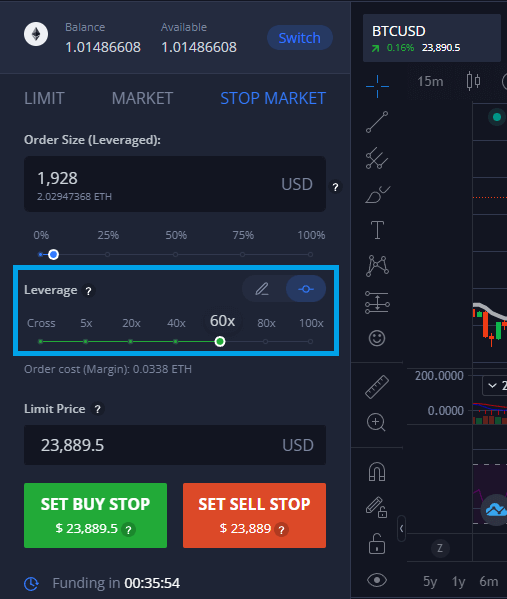

4. Set your stop market limit price and leverage

Use the “Limit Price USD” field to set the price limit for your stop market order.

If you’re trading with leverage, you’ll need to select the amount of leverage you’d like to trade with using the leverage slider.

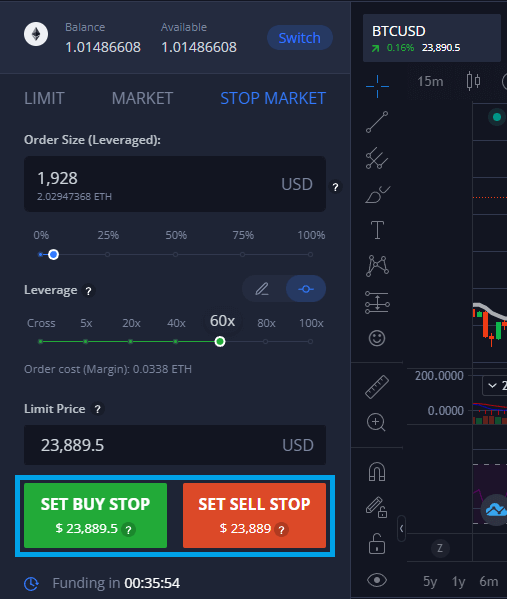

5. Confirm details and place your order

After you’ve set up your order, confirm the details you’ve entered then click either SET BUY STOP or SET SELL STOP.

Summary

Different types of orders can be used to rapidly purchase or sell assets, minimize risk, automatically close a position in order to take profits, or take advantage of a crypto trading opportunity. The order types available on Margex work the same way as on other cryptocurrency exchanges and trading platforms.

Understanding how each of the order types outlined in this article works will help you understand how the Margex crypto trading interface works and how to create effective and strategic trades.

FAQ

How do I decide which type of order to use?

The correct order type to use depends on your crypto trading strategy. If you simply want to purchase an asset quickly and easily, a market order may suffice. If you’re aiming to minimize risk, you may choose to set up a stop loss order.

Will a limit order always be filled?

A limit order will only be executed and filled if the limit price set by the trader is reached by the asset. The limit price can be either higher or lower than the current market price of an asset.

How long does a limit order or stop market order last?

Your order will remain open until the asset you have placed the order for reaches the price defined in the order, or if you close the order — the time of the order doesn't matter.