Rug pull is one of the worst crypto scams that makes unsuspecting investors lose money. We've highlighted how it works and the best ways to identify rug pull scams. Read along.

In cryptocurrency, a rug pull occurs when a development team abruptly drops a project and sells or eliminates all of its liquidity. The term "pull the rug out from under someone's feet" refers to an abrupt withdrawal of support.

The Decentralized Finance (DeFi) projects that provide liquidity to Decentralized Exchanges are most frequently associated with rug pulls (DEXs). A DEX is the only source of liquidity for new projects' DeFi tokens because CEXs typically do not list them. A DeFi project will typically produce its token and give a certain amount of liquidity to a DEX.

This could be sold in an initial DEX offering or immediately added to a liquidity pool (paired with another token like ETH or BNB) (IDO). Investors buy the coin in an IDO, and the money is typically locked for a set amount to ensure a certain level of liquidity.

Once the project has access to its liquidity and high hype levels, the rug pullers have two choices. They can either remove all liquidity by selling their tokens at a high price or use back doors in smart contracts to steal investors' money. Investors struggle to sell their tokens or are compelled to sell them at a loss if insufficient liquidity exists.

Types Of Rug Pull In Crypto

There are three types of rug pulls that can be found in cryptocurrency. They are as follows:

Liquidity theft

Liquidity theft occurs when the founder of a project (the creators of a token) abruptly withdraws all of the coins from the liquidity pool used to fund a project. When this happens, the token's value is lost, leaving investors with a worthless asset that can't be used for anything. This style of rug pull is most commonly found in the DeFi industry.

Limiting sell orders

This is a more subtle method for fraudulent founders to defraud investors. In this scam, a developer creates a token with a smart contract that restricts who can sell it. This means that investors cannot sell the token to other peers, effectively locking them into an untradeable asset. When enough investors have purchased the token and the founder has made a profit, they sell their tokens, leaving investors with worthless tokens.

Pumping and dumping

Dumping occurs when a founder or crypto developer quickly sells off a significant portion of their own tokens. When this happens, the coin's price plummets dramatically because demand falls while available supply increases. In a rug pull, fraudulent founders will pump the token to increase its value and attractiveness to investors to hype the project. Vulnerable investors will purchase the tokens as a result of marketing and promotion. When the price of the tokens rises, the founder will sell them, profiting from the hype.

Most Known Rug Pull Examples

OneCoin

Ruja Ignatova, the self-proclaimed "crypto queen," and others founded the Bulgarian cryptocurrency company OneCoin Ltd in 2014. Ignatova and her associates allegedly made false claims about the coin and its perceived value to entice investors.

In 2017, Ignatova vanished, and the exchange abruptly shut down. The platform is thought to have defrauded more than $4 billion in victims in total.

She was charged with conspiracy to commit wire fraud, conspiracy to commit money laundering, securities fraud, and securities fraud, and she was placed on the FBI's Ten Most Wanted list in June 2022.

Neko Inu

Neko Inu was a cryptocurrency game project in which players could earn USDT. It was a cute Player vs Player (PvP) virtual platform that was ideal for playing with family and friends.

Neko & Inu Corporation funded Neko Inu, a global joint venture between a Hong Kong consortium and a Cambodian casino, with the help of an international digital platform, Lemon Game.

Even though the gameplay was adorable and promising, some players noticed several red flags. First and foremost, the referral scheme was more extensive than usual. As you can earn from your downlines, you would earn more if you recruited more players into the platform.

Second, the USDT earnings were overstated. According to the platform, players' in-game pets' values could increase by 5% every 12 hours.

Finally, the pending time for withdrawals was longer than usual. It only took a few minutes to almost instantly deposit your money into the platform. However, withdrawing the fund took two days and a 5% fee.

SnowDog rug pull

SnowDogDAO was a project with the lofty goal of becoming the crypto space's reserve currency. With Snowbank performing well, most people in SnowDog thought it was a good project, primarily because the Snowbank developers stood to gain more if the project thrived than if it died.

Regardless, confusion ensued on the day of the buyback when it was revealed that the buyback would only be done on a custom SnowDog AMM (Automated Market Maker) rather than Trader Joe, the decentralized exchange that most had previously used to buy $SDOG.

When $SDOG owners finally gained access to the password-protected AMM, they were greeted with a sharp dump. Two whale wallets had already surpassed everyone else, with one selling 187 $SDOG for US$10 million, or $54,000 per token.

While most $SDOG holders expected they would not be the first to sell their $SDOG tokens, the real frustration came later when the community discovered that the wallets that dumped their tokens could do so before the AMM's password protection was removed.

Furthermore, the $SDOG contract on the Trader Joe's platform had never authorized these wallet addresses.

Luna Yield rug pull

Luna Yield was a Solana (SOL) platform-based ecological farming project. Before Luna Yield vanished, the Solana (SOL) project had steadily grown. The project's creators abruptly deleted their website, Telegram, and Twitter accounts and withdrew millions of dollars.

Following the deletion of the social media accounts, Luna Yield investors attempted to withdraw funds that had not been staked but were unsuccessful. Further investigation revealed that the project developer had approved the transactions, resulting in the rug being pulled on tracking the address.

Thodex

According to the state news agency Anadolu, the centralized Turkish cryptocurrency exchange Thodex was founded in 2017 and has approximately 400,000 users.

The exchange stopped allowing its users to withdraw funds in 2021, and founder and CEO Faruk Fatih Ozer vanished shortly after. According to users, certain cryptocurrencies, including dogecoin, were trading at much lower prices than other markets the night before the exchange shut down.

According to Chainalysis, users lost over $2 billion in cryptocurrency. Subsequently, Turkish prosecutors began proceedings to charge the exchange's founders and executives for their role in the scam.

How to Stay Safe From Rug Pulls

Investors should look for several clear signs to protect themselves from rug pulls, such as the liquidity not being locked and no external audit being performed.

The following are five indicators that users should be on the lookout for to protect their assets from crypto rug pulls

Developers who are unknown or anonymous

Investors should consider the credibility of the people behind new cryptocurrency projects. Are the developers and promoters well-known in the crypto world? How long have they been in business? Do they still appear legitimate and capable of delivering on their promises if the development team has been doxxed but isn't well known?

Investors should be wary of new, easily fabricated social media accounts and profiles. The project's white paper, website, and other media quality should provide clues about its overall legitimacy.

The presence of anonymous project developers could be a red flag. While Satoshi Nakamoto, the world's first and largest cryptocurrency creator, remains anonymous to this day, times are changing.

No liquidity locked

One of the simplest ways to tell the difference between a scam coin and a legitimate cryptocurrency is to see if the currency is liquidity locked. With no liquidity lock in place on the token supply, nothing prevents the project creators from stealing the entire liquidity.

Liquidity is ensured by time-locked smart contracts, which should last three to five years after the token's initial offering. While developers can write their own time locks, third-party lockers can provide more security.

Investors should also look at how much of the liquidity pool has been locked up. A lock is only useful in proportion to the amount of liquidity it protects. This figure, known as total value locked (TVL), should be between 80% and 100%.

Sell order limits

A bad actor can program a token to limit the ability of certain investors to sell but not others. These selling restrictions are typical of a sham project.

Because selling restrictions are buried in code, determining whether there is fraudulent activity can be difficult. One way to test this is to buy a small amount of the new coin and immediately try to sell it. The project is most likely a scam if there are difficulties in offloading what was recently purchased.

Suspiciously high yields

If something appears too good to be true, it most likely is. If the yields on a new coin appear suspiciously high but do not prove to be a rug pull, it is most likely a Ponzi scheme.

Although not always indicative of a scam, when tokens offer an annual percentage yield (APY) in the triple digits, these high returns usually translate to equally high risk.

No external audit

New cryptocurrencies must now go through a formal code audit process conducted by a reputable third party. Tether (USDT) is a well-known example of a centralized stablecoin whose team failed to disclose that it held non-fiat-backed assets. An audit is especially important for decentralized finance currencies, where auditing is required by default for DeFi projects.

Potential investors, on the other hand, should not simply take a development team's word for it that an audit has taken place. The audit should be verifiable by a third party and demonstrate that no malicious code was discovered.

How Margex helps you to earn in crypto market and keep your money safe

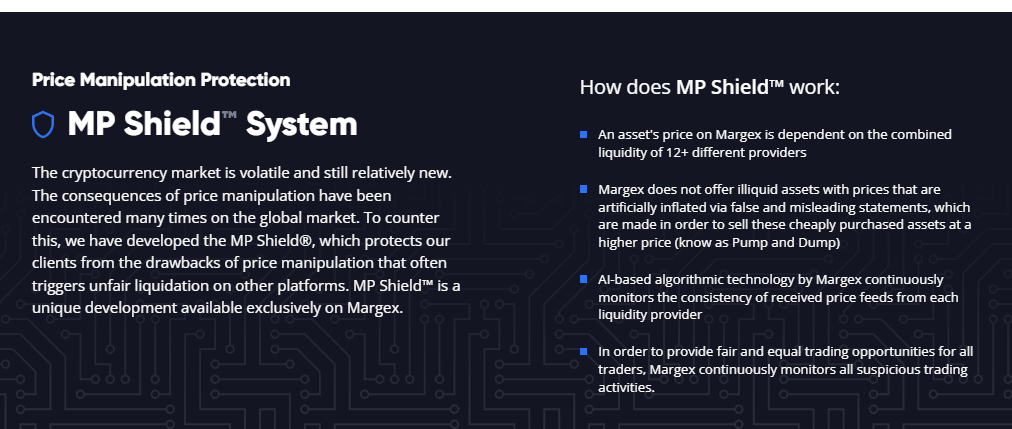

MP shield system

Margex is a cryptocurrency derivatives trading platform that provides leverage of up to 100x. Its proprietary MP Shield System, which protects against price manipulation, distinguishes it from other similar platforms.

The price of an asset on this exchange is determined by the combined liquidity of at least 12 different providers. This means that an error in the data provided by a single provider cannot cause problems on Margex's end. Furthermore, the number of tradable assets on Margex is extremely limited. At the same time, this may appear to be a disadvantage, it is actually a method of avoiding illiquid assets that may be part of a pump-and-dump scheme.

As an added security measure, the team developed an AI-based algorithm that monitors the consistency of all price feeds from each provider—helping to identify if a provider begins sending inconsistent data for any reason. The same vigilant eye is turned on platform traders: all suspicious trading activities are consistently monitored.

These contribute to resolving some of the most common margin trading issues. While the practice remains highly risky and necessitates significant prior knowledge—as well as the willingness to potentially lose everything you have invested and more—Margex adds a little more security and transparency to the highly volatile cryptocurrency margin trading world.

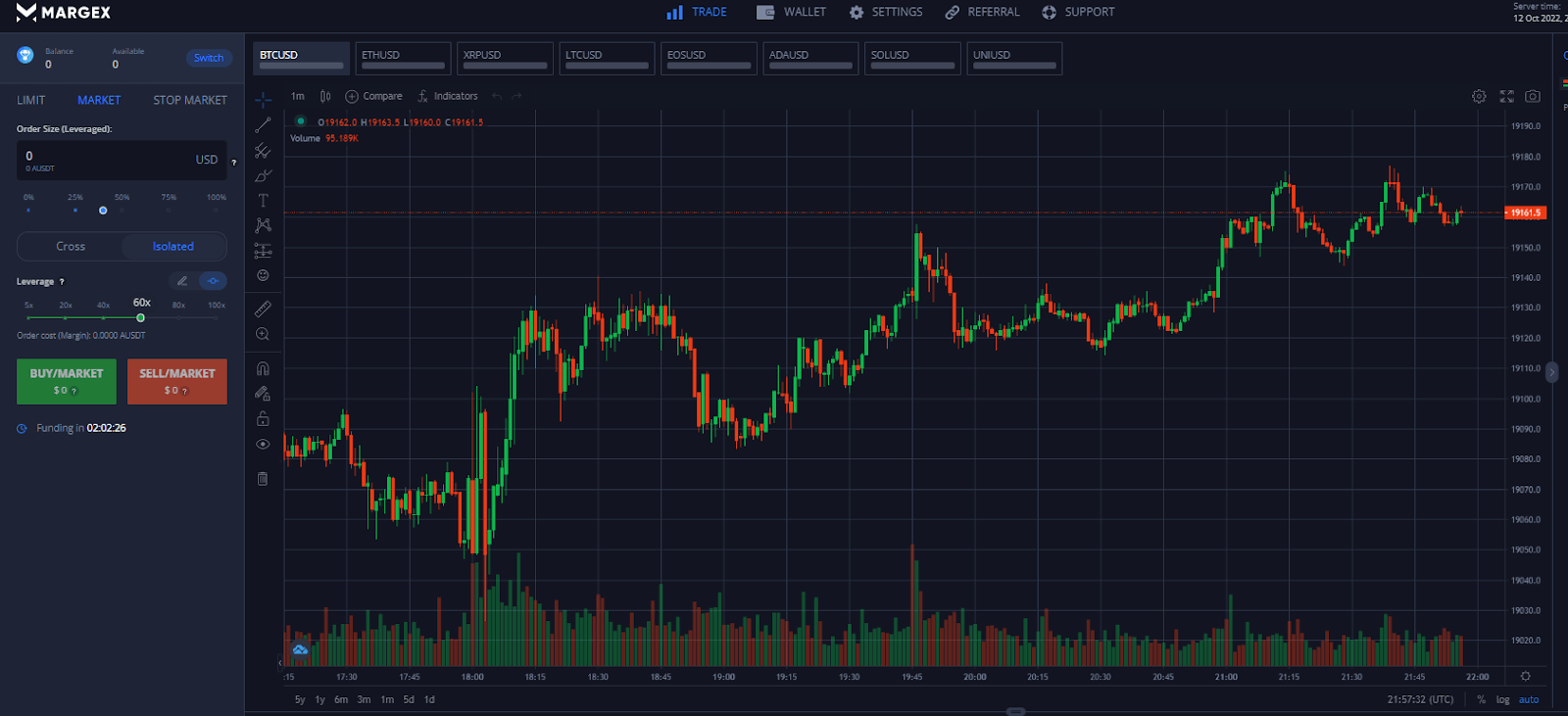

User-friendly trading platform with transparent commissions

Margex employs the most practical and highly scalable infrastructure, allowing traders to trade seamlessly and uninterrupted, even during peak market activity. Margex combines the best of cryptocurrency with bank-grade security. All assets are kept in cold offline wallets.

You have access to all information on the Margrex platform. You have complete control over your order from submission to execution.

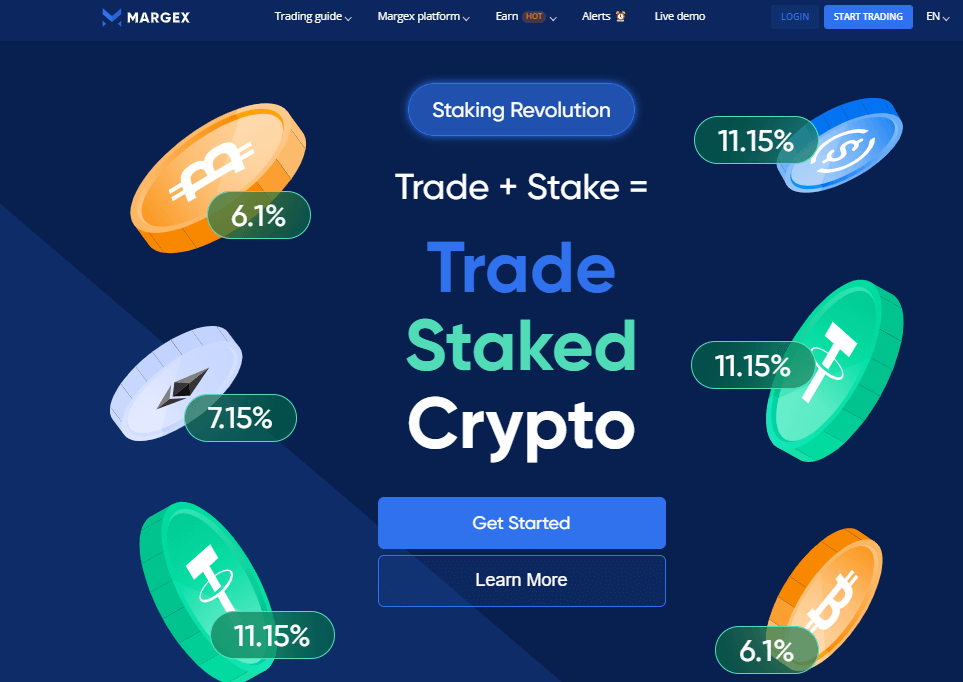

Unique staking feature

Margex's trading platform now includes revolutionary new crypto staking feature that provides the highest yields in the industry while requiring no lockup period or fixed-term staking. The innovative new feature enables all users to trade using staked balances to profit from both staking and trading simultaneously.

Daily staking reward payouts are automatically added to the staking balance. Staking pools are collectively limited. On the other hand, individuals have no limits, and withdrawals while staking are never restricted.

The all-new Margex crypto staking solution, when combined with leveraged margin trading, is one of the most profitable tools in the cryptocurrency market.

FAQ

Are rug pulls illegal crypto?

While crypto rug pulls should be illegal, due to the industry's youth, the laws governing rug pulls are not the legal system. Unfortunately, many criminals have gotten away with rug pulls and other similar crimes and continue to do so.

What happens when crypto gets rug pulled?

When a rug pull occurs, the investors are left with worthless currency. It's not just a crypto phenomenon. However, cryptocurrency is particularly vulnerable.

What Cryptos have been rug pulled?

Some of the most popular rug pull cases are OneCoin, Neku Inu, SnowDog, Luna Yield, Thodex.

How long does it take for a rug pull in crypto?

A rug pull can take place within any period of time. It could be months, weeks, days, or even hours. A rug pull coin, for example, can go from 0 to 50X in 24 hours. This trick is intended to generate FOMO, causing more people to invest in the token.

How do I stop rug pull crypto?

Investors can protect themselves by selecting established cryptocurrency projects, ensuring that any new project's code has been reviewed, and verifying the developers' identities.

How do rug pulls make money?

Rug pulls are typically carried out by cruel scammers who create hype around their coins before abandoning the project and sprinting away with the money. These cryptocurrencies are typically created on reputable utility blockchains like Ethereum or Binance Chain.