Understanding blockchain technology and the intricacies of trading can never be over-emphasized as many traders and investors seek to learn to trade and make a fortune out of the maket, with many claiming that trading in the crypto industry can lead to generational wealth.

Trading can indeed be very lucrative, but for one to become a good and profitable trader, then such one needs to master all that is required to become a good trader with working strategies, an edge in the market, and the right psychology to deal with the downside that comes with losing a trade.

Trading in the crypto industry to make some great profit involves more than buying and selling an asset; it involves being involved in the market, trading with the right strategies, following your plan and executing it to the very last, and the use of technical analysis tools to make the process very easy. Some traders use chart patterns, indicators, oscillators, and market structures to best time their entries and exits.

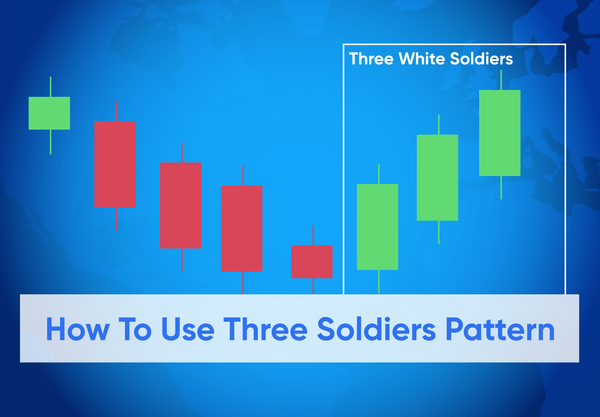

In this guide, we will focus on three white soldier chart patterns, how to use and trade with three white soldier candlestick patterns, and how to spot bullish reversal patterns for technical analysis when trading in cryptocurrency for higher and better profitability. At the end of this guide, you will have a good understanding of trading the 3 white soldier pattern and why it is very effective in trading bullish reversals and price continuation.

What Is The Three White Soldiers Pattern?

The three white soldiers candlestick pattern is a bullish reversal pattern that most traders find or try to spot at the end of a bearish downtrend or a bear market. The appearance of the three white soldier candlestick pattern signals to the traders an imminent price reversal from a bearish trend to a bullish trend with high buying pressure stepping as the bulls or buyers take over the market with their high demand for the assets.

Traders who trade a lot with the Japanese candlestick charting pattern or technical analysis know that a lot of price action goes into the candlestick formation. Depending on where the three white soldier pattern appears it shows strong buy orders. It could appear at the end of a downtrend or bear market, at the middle of bull market or uptrend signaling buers wish for a continuation pattern. Usually whe the three white soldier pattern is formed at the end of a downtrend it signifies trend reversal or price reversal from bearish to bullish.

The three white soldier pattern gives a clear picture of the market being overpowered by buyers as there is a shift in market sentiment making the buyers to dictate the direction.

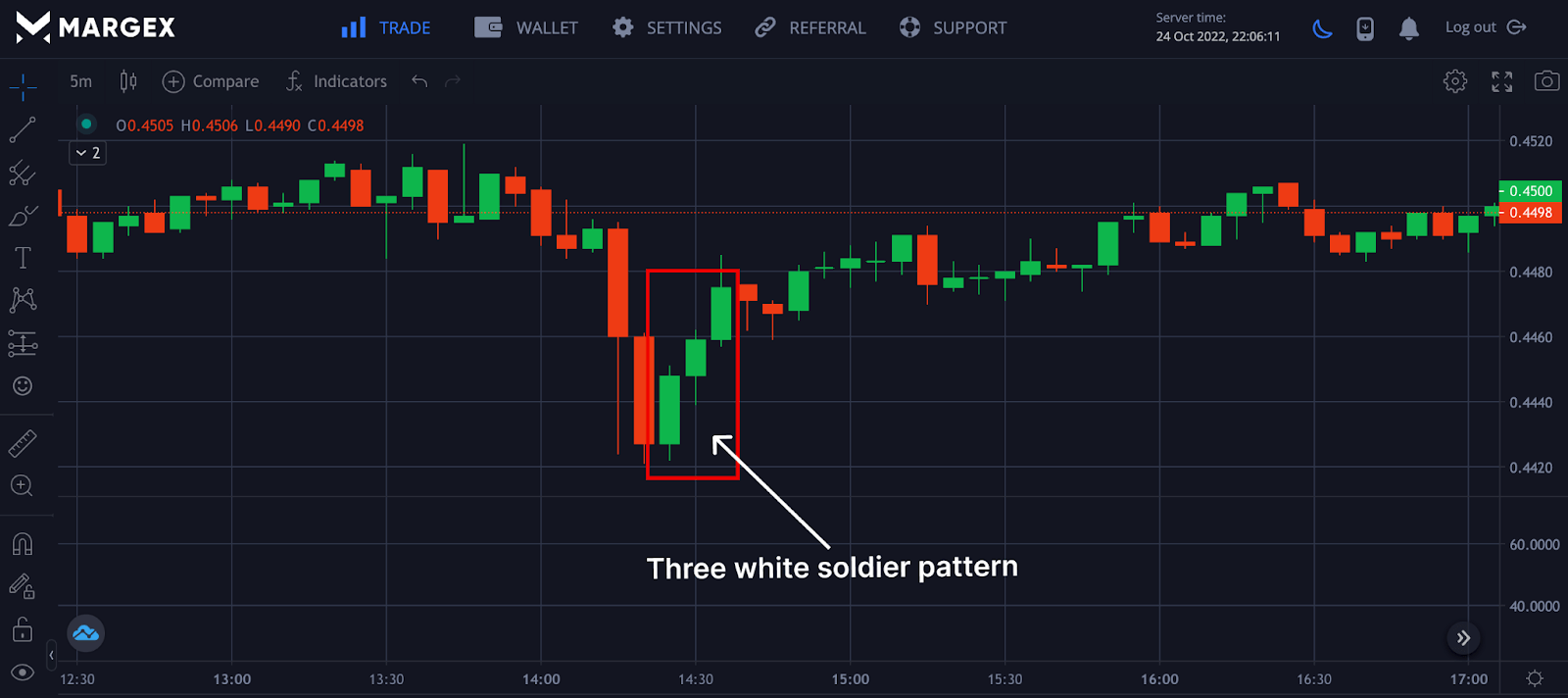

From the chart above, the three soldier patterns are formed with the candles looking almost the same size indicating strong buy pressure from the buyers as they overpower the sellers to drive the price of XRPUSD to the market's upside. Here are the characteristics of the three white soldier patterns.

- The three white soldier candlestick pattern is formed by three green candles with a distinct price range.

- The three candlesticks are almost the same price in appearance

- The cansticks have small upper and lower shadows or wicks.

- The first green candle and the last green candle can’t go beyond the middle price of the middle.

- The opening price of the next candles opens with the previous body candle

- Each closing price for the next candle exceeds the previous candles closing price.

For example, the daily timeframe means the appearance of the three white soldier pattern indicates the bulls or buyers dictating the market on three consecutive days; a trader can look to open a long position when the three white soldier candlestick pattern appears would signal a strong bullish reversal or bullish continuation. It is best to confirm this shift in market sentiment before entering a long position; technical indicators, oscillators, Moving Averages, and others can all be used to confirm this trend shift.

How To Identify The Three White Soldiers Pattern (Show Examples From Margex)

Margex is a Bitcoin-based derivatives exchange that allows users and traders to trade with up to 100X leverage size while also staking that tradable asset in Margex's unique feature with up to 13% APY returns.

You don't need to be a professional trader to access Margex's unique staking feature, one of its kind in the crypto space. There are no lockup periods, and rewards from staking are sent to your staking balance daily with the help of the Margex automated system.

To access all of Margex's technical tools and other features, you must be a registered Margex user. Let us see how we can identify the three white soldier patterns on the Margex platform.

Assuming you have access to your Margex account, head to the trading section while selecting the candlesticks chart and the timeframe you wish to trade with. To correctly identify the three white soldiers, not all patterns are tradable, and patterns need to meet certain requirements to trade them. Let's examine some key factors when trading the three white soldier patterns.

The image above highlights the characteristics that three white soldier pattern should meet before trading them.

- The three white soldier candlestick patterns should be found at the end of a downtrend or bear market, indicating a potential price reversal.

- The three candles should have a considerable length size if different.

- The trend reversal needs to be accompanied by a potential increase in buy volume.

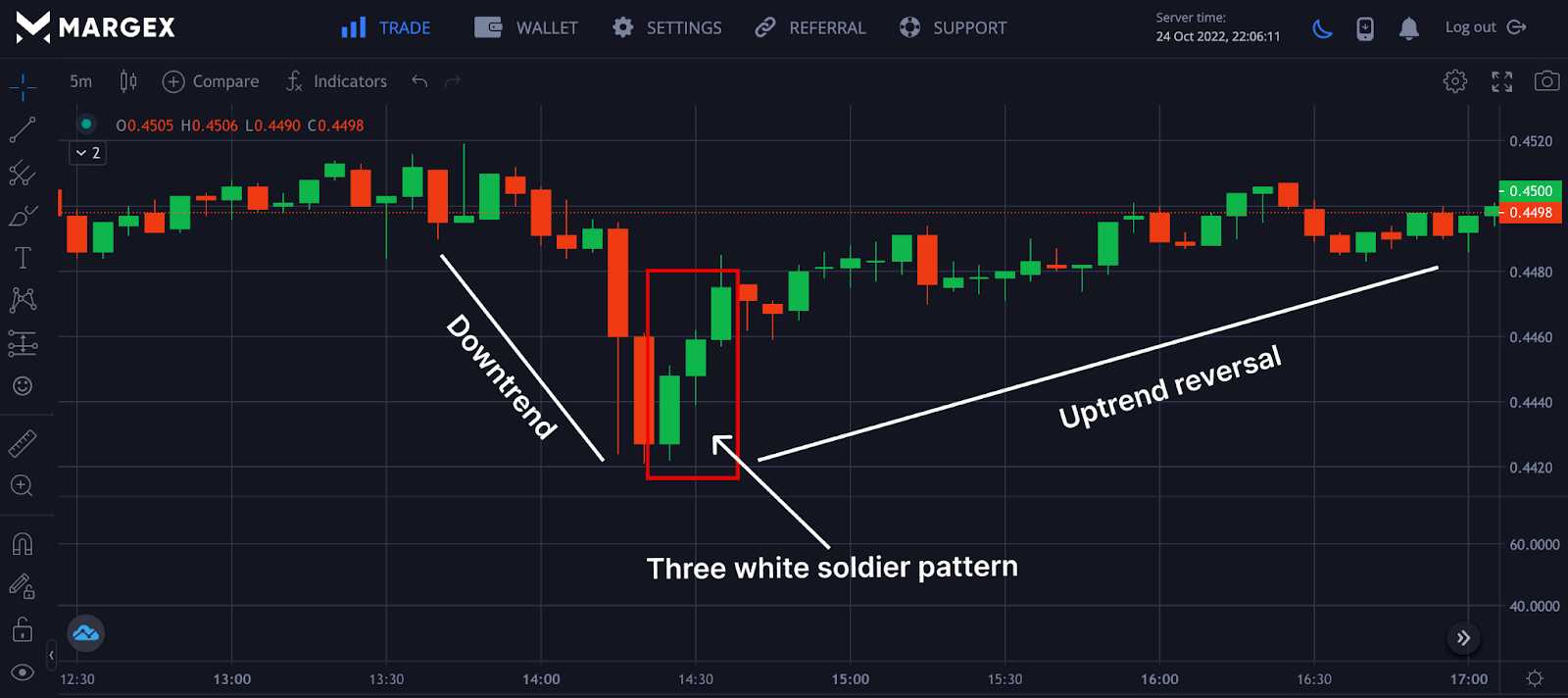

Example Of How To Trade Three White Soldiers

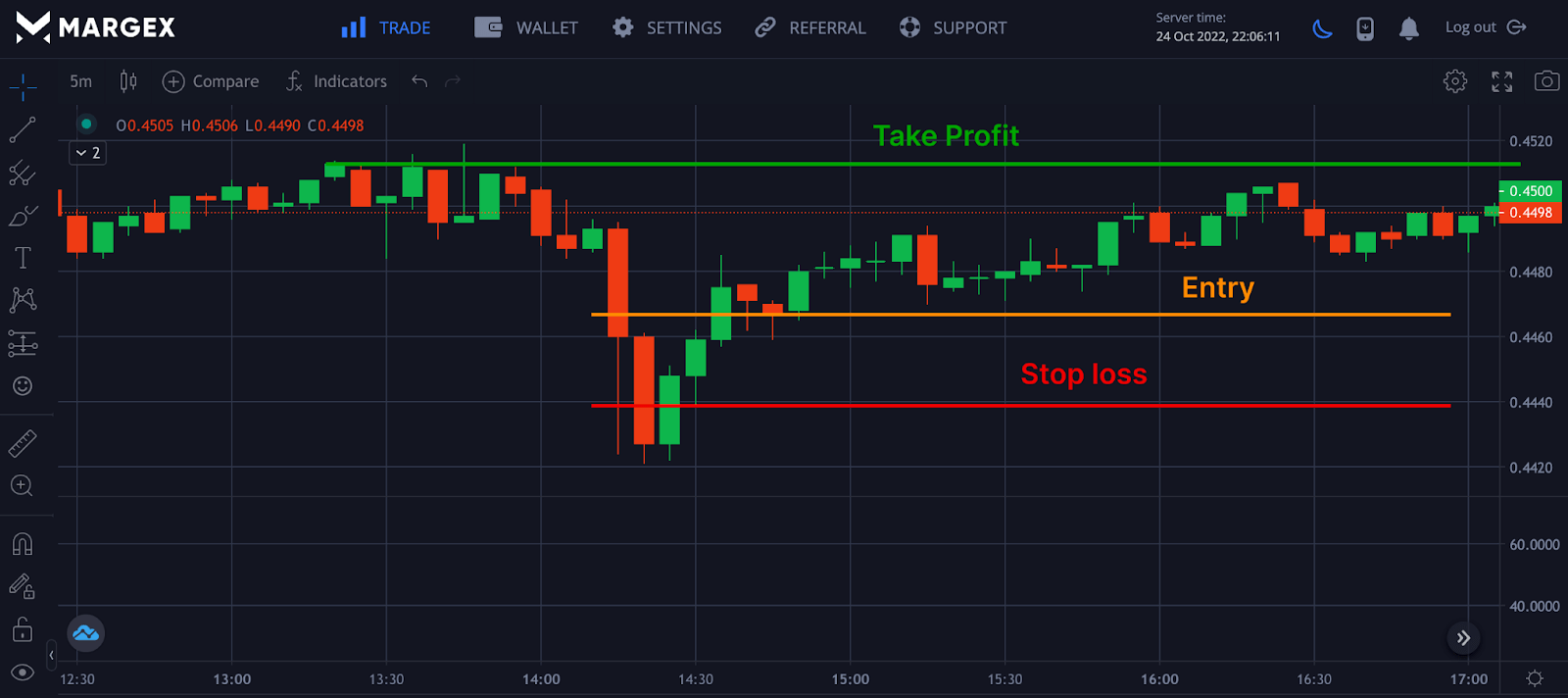

From the image above for the XRPUSD pair, three white soldiers emerged with no interference showing a potential price reversal after the downtrend ended. After the formation of the three white soldiers, the price of XRP was retested before the price went higher; a trader would look to enter this trade at the retest as the price could be headed to the upside after completing this pattern. A long position would be initiated with stop loss and take profit in place to reduce excessive risk exposure.

How To Trade When You See The Three White Soldiers Pattern

When you have found the three white soldier pattern, there are many ways to trade them, but it is most appropriate to confirm if this pattern will give rise to an uptrend or just a bear trap. We could use technical indicators such as the Relative Strength Index (RSI), Moving Average, Oscillators, and others to confirm this pattern.

These indicators can give more confluence regarding price trends and price actions, giving the trader a better perspective of where the market could be headed.

A good strategy is to use RSI to confirm this trend reversal when the three white soldier pattern appears at the end of a trend. RSI is a good indicator for predicting and tracking speed and momentum change in the market. On confirmation of a potential trend reversal, you could open a long position with stop loss and take profit in place.

How To Use The Three White Soldiers To Identify Entry And Exit Points

There are different approaches in trading the three white soldier pattern; most traders open a buy order or long position on a break of the green candles that form the three white soldiers, while others buy at a pullback or retest. Some traders use this pattern to exit their trade that has been in a short position.

The three white soldier pattern can be used as an entry trigger for some traders who want to go long after the downtrend or bear market comes to an end, while others use this pattern as an exit for their trades if they have been riding the downtrend of an asset, a trend reversal serves as an exit point for a short position.

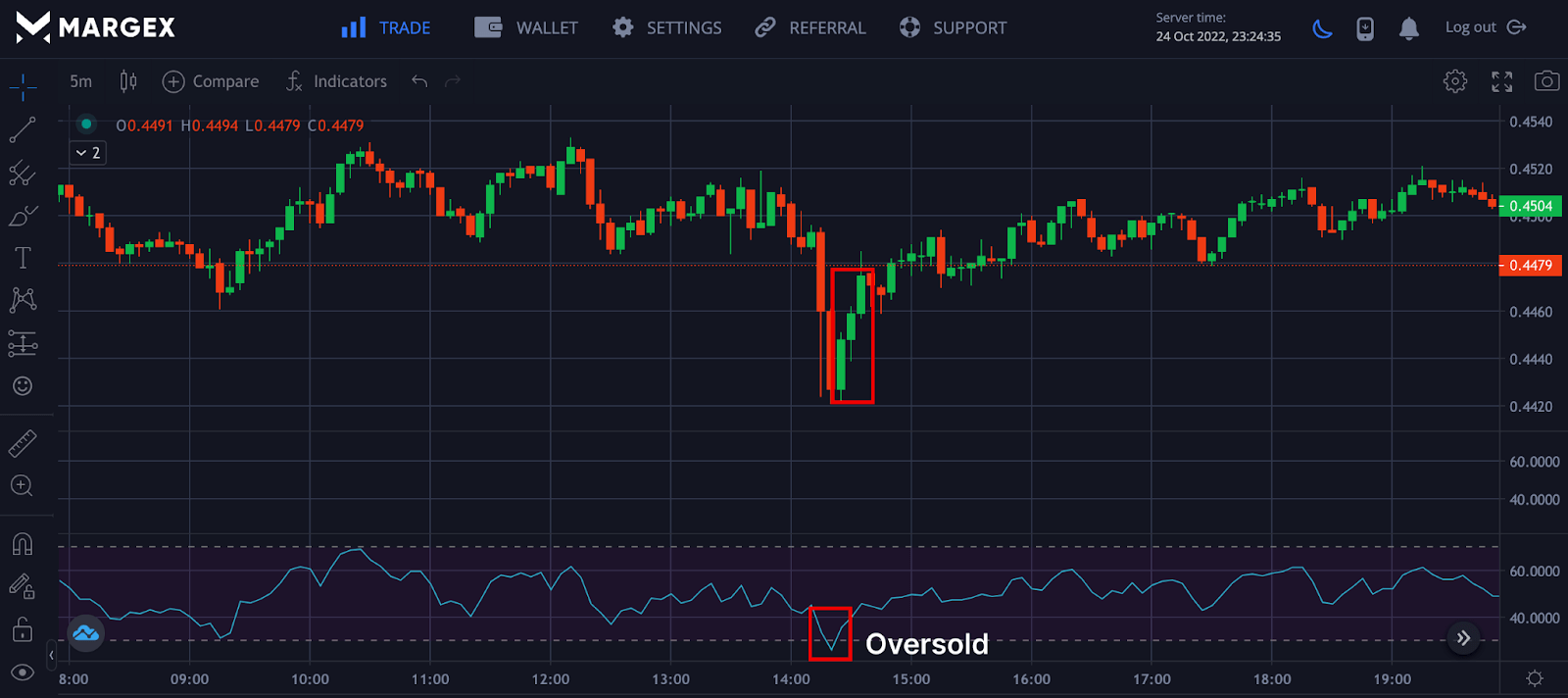

From the image above, the three white soldiers appeared at the end of the XRPUSD pair downtrend; the appearance was confirmed by the RSI moving from the oversold region, indicating a potential price reversal. This was confirmed after the price broke and retested before heading to the upside of the chart.

Despite how fascinating the three white soldier pattern can be, sometimes it is prone to false signals and can be exploited in an extremely volatile market. The three white soldiers could appear during a period of consolidation, and traders could be trapped when they open a long position thinking this is a price reversal.

One of the key ways to avoid this is to use other technical indicators for better confirmation, like RSI, Moving Average, and oscillators during trading.

Frequently Asked Questions (FAQ) About The 3 White Soldiers' Pattern

Here are the frequently asked question on the use of three white soldier pattern.

Does The 3 Soldiers' Pattern Still Work?

The three white soldiers candlestick pattern formations are utilized as indicators of a bullish price reversal by traders in the financial and cryptocurrency markets.

Its efficiencies in determining bullish price reversals are utilized with other technical indicators for further confirmations on the validity of its bullish reversal signals.

While the three white soldiers pattern might validate a bullish reversal, traders may be advised not to use it as a standalone reversal strategy as its bullish reversal signals may not always be accurate.

Traders may avail themselves of learning technical analysis and conducting personal research on trading strategies and technical indicators, including candlestick patterns.

The Benefits Of 3 White Soldiers Candlestick Pattern

The three white soldiers' candlestick formation can be a beneficial tool and useful indicator when leveraged adequately with other technical indicators.

One benefit of the three-white soldier candlestick pattern is its unique candlesticks formation indicating a bullish price reversal and trend shift.

It may also give market insight to traders on a steady increase of buying pressure and bullish activity in its three-candlestick formation structure.

Another advantage and benefit of the three white soldier candlestick pattern are that traders can use its formation to validate bullish reversal signals from other technical indicators and candlestick patterns.

What Do The 3 White Soldiers Mean?

Three white soldiers' candlestick pattern formation may indicate that a bullish price reversal from a downtrend is imminent.

The 3 white soldier candlesticks pattern are candlesticks formations that communicate to traders a potential increase in bullish momentum and buying activity of an asset pair traded on the cryptocurrency markets.

Traders looking for opportunities for long positions may leverage three white soldiers' candlestick patterns when it appears and utilize multiple technical indicators to validate the bullish signal from three white soldier patterns.

How Can You Identify The 3 White Soldier Pattern

The three white soldiers pattern can be easily spotted and identified when it completely forms on a price chart.

Traders looking to spot the three white soldiers candlestick pattern can simply look out for three consecutive white or green candlesticks following each other in succession.

A key identifier to note is that these three white or green candlesticks forming in succession must close notably higher than the previous candlestick in the trio succession.

The three white soldier's candlesticks pattern must have tall or large candlestick bodies with little to no wick attached to their candlestick bodies.

How Accurate And Effective Is The Three White Soldier Candlestick?

The accuracy and effectiveness of utilizing the three white soldiers' candlestick patterns may depend on usage with other technical indicators and trading tools.

Using the three white soldier candlestick pattern alone in making trade decisions may not always lead to positive trade outcomes as its bullish signaling reversals may be false.

Traders may need to acquire knowledge of other trading strategies and bullish reversal technical indicators in addition to the three white soldiers' candlestick pattern.

Comprehensive knowledge of technical analysis may help traders make better trade decisions and validate bullish reversal signals stemming from three white soldiers' patterns using multiple technical indicators.