Almost a month in from the shock of the FTX implosion, the crypto market is still broadly reeling in the after effects, with most cryptos, and especially altcoins related to FTX and Alameda taking a hit in price since the event unfolded throughout November. As a result, most coins have dropped to lower levels compared with what they were doing in October when the market saw some signs of life. While investors would expect that the market wide selloff would not have spared any crypto asset, two coins actually benefited from the after effects of the FTX implosion and gained in price. Let's read on to find out which are the best and worst performers.

Solana Was the First Coin to Sell Off

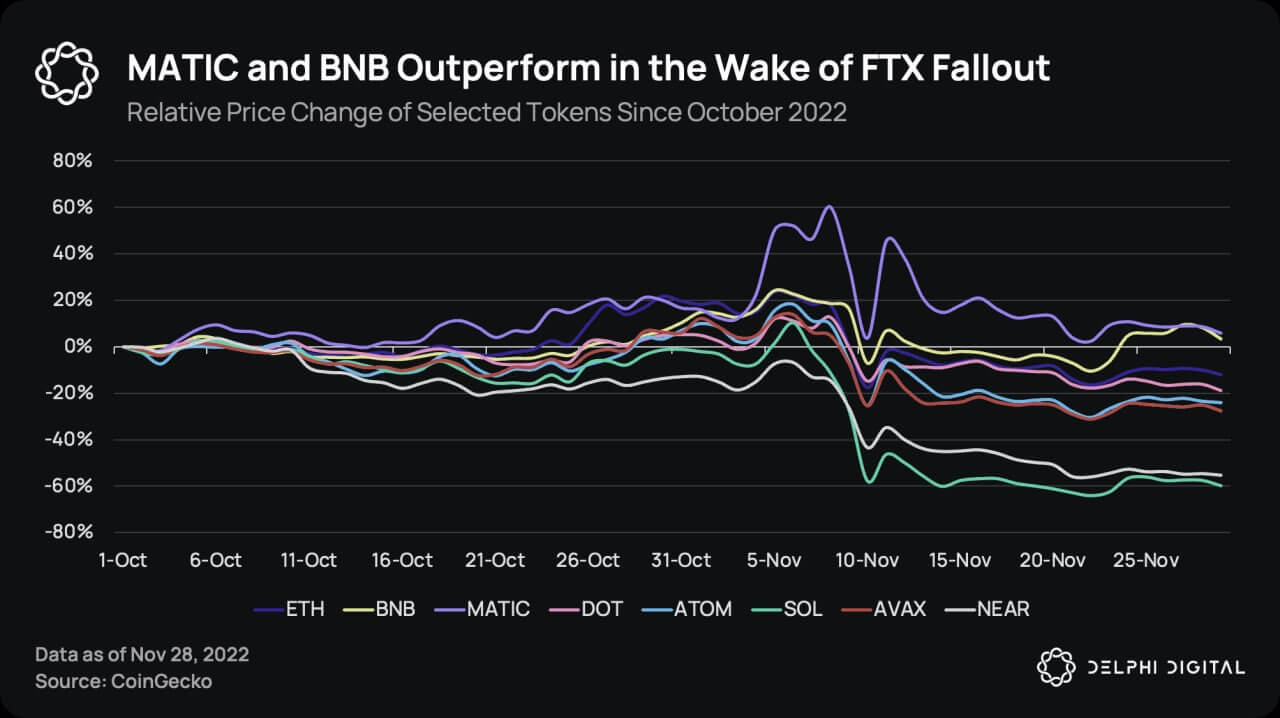

Delphi Digital, a blockchain analytics firm, recently released a report tabulating the performance of layer 1 blockchains from October 1 before the FTX implosion up to the end of November to show how the saga has impacted the price of various popular cryptos. The FTX selloff started on November 10, with the price of SOL already showing signs of distress beginning on November 5, followed by AVAX and NEAR, which also saw significant price drops. Ethereum however, was the last altcoin to witness the effects, only starting to fall around November 9.

Needless to say, as rumors of the FTX balance sheet problem started to make its rounds in the market, the coin that FTX held the most on its balance sheet, SOL, was the first to come under pressure (this study left out FTT which was the main lead in the entire saga because FTT was a utility token for FTX and not a layer 1 blockchain). Other coins that FTX had ever invested in, like NEAR and AVAX, also started getting significant price declines early on.

Interestingly, despite Alalema holding a significant chunk of Ethereum, it was the last coin to fall. This could be due to investors having more confidence in Ethereum due to its market cap. It was only after news broke that a hacker had stolen coins from FTX and converted them to Ethereum that the price of Ethereum took a quick plunge. Ethereum price subsequently rebounded as the hacker had to sell all the coins he stole into Ethereum, effectively buying Ethereum against all other stolen coins, this explains why the price of Ethereum rose so sharply compared with other altcoins between November 11 to 14 as can be seen in the diagram below.

However, as investors realized that the hacker would eventually sell his Ethereum, they started dumping Ethereum hoping to get out before the hacker sold his stake. Despite selling by the masses, Ethereum made a decent price recovery after whales came in to support the price by accumulating more Ethereum. The same cannot be said for SOL and NEAR, these two coins are not showing much rebound even when they were the hardest hit, which is not a positive sign for the price of these two coins for the immediate future.

Some Coins Are Actually Benefiting From the FTX Implosion

Interestingly, after the broad market selloff, the price of BNB and MATIC recovered, with BNB leading the gains and recovering to levels very close to where it was before the FTX saga. This could be due to the fact that Binance would become the biggest beneficiary after FTX is gone because one of its biggest competitors is gone. It could also be because the implosion of FTX is making investors lose confidence in centralized entities. This has resulted in users moving to decentralized exchanges and applications, and to use these dApps will require users to acquire the tokens of the blockchain that the applications are run on, causing the demand for layer 1 blockchains that have a lot of applications already built on them to shoot through the roof. MATIC and BNB-chain are perfect examples of such blockchains, which may explain why their prices are recovering more than the other layer 1 blockchains.

BNB in particular, has the dual advantage of both being the required fuel to interact with a popular decentralized wallet known as Trust Wallet, as well as being the native token of the Binance exchange. This could explain why BNB has rebounded the sharpest and quickest.

Ethereum would also be a key beneficiary once the FTX hacker finishes selling all of his stolen Ethereum. Large whales are already accumulating Ethereum and soon, more users could also be adding Ethereum to their portfolio due to the need for it to be used on popular decentralized exchanges like Uniswap, which is run on the Ethereum blockchain.

As a result, the FTX fallout appears to be causing a change in user behavior to use more decentralized applications. This could ironically become a catalyst for price appreciation for many layer 1 blockchains and in the long run, serve to benefit the crypto space as this unfortunate event happens to create a silver lining, in that it could bring about the true adoption of decentralization.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and are only meant to be informative in nature. Thus, they should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.