The cryptocurrency industry is growing at a fast rate and more participants are looking to purchase and sell cryptocurrencies to maximize their profit and income. Due to the general extreme volatility of cryptocurrency values, it is possible to make significant gains or losses depending on the market conditions at the time of purchase. Although trading bitcoin and other cryptocurrencies could be a very lucrative endeavor and there is a potential to make a profit, there is also the possibility that things may go tragically wrong.

A cryptocurrency that is in a bullish trend can very quickly reverse and go into a full downtrend, which is something you wouldn't expect to happen so quickly. To avoid losing money when this happens, crypto traders develop trading strategies and use trading tools. Stop losses and take profits are two of the most effective and widely used trading tools available today.

Due to the extreme volatility of the cryptocurrency market and because there are so many potential market outcomes, it might be difficult to prevent a loss at times, but stop-losses can be a helpful trading tool, especially for beginner traders. That's why the stop-loss feature has become a standard tool that should be remembered by virtually all cryptocurrency traders.

What exactly is a stop-loss and how does it work?

As the name suggests, stop-loss stops the loss of your trade. A stop-loss is a trading tool used to limit the amount of loss that can be incurred when opening a trading position in the market. The most effective trading tool you can use to protect yourself from the volatility of the cryptocurrency market and to reduce your losses while trading cryptocurrencies is the stop-loss order.

A stop-loss order allows a cryptocurrency to be bought or sold when its price reaches a certain level, known as stop price, limit price, or a stop-loss threshold. In order for a stop-loss order to work, the trader must specify the trigger price point (limit price). When the price of the crypto asset falls below the specified threshold, a stop-loss order will be triggered. This will trigger a market order, which will result in the immediate sale of the crypto asset at the best available price.

Let's say, for example, you opened a long position in bitcoin with 100 USD and you set a stop-loss for 10% below the price, which is 90 USD. If the price of bitcoin falls below 90 USD at any point in the future, the stop-loss is triggered and the position is sold at the lowest price available below 90 USD.

Although the primary goal of a stop-loss is to prevent trades from incurring more losses, it may function in various ways. The following are the most common forms of stop-loss orders.

Full (Complete)

A full stop-loss will liquidate the entire position when the limit price reaches the stop-loss threshold. Closing the entire position removes the likelihood that the trade will continue to decline. It is advisable to use this form of stop-loss when trading cryptocurrencies with larger market cap rather than small ones, as the spike in price will cause traders to miss out on potential profits in the event of a correction.

Partial (Limited)

This type of stop-loss closes a portion of a trade once activated. This is especially advantageous when trading highly volatile cryptocurrencies, as traders can still hold on to a portion of their trades to maximize the profits in the event of a price spike.

Trailing

This type of stop-loss uses a distance chosen by the trader to change the limit price in response to the rise in the value of the crypto asset. If the price rises, the tracking distance will cause the stop-loss value to increase as well.

Why should you use a stop-loss when trading cryptocurrencies?

Stop-losses and take-profits are among the most effective trading tools and there are several reasons why you should always use a stop-loss when trading in the cryptocurrency market.

Due to the extreme volatility of the cryptocurrency market, it can be challenging to control the risks associated with crypto trading. For this reason, experienced and beginner traders are always advised to use a stop-loss order on every trade to limit the maximum loss they may incur. If traders do not use stop-loss orders, they have a greater chance of losing a large portion of their trading profits, if not their whole portfolio.

Stop-loss also helps in strategy formulation and decision making. When traders use stop-loss orders, they can calculate how much they are risking versus how much they could gain , regardless of the position size. Traders who use stop-loss orders are also more likely to maintain control over their emotions while their trades are running, which is especially important when they are absent from their devices and unable to monitor trades.

The trailing stop-loss can also be used for capturing profit when a trade is favorable. An increase in the price of a cryptocurrency will also increase the value of the stop loss. As a result, traders can secure any advantage they gained from the previous price movement in their favor.

How to calculate stop-loss for cryptocurrency trading

The placement of your stop-loss is primarily determined by how much of your entire portfolio you are prepared to risk; however, as a general guideline, traders are recommended not to risk more than 2% of their total capital on each trade.

Consider the following scenario: Bitcoin is now trading at $10,000, and you wish to take a long position on 1BTC. To minimize risk, you don't want to lose more than 5% of your capital. You can use a stop loss to do this.

5% of $10,000 is $500. This means you would place your stop-loss at $9500 or 500 points below the entry point. In most cases, crypto price movements are in dollars; therefore, a rise from a price of $10 to $11 for a cryptocurrency would indicate that the cryptocurrency has moved one point in value. If the price of BTC falls below $9,500, the stop-loss would be triggered and the crypto will be sold at the next available price below $9,500.

How to set stop-loss and take-profit targets on Margex

Despite having one of the simplest user interfaces in the industry, Margex offers a wide range of advanced trading tools and instruments, and setting stop-loss and take-profit targets is a simple and straightforward procedure, even for someone who has never done this before. Below are the steps to follow in order to set stop-loss and take-profit targets on Margex:

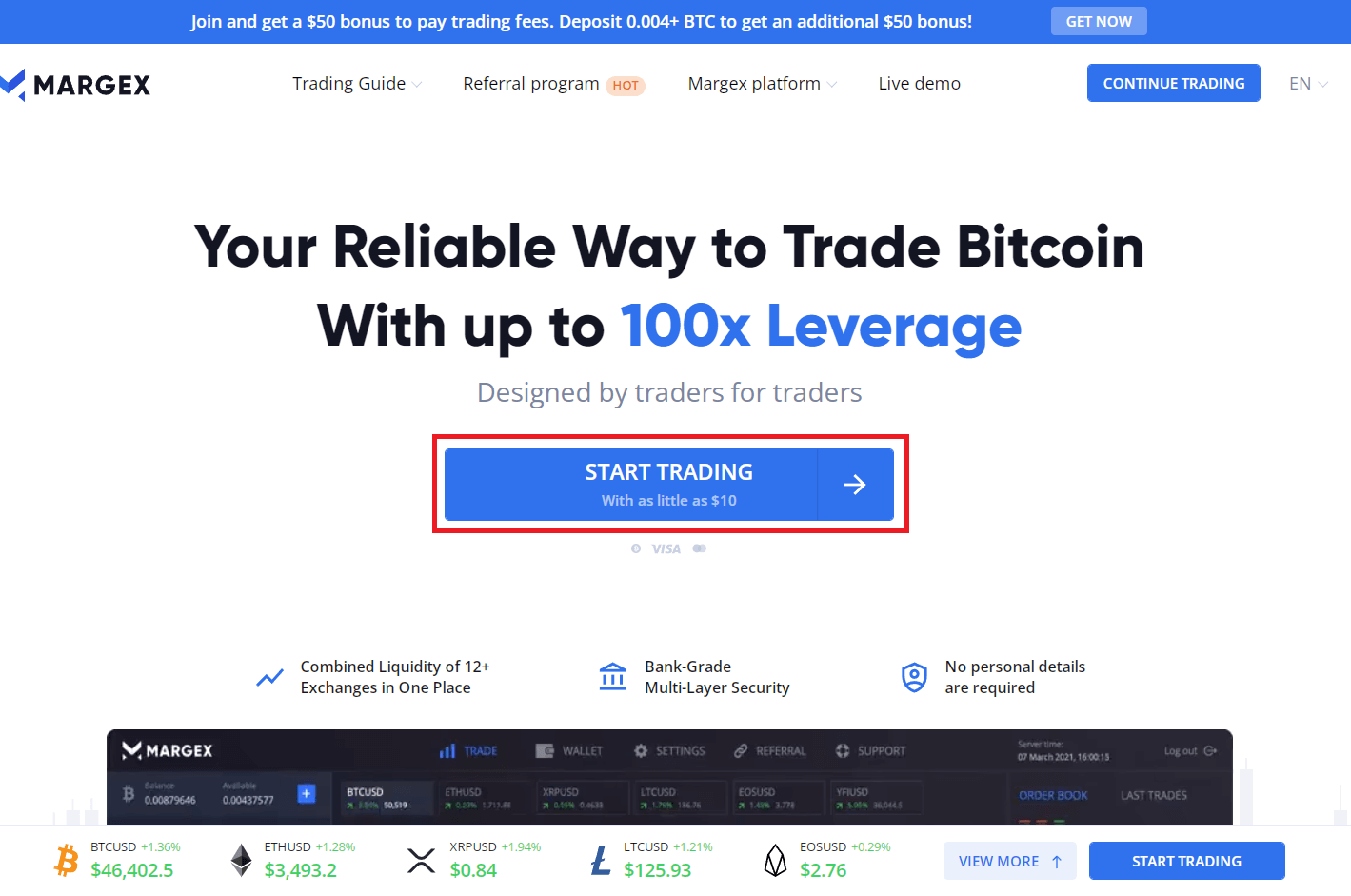

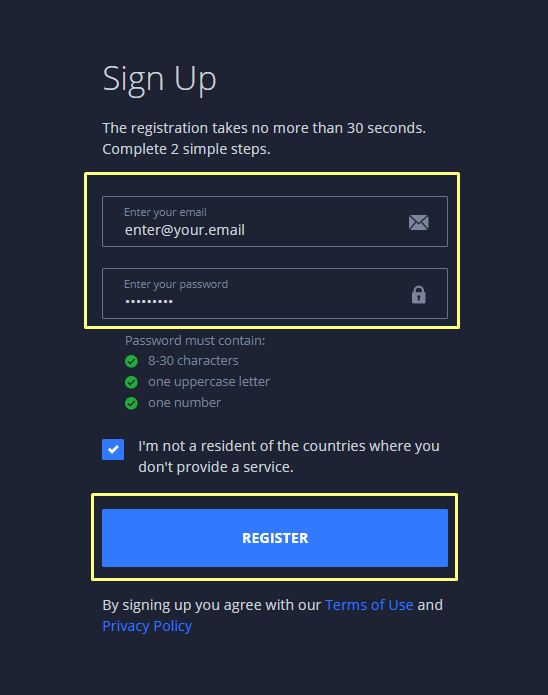

Step 1: Create an account

The first thing you have to do is to open a Margex account. To begin trading, go to Margex.com and click on the "Start Trading" button. You will be directed to a sign-up page where you will need to provide simple information such as an email and a password to continue.

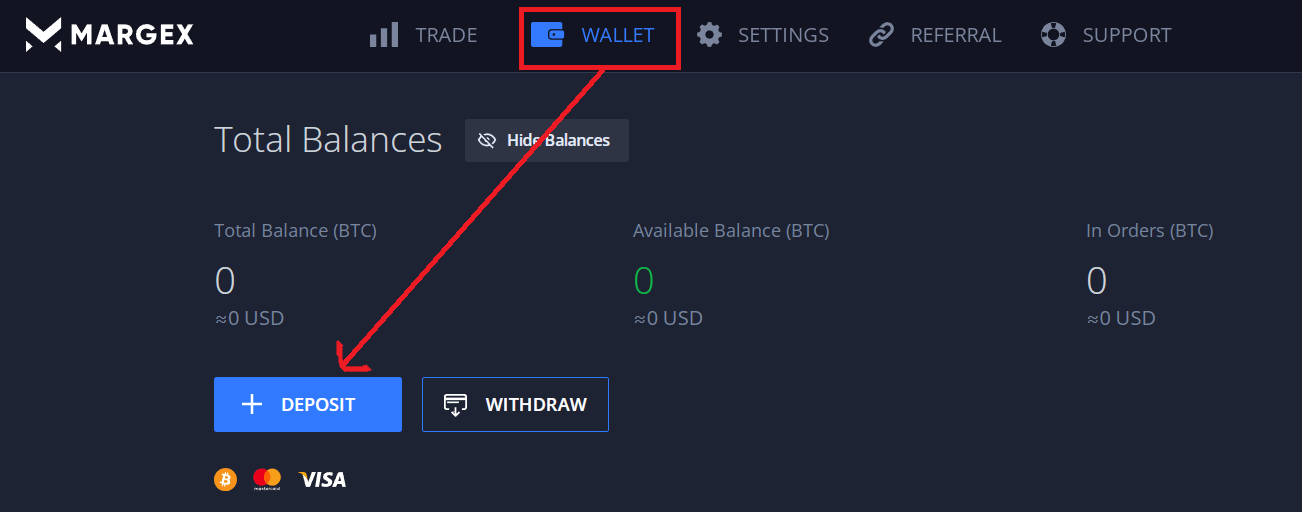

Step 2: Make a deposit

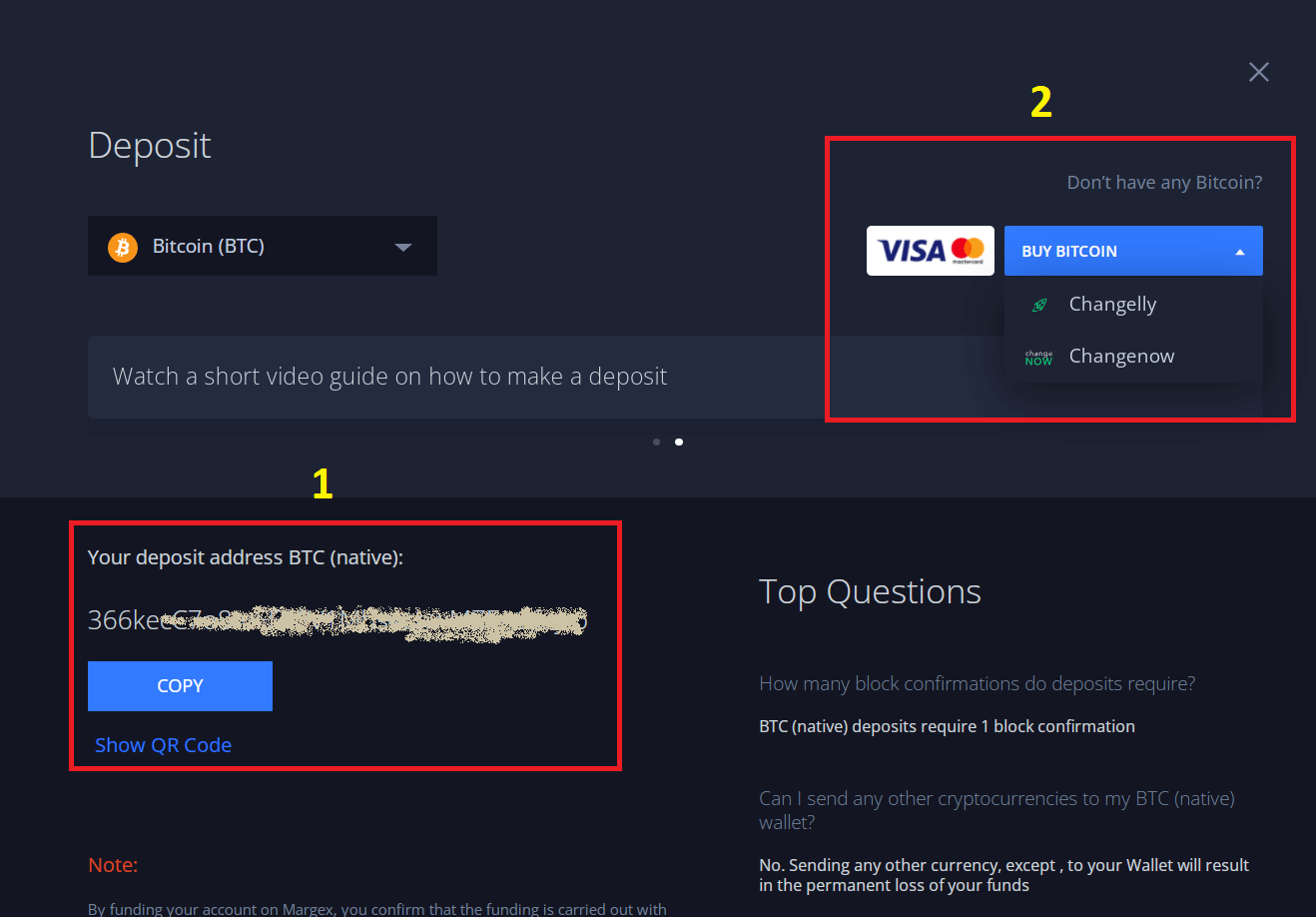

Secondly, to start trading, you will need to make a deposit into your account.. To make a deposit, go to the "Wallet page" and click on "+Deposit."

You have two options available to make a deposit. You can either make a direct deposit of BTC and other cryptocurrencies available by transferring from another wallet to your Margex account wallet, or you can click "Buy Bitcoin" and use the direct integrations of Changelly or ChangeNow to purchase cryptos if you don't already have cryptocurrency.

Step 3: Start Trading

Once you have made a successful deposit, go to the "Trade" page to start trading in real time. To set up a TP/SL order, go to the trade for which you will place a protective order in the “Open Positions” window and click on the dotted line under Take Profit/Stop Loss. Once clicked, a pop-up window will appear that will allow you to manually enter the TP/SL price or by RoE (Return on Equity) percentage.

Best strategies for using stop-loss in crypto trading

Place stop-loss at major support or resistance levels

It is generally recommended to use significant support and resistance levels as your stop-loss markers when trading. This can be achieved by thoroughly evaluating the current state of the cryptocurrency market and performing sufficient fundamental and technical research. This will help you to determine the next support or resistance zone.

Combine take-profits and stop-losses

Take-profits and stop-losses complement each other. This is why a lot of smart traders use them right after opening trades. Combining take-profit and stop-loss orders allows you to spread the risk associated with trading, increasing the likelihood of making profits.

Adjust your stop-loss to protect your profits

Another strategy to keep in mind is to move your stop-loss when the market begins to move in your favor and you're making a profit on your trades. The movement can be controlled manually or with the help of a trailing stop-loss. Manually adjusting the stop-loss order enables you to time the movement.

Set your stop-loss according to your profit target

The objective of every trader is to make a higher profit than the possible loss; therefore , you should do your calculations and place your stop-loss based on how much you are willing to risk versus how much you anticipate to profit.

Conclusion

Stop-loss orders are one of the most important trading tools available to all traders, and when used correctly, can provide significant advantages. As a serious trader, you should always put your stop-loss first when putting together a trading strategy.

Stop-losses are an important aspect of risk management. Before using stop-losses in crypto trading, however, you should be fully familiar with the way they operate and how they can be managed effectively, because the success of your trading depends on your ability to manage risks. It is also important to evaluate the risk-to-reward ratio when setting a stop-loss.

FAQ

How do stop-losses work in crypto trading?

A stop-loss is a tool that can help you minimize your losses. In a stop-loss order, you set a limit price when making a trade. A market order will be formed if the limit price is met, and the trade will be sold at the best possible market price.

What is a good stop-loss percentage?

The percentage of your stop-loss really depends on how much you're willing to risk. As a general rule, it is recommended to never risk more than 2% of your capital on every trade.

Can you lose money with a stop loss?

Although stop-losses can help you to minimize your loss, you can also lose money due to the volatility of the crypto market. If your stop-loss is placed too close to the entry point, it can be triggered before the market spikes back up (or goes back down, if you’re shorting).

How do you calculate stop loss?

Calculating stop losses for cryptocurrency trading is relatively easy and they can be effective when calculated and placed correctly. Determine what percentage of your total capital you are willing to risk for a given trade. Since cryptocurrency prices move in dollars, you can go ahead and place your stop loss at a price equal to your calculation.

What happens when stop loss hits?

When a stop loss is triggered, a market order is triggered that causes the crypto asset to be sold at the next available price below the stop-loss.

Are stop losses visible?

A stop-loss order remains hidden in the order book until the limit price is reached , at that point it turns into a market order and is executed immediately at the next best price.

Do professional traders use stop losses?

No doubt. Stop-loss orders are used by professional traders as they are an essential trading tool for all traders. Every experienced crypto investor has their own risk management strategy and stop-loss is an essential part of that strategy. Professional traders are also more likely to use stop-loss because of their trading experience.