With the once-in-four years soccer World Cup here again, soccer fans and even non-fans all over the world have started to join the world cup fever as the tournaments start to heat up. With the world’s attention now turning to watching soccer, and with the ease of soccer betting around the world, will people ignore crypto for the coming month as they switch to punting on their favorite soccer teams instead? Read on to find out.

US Stocks Makes a Good Crypto Proxy

According to crypto analytics firm, The Block, the cryptocurrency market has remained highly correlated with the US stock index for a longer period of time year-to-date. As a result, any impact the world cup would have on the US stock market could also directly impact the crypto market, which is why studies about the world cup’s effect on the US stock market have been used to predict its effect on the crypto market.

Crypto experts may use this theory to form their investment and trading thesis around this period of time, which would exacerbate the effect even more. Thus, knowing this information could be useful to help one in his trading. So, how does the world cup affect the US stock market?

Studies Reveal Negative Impact on World Markets

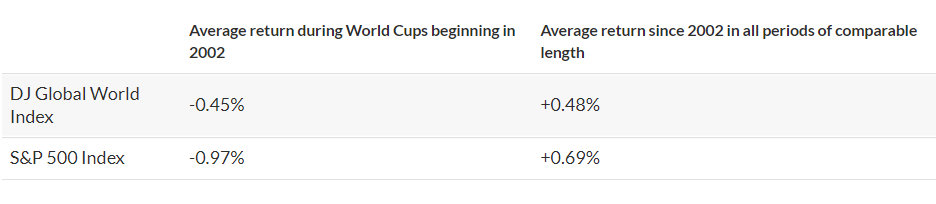

An academic study entitled “Sports Sentiment and Stock Returns” has been done to demonstrate how global risk markets tended to underperform during the World Cup, not only in terms of lower-than-average market volume, but also in terms of poorer returns. As the study was done in 2007 where the crypto market has not been in existence yet, the study focused on the US stock market. However, that result has been similarly applied to crypto as well by market pundits since the correlation between US stocks and crypto have been very strong since the COVID recovery.

The findings revealed that average stock market returns during the World Cup since 2002 to 2007 (over two world cups) confirmed the negative effect the World Cup had on US stocks.

In another study titled “Exploitable Predictable Irrationality: The FIFA World Cup Effect on the US Stock Market ”, two scholars, Guy Kaplanski and Haim Levy, argue that because the world cup’s negative effect on the markets is predictable, by recognizing and understanding this phenomenon, investors may exploit this effect by shorting the market just before a world cup begins in order to profit from the decline that is to come in the month ahead. This logic may explain the sharp pullback in soccer fan tokens ahead of the Euro 2021, or even the sharp decline in the crypto market early this month, which, however, was set off by the FTX scandal. With that said, it is puzzling as to why the FTX whistleblower had to pick the timing of early November to reveal FTX’s balance sheet, which was the initial spark that started all the unraveling of the FTX mess in the first place. There have been unverified rumors circulating that the whistleblower got the balance sheet way back in September.

Investors Behavior Makes The Phenomenon Self Fulfilling

With the explosion of social media, information or tip sharing can spread like wildfire very quickly and influence the decisions of many investors to act in the same way. As such, when one person starts recommending others to “go short” on the market at the start of the world cup, many others can pick up the message and act on it very quickly, causing the effect to compound. This will create a self-fulfilling situation where the moves of a large group of people actually cause the expected outcome to come true. We have seen the power of the masses last year during the GME short squeeze saga when a group of traders banded together to buy up the stock of beleaguered stock GME to the point that even a hedge fund had to file for bankruptcy due to hefty losses incurred as a result of shorting the stock. Thus, the power of the masses cannot be ignored. Books or recommendations like the above could be picked up by one person and spread to many others within a short amount of time.

Bitcoin’s 4-Year Market Cycle Coincides with 4-Year World Cup Cycle

A scientific way of explaining why the world cup will particularly affect the crypto markets in a negative way is to look at the Bitcoin halving cycle. As fate would have it, the bear market portion of the Bitcoin 4-year halving cycle just so happens to coincide with the once every four years world cup tournament. Due to the coincidence that both events happen once in four years and their schedules cannot be altered, the time that Bitcoin, and with it, the entire crypto market, is in a bear market will always correspond with a world cup year. This is simply a coincidence at the time of the inception of Bitcoin and has nothing to do with the world cup itself. However, if we include the psychological impact of traders making use of the phenomenon to short the markets, then the crypto market, with its 4-year cycle, could see a more intense negative reaction as compared with the stock market which does not follow a similar boom-bust cycle. As a result, the world cup could affect the crypto market even more negatively than it does the stock market.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.