Many beginners in the crypto world are confused about APR and APY and think they are the same thing. While APR and APY may sound similar, they will treat you quite differently. Hence, a crypto investor, especially one in DeFi, should know the difference and make the best out of each.

What is APY/APR in DeFi?

Crypto investors have definitely come across the terms APR and APY as they are the key concepts used to calculate interest in the crypto world. APR and APY are used for deriving the rate of return of staking rewards, yield farming rewards, crypto-earn accounts, as well as for the provision of funds to liquidity pools on exchanges, and more.

Thus, it is imperative for a DeFi user to know the difference between APR and APY to better allocate his funds efficiently to achieve the most profitable outcome. Most crypto users however, are still not sure what the difference is between the two.

We will uncover the difference to you now so you know how to pick the best rate that is most suitable for you.

What Is APR (Annual Percentage Rate)?

APR, or annual percentage rate, refers to the ordinary interest applied to the principal amount of an investment or loan. APR is similar to your simple interest or savings rate and is usually expressed as a fixed-term annual rate. If your investment or loan is held for less than a year, the interest applies on a pro-rata basis. If it is held for more than a year, it is multiplied by the number of periods.

What Is APY (Annual Percentage Yield)?

APY, or annual percentage yield, is much like APR, except that it takes into account the effect of compounding interest. This means that acquired interest rates contribute to the calculation of the next interest rate, which will inevitably generate a higher amount of interest than APR. This is similar to the concept of compound interest in traditional finance.

What is the difference between APR and APY?

The difference between APR and APY is the compounding effect. APY generates a higher percentage yield than APR since APY pays interest on the previous interest that has been earned, while APR does not. An investor would definitely want to invest in the highest-yielding platform wherever possible, which makes investing in APY yielding products more attractive than APR based products, vis-a-vis.

Example

Suppose you have $10,000 USDT and are planning to put it into DeFi. You have a choice between two DeFi platforms that will pay interest on a weekly basis.

Platform A gives you 10% APR on staking USDT for one year.

Platform B gives you 10% APY on staking USDT for one year.

How much would you earn after 1 year?

Platform A – At the end of the year, you will have a total of $11 000 USDT (initial investment sum of $10,000 + $1,000 in interest)

Platform B – At the end of the year, you will have a total of $11 050.65 USDT (initial investment sum of $10,000 + 1,050.65 in interest)

Platform B will be the obvious better choice since it gives you a higher yield.

Formula

Now that we have seen an example of the difference in yield between APR and APY, let us dive into the details on how to calculate them.

How to Calculate APR?

APR is normally quite straightforward in that it does not differ much from the given rate. However, in the event you still need to calculate for cases where there is more than one compounding period in a year, it is as follows:

APR = (interest rate per compounding period * number of periods in a year)

How to Calculate APY?

Unlike APR, APY takes into account the number of compounding periods, which is the number of times the investment amount is recalculated based on the quoted nominal interest rate. This is known as the effects of intra-year compounding. DeFi users need to especially take note as this subtle difference can have important implications for investing and borrowing money.

APY is calculated by adding 1+ the periodic rate as a decimal and multiplying it by the number of times equal to the number of periods that the rate is applied, then subtracting 1, as written below:

APY = (1 + Nominal Interest Rate/No. of compounding period per year)ˆNumber of periods – 1

Please pay special attention to the compounding periods when doing the calculation, you have to calculate the interest rate per period (e.g. week, or month), rather than using the standard yearly rate.

Exploring 0% APR

0% APR allows a crypto user to borrow at zero percent interest rates. There is a growing number of CEXs platforms that allow their users to borrow against their crypto holdings without paying interest, as long as their collateral has enough value.

This arrangement is very attractive for the crypto holder, while platforms are able to limit their risks by requiring more collateral than the borrowed amount, commonly known as over collateralization.

Examples of APR and APY in Crypto

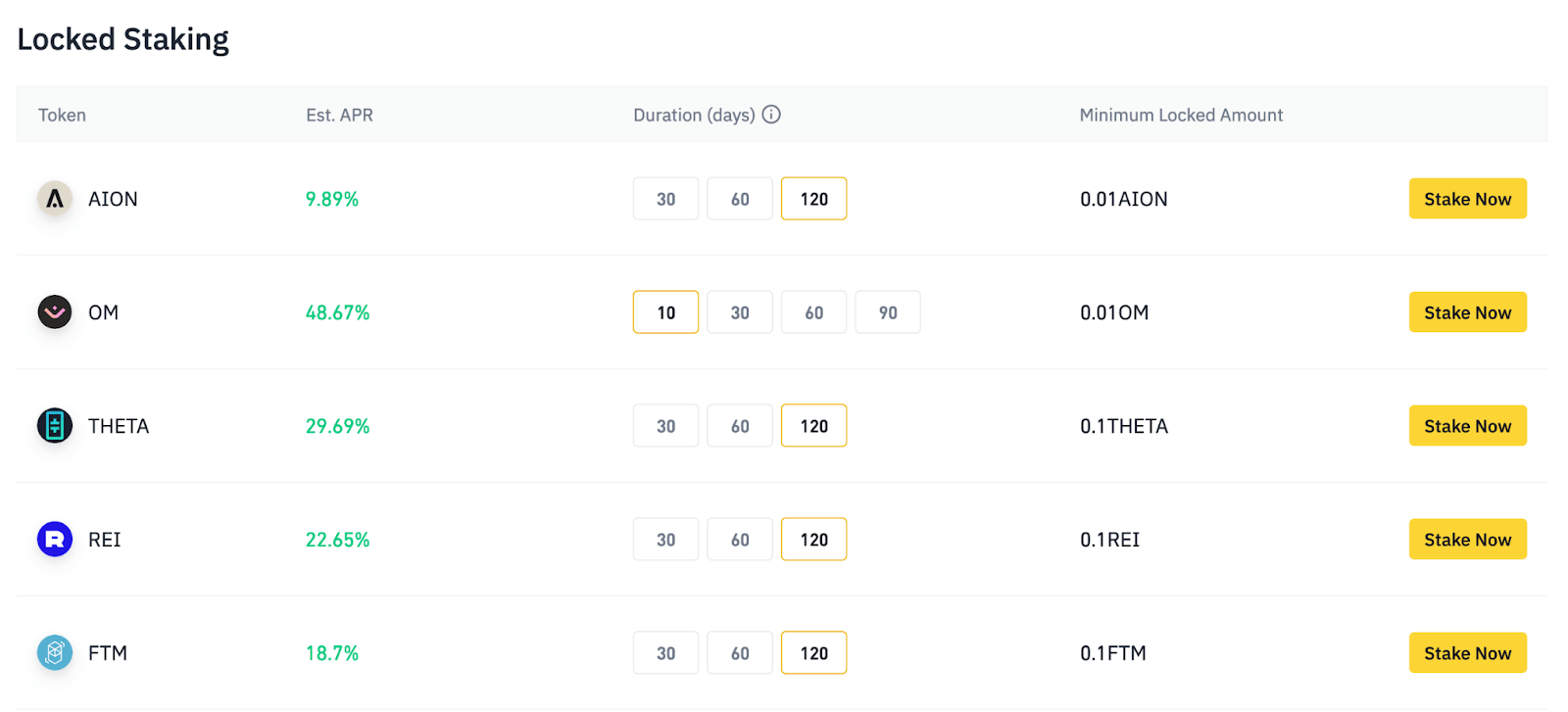

Binance is one platform that allows its users to stake a variety of tokens on their platform. As you can see in the diagram below, they present the estimated returns of staking there in APR rate, which means that what you receive is a simple daily reward which is not compounded.

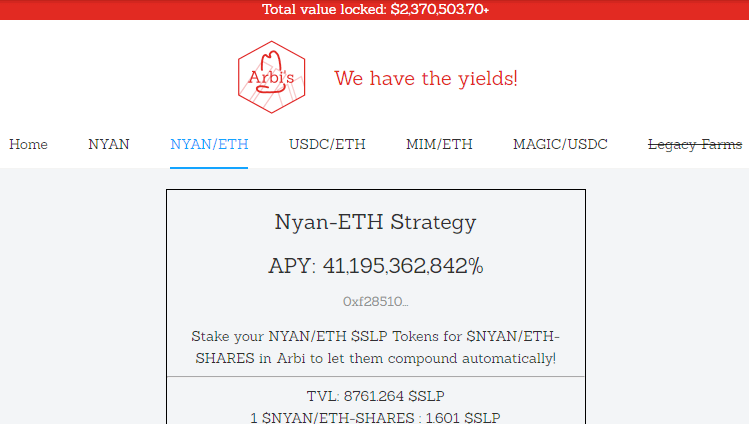

However, in the less well-travelled or should we say, more degen areas of crypto-land, you can find eye-popping APYs on altcoins, usually at the cost of significantly higher risk. For example, the diagram below is a screenshot from a yield farm on Arbitrum.

Notice the ridiculous APY of 41 million percent APY. Someone actually participated in this strategy during the peak of the bull market, doubled his staked amount in 36 hours, and got out before the yields crashed. We do not need a rocket scientist to know that such incredibly high yields are not sustainable and investors are cautioned to only participate after weighing all the risks associated. Never participate with money you cannot afford to lose and be quick to pull off your funds. While this example demonstrates that high yields can be earned in crypto, they are extremely high risk, and the market is awash with outright scams.

As the crypto industry matures, DeFi platforms, third-party sites as well as centralized crypto platforms are adding products with both APR and APY yields. One such example is Pancakeswap, which has both APR and APY based products for users to choose from. That said, yields being offered in APY are still currently quite hard to come by, and are mostly offered only to staking products that are locked up for a long period.

APY versus APR in Crypto: Which is Better?

Whether APR or APY suits you better depends on your objective. Most of the time, it depends on whether you are an investor or a borrower. An investor would definitely prefer APY, while a borrower would prefer APR.

If you are a borrower, you are paying off the debt balance as you go, whether you are paying off a personal loan or credit card debt. Hence, you will definitely prefer to be charged in APR, as there is no compounding effect to increase your accrued interest payment and cause a subsequent increase in the total final amount you would end up paying. If you were charged in APY, your total borrowed amount inclusive of interest would definitely increase more than if it were APR-based. This is true for crypto borrowing as with traditional finance.

If you are an investor or lender however, you will surely prefer using APY since the compounding effect will increase your total return more than if APR were used to calculate your interest.

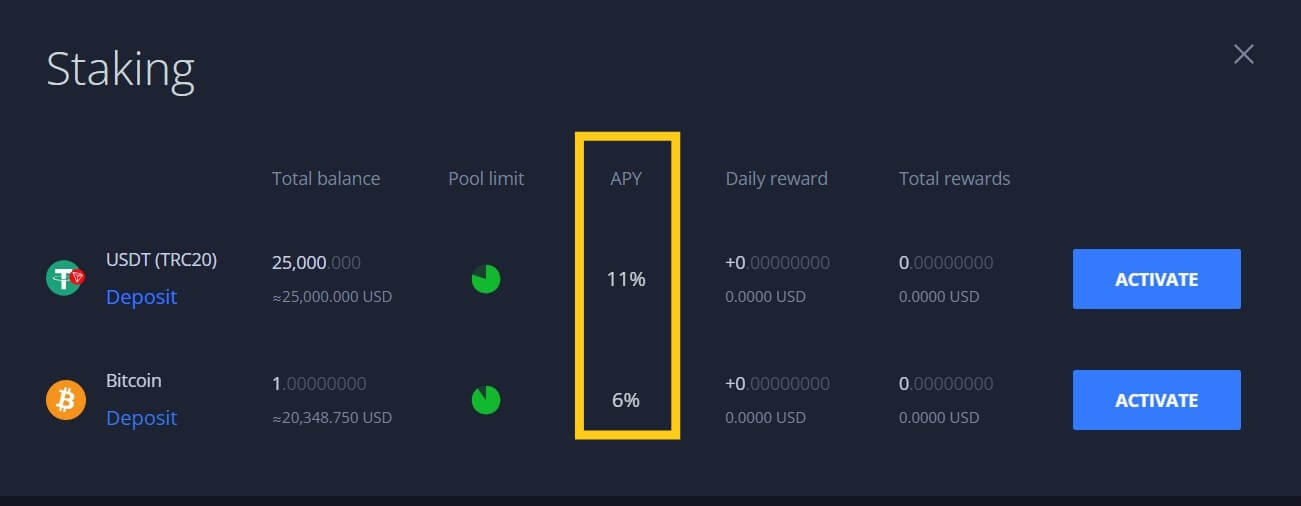

APY/APR for Crypto Investment on Margex

Margex is one of only a few platforms that offers its users an APY rate in calculating their staking returns so users get to receive compounded interest rates that will pay interest on their previously earned interest as well. One attractive feature is that Margex offers APY earning even on stablecoins, which is very rare in the industry. Furthermore, staking on Margex is on flexible terms, you are free to unstake anytime you wish, even when getting paid APY interest rates!

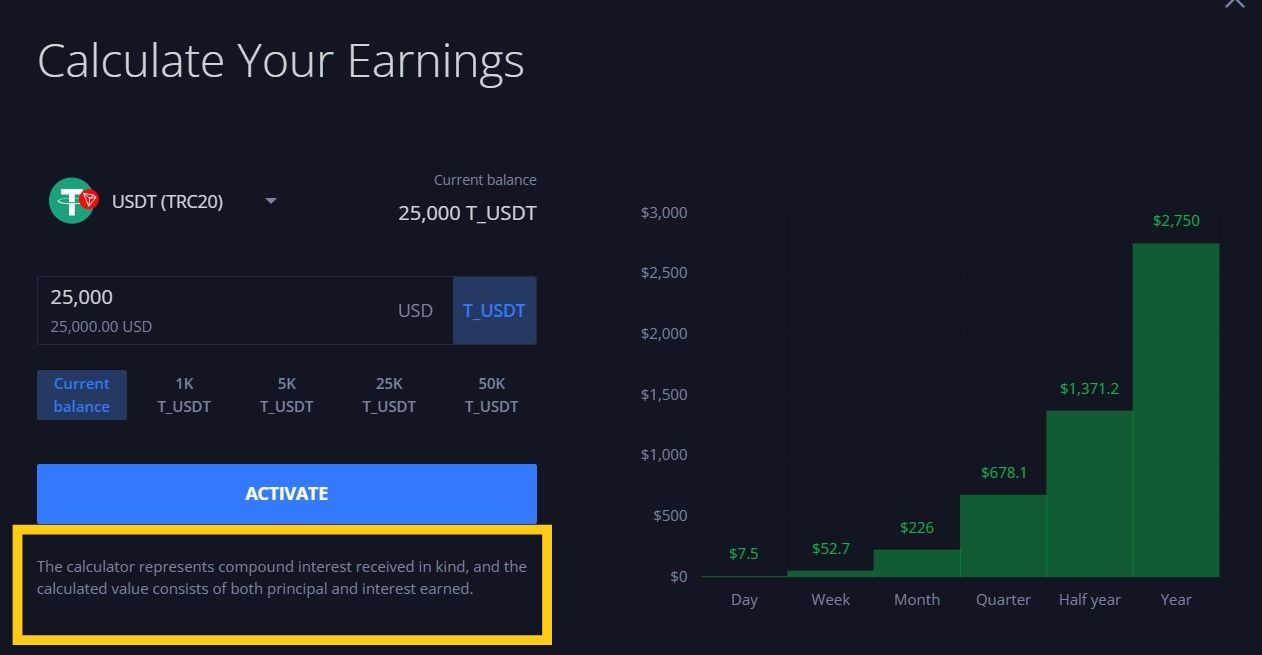

As can be seen in the diagram below, Margex also has a graph to help users visualise how much interest they will be earning through compounding so they need not have to do any recalculation themselves.

Not only that, Margex even allows its users to trade with their staked crypto assets, so that its users will be able to earn even more by being able to trade the crypto market’s volatility, even as they continue to earn compounded returns through staking!

Other Crypto Investment Factors Besides APR and APY

Even though APR and APY are important things an investor needs to take note of, there are other factors to consider in order to make the best out of a crypto investment opportunity. Let us look at some of these below.

Fees and Costs

Crypto investing comes with fees, some of which are inherent blockchain transfer fees like gas fees which cannot be avoided. Other fees like withdrawal fees or platform fees should also be taken into consideration when doing crypto investments.

An investor will need to always remember to add these fees into account when calculating your overall final returns, as an opportunity with a high APR or APY, but an unfavorable fee structure, may eventually eat into your returns and give you much worse yields than you initially expected. Hence, users of crypto yield farming, especially those on DeFi, should consider the fees involved before “apeing” into any protocol just because the quoted interest rate is very high in order to not fall into the fee trap.

Variable vs Fixed APR and APY Rates

A crypto investor should always figure out whether an advertised APR or APY is variable or fixed. Typically, fixed rate opportunities apply the published interest rate for the entire duration of the investment, while variable rates are subject to fluctuations depending on market conditions. Due to the volatile nature of crypto prices, the fluctuations in crypto rates of interest can also be more extreme when compared with traditional investments.

APY versus APR FAQ

Now that we have had the low-down on APR versus APY as well as learnt which is more favourable under different circumstances, let us do some revision exercises.

Is APR or APY Better for Crypto?

Whether APR or APY is better depends on your objective rather than the asset class. If you are a borrower, it does not matter whether it is crypto or any other credit product, you will prefer to be charged APR rate. If you are an investor or are lending out your funds, you will prefer to earn an APY rate.

What is APR and APY in Crypto Staking?

APR and APY are rates used to represent costs and rewards in crypto staking.

What Does APR Mean for Crypto?

APR in the crypto world simply means a rate of interest that is not compounded. i.e. the return is as published and can be multiplied by the number of investment periods. It gives crypto users a figure that can be easily compared amongst different staking platforms.

How Does APR Work in Crypto Staking?

APR is similar to simple interest in traditional finance. It is the rate of return you get, multiplied by the number of staking periods you lock up your crypto asset for.

Using another example, assume you invest 1.0 Ether in a lending protocol on a DeFi platform and the interest rate in APR is 24%.

If you lock your funds in the protocol for exactly one year, your total investment will grow to 1.24 Ether, which is your principal amount of 1.0 Ether and another 0.24 Ether as accrued interest.

If you lock your funds in the protocol for a half-year, your total investment will grow to 1.12 Ether, which is your principal amount of 1.0 Ether and another 0.12 Ether as accrued interest (24% * 0.5 due to half of the investment period)

If you lock your funds in the protocol for exactly two years, your total investment will grow to 1.48 Ether, which is your principal amount of 1.0 Ether and another 0.48 Ether as accrued interest (24% * 2 due to two investment periods)

What is a Good APY in Crypto?

It is difficult to establish objectively what is a good APY in crypto as there are other factors like fees, costs, and variability of the interest payout to consider. While some platforms could offer higher-than-average yields, the associated hidden fees involved may make the overall returns less attractive. Furthermore, there is the element of risk that an investor will need to consider before deciding if an advertised APY is attractive. Kindly refer to our article above for more information on the factors that could affect your yields in crypto.