Bitcoin has undergone several ups and downs in value and price trends since its launch in 2009. But one thing hasn’t changed: its higher crypto market share shows unrelenting dominance in the cryptocurrency market.

So, what is Bitcoin dominance, and does it matter? Bitcoin dominance shows the ratio of its market capitalization compared to the sum of the capitalization of all other coins in the market.

Historically, Bitcoin has consistently held its top spot among cryptocurrencies despite market variances. It currently sits on the number one spot on CoinMarketCap and now has a market cap of $377,350,331,326.35.

This figure makes bitcoin the largest crypto project in the world. With such relevant statistics, it is easy to see why some traders use BTC dominance to pattern their trading. Traders believe that its dominance reflects the general crypto market trend.

Keep reading to learn more.

What Is Bitcoin Dominance In The Crypto Industry?

Bitcoin dominance measures the ratio of BTC market capitalization to other cryptocurrencies in the market. It is a deciding factor for investors’ trading strategies in the crypto market, allowing them to gauge the value of BTC at any point in time.

A bitcoin dominance index is a tool that enables investors to study various market conditions to compare the trend between bitcoin and altcoins. The basic principle behind bitcoin dominance is as follows:

If bitcoin’s dominance decreases, the value of the altcoin will increase, and vice versa.

BTC Dominance And Market Capitalization

Currently, the bitcoin market cap stands at $367,369,931,553.71, while its market dominance is 39.99%. There is an obvious relationship between its dominance and market cap. If the cap is high, dominance increases, and vice versa.

BTC Market cap shows its value at any point in time. To get the real value, multiply the total mined BTC coins by the price of 1 coin.

To gauge the level of bitcoin dominance, it has to be calculated relative to the total market capitalization of other cryptos in the space. To know the percentage of BTC dominance, sum the total cryptocurrency market cap of all others and use the figure to divide the bitcoin market cap.

Mathematically, this can be calculated using this formula:

BTC dominance = BTC market cap/ total cryptocurrency market cap.

So, the percentage of bitcoin’s dominance over other coins relies on its market cap.

Factors Affecting Bitcoin Dominance In The Cryptocurrency Market

Some factors influence the dominance of bitcoin in the market. These factors might vary over time, but they all impact the coin.

Changing trends and trading behavior

Bitcoin dominance was close to the 90% mark before the explosion of altcoins. The emergence of altcoins in the market reduced the unrivaled investor interest in bitcoin. Users paid attention to other coins with greater price swings and new functionalities.

Bitcoin emerged to tackle the way currency was transferred and handled. The altcoin season, however, and other crypto projects birthed new trends. These new projects find applications in art, De-Fi services, gaming, and more.

Non-Fungible Tokens (NFTs) in particular, helped to reduce the dominance of bitcoin since other coins supported this new feature.

Overall, market conditions and trend reversals are vital in determining trading strategies. Generally, investors see bitcoin as more stable than other coins in the market. But traders capitalize on the volatility of altcoins and their price swings for profit-making opportunities. Profits can be made with sudden price pump noted in some altcoin projects.

Although investment in altcoin is risky, even bitcoin has shown vulnerability in the general bearish trend of the market. This scenario has made many people adjust their trading strategies in the market.

Bull or bear market cycle

The rise of stablecoins recently has increased the pressure on BTC dominance. Since stablecoins are pegged to a fiat currency like the USDT, they maintain stability even in a bear market.

Stablecoins are special altcoins with one goal: stability. These coins protect investors’ capital during the bear flag cycle. All they need to do is convert their coins to stablecoins to keep their total value intact. By that, their profits will not suffer the effects of the market downtrend.

As these investors convert their crypto assets, for instance, from BTC to USDT, the former loses its dominance, given that its market cap will plummet.

However, traders prefer converting their crypto assets to volatile assets like Ethereum and BTC in a bull market scenario. So, they’ll move value from stablecoins to Bitcoin, pushing its capitalization and dominance higher.

This unsteady market trend is why many investors now adopt diversified portfolios.

Use of Stablecoins on-ramping

Stablecoins are better than fiat because they offer investors different types of cryptocurrencies. Most exchanges that support fiat-to-crypto services provide a limited number of cryptocurrencies on their platforms. These exchanges, known as gateways, prefer the popular cryptos and stablecoins.

But crypto-to-crypto exchanges make the process easier with a wider selection of coins that users can trade with stablecoins. Stablecoins now serve as the middleman for trading one crypto for another or fiat to crypto trades.

As many funds rely more on stablecoins than bitcoin, the total cryptocurrency market cap increases, diluting BTC’s market dominance.

The influx of new coins and crypto assets

New coins can emerge and quickly grow in adoption and popularity. Now, bitcoin has to compete with many cryptocurrencies as developers are developing innovative and faster protocols. This continuous influx harms BTC dominance at a time when many people adopt the coins.

However, some new coins dip after the initial hype at inception. When this happens, traders and investors dump the coins and move their liquidity to bitcoin or other tokens. In such a case, bitcoin will gain more dominance in the market.

Applying BTC dominance In Trading Decisions

Bitcoin dominance can help investors detect a potential profit opportunity using chart datum and studying the general crypto capitalization. The dominance chart of bitcoin will show possible trend reversals and bitcoin price fluctuations.

There are three applications of bitcoin dominance that traders apply to their charts.

- The Wyckoff Method

- Spotting altcoin season with BTC dominance

- Using BTC dominance with the current BTC price

The Wyckoff Method

These principles are designed for investors and traders in the traditional finance market to identify potential profit-making scenarios. There are three fundamental laws on which this method is hinged.

The law of Supply and Demand

This law holds that there will be a price increase as far as the demand is greater than the supply. Also, if the supply exceeds the demand, the price will fall.

In simple terms:

If demand > supply = rise in price

If demand < supply = drop in price

If demand = supply = the price remains constant or has little variance.

Whenever there are more buyers than sellers, they drive the price up, and a bullish trend will follow. If there are more sellers than buyers, a bearish trend begins and red candles will be more prominent.

The law of cause and effect

This law states that the differences recorded between supply and demand are not random. They come after periods of preparation and are a result of specific events. An accumulation period, which is the cause, will eventually lead to an uptrend, the effect. In contrast, a distribution period (cause) will lead to an eventual downtrend (effect).

Wycoff created a charting technique to estimate the potential effects and causes. These methods define trading sessions based on accumulation and distribution periods.

With this, traders can estimate the probability of a market trend being extended after a breakout from a trading range or consolidation zone.

The law of effort vs. results

The third law states that changes recorded in the price of an asset or cryptocurrencie result from an effort represented by the trading volume. The trend will likely continue when the price action is in sync with the volume.

However, if there is a variance between these two parameters, the trend might stop or have a possible reversal.

The Composite Man

This is an imaginary character in the market. Wycoff proposed that traders and investors should study the stock market with the view of the market being controlled by a single person.

This composite man is the umbrella figure representing the market makers contributing large amounts to the entire crypto market volume. These market makers include the whales and institutional investors.

The composite man concept controls four market cycles:

Accumulation

Here, the composite man accumulates assets before most investors can key in. A sideways trend usually characterizes it. The accumulation is gradual to prevent a sharp price change.

Uptrend

If the selling force has diminished in the market and the composite man holds enough shares, he drives the prices up. This trend will attract more investors and increase demand.

During an uptrend, more than one accumulation phase can be recorded. These smaller phases are called re-accumulation phases. If this trend continues, then demand will be higher than supply.

Distribution

Here this imaginary figure distributes his investments. Cashing in on profitable positions to market latecomers. It also displays a sideways trend to absorb much of the demand in the market.

Downtrend

Once the distribution is complete, a downtrend reversal begins. The composite man (the big players) is pushing down on the market. Supply will then exceed demand, creating a downtrend.

The downtrend can also have re-distribution phases in-between. Here there is also the likelihood of smaller traders falling into bull traps where buyers hope for a trend reversal that doesn’t happen.

After the bearish trend, another accumulation phase will be activated.

Wycoff’s five-step approach

Identify the trend

You must identify the type of trend, how far it will go, and how it relates to supply and demand.

Know the strength of the asset

You must determine the strength of the particular crypto asset relative to the market. Observe if it is moving in line with or away from the general trend.

Identify assets with sufficient cause.

Identify if the cause is strong enough to make the effect worth the risk, and if there are enough reasons to enter a trading position.

Time your entry right

Analyze the proper market data relative to the particular asset. Due to the volatile nature of the crypto market, this data might still not give you an accurate entry point.

How to trade with BTC dominance on Margex using Wycoff’s method

Margex allows you to use various tools to place your trade and maximize profitability. You can trade using the Wycoff method on Margex with these simple steps.

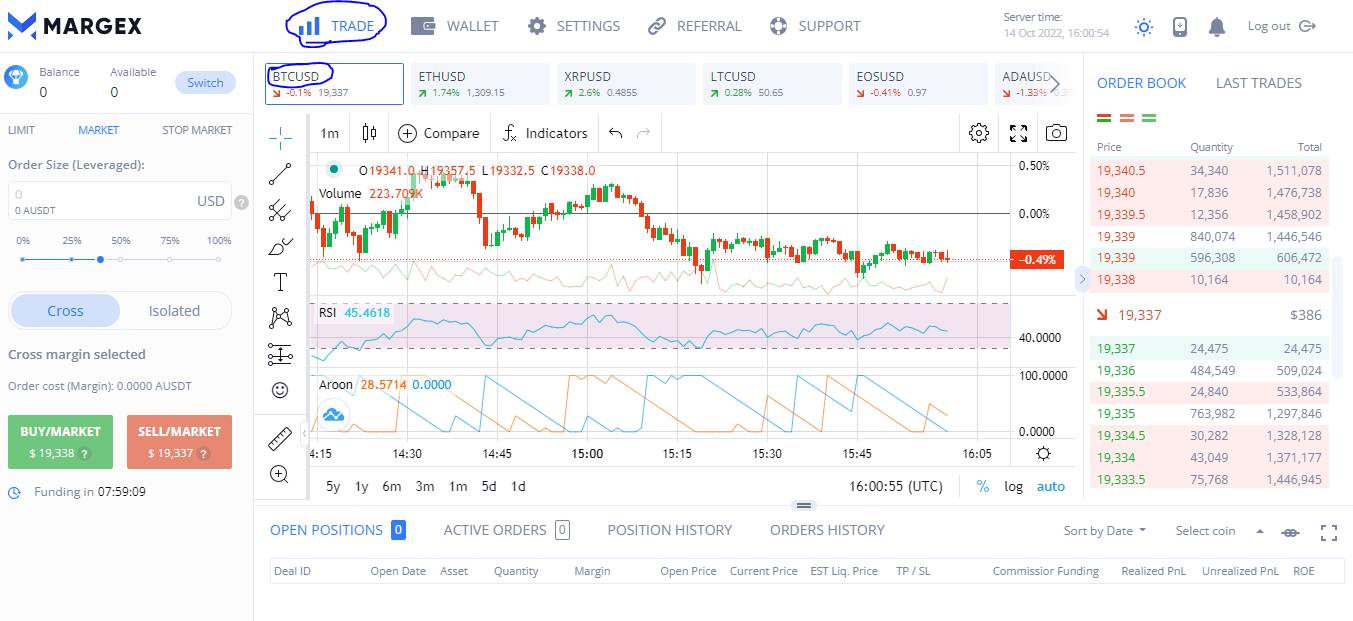

1. Log in to your trade account.

2. Click on Trade and select BTC/USD chart, since bitcoin is our asset of interest.

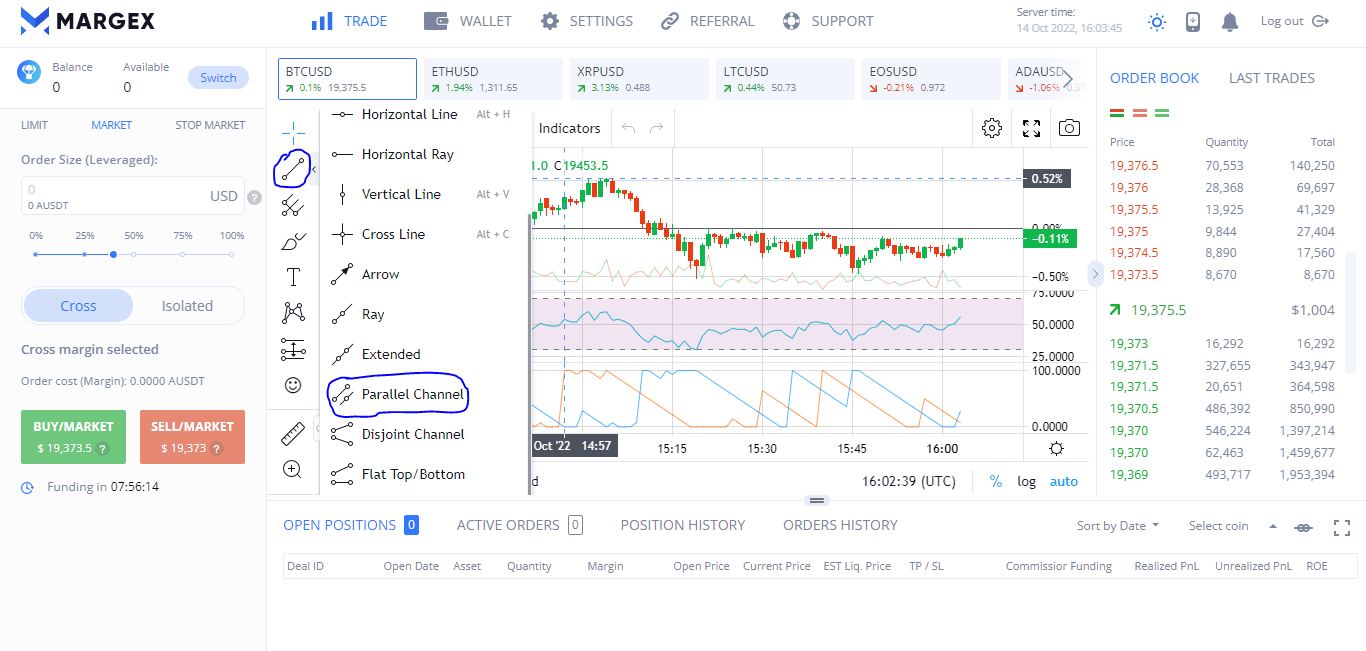

3. Next, go to your sidebar, click on trend line tools and select a parallel channel.

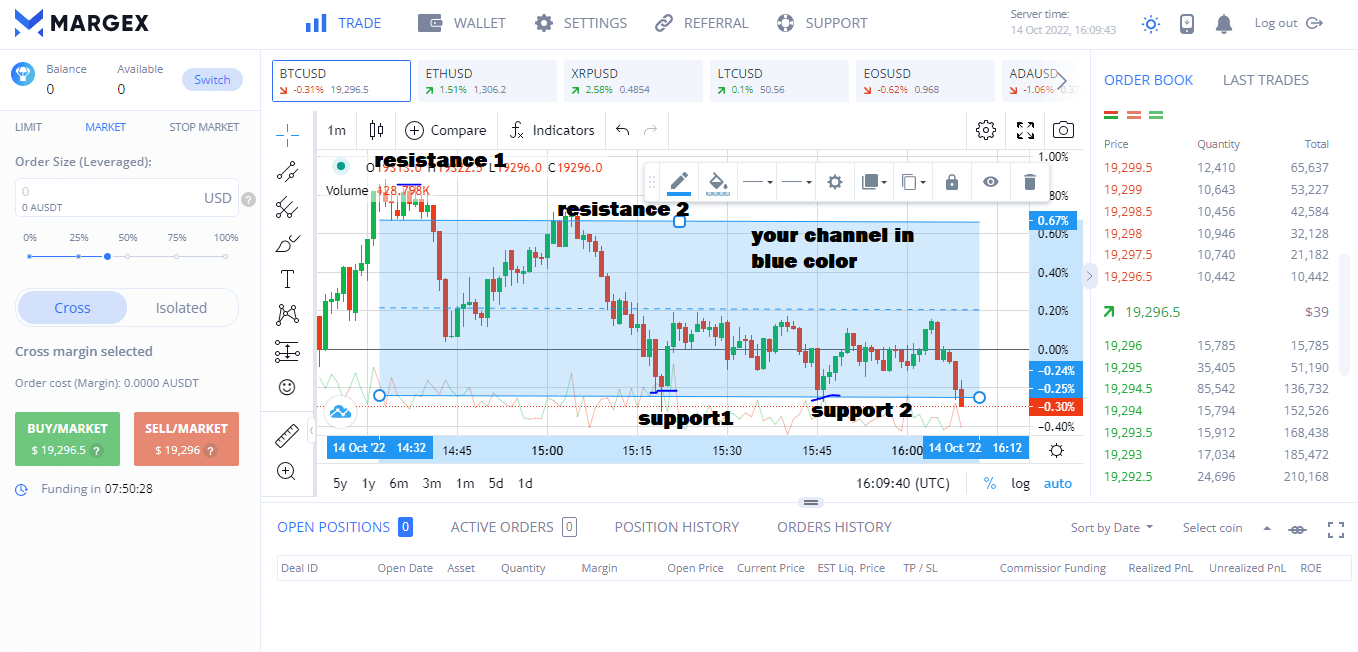

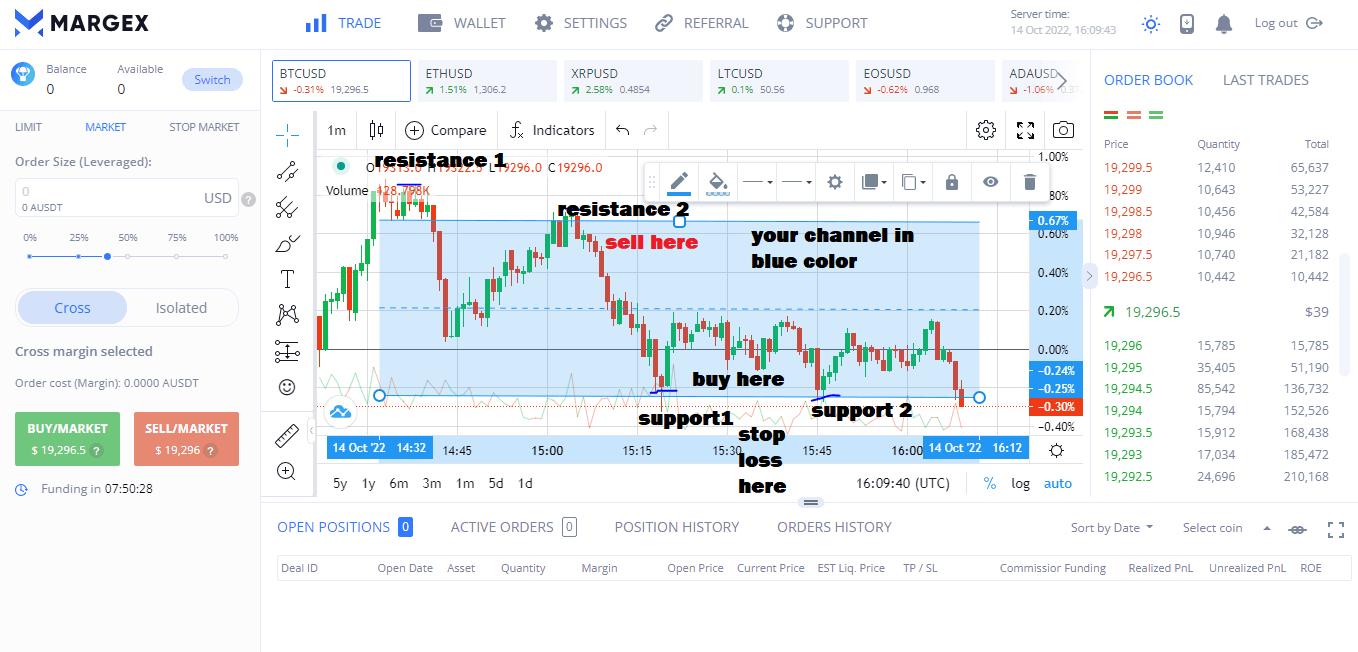

4. Draw your channel and mark resistance and support levels on your chart.

5. Place your buy close to the support level and set your stop loss just below the support.

For your sell, place it close to the resistance level and set your stop loss just above it.

Congratulations, you are successfully trading.

Applying BTC dominance to identify altcoin season

Bitcoin dominance is not so pronounced, with so many altcoins flooding the market. Periods when altcoins do better than bitcoin are called altcoin season or alt season. According to the Wycoff principles, such movements are cyclical and will eventually reverse. A crypto Investor that hold bitcoin and altcoin can monitor this season and adjust his trading strategy accordingly.

Using Bitcoin dominance with its current price

The current bitcoin price and its market dominance can be used to make trade decisions.

- When the price of BTC and its dominance increase, a bitcoin bull market might follow.

- If the price of BTC is increasing while its dominance is decreasing, a potential altcoin bull run might follow.

- If the BTC price is downtrend and its dominance grows, an alt coin bear market might follow.

- When Bitcoin’s dominance and price decline, the entire crypto market might be on the verge of a bearish trend.

These factors are not always 100% accurate. But historical data has shown more correlation.

FAQ-More Questions And Answers On BTC Dominance

If you’re still confused about the dominance ratio of BTC over other cryptos, find relevant answers below.

Why are stablecoins not covered in Bitcoin Dominance

Stablecoins and fiat currencies are similar because both are under the government’s control. Moreover, this set of digital assets primarily facilitates the relationship between cryptocurrencies and fiat currencies.

Aside from the above reason, stablecoins depend on the existence of fiat dollars. This fact excludes the tokens from Bitcoin Dominance because it only focuses on cryptos with the potential to be accepted globally by financial institutions and other businesses as money replacements.

Why do only proof-of-work coins matter in Bitcoin Dominance?

The major reason lies in the basic operation of the proof-of-work consensus system, which sustains a decentralized network. This is particularly significant for improving the present centralized banking system.

Why is the Real Bitcoin Dominance Index important?

The Real Bitcoin Dominance Index program makes tracking any POW-based cryptoasset easy. It focuses on those cryptocurrencies with the potential to become global exchange mediums.