The blockchain has many benefits which cut across diverse sectors and practices in the financial world and beyond. But achieving a holistic blockchain that is scalable, secure, and decentralized has proven to be difficult for developers.

For instance, Bitcoin was developed on blockchains back in 2009 with limited functionalities. But when Vitalik Buterin created the Ethereum mainnet, he expanded the functionalities of the blockchain to work like traditional banks by supporting investments, trades, lending, savings, and borrowing. All these functions necessitated a more robust blockchain capable of cushioning the new capabilities.

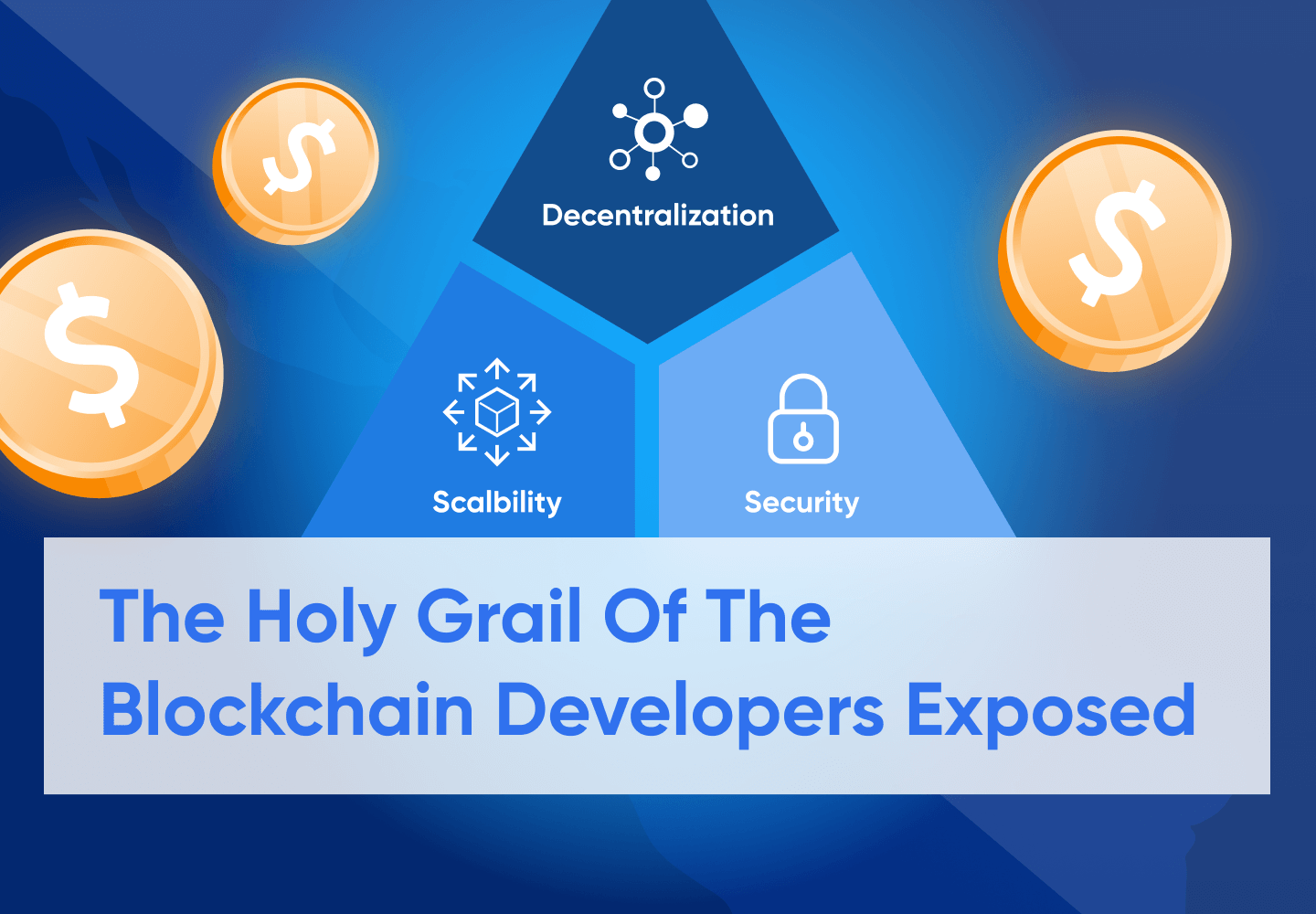

But to fully achieve its potential, every blockchain technology must merge three pillars; security, decentralization, and scalability. Unfortunately, these three fundamentals have constantly posed a challenge for developers because achieving the three together is difficult.

It always seems that developers must sacrifice one of these features for the other two to be present. This situation gave rise to the blockchain trilemma.

So, what is the blockchain trilemma? Has it been solved, and how? Find the answers below.

Blockchain Trilemma, What Is It?

The blockchain trilemma is the difficulty developers face in achieving the three key features of the blockchain. These are scalability, decentralization, and security. In theory, every blockchain must be secure, scalable, and decentralized.

Vitalik Buterin came up with the word “blockchain trilemma” in 2014 during the development of Ethereum. During that time, Buterin aimed to create a blockchain that would offer the three features together, thereby closing the gap in its predecessor, Bitcoin. But he soon discovered it wasn’t easy.

These lapses are never noticed until you dive deeper into the operations of any blockchain. For instance, Ethereum’s scalability issue became apparent in 2020 when many DeFi and NFT projects were developed on its network, resulting in lower transaction speed.

Developers overloaded the Ethereum blockchain with more than 300,000 ERC-20 tokens and NFTs (non-fungible tokens), slowing down the processing power speed and skyrocketing gas fees. These events negated Buterin’s claims that Ethereum is scalable as it is decentralized and secured.

In reality, distributed networks such as Bitcoin or Ethereum have been known to face a lot of scalability issues. These blockchains are secure decentralized networks, but are not scalable. That’s why the crypto space records more emerging L1 and L2 blockchains, offering to close the gap created by Ethereum and Bitcoin.

Notably, both Bitcoin and Ethereum are pushing to solve scalability issues. While Ethereum developers are making plans to migrate to Eth 2.0, a proof-of-stake version of the network, Bitcoin developers are creating off-chain solutions to facilitate faster processing, such as the Liquid Network and the Lightning Network.

The Three Concepts Of The Blockchain Trilemma

Three features that make up an efficient blockchain are scalability, decentralization, and security. But these pillars are always difficult to achieve together in several blockchains. So, let’s explore them below.

Decentralization

Nowadays, many people would use cryptocurrencies instead of fiat currencies for national and cross-border transactions. This is due to the decentralization of blockchain technology. Decentralization is one of the core features, ensuring that users have the right to dictate what happens in their transactions.

What is blockchain decentralization?

Decentralization is the practice of dividing authority amongst the participants of a network. No central authorities approve or disapprove access to crypto or transactions in decentralized systems like blockchains.

All the participants on a blockchain are equal, and the data is distributed. By that, a central entity won't have the authority to dictate what happens or change the processes of the ecosystem. That’s why blockchain developers pursue decentralization to ensure immutability.

Bitcoin, the first cryptocurrency on the blockchain, was a permissionless system. Users have absolute power over their crypto and can transfer it without intervention. Being a trustless proof-of-work system, users don't need a third party's trust to transact. Once a transaction is validated, network nodes won't be able to reject it.

How does it affect scalability and security?

Decentralization becomes a stumbling block when it comes to achieving scalability and security. It is easier to secure a system when a central authority oversees or controls the processes. However, this practice keeps the participants of such networks at the mercy of one single entity, which negates the promise of these blockchains.

To achieve decentralization, which is the core foundation of a cryptocurrencie, developers must sacrifice either scalability or security. Unless they’re prepared to sacrifice decentralization for the other two features.

A blockchain project, such as Ripple (XRP), can exist without decentralization. The crypto has a large market cap, but then it is a centralized network that suits banking processes. But such a blockchain will still be ruled by subjective human judgment and biases.

This is why the cryptocurrency community is divided between the proof-of-work (PoW) and proof-of-stake (PoS) consensus mechanisms. The debate is on which mechanism should be used in a crypto network. For example, Vitalik Buterin claims that a PoW chain is entirely decentralized, but it is not very secure and scalable. On the other hand, the PoS mechanism is more centralized, scalable, and secured.

But practically, a PoW network might be more sustainable in the long run when it comes to security. According to experts, such a network can recover after a Sybil attack if new miners emerge and filter out the criminals. But a PoS chain will require a complete fork to recover its consensus.

Scalability

People use MasterCard and VisaCard all over the world because the networks can process millions of transactions in seconds. If people had to wait very long to complete their transactions, these financial systems wouldn’t be so popular.

MasterCard and Visa boast millions of users and continually sustain their efficiency by offering 5000 to 10,000 TPS. As a result, transaction fees on these networks have remained between 1-1.5%. All these functions are because of scalability.

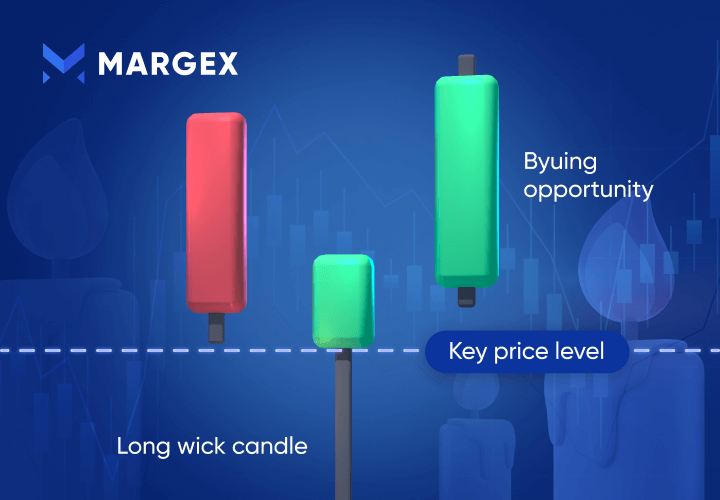

Scalability issues have become a thorn in the flesh of many cryptocurrencies. It became more evident during the craze of DeFi and NFTs, when the Ethereum network could no longer sustain its mass transactions. This discovery led to the frenzy for developing off-chain solutions to mitigate the problem.

What is blockchain scalability?

Scalability is a feature of a blockchain network that makes it practical and efficient in processing millions of transactions very fast. For any blockchain to support mass adoption, it must be scalable to cushion the load of the transactions and also execute them speedily.

For instance, in the 2017 bullish trend, Bitcoin struggled with scalability issues as its active users increased unimaginably, leading to high transaction fees of $60. This is what later happened to Ethereum when many DeFi and NFT crypto projects were built on its ecosystem.

An emerging blockchain network might not process thousands of transactions at the beginning. But when its global adoption grows, it will slump under millions of active users. For instance, a blockchain network with 6000 TPS can support 50,000 active users initially but not when the users increase.

All these experiences prove that scalability is a feature that must exist in every crypto network. These systems are expected to continue their functions without slowing down or recording network failures due to backlogs when active users increases.

Thankfully, the newly-emerging blockchains such as Kadena (KDA), and Solana (SOL) have won the attention of many crypto projects by offering 10,000+ TPS with even lower fees. Also, Ethereum is approaching the migration to Eth 2.0 with the PoS consensus mechanism. This move will increase its TPS from 14 currently to 100,000. By that, transactions will be faster with much lower fees, thereby fixing the scalability issues in the blockchain trilemma.

Bitcoin network on-chain TPS is 4 to 5, proving its scalability problem. But the developers have also tried to solve the issues by creating off-chain scaling networks like the Liquid and Lightning Network. These solutions can process a million transactions in the shortest time possible, but they are centralized. They have sacrificed decentralization for scalability unlike Algorand that is decentralized and scalable.

Why is scalability important in blockchains?

Scalability ensures efficiency in a blockchain network and positions it for future growth. Let’s consider more of its importance below.

1. Accommodates higher workload

A network that can scale will handle the incremental workload without crumbling. For example, at the beginning of every blockchain network, transactions are fewer and are processed faster. But when it grows, active users increase, thereby overloading the capacity of the nodes. But with solid scalability features, such a network will continue to work as fast as before without issues.

2. Supports diverse protocols

Ethereum collapsed when DeFi and NFTs developers built diverse projects on it. However, a scalable blockchain project can support protocols requiring many transactions such as social platforms, video streaming, gaming, etc., without crumbling.

3. Allows new nodes

New nodes can be added to a scalable network to increase data handling capacity, thereby reducing costs. This is important because fewer nodes with scarce resources will not have adequate computational power for fast transaction verifications.

4. Reduces propagation delays

Blockchains broadcast the details of every transaction across miners and nodes. These are the main characteristics of a decentralized network. Without the scalability feature present, data transmission will be slow, and queuing will skyrocket.

Security

When it comes to crypto networks, blockchain security is at the forefront because, without it, the technology is useless. That's why the crypto trilemma exists because for a network to be secure, it needs to be permissioned to control the users' activities.

Public blockchains struggle with security because they’re decentralized and open-source. Many depend on smart contracts to initiate and conclude transactions. That’s why there are many exploits targeting blockchains every year. In 2021, the exploits of decentralized finance protocols took a crazy turn with the advent of flash loans. Investors lost more than 182 million in diverse flash loan attacks.

What is blockchain network security?

Blockchain security is a network feature that protects crypto investor funds' safety. Without being secure, hackers will compromise addresses and siphon people's funds. The presence of strong security in any blockchain instills trust in the minds of the users. Without adequate security, a blockchain is useless because cases of exploits and hacks will occur daily.

Since the development of Bitcoin on the blockchain, security concerns have kept developers restless, thereby adding to the blockchain trilemma. Even with steady efforts to combat the challenges, layer-2 DApps on Ethereum and many DeFi-powered chains record large numbers of hacks.

Apart from these, Bitcoin faced many security issues even as early as 2010. For example, a malicious actor discovered a bug in Bitcoin code and exploited it to create 184B BTCs. Thankfully, Satoshi Nakamoto, the pseudonym owner of bitcoin, fixed it.

On the part of Ethereum, its DAO hack resulted in the malicious transfers of 3.5 million ETH during its ICO sale. The hacker discovered a vulnerability in its code and exploited it. Thankfully, the founders hard-forked the network and retrieved the funds.

How does it affect scalability and decentralization?

Security has become part of the blockchain trilemma because the presence of decentralization and scalability increases its utility. But to achieve it, a network needs high processor power. If you combine this requirement with that of decentralization and scalability, the issues compound.

Scalability requires enormous processing power to improve TPS. Also, decentralization requires the same to ensure that every transaction written into the ledger is correctly updated to network nodes.

To achieve all three, developers must discover the right way to balance them. Sacrificing any of them shakes the foundation of blockchain technology, unless they decentralize for the other two to function.

Layer 1

Layer 1 is a solution on the blockchain that makes it efficient and faster. These solutions facilitate on-chain transactions. Some functions of Layer 1 networks include:

- Increasing block confirmation rates

- Expanding block size to accommodate more transactions

- Breaking transactions on a blockchain into shards to enable a parallel processing

- Reducing the energy consumption by transitioning into a consensus mechanism requiring lesser energy

Examples of Layer 1 solutions are Bitcoin and Ethereum. But these solutions have continued struggling with scalability. That’s why they’re creating Layer 2 solutions to sustain growth, thereby solving the blockchain trilemma. Ethereum's migration to PoS is a typical example of a Layer 2 solution.

Its Layer 1 relies on the popular proof-of-work mechanism, an energy-intensive mechanism. Miners must utilize large computing power to sustain operations. But the latest PoS is different, as a validator only has to stake high financial collateral to secure a network.

Layer 2

Due to the inability of Layer 1 solutions to handle the need for scalability, Layer 2 solutions emerged to support them. These solutions are third-party tools that developers connect to a major blockchain to facilitate faster processing.

Some existing Layer 2 solutions now include Ethereum Polygon (MATIC) and Bitcoin Lighting Network. With these Layer 2 solutions, a blockchain network can achieve decentralization, security, and scalability, thereby fixing the blockchain trilemma.

Notably, many cryptocurrencies such as Cardano (ADA) and Ethereum combine both layer one and layer two to achieve increased network performance. But note that Layer 2 is different from a side chain solution. A sidechain runs parallel to the network it is supporting. So, for instance, the Ethereum side chain stands on its own and relies on its security. But it also helps to facilitate improvement on Ethereum processing speed.

FAQ

Who solved the blockchain trilemma?

Many new blockchains, such as Dragonchain, Solana, Polkadot, Cardano, Fantom, Avalanche, etc., claim to have tackled the blockchain trilemma through different approaches.

DragonChain claims to have integrated the three elements, scalability, decentralization, and security, into its blockchain. To bridge the gap, others follow diverse approaches such as Proof-of-stake, Sharding, Layer 2, Nested Blockchains, Sidechains, Rollups, etc.

This means that a blockchain can be optimized to achieve its goals, but the blockchain trilemma is still challenging to solve. Developers hope that as technology advances in the future, the trilemma can be solved easily during blockchain development.

Can blockchain be hacked?

A blockchain can be hacked, but not directly. Three ways by which hackers can compromise blockchains are through 51% attacks, creation errors, and insufficient security.

In reality, the 51% is practically impossible on more extensive and complex blockchains because one entity cannot own 51% of its power to manipulate transactions. But it is likely to happen on smaller blockchains.

Hackers can also exploit errors in blockchain foundations to compromise them. This is prevalent on smart contract blockchains, characterized by vulnerability or security flaws. Lastly, hackers can compromise a blockchain through blockchain-adjacent processes.

What are nested blockchains?

Nested blockchains are usually within or on another blockchain. These blockchains are often used by Layer 1 blockchains to process transactions. This approach is one of the approaches through which major blockchains solve scalability issue. An example of a nested blockchain is the Ethereum OMG Plasma. This blockchain rests on its Layer 1 to make transactions cheaper and faster.