Arthur Hayes, former CEO and founder of BitMEX, a high profile thought leader within the crypto industry, has regularly penned his thoughts about the market and where prices could be heading ever since stepping down from his role as CEO of the once top crypto derivatives exchange. In doing so throughout this year when the market has been in need of some sensible opinions, Hayes has come through as a helpful advisor to many crypto investors to guide them through the muddy landscape in this very cold crypto winter. Over the course of the year, Hayes has been bearish, often calling for lower prices for both Bitcoin and Ethereum. Last week however, the maestro’s bullish comments about the worst being over for crypto got the market sitting up and paying attention as the aftermath of the FTX implosion hits the one month timeline. So what made Hayes bullish? Let’s find out below.

The Worst of the Guys Have Gone Bankrupt

Hayes famously made a comment in a December 11 interview with crypto advocate and podcaster Scott Melker that said, "Looking forward, pretty much everyone who could go bankrupt has gone bankrupt.”

Going further to elaborate his point, Hayes explained that when centralized lending firms (CELs) have financial troubles, they will often call in loans first, and then proceed to sell Bitcoin as the first asset of choice because it operates as the “reserve asset of crypto” and is “the most pristine asset and the most liquid.”

"When you look at the balance sheet of any of these heroes, there's no Bitcoin on it because what do they do, they sold the Bitcoin as they were going bankrupt, they sold the Bitcoin during the wave before they went bankrupt."

Hayes explained in his blog post on December 9 that centralised lending firms (CEL) usually go bankrupt because they either lent money to entities that can’t pay them back, or they have duration mismatches in their lending books. Duration mismatches occur because the lenders receive deposits that can be recalled by their depositors on a short time frame, but they make loans using those deposits on a longer time frame. If the depositors want their money back, or demand a higher rate of interest due to changing market conditions that the CEL can’t afford, then the CEL becomes insolvent and bankruptcy quickly follows, unless it manages to find capital injection big enough to repay those loans.

By this logic, before a CEL becomes insolvent or announces bankruptcy, they will have attempted to raise funds to ameliorate the situation. The first thing they would do is to call back all loans that they can, affecting anyone who borrowed money from them with a short time horizon. This part of the equation appears to have passed.

The second stage after a CEL recalls all the loans that it can, is that it will begin liquidating the collateral that underpins its loans, which is usually Bitcoin or Bitcoin mining machines. So once things start to go south, CELs start by selling Bitcoin, as it is the asset most used to collateralize loans and it is the most liquid cryptocurrency. Hayes argued that this was why the price of Bitcoin came crashing down in the first week of the FTX saga - CELs were selling Bitcoin to raise capital to try to keep afloat. This part of the equation also seems to have passed.

While Hayes is unable to prove that CELs do not have any more Bitcoin left on their balance sheet to sell anymore, looking through the bankruptcy filings of firms like Three Arrows Capital, FTX, Alameda, Voyager and whatever other smaller victims reveal that these firms indeed no longer have any Bitcoin or Ethereum, but they do still hold a basket of illiquid shitcoins that they could not sell.

Miners Have Also Sold the Bulk of Their Bitcoin Reserves

Hayes is also of the opinion that miners have sold most of their Bitcoin reserves, making miners no longer a threat to the price of Bitcoin.

The massive downturn in the price of Bitcoin, along with rising energy prices, have squeezed miners across the industry, leaving many miners desperate for fresh capital before they would have to cease operations or file for bankruptcy. It is already a known fact that miners have been selling Bitcoin in the last quarter of 2022.

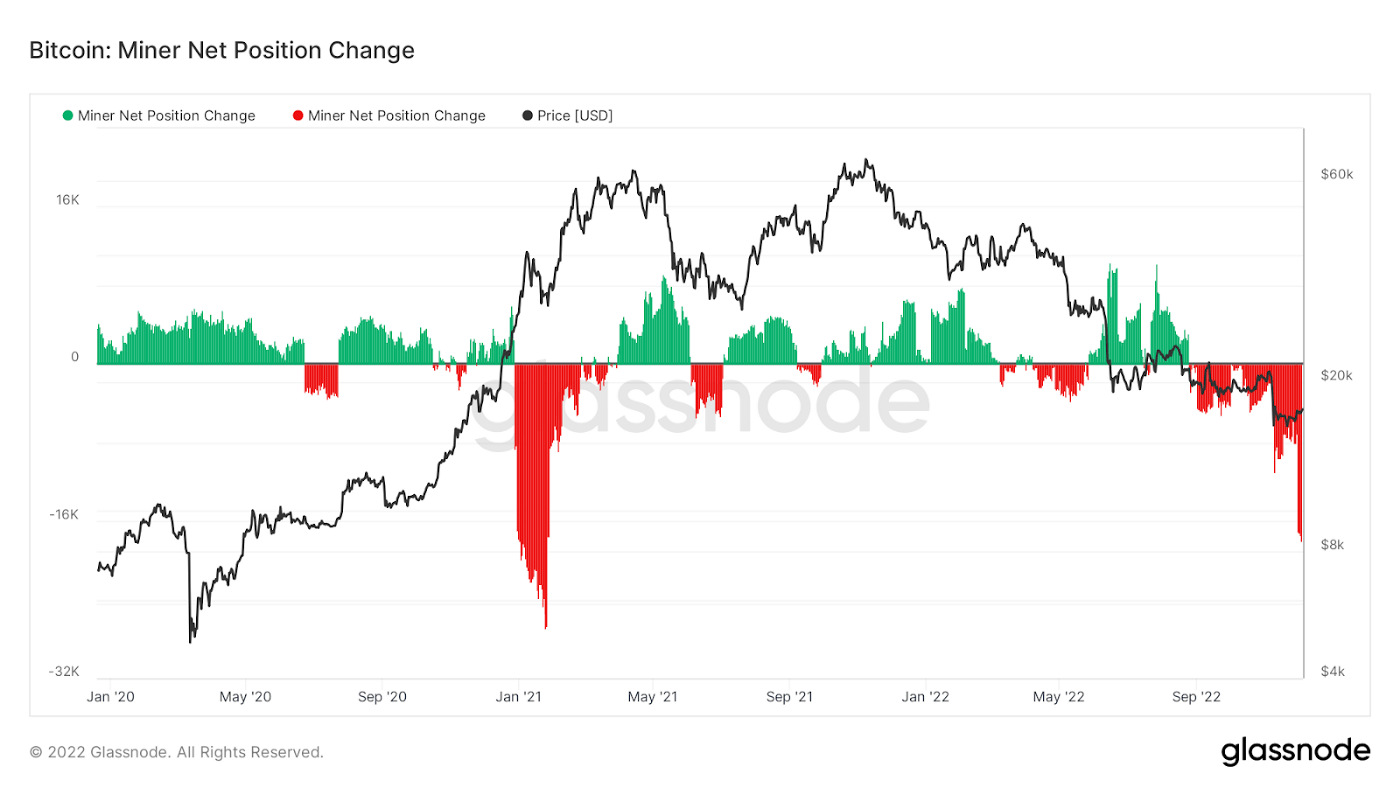

Hayes pointed to a Glassnode chart which shows the net 30-day change in Bitcoin held by miners and mentioned that the amount of Bitcoins miners have sold recently is exceedingly large, and far bigger than the previous capital raising event in May this year, suggesting that miners are pouring out their reserves and selling them. While Hayes is also unable to confirm if the biggest of the miners’ selling is over and done with, such large reductions in net positions cannot continue for much longer as it is not difficult to calculate how much Bitcoin miners would have collected over the year since there is only a fixed number of Bitcoin produced in any one year.

Hayes also pointed to a falling Bitcoin hashrate as a sign that miners who left the industry have sold their Bitcoin based on the logic that any business would first try to raise capital to keep the business afloat before actually calling it quits after attempts to salvage the business becomes futile. The fact that the Bitcoin hashrate is falling is a sign that miners are beginning to fold up and leave the industry, which is an after effect of selling all their Bitcoins.

Thus, while Hayes is not able to confirm his hypothesis that no one that needs to raise capital has any more Bitcoin to sell, his arguments make reasonable sense. Do you agree with his opinion?

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and are only meant to be informative in nature. Thus, they should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.