Trading the crypto market can be challenging, especially during a bear market like the one we are currently facing, as becoming profitable becomes increasingly difficult to deal with as this requires a good understanding of technical analysis coupled with the right psychology to deal with the market price actions and volatility.

Becoming a successful trader goes more than just buying and selling crypto assets to make a profit; it involves building a successful strategy and having an edge to help you deal with crypto “winter” and stay ahead of the game as whales and institutions are always looking for a way to push you out of the market or trade.

It is said the crypto market provides so many opportunities, but you can only utilize this opportunity if you are prepared to spot this chance when it presents itself. The crypto industry can be technical and tough to deal with for beginners, and even advanced traders, which is why building a strategy that works is like an escape route.

Most traders employ strategies, patterns, indicators, oscillators, and technical analysis tools to stay profitable and ahead of the market.

In this guide, we will discuss one of the chart patterns traders and investors use to spot trend reversals and position themselves for high rewards as the market reverses in their favor.

We would discuss extensively how traders use the abandoned baby candlestick trading pattern with examples for you to increase your knowledge, make gains in the market and manage your risk accordingly.

What Is An Abandoned Baby Candlestick Pattern

The abandoned baby candlestick pattern is a trend reversal candlestick formation similar to the morning star for a bullish abandoned baby candlestick and the evening star similar to the bearish abandoned baby candlestick pattern. This Japanese candlestick pattern is a dependable trend reversal pattern that appears after a gap in piece movement to the upside or price movement to the downside. The baby is a Doji candlestick, with the other candlesticks being fully bodies, either uptrend or downtrend making it so easy to spot the formation.

A good understanding of how the morning and evening star patterns are formed will give you a better understanding of the formation of the abandoned baby candle, as these patterns look similar.

The morning star pattern is a technical analysis pattern used by traders and investors to spot trend reversal from bearish to bullish trend. It is formed by three candles, a full-bearish candle, a small candle in the middle, and a full-bodied bullish candle. At the same time, the evening star is in a bearish price reversal pattern from bullish to bearish. It is formed at the end of an upward trend indicating a possible price reversal as it is formed by three candles, a bullish candle, followed by a small candle, and finally, a bearish full-bodied candle to initiate the trend reversal.

Like the morning and evening star, the abandoned baby candle pattern is a three-bar trend reversal pattern with the three real bodies or shadows not overlapping. The formation of these patterns makes the abandoned baby pattern rare and unique, as this pattern does not occur as often compared to other pattern formations.

This candlestick represents a sudden change in price movement from bulls to bears or vice versa that catches the other side off guard. During rallies, forming an abandoned baby bottom can be quick because traders with open short positions will be forced to cover quickly. Additionally, when the abandoned baby pattern is formed at the top of an uptrend trend reversal, quick traders want to sell their positions to keep their profits.

What Does The Abandoned Baby Pattern Look Like

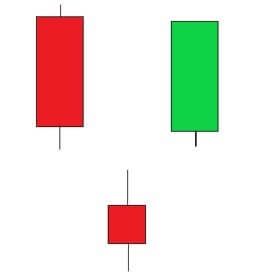

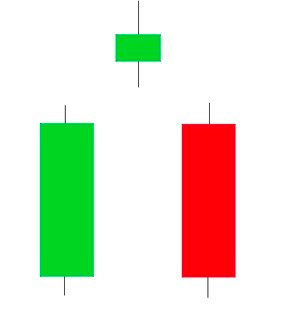

Trading in the crypto space is more practical, and getting to know these patterns and how they can be used rather than theoretically learning about them. Identifying these chart patterns, how they look, and their application helps the trader best use them when needed. There are two abandoned baby patterns, as discussed, the bullish and bearish abandoned baby candle. Three candlesticks form the area with gaps between the full-bodied candle and the middle candle, which can be a Doji candle. Below is s bullish abandoned baby candle formation indicating a potential trend reversal to the upside.

Bullish Abandoned Candle

The bullish abandoned candle is a bullish reversal pattern used by traders to identify potential trend reversal from bearish to bullish with the appearance of this pattern at the end of a downtrend. The bullish abandoned candle pattern consists of three candles; the first is a bearish candle followed by a gap, the second candle is a Doji type of candle while the last candle is a bullish candle gap the middle candle as the price closes to the upside, creating a more bullish scenario. How to identify this pattern in three simple steps

- The first candle is formed during a downtrend.

- The second candle is a doji that gaps down from the initial candle.

- The last candle is a bullish candle that gaps up.

Bearish Abandoned Candle

The bearish abandoned baby candle is a bearish reversal pattern used by traders to identify potential trend reversal from bullish to bearish with the appearance of this pattern at the end of an uptrend. The bearish abandoned baby candle pattern consists of three candles; the first is a bullish candle followed by a gap, the second candle is a Doji type of candle while the last candle is bearish, gaps the middle candle as the price closes to the downside creating a more bearish scenario. On identifying this pattern, a trader could look to open a short position as this strategy has been identified to work very well. How to identify this pattern in simple, clear terms.

- The first candlestick being a bullish candle, is in the direction of the major trend

- The second candlestick is a doji which gaps or creates an overlap with the first candle

- The third candlestick is a bearish candle in the opposite direction of the first candle and gaps the doji candle with price closing downward.

Why It Forms

By now, you are already aware that the bullish abandoned baby pattern appears in a downtrend, indicating a bullish reversal. Its appearance in a chart indicates a change in trend from a bearish trend to a bullish trend. So is the bearish abandoned baby candle, as this indicates a potential trend shift from bullish to bearish. Due to fundamental or psychological reasons of traders, these trends could indicate a potential shift.

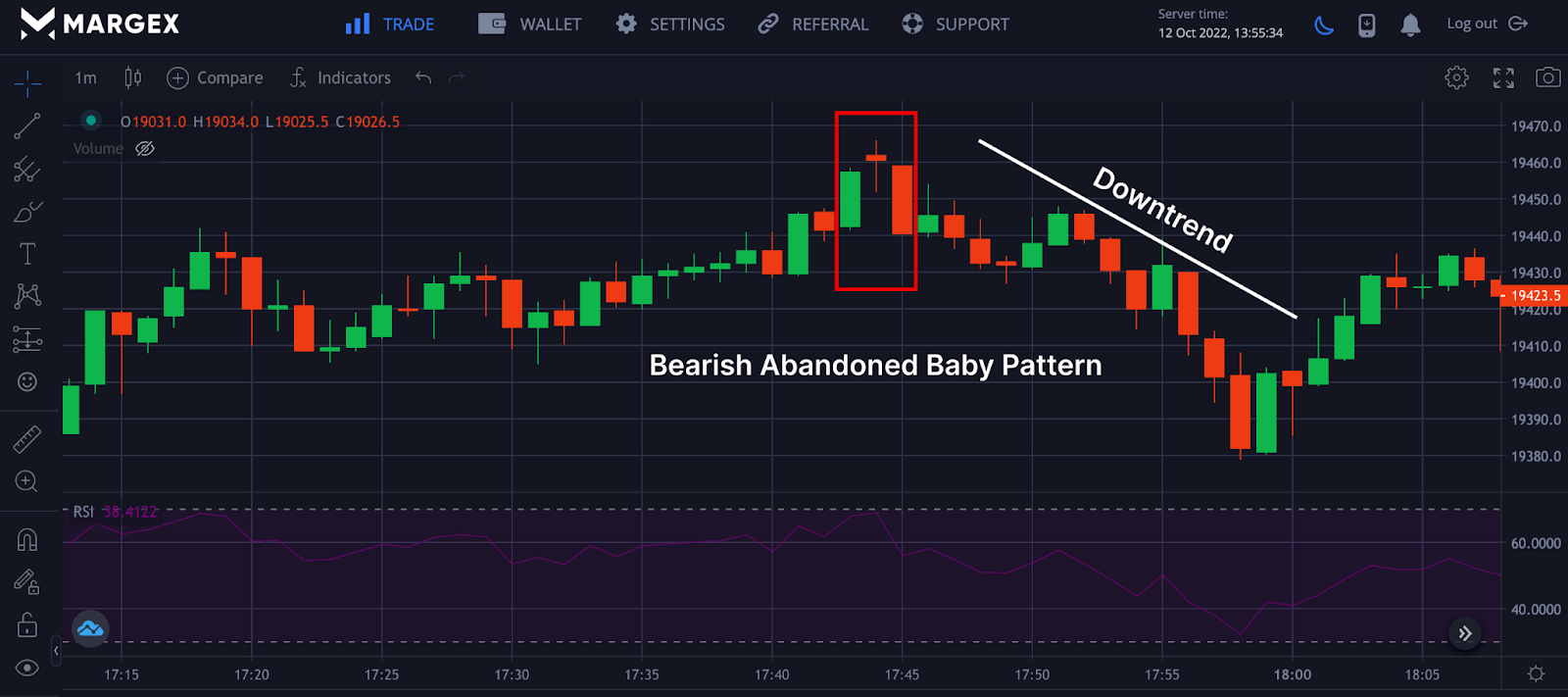

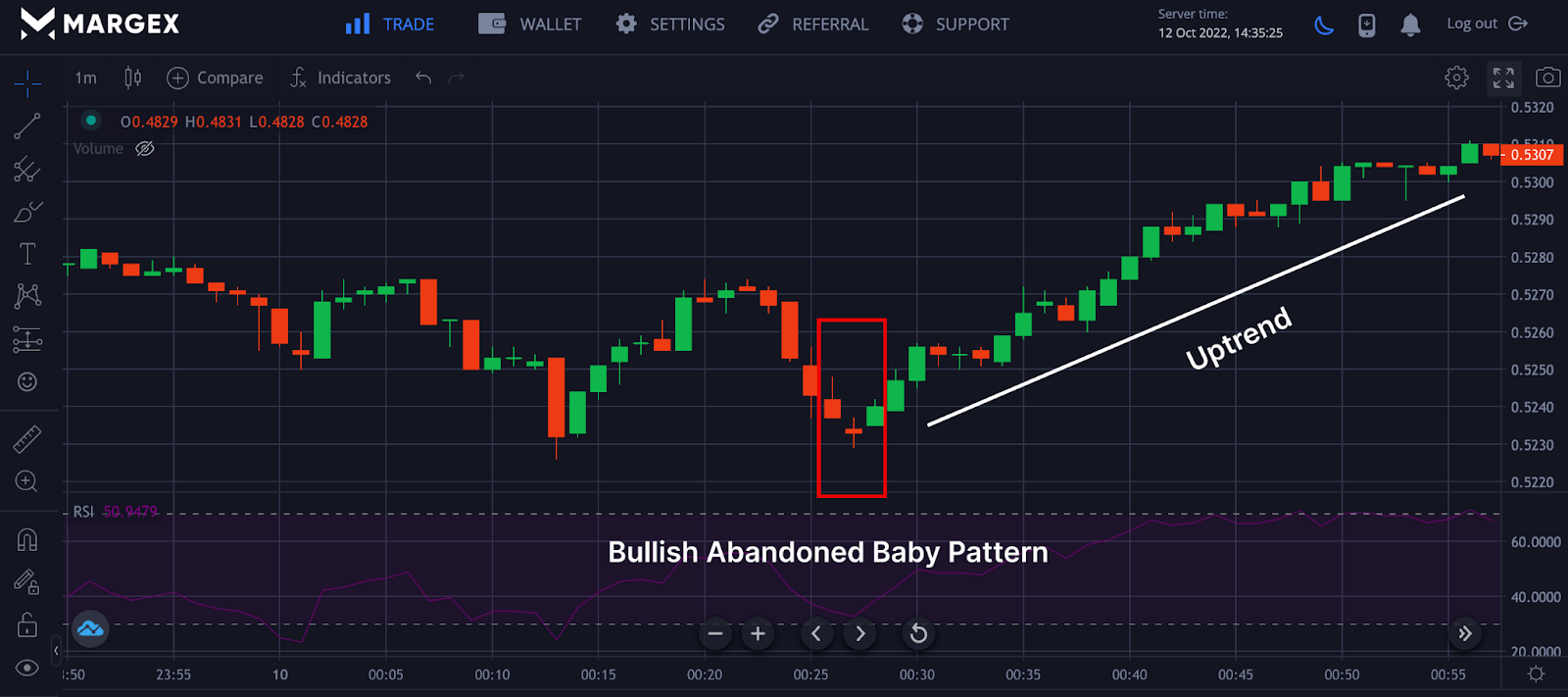

Chart Example

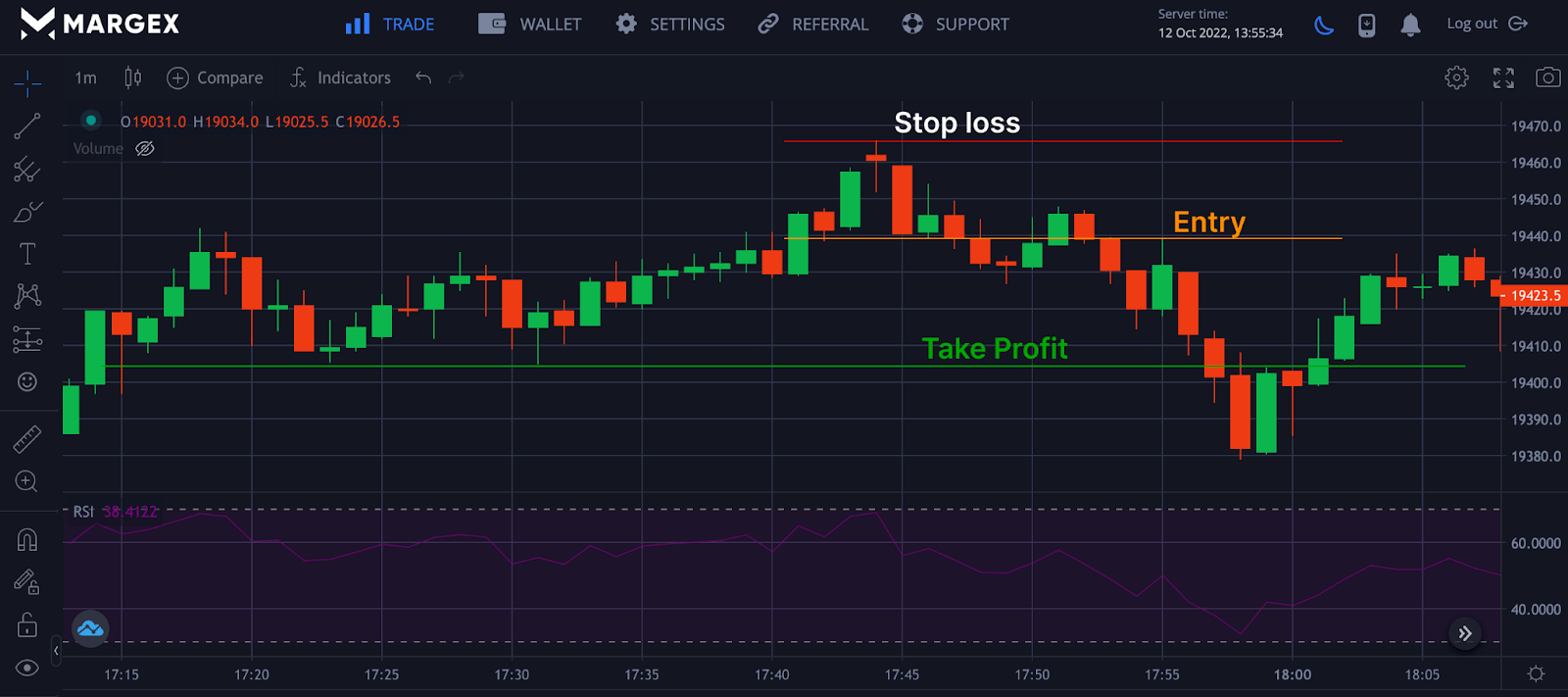

The chart above for BTCUSD shows a bearish abandoned baby pattern with a clear downtrend followed after the formation. After identifying this pattern with other criteria for taking this trade, a trader could look to open a short position with proper risk management.

The chart above for the XRPUSD pair shows a bullish abandoned baby pattern with a clear uptrend after the pattern appeared. After identifying this pattern with other criteria met for taking this trade, a trader could look to open a long position with proper risk management to avoid overexposing itself to the volatile nature of the crypto space.

How To Trade Crypto Using The Abandoned Baby Candlestick Pattern (With Screenshots From Margex Platform)

Margex is a bitcoin-based derivatives exchange that allows traders to trade with up to 100x leverage size while also staking their tradable crypto-asset, allowing you to earn up to 13% APY for your staking rewards. There are no lockup periods, and staking rewards are sent to your staking balances daily via the Margex automated system.

Margex has been designed to ensure the needs of its users come first, with high regard for the security of assets and usability of the platform, ensuring that the platform can be used by beginners learning to trade crypto assets and at the same time earning through its uniques staking feature.

The abandoned baby pattern can be rewarding for traders with good technical analysis; let us see how this can be used on the Margex platform.

As a new user, creating an account on Margex gives you access to the use of technical analysis tools and opportunities to interact with Margex features. All for free with no charges.

Trading The Abandoned Baby Candlestick Pattern

The abandoned baby pattern, although very successful when identified on the chart and tradable, it is very important to combine other trading indicators, chart patterns, and strategies for a better success rate as the use of the abandoned baby candle is not 100% certain and can be exploited during extreme price actions and volatile market.

Stop Loss Orders

From the chart above for the BTCUSD pair, on spotting the formation of the abandoned baby candlestick, a stop loss is set some distance from the middle candle of the Doji to avoid stop hunted and reduce risk. Trading with stop loss as a trader gives you a measure of controlling your funds and avoiding too many exposures to price actions aimed at kicking you out of the trade.

Profit Targets

The chart above helps you to set your take profit as a trader just the next support or before the support of the trading pair for a short entry position. On spotting the abandoned baby pattern, a trader could open a short position to trade the pair setting up stop loss, entry, and profit targets.

Frequently Asked Questions (FAQ) About The Abandoned Baby Candestick Pattern

The abandoned baby candle formation has a great success rate when you can identify it depending on the type of formation and where it appears. Here are the questions traders and beginner traders have asked as regards this pattern.

What Is An Abandoned Baby Candlestick Pattern?

The Abandoned baby candlestick pattern formation is a technical analysis tool used by traders to spot trend reversal from bullish to bearish and vice versa. This pattern comprises three Japanese candlesticks, the first and last candles being full-bodied. In contrast, the middle candle is a Doji with a gap separating the middle candle and the other bodied candles.

How To Identify The Abandoned Baby Candlestick Pattern?

The abandoned baby candlestick pattern is not common and can be a tough finding, but the strategy is highly successful when found. The are two types of abandoned baby patterns. We have the bullish abandoned baby candlestick formation indicating the end of a downtrend with trend reversal imminent. The bearish baby abandoned pattern appears at the end of an uptrend, indicating a potential price reversal to the downside.

What Does The Abandoned Baby Candlestick Pattern Tell Traders?

The abandoned baby pattern is a chart pattern that appears at the end of a bullish or bearish trend indicating a potential price reversal. Three candles form the pattern, with the middle candle being a Doji candle.