The crypto market has always been volatile since the emergence of Bitcoin in 2009. Investors can make huge returns today and lose all tomorrow if the price of a crypto asset plunges. That more likely led to the creation of stablecoins, cryptocurrencies backed by real-world assets, to combat market volatility.

According to the Blockchain Council, up to 200 stablecoins already exist in the current crypto market. With this number, new investors in the stablecoins market will struggle to choose the best one. But amongst the leading coins such as Tether UST, USD coin, Binance USD, DAI, etc., the two top contenders with higher stablecoin supply are USDT and USDC.

This article explores these stablecoins in a USDC Vs. USDT comparison approach to determine the best. It also outlines their benefits in general and what makes them stable. So, keep reading to learn more.

What Is A Stablecoin?

A Stablecoin is a cryptocurrency backed by a real-world asset. These reserve assets can be currencies (Euro/U.S. dollar) or commodities such as real estate, gold, or oil. That’s why categories of stablecoins are based on the assets they’re pegged to, such as:

- Fiat-backed stablecoins (USDC, TrueUSD, USDT, and BUSD)

- Commodity-backed stablecoins (Tether Gold, Meta Gold, Gold Coin (GLC), DigixGlobal, (DGX)

- Cryptocurrency-backed stablecoins (DAI, a decentralized ERC-20 token)

- Algorithmic or non-collateralized Stablecoins (Tether UST)

Due to the nature of stablecoins, their values are not prone to market volatility. The only hitch in stablecoins is to ensure that the reserve asset backs the particular one you chose in the acclaimed ratio. For instance, 1 USDC is supposed to be the same value as 1 USD. If the stablecoin loses its peg on the fiat currency, the value will be lower than $1.

However, even with the risks, these cryptos continue to explode. In theQ2 of 2022, the total stablecoin supply hit $151.3 billion, even after losing 18.8% in Q1.

Why Do We Have Many USD Stablecoins?

The United States dollars have always been stable and dependable. Some reasons for this preference include,

- Many central banks and top institutions globally prefer USD for trading.

- The United States dollar is still the number one in official currency reserves, foreign-currency debt instruments, cross-border loans and deposits, and foreign-exchange transaction volume.

- The 2021 official foreign reserves disclosure revealed that USD share outweighed other currencies at 60%

- The U.S. dollar index rating stands at 75, way beyond Euro at 25.

- Stablecoins pegged to the US dollars increased the success of the Decentralized Finance market.

The global crypto market capitalization as of August 4 is above 1 trillion dollars. So it’s safer to have more USD stablecoins, such as USDC, to serve as a store of value for investors.

Also, a USD stablecoin such as USDT, with the largest market capitalization, facilitates seamless peer-to-peer transactions in trading and payments.

Understanding Tether USDT?

USDT is a popular stablecoin backed by the United States dollars. Tether Limited Inc., a Hong Kong-based company, created USDT to facilitate seamless transactions amongst users without a third-party intermediary. It was the first stablecoin to emerge in the crypto market, and this mover-advantage increased its popularity.

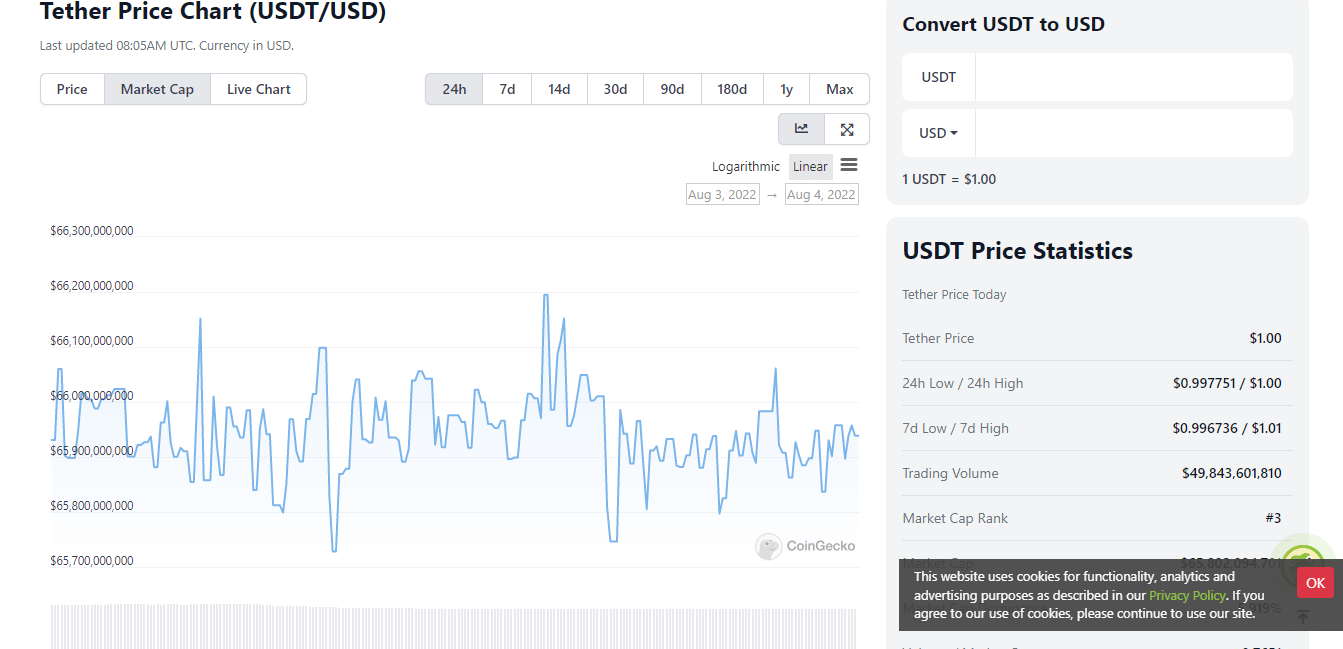

With Tether USDT market capitalization above $65 billion, the coin is the top crypto for trading and payments. Users transact with a blockchain-based USD with the exact mechanisms of other cryptocurrency assets in terms of liquidity.

USDT enables fast and cheap transactions in the crypto ecosystem. Besides decentralized finance, enthusiasts can use USDT to earn interest on diverse protocols. Most importantly, USDT makes it possible for merchants to avoid risks in crypto payments.

USDT is mainly popular on many exchanges without the fiat-to-crypto trading pairs because it is an alternative to USD.

When Was USDT Launched

Tether Inc. launched the USDT in 2014. During the launch, the USDT was known as Realcoin, and its founding fathers were Craig Sellars, Brock Pierce, and Reeve Collins.

USDT Volume

USDT trading volume in a 24-hour's time frame stands above $55 billion, which is even higher than that of Bitcoin, above $29 Billion. The coin ranks number 3 in the cryptocurrency market. Its market cap stands above $66 Billion, making it the top stablecoin in the market now.

USDT Stability

Tether USDT is pegged to the United States dollars, ensuring an enduring value. According to Tether Inc., whenever there’s an issue of new tokens, it allocates an equivalent amount of USD to USDT reserves to ensure the stablecoin is backed by cash and cash equivalent.

Understanding The USD Coin?

USD Coin or USCD is a fiat-backed stablecoin with a famous mantra, “digital money for the digital age.” The USD Coin draws stability from the United States Dollars, as 1USDC equals $1. Each circulating supply of more than $54 billion USDC is backed by one US dollar in its reserve. The USDC reserve is made up of short-term US Treasury bonds and Cash.

USDC is a product of Circle and Coinbase and overseen by the “Centre Consortium” This governing body monitors its technical and financial standards to ensure that one USDC is pegged to 1 USD.

USDC encourages cashless transactions and can hedge against volatility. Also, USDC makes it easier for merchants to accept digital asset payments. It has also found its way into the DeFi and gaming sectors. According to its founders, the main aim is to make USDC a widely accepted crypto by exchanges, dApps, wallets, and service providers.

USDC is on many top crypto providers and exchanges. It is also compatible with ERC-20 wallets on the Ethereum blockchain. You can also send or receive the coin in many other blockchains such as Solana, Algorand, Hedera, Binance Smart Chain, Tron, etc.

When Was USDC Launched?

The USD Coin was launched in 2018. The founding fathers are Circle, a payment service company, and Coinbase, an exchange. These two companies also formed the Consortium in 2018, allowing other cryptocurrencies to join.

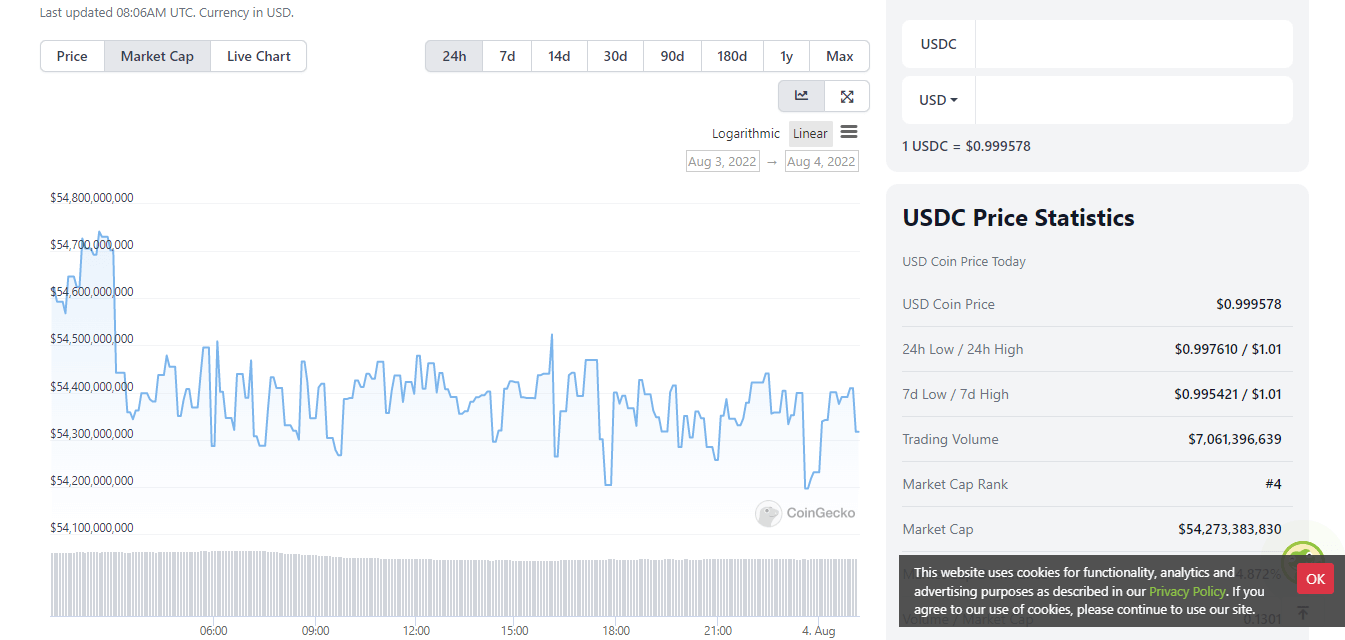

USDC Trade Volume

According to market data on its 24-hour trading volume, USDC stands above $8 billion, and its market capitalization as of August 3, 2022, is above $54 billion. Also, the market rank of USDC stands at number 4, and its market dominance is 5.02%

USDC Stability

The USD Coin remains stable by using a 100 percent collateralization approach. The circulating supply of this USD-backed crypto stands above $54 billion. According to its system, there’s also an equal amount of USD in its Reserves. Moreover, Circle states that each USD Coin in circulation is exchangeable for cash on a 1:1 basis.

USDT vs. USDC

Both USDT and USDC are stablecoins pegged to the United States Dollars. But while USDT boasts a larger market capitalization and popularity, the USD Coin has proven safer.

USDT vs. USDC Comparison Chart

Let's look at other differences between the USDT and USDC in detail below.

- Transparency

Tether didn't share updates on USDT reserves until March 2021, when they disclosed the composition of the reserve. Their hesitation attracted a lot of scrutiny from regulators, making the company eventually capitulate to releasing updates. But Tether is yet to perform a full audit.

USDC stablecoin is more transparent in disclosing updates about its peg to USD. The Centre Consortium ensures a monthly audit of the reserves. Also, it ensures that the crypto complies with government regulations.

- Safety

USDT is not a safe stablecoin given that it is not transparent in disclosing the content of its Reserves regularly. Also, the recent 2022 crash increased the FUD (fear, uncertainty, and doubt) surrounding Tether.

USDC has proven to be safer as a store of value, even though it's not also 100% secure. The Circle constantly monitors its standards to ensure it remains pegged to USD. Moreover, the body does a monthly audit by Grant Thornton LLP and regularly publishes updates on the status of the reserve. Also, USDC complies with government regulations.

- Available Trading Pairs

USDT has many trading pairs on diverse crypto exchanges. Many people utilize it on decentralized finance protocols, thereby skyrocketing its trading volume.

But USDC has continued to close the gap. USDC now has 301 trading pairs on 115 crypto exchanges.

- Regulation

Tether USDT has seemingly been averse to regulation. It doesn’t support full public disclosure of its reserve and hasn't been consistent with audits. But Tether is trying to change that by providing more reports on its reserve contents.

On the other hand, USDC has always been transparent, carrying out monthly audits, and complies with the same supervision standards as the traditional banking system. Also, the Circle has positioned the stablecoin to be ready for future regulations.

Recently, there have been a lot of calls to strictly regulate stablecoins after the crash of Tether in May 2022. According to reports, US lawmakers are pushing new rules on stablecoin operations. Apart from the United States, other governments such as China, Singapore, Russia, European Union, Middle East are all pushing for Stablecoin regulations.

With all the push for these regulations, USDC is better positioned to cushion the effects of the upcoming rules.

Why Use USDT, USDC, And BUSD

There are many benefits of using USD-backed stablecoins such as USDT, USDT, and BUSD. Find them below.

- Transparency

USDC, USDT, and BUSD are transparent Stablecoins disclosing the status and contents of their reserves. For example, BUSD and USDC maintain monthly audits by Withum and Grant Thornton LLP accounting firms, respectively. This practice instills confidence in users.

- Fast Transactions

Transactions in these stablecoins don't take more than ten minutes. It is better than traditional banks that require one to five business days to receive fiat deposits.

- Security

Transactions in stablecoins are secured due to blockchain technology. The technology operates based on consensus, cryptography, and decentralization.

But there’s nothing like 100% security in cryptocurrency since the blockchain is also susceptible to fraud and hacks. Also, different blockchains may not have the same level of security.

- Always Available

You can make crypto transactions anytime from anywhere. The channels are always open 24/7, and there's nothing like holidays or weekends.

- Price Stability

Stablecoins are more stable in prices because they're usually pegged to a real-world asset and constantly mirror their value. This differs from other cryptocurrencies, whose price fluctuates erratically based on market conditions, sentiments, or economic situations.

- Fees

Stablecoin transaction fees are lower than what's attainable in standard transactions. For instance, a cross-border transfer of $200 can incur up to 5 to 9.3% fees. But stablecoins might incur charges in cents. That’s why in the first half of 2021, USDC and USDT transfers reached $3 trillion.

USDT vs. USDT, Which Stablecoin Should You Choose?

Choosing between USDT and USDC depends on several factors. Find these factors below.

- Liquidity

USDT is notably the leading stablecoin with a large volume of investment. Until now, it remains the stablecoin with the highest trading volume and market capitalization. But USDC is also good for payments and trading, given the recent hike in growth.

- Store of value

USDC has proven to be the leading stablecoin in storing value. Centre Consortium oversees its standards to ensure it maintains a peg on USD, thereby maintaining its stability. But USDT recently lost its value during the 2022 crash of Tether.

- Future growth

USDT comfortably occupied the first position until the 2022 crypto winter. Now the growth trend is not moving upwards as before. So, regarding future growth, USDT is decreasing while USDC is growing steadily.

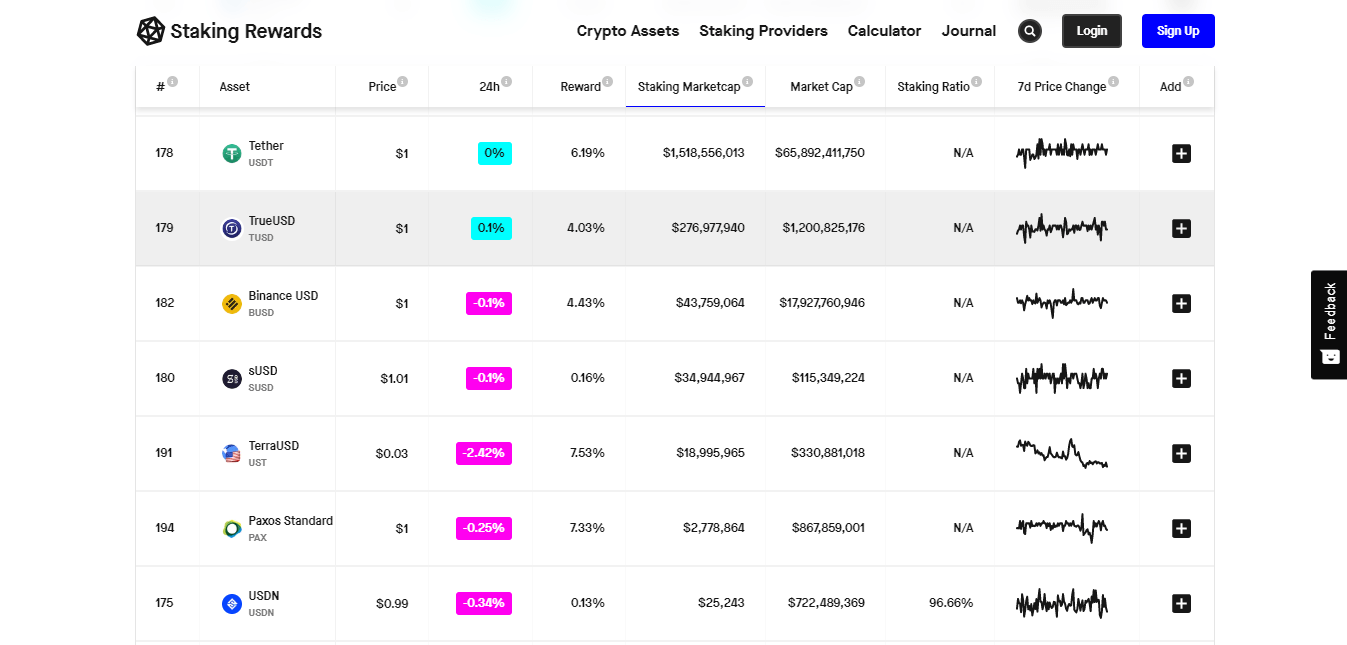

- Earning interest

Lending USDT and USDC on diverse DeFi platforms assure you of higher APY with minimal risks since they’re both collateralized. But when it comes to staking rewards, USDT tops the pack. Also, you can earn yields by opening a Cabital account and depositing USDT.

What Does The Future Hold For Stablecoins?

Given the trend in crypto adoption, asset-backed cryptos might become a reliable medium of exchange in the nearest future. But it will favor stablecoins backed by fiat currencies such as USD, as they strive to maintain their value and are redeemable on short notice.

Regulations are another factor that might affect the future of stablecoins. Regulators in the US are pushing to control stablecoins under the Federal Deposit Insurance Corporation. With such stringent frameworks, entry barriers will increase.

Another factor is the launch of CBDCs (Central Banks Digital Currencies). Now, private companies are responsible for minting stablecoins. But all that will change once central banks start launching their own digital coins.

USDT vs. USDC: Which Is The Safest Stablecoin?

The safest stablecoin in 2020 remains USDC. The crypto has remained stable in value and continuously discloses its Reserves. Also, it is compliant with regulations and positioned for future rules.

The FUD surrounding USDT after the May 2022 crash caused a downward growth and trust trend. Also, Tether has faced many legal issues and even received a fine for lying about its reserves.

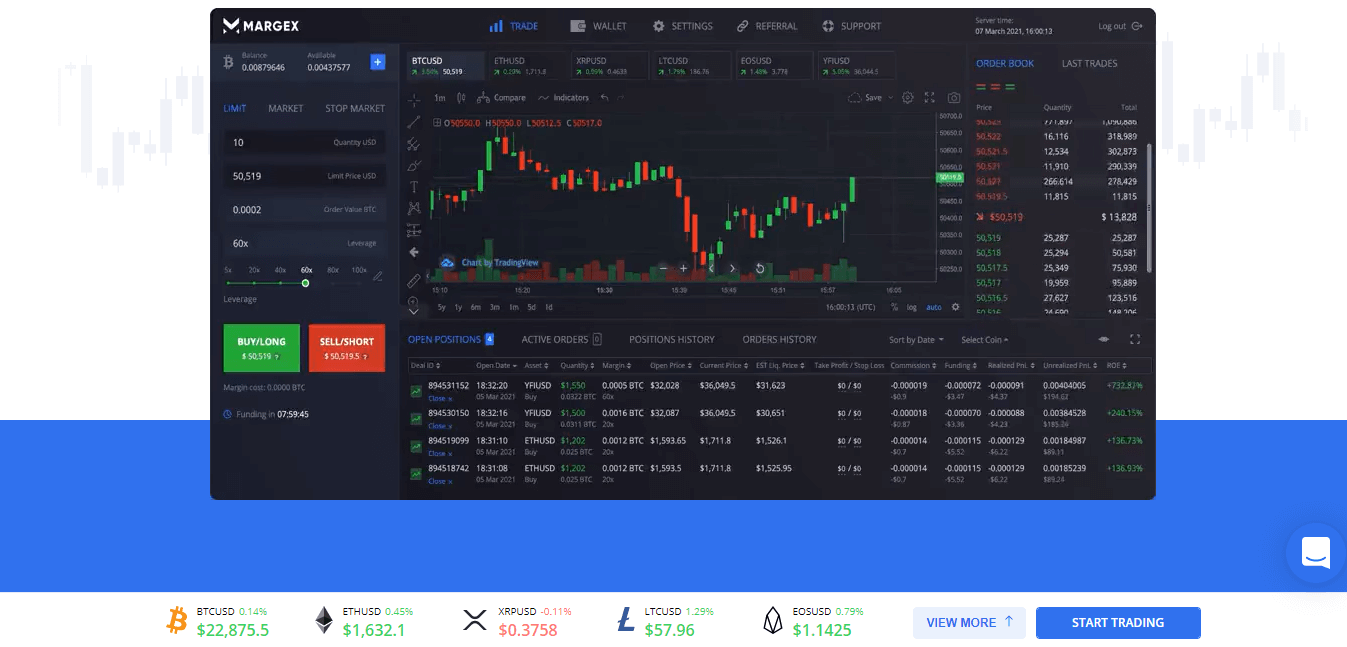

You Can Use Stablecoins So That Volatility Does Not Affect Your Income On Margex

Trading with Stablecoins on Margex is the best way to avoid volatility. Margex is a reliable platform where you can trade different cryptocurrencies with ease. It has a user-friendly interface and low fees.

The derivatives trading platform is protected with bank-grade multilayer security. Also, it depends on the liquidity of many crypto exchanges, thereby reducing the volatility risks of cryptocurrencies.

Being a derivative platform, you can trade Bitcoin with 100x leverage, meaning that you can trade up to $200,000 with a fund of $2000. All you have to do is open an account, deposit money to your Margex wallet and start trading.

FAQ

Find short answers to any further questions you might have about the top stablecoins in the market right now.

Can I Convert USDC To USDT?

You can convert USDC to USDT as both stablecoins have the same value 1USDC=1USDT. Some of the exchanges that support the conversion include, Kucoin, CoinEx, Binance, OKX, Gate.io, and at least 113 more crypto trading platforms. To make the conversion easier on some exchanges such as KuCoin, simply trade the USDC/USDT pair. You can also change USDC to USDT at low fees on Changelly and Changenow.

Is USDT Better Than USDC?

USDT is not better than USDC, although their position is relative to the investors' interest. Each coin has its area of application. For instance, to store value, it's better to use USDC since it is safer as things stand. But for payments and trading, USDT wins as it's higher in market cap and ensures continued liquidity alongside high APY.

Is USDC Safe To Hold?

It is safe to keep USDC. The stablecoin is pegged to the US dollar and has continuously maintained its status of a 1:1 ratio. Also, the stablecoin is transparent, given its monthly audit and full public disclosure. Investors are always in the know of the assets that make up the USDT reserves and at what proportions. By that, they’re sure of redeeming their holdings at any time without fear of losses.

Why Is USDT More Expensive Than USD?

USDT is a tradable stablecoin whose prices depend fully on its sellers and buyers. If there is a market crash, many people will rush to buy USDT, and if there is a price hike, there will be a sell-off spree.

Is It Safe To Keep Money In USDT?

It is not safe to keep money in USDT since the coin can lose value. USDT is one of the stablecoins pegged to USD, a leading fiat currency in terms of stability and value. But the recent crash has made Tether unsafe since it depegged from the US dollars leading to massive losses for investors. Such events are unpredictable and can happen without notice.

Moreover, keeping money in USDT faces another risk stemming from the staking platform where you hold it. If the platform is hacked, you might also lose your investments. So, it’s better to choose a regulated platform with proven security track records and adequate insurance is better.

Which Stablecoin Should I Use?

The stablecoin you should use depends on your purpose. To earn higher staking rewards, you can choose USDT. But when it comes to the safety of investments, USDC is better for now. You can also consider BUSD and DAI, other transparent and fast-growing stablecoins.