The USD coin (USDC) is the second largest stablecoin in digital finance by market capitalization. Most recently, the stablecoin has experienced mild to moderate turbulence and some exciting news. It had been listed by Robinhood brokerage. However, some crypto exchanges have planned to reduce the stablecoins functionality.

These events are popping up after the USDC appeared to be crypto traders' and investors' choice of alternative stablecoins following the collapse of TerraUSD, the algorithmic stablecoin of Terra.

This makes now a good time to understand what the USDC is, why it is better than other stablecoins, and if it will stay stable even in the future.

In this article, you will get all the important information that will help you understand USDC, its price predictions, technical analysis, and possible future projections.

What is USD Coin (USDC)?

In 2018, the USDC stablecoin was launched and pegged on a 1:1 ratio or basis to the United States dollar. The stablecoin was created and offered by an organization named Centre Consortium, which was established by Circle fintech company and crypto exchange, Coinbase.

USDC, like most stablecoins, is important to crypto assets' ecosystems. This stablecoin helps connect the ever-changing digital finance world to our traditional financial institutions. A connection that helps increase the functionality of our traditional or fiat currencies in the crypto world.

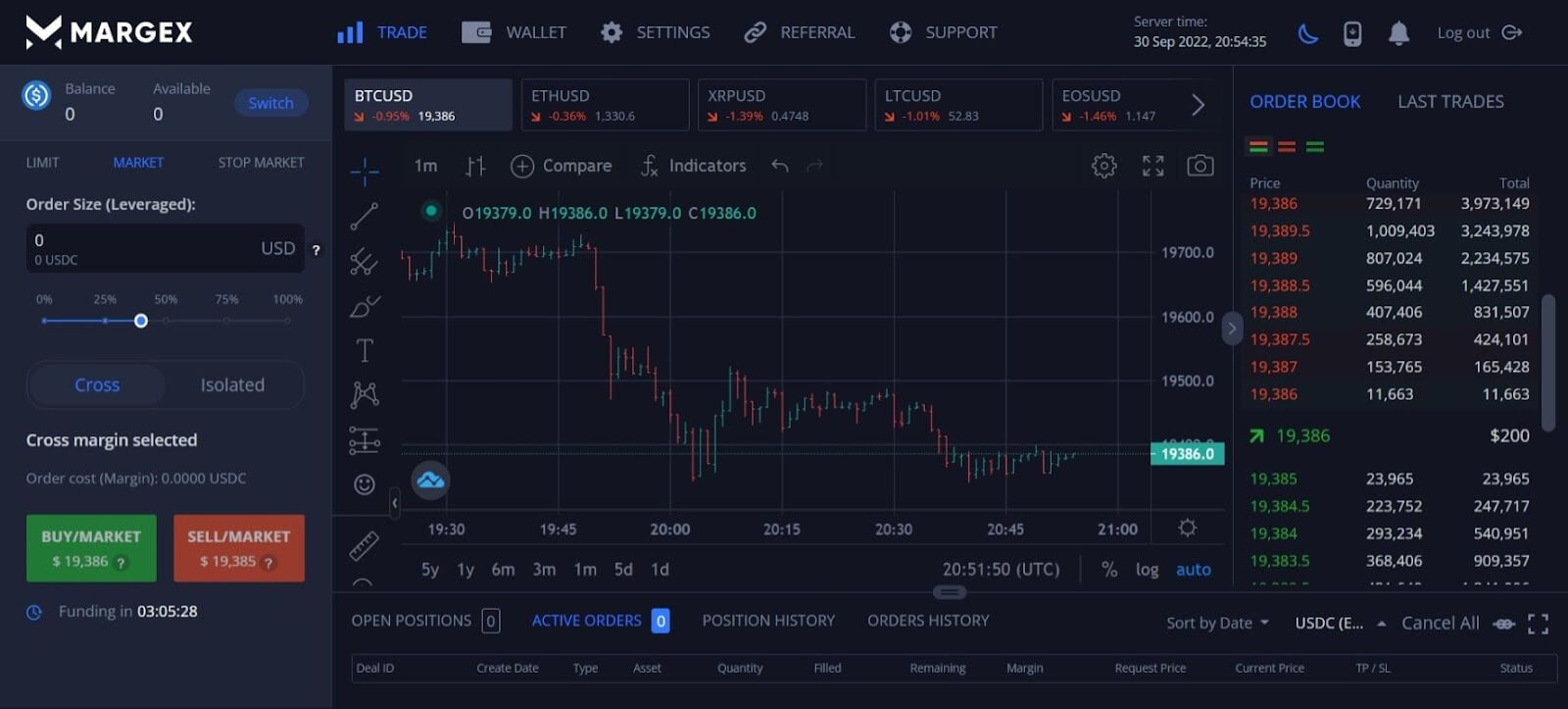

On crypto exchanges or trading platforms like Margex, fiat currencies like USD, Euros, etc., are converted into the stablecoin USDC and are used for several functions ranging from crypto trading to staking, borrowing, and lending. These stablecoins are also used to access the functions of decentralized apps, dApps.

USDC can be used for a wide range of purposes. It can be used for remittance across different countries or payments. It also exposes the United States dollars to crypto holders and can hedge against crypto market volatility since it can store value. Aside from that, the USD coins also provide full transparency with attested reports of their reserves published and reviewed monthly.

The stablecoin is fully regulated and is managed by Bank of New York Mellon and BlackRock. They also serve as custodians of the stablecoins reserves.

The stablecoin USD coin runs on an open-source framework for fiat stablecoins created and maintained by the Centre. USDC is supported natively across several blockchain protocols, like Ethereum, Algorand, and Solana.

Over the years, the USDC stablecoin has grown in terms of supply, from nearly 8% at the beginning of 2020 to approximately 30% in the middle of September 2022. The stablecoin has grown to become the fourth largest crypto by market capitalization, following Bitcoin, Ethereum, and Tether, in that particular order, from Top to third. This was as of the third week of September 2022.

Both USDT and USD coins are stablecoins with low volatility and offer no opportunity to profit from trading. However, in Margex you can stake USD coins, USDT, or any other stablecoins. It will help you to know that the rates associated with the USD coin float by a couple of cents, giving you a great arbitrage opportunity. However, you should be watchful of depeg or panic selling due to the absence of stable or reliable support.

The market cap of USDC also holds promise for the stablecoin. The market cap has increased by more than ten times its value at the beginning of 2021, from $ 4 billion to $ 50 billion in the third week of September 2022.

It is believed that the USD coin stablecoin is growing stronger and creating and enhancing the growth of the decentralized finance (DeFi) world. It helps grow the DeFi business since it is regulated and meets most financial institutions' needs. The stablecoin also interacts easily with the DeFi protocol crypto assets.

Few experts believe that USDC will surpass USDT to become the largest stablecoin. However, we will have to wait for time for that to happen.

The table below shows important information about USDC, ranging from its trading volume to all-time highs or lows.

Factors Influencing USD Coin Price

Before you buy any crypto coin, token, or stablecoin, you must thoroughly understand the asset. You will need to analyze coins or tokens' price history and observe what factors influence their price fluctuations.

There are many ways crypto investors and analysts analyze the performance of crypto assets. However, the most common ways are fundamental analysis and technical analysis.

The technical analysis becomes valuable if you can't access the crypto asset price history. This will show you a pattern of the risers and fall of the assets, but it should never be used as the only source for decision-making since the pattern might change in the future.

On the other hand, fundamental analysis helps to investigate the other factors that affect the price of a crypto asset. These other factors can range from economic to political, financial, and even social factors. The fundamental analysis gives you information that will help you make better decisions about a crypto asset.

Most crypto investors and analysts prefer using the two analyses in determining which crypto asset is worth their time.

When it comes to determining the price of USDC, a lot of factors come to play. There is the effect of scarcity, news, regulations, and drastic economic changes. Understanding how these things affect the USDC price will give you a better understanding of the stablecoin.

Scarcity

Many factors influence the value and price of USDC. Remember that, like all other crypto coins/tokens, USDC has a fixed supply, and being scarce helps to increase the price of the stablecoin. It works like demand and supply. The higher the demand, the more scarce the coin and the higher its value.

News and Headlines

News and headlines greatly influence the price of USDC or any other crypto assets. When a billionaire or celebrity supports or buys a large amount of crypto, and it makes it to the news, the crypto prices soar.

This is becoming increasingly popular and common in the non-fungible token (NFT) space as billionaires and celebrities help promote crypto assets, increasing their prices.

Government regulations

The price of the USDC stablecoin is also greatly affected by government regulations. This also affects other crypto assets and is not solely linked to USDC.

These government regulations on investing in USDC, tax policies, or restrictions on mining can affect the price of USDC. It can make the price go up, or it can make it plummet.

Changes in the economy

Drastic changes in the larger economy also influence the price of USDC. Take, for instance, 2020, when many economies worldwide suffered from the pandemic's effects. In light of this change, most cryptocurrencies made incredible benefits, which can be attributed to investors seeking new forms or classes of assets in these dark economic times.

USDC price performance in the past

Understanding the past performance of USD coins will guide you through understanding its current price and possible future forecasts and predictions.

In almost the first half of 2019, USDC traded at its all-time high, a price of $ 1.159350. However, this was not the highest performing year for the stablecoin. It was, in fact, the worst, seeing that the stablecoin went from $ 1.015827 to $ 1.003551, a -1.21% decrease.

In 2018, USDC had its best year, soaring from $ 1.005383 to $ 1.015827, an increase of 1.04%.

USDC is seen to perform best in its yearly fourth quarter than other quarters, especially the third quarter, which can be considered the worst.

The coin's fourth quarter average of 0.31% shows it gained more during these periods and performed less in the third quarter with a loss of -0.42%.

How Is USD Coin Doing Now?

As it stands, USDC represents a haven where crypto investors and traders can store their crypto assets to hedge against market volatility.

In February 2022, the Russian-Ukrainian war led to an increase in USDC volume. The massive spike in the volume is largely attributed to the war since it leads to a decrease in the fiat currencies of the two countries.

In March 2022, the volume of USDC saw a further increase as the market cap went over $50 billion US dollars. This was the first time this happened, and USDC, since then, has continued to show remarkable growth.

The stablecoin is available in more than seven blockchain protocols. Its ecosystem is so flexible that it is integrated into several crypto wallets, over 200 crypto exchanges, and trading platforms like Margex, which is a user-friendly derivative exchange and trading platform based on Bitcoin that allows crypto traders and investors to trade cryptocurrencies, including the USDC with a leverage of up to 100x and access to the crypto global market and economy.

The USD coin has made great feats and will continue to make more. Experts believe that being more compliant will help the stablecoin grow stronger and gain more favors from financial institutions.

USD Coin Price Prediction Today

The price of USDC is expected to trade around $ 0.999850 and have a 24-hour trading volume of about $ 8.67 billion. The stablecoins market capitalization is about 48.56 billion, dominating the crypto and stablecoin market with a 5.07% market dominance.

However, the last hours before today have not been friendly as the stablecoin decreased by -0.01%.

The current supply of USDC in circulation is about 48.56 billion coins. With the current supply inflation rate for the year at a little above 139%, it shows that also 27.45 billion USDC was created in 2021 or more.

In market capitalization, USDC is ranked the second highest in the sector for stablecoins and the second in the Algorand blockchain network or protocol sector.

Although experts believe the price of USDC will be more promising today than tomorrow, leveling at $0.91293817323701 to $1.343, other crypto analysts and investors believe it might reach somewhere close to $1.01 and eventually near $1.01 towards the end of the day.

Short-term USD Coin Price Prediction For February 2023

The price of USDC is expected to soar in February 2023 to a high of almost $1.19918, which would rise and fall as the month goes by, to end with a price of $1.08744.

From the table below, USD Coin is expected to hit a maximum price of $1.59918 in October 2022 and fall as low as $1.08744.

The closing price for November 2022 is expected to be $0.98881541761182, which is expected to be the opening price in December 2022. Although it can reach a high of $1.59919 or a minimum of $1.08745

Long-term USD Coin Price Prediction For 2023

USDC stablecoin in 2023 will start with $1.08745 as the minimum price and a maximum of $1.59920. The average will be $1.28

It will end the year with a minimum price of $1.08755, a maximum price of $1.59933, and an average of $1.27947.

Long-term USD Coin Price Prediction For 2023 – 2030

Crypto experts like Wallet Investors expect the USDC coin price to stay mostly pegged to the US dollars, even up to the next five years or more.

It is expected that in 2023 the average price of USDC will be set at a little above $1, which will level between $1 and $1.5 between 2023 and 2025.

The table below shows the minimum, maximum, and average price for the USDC stablecoin from 2023 to 2030.

Long-term USDC Price Prediction By Experts

Crypto experts and analysts all hold different views about the price prediction of USDC. In the following sections, we will look at these forecasts and predictions to glimpse what the future holds for USDC.

Forecasts by Wallet Investor

Forecasts from Wallet investors expect USDC to experience a long-term increase of up to $1.005 in the next five years.

Price prediction by Gov Capital

Gov Capital, as usual, is bullish, with its price prediction expecting the price of USDC to hit $1.66 in 2023 and over $5.50 in the next five years.

Price prediction by DigitalCoinPrice’s

DigitalCoinPrice's prediction for USDC is set at $1.01 for 2022, 2023, and even up to 2030.

Price Prediction By Margex

At Margex, the USDC price is predicted daily, monthly, and yearly. We do this for other cryptocurrencies as well.

However, these predictions are merely suggestions of how the price of USDC is expected to move and are not to be taken or considered as financial advice, nor should they take the place of thorough research.

Always carry out thorough research before putting your money into any investment.

FAQ

What is the USD Coin price prediction for the end of 2022?

According to some crypto experts, the price of the USDC stablecoin can reach a high of $1.01 or $1.26 by the end of 2022.

Is USD Coin a good investment?

The USDC stablecoins have high hopes of succeeding the USDT to become the largest stablecoin in the crypto industry. Although crypto experts believe, there is no guarantee that this may happen. However, with recent strides in crypto, one can think the stablecoin is a good investment. Whether it is good for a particular investor will depend on their risk level and other factors like investment capital.

Will USDC go up in price?

The price of USDC is expected to go up in price. However, we can't decide how high or when. Crypto experts and analysts believe the coins might reach $1.66 or go even higher.