In September 2020, Cornell Researcher Emin Gün Sirer conceived a platform based on blockchain algorithms to handle the challenges of enhanced transaction speed, decentralization, and security. With this kind of solid blockchain technology, the Avalanche network will operate as a significant power booster, becoming groundbreaking in the realm of payments.

Avax will deliver a fundamental financial revolution as a catalyst for enabling rapid-fire transactions in the global payment ecosystem. With quicker speeds, better throughput orders, and cheaper costs, the Avalanche ecosystem is entirely interoperable with Ethereum assets, applications, and tools. It is a platform enabling blockchain developers to establish Defi apps, assets, average trading, and other services.

It enables anybody to create, sell, forecast and control an investment decision or any crypto asset in a decentralized way utilizing smart contracts and other modern technology. The governance structure distinguishes Avalanche blockchain from different blockchain networks. As the system matures, Avalanche price prediction and staking incentives are subject to dynamic adjustments.

What Is Avalanche Tiker?

Each cryptocurrency has a unique ‘ticker’ or shortened symbol that is used to identify it while trading on an exchange or watching a trading chart. Bitcoin is denoted by the symbol ‘BTC,’ Ethereum by the character ‘ETH,’ Litecoin by the symbol ‘LTC,’ and so on. The ticker for the Avalanche token is ‘AVAX’.

A brief history of avalanche

Avalanche or AVAX blockchain began in 2019 when the platform was founded. Dr. Emin Gun Sirer, the creator of AVAX, claimed he has achieved the best possible “time to finality”.

It is important to remember that the “time to finality” refers to the time necessary to complete a crypto transaction and verify it as irreversible and permanent. When a crypto transaction reaches finality, it becomes “final,” and it is almost difficult to change or roll back the transaction. As a result, it is possible to infer that finality is a desirable blockchain feature, especially for financial applications.

However, the “time to finality” for all blockchain networks is not necessarily the same. Ethereum, for example, may reach finality in under one minute. On the other hand, Avalanche can obtain finality theoretically within one second, allowing for almost immediate transactions.

Today, the live AVAX mainnet includes a varied, growing community supported by a $230 million ecosystem fund. The AVAX blockchain is the frontrunner for near-instant finality. However, it is vital to consider how it does the same thing. You may discover solutions to your questions by thinking about how it works.

What protocol does Avax use?

The architecture of Avalanche incorporates sub-networks or subnets. They are comparable to Ethereum 2.0’s sharding. Subnets may be thought of as a clone of a standard blockchain. A subnet is a collection of validators that collaborate to establish consensus.

Validators in a subnet may be needed to have the following characteristics:

- Clear KYC/AML checks

- Possess a certain license

The network’s design also allows for private subnets that specified validators can only join. As a result, the blockchain’s contents will be available only to these validators. Secret subnets are useful for businesses that wish to keep their data private.

Users may establish subnets as needed and to their requirements. As previously stated, a subnet might launch another subnet if its scaling restrictions were temporarily exceeded to meet network needs while effectively boosting the number of transactions.

The limitless range for subnet construction on Avalanche demonstrates how it can overcome the scalability difficulties that plague traditional blockchains. All subnets must be validators for both the Primary Network chain and their own blockchain. Each subnet must be a Primary Network member (2,000 AVAX) for the Primary Network to be validated.

Avalanche’s architecture works as follows: the main network verifies the built-in blockchains on Avalanche. The P-Chain organizes validators, establishes subnets, and employs the Snowman Consensus Protocol, which allows the network to execute self-executing smart contracts.

The X-Chain protocol produces assets, swaps assets, and employs the Avalanche consensus system. The C-Chain uses the Snowman consensus system, which executes executive EVM contracts.

What distinguishes Avax from other cryptocurrencies

Avalanche is a blockchain platform that uses a novel Proof of Stake (PoS) technique to solve the blockchain trilemma of scalability, security, and decentralization.

Avalanche, like Ethereum, offers smart contracts for running decentralized apps (dApps) on its network. Because Avalanche’s smart contracts are written in the Solidity language, also used by Ethereum, it hopes to improve blockchain interoperability by integrating a variety of decentralized finance (Defi) ecosystems, including notable projects like Aave and Curve.

AVAX, the Avalanche platform’s native token, is utilized to power transactions inside its ecosystem. AVAX distributes system incentives, engages in governance, and enables network transactions by paying fees.

Factors Influencing The Price Of Avalanche (AVAX)

Several inherent and extrinsic elements that crypto experts feel will have the most impact on Avalanche’s price movement and direction over the next ten years. In this tutorial, we will look at the three most influential and the influence each will have on the price of AVAX.

They are as follows:

In-Network Developments

Avalanche is still a work in progress, and engineers at Ava Labs are already working hard to complete the Avalanche plan. Furthermore, as Avalanche attempts to discover its competitive edge and cement its supremacy over the other Ethereum killers, we anticipate it to roll out further network improvements, particularly NFT and Defi-focused updates. These will increase its popularity and may pique investor interest, increasing demand, and price for AVAX tokens.

Strategic Partnerships

Avalanche has already worked with renowned businesses such as Insure Token, Deloitte, and Penguin Finance a little over a year after its start. As more on- and off-chain companies recognize Avalanche’s low-cost, ultra-fast, and highly secure network, we can expect to engage in additional strategic collaborations. As is customary in the cryptocurrency market, this will increase the demand for and price of AVAX tokens.

Crypto Market Performance

Avalanche’s price behavior is excessively reliant on the general success of the cryptocurrency market. The price of AVAX rises when the market is doing well and falls when the market collapses. For example, Avalanche soared to $50 during the early 2021 crypto market rise, then lost more than 70% of its value when the market fell in mid-May and finally rebounded to its current all-time high after the crypto markets mini-rally in the fourth quarter of the year.

Moving ahead, AVAX’s price behavior is anticipated to be influenced by the general performance of the crypto market.

Avax Price Performance In The Past

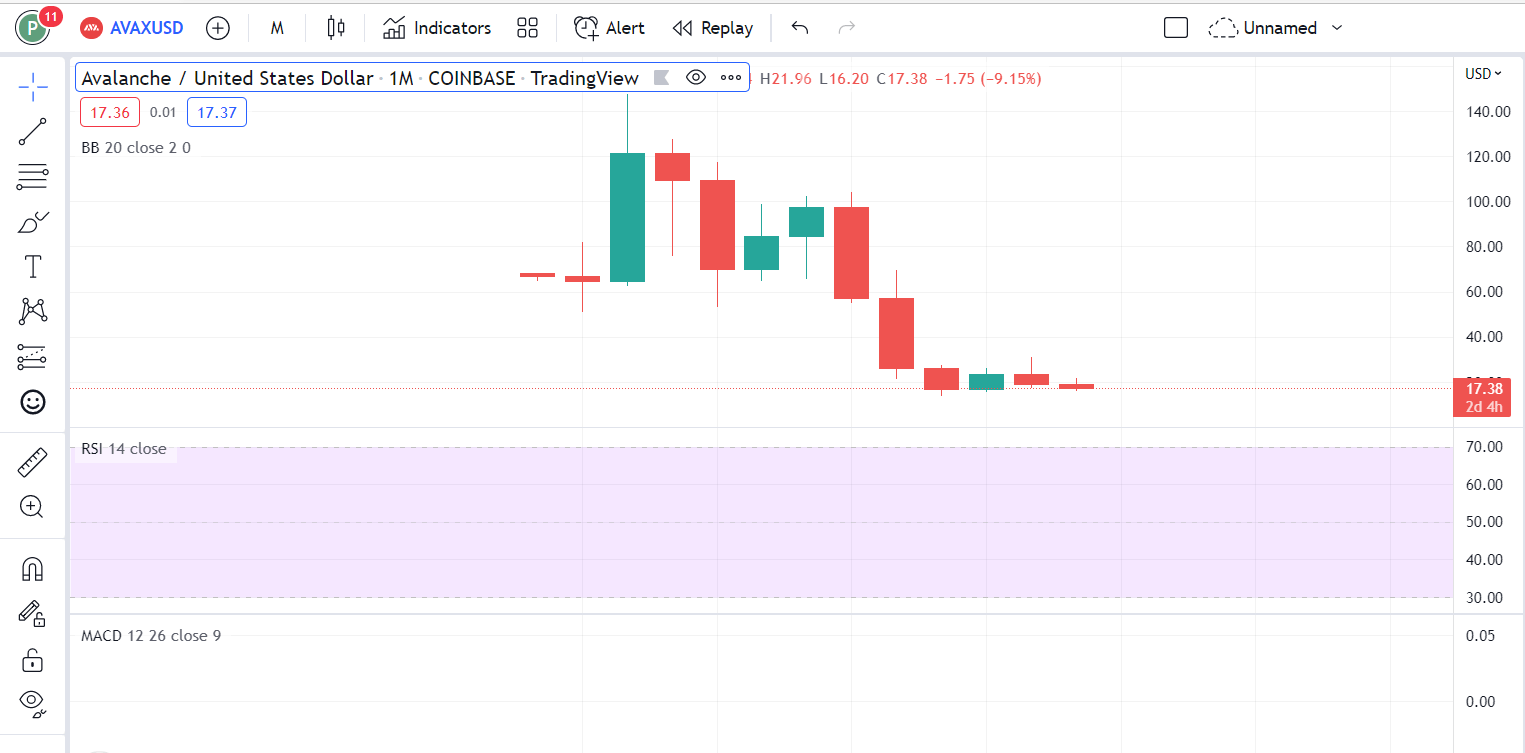

According to the monthly Avalanche chart, the cryptocurrency displayed negative signs at the start of the year. It was moving in a downward channel, but it was still in the trading range’s bottom zone. As trading volumes fell throughout the slump, AVAX dropped even more as the token made new lower lows and lower highs.

The AVAX price fell by 12% between December 2021 and January 2022, indicating that the currency is now in a slump. The coin price has been driven to its closest support since last week, and it seems it may move over $70.

Due to the collapse of many projects in 2022 and the domino effect of the FTX saga, this resulted in most crypto projects going to their very low as AVAX traded at a low of $10, but the price bounced off in the relief of January 2023 to a high of $22 making close to a 100% price recovery.

As seen in the monthly chart above, the coin has literally been on a free fall since March 2022, and has dipped from the $98 that it tested in March.

How Is Avax Doing Now?

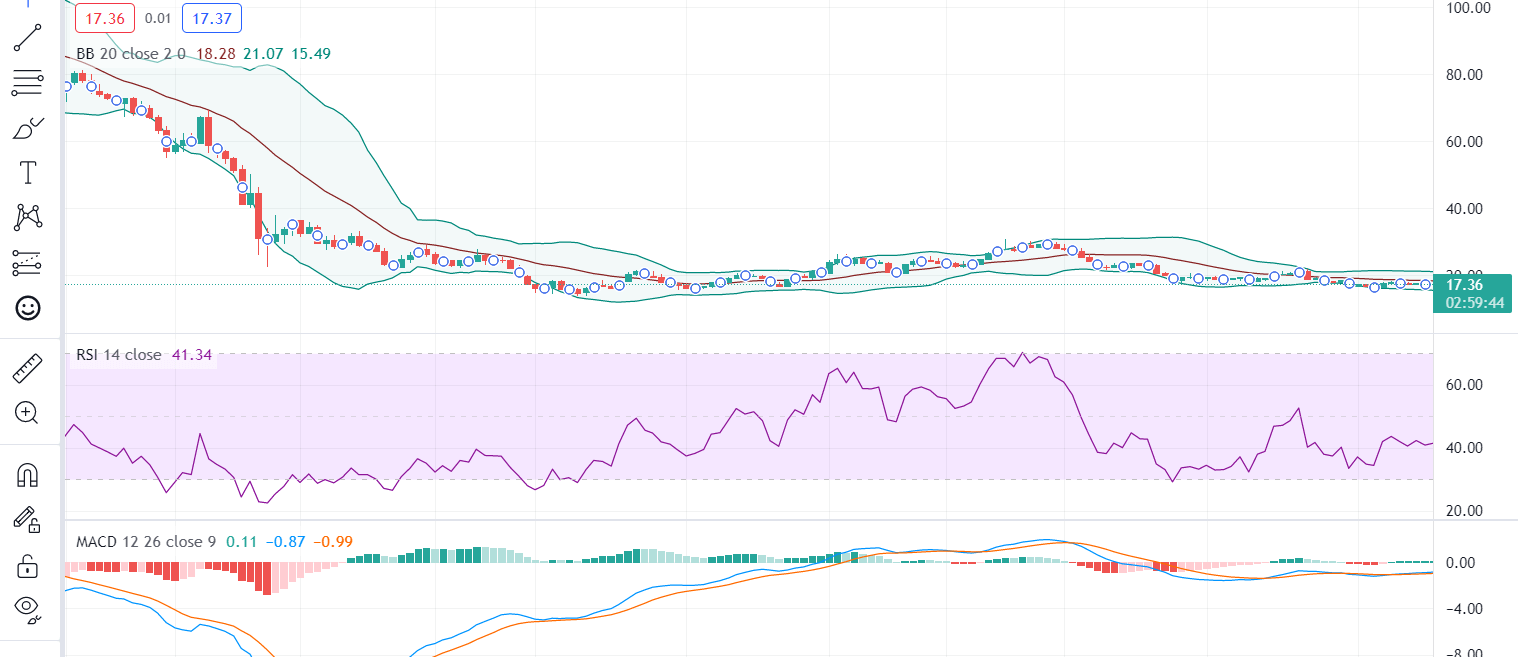

The critical resistance levels to look out for are $21, $29, and $37. A negative trend might lead the AVAX to $17, and a bearish breakthrough at the stated support level would expose the currency to the $10 and $6 support levels.

The bears have taken possession of Avalanche. The currency is developing a bullish double bottom chart pattern, and the price has yet to accept the order. On August 14, the Avalanche market began a negative trend, evident when the bullish candle did not break over the $29 barrier level. More bearish candles have appeared, and the price has fallen near the $17 support level. At the moment, the price is between $21 and $17.

Sellers dominate the market on the daily chart. The price movement is attempting to breach the $17 support level. The critical resistance levels to look out for are $21, $29, and $37. A negative trend might lead the price to $17, and a bearish breakthrough at the stated support level would expose the currency to the $10 and $6 support levels. The Relative Strength Index (14) is approaching the 40 levels, signaling more decline.

Celsius Network, a prominent US cryptocurrency loan firm, initiated the massive drop in June 2022 when it suspended withdrawals and transfers, claiming “extreme” circumstances. The move fueled a dip in the value of cryptocurrencies like the Avalanche, which fell below $1 trillion for the first time since January of last year.

Global stocks have declined as a consequence of:

- The war in Ukraine/Russia

- Concerns about inflation

- Higher interest rates will make borrowing money for companies more costly.

This has spread to the cryptocurrency industry and consequently impacted the price movement of AVAX.

Avax Crypto Price Prediction Today

In recent years, cryptocurrencies like Avalanche have gained a solid footing in the global financial sector and are now traded on par with conventional assets such as equities, commodities, and foreign currencies (Forex).

Some institutional investors even see cryptocurrency as an effective hedge against rising inflation and global economic instability. Retail investors and traders are interested in cryptocurrencies like AVAX because it is perhaps the most accessible financial market, with several assets capable of 100X to 1000X increases quickly. These returns are unreachable in other markets, which is why most cautious investors carefully complement their current portfolios with cryptocurrencies like Avalanche, while forward-thinking investors allocate a considerable percentage of their cash to this fast emerging asset class.

This is certainly a reasonable strategy given that the global economy is in perpetual crises and conventional markets are bowing to the whim of the powerful. Traditional repositories of wealth, such as fiat currencies like USD or precious metals like gold, can no longer be depended on, hence an increasing number of individuals are turning to cryptocurrencies in general, and AVAX in particular.

At the time of writing, AVAX is trading at about 17.16 with an intraday high and low of 17.37 and 16.73, respectively. Avax did break down from the significant support at 17.42, and we had this huge sell-off towards the downside. If you look at the past price section that we have available, the level at about 18.37 was the previous resistance that AVAX was experiencing from the 7th of August to the 31st of August.

Avax Prediction For February, 2023

The price of AVAX in February 2023 has been predicted by cryptocurrency specialists. During this month, the minimum trading cost might be $18.58814, while the highest could be $20.21798. On average, the value of Avalanche is predicted to be about $19.48805.

Avax Short-Term Price Prediction For 2022

According to crypto analysts, it was tipped that increased interest in Defi will propel Avalanche ecosystem activity to new highs in 2022. According to Avalanche’s price estimate, the short-term price prediction was tipped to cross the $30 mark in 2022 and reach an average price of $35 by the end of the year. Furthermore, our Avalanche forecast for 2022 suggests that AVAX will hit a high of $50 and a low of $25.

Avax Long-Term Price Prediction For 2023

By 2023, Avalanche will have piqued the interest of many notable blockchain projects, many of which may elect to transfer to the Avalanche Network. Following previous gains’ footsteps, the 2023 Avalanche price forecast predicts that AVAX will begin the year at $20 and reach $35 by mid-year. The coin forecasts a maximum price of $40 and a minimum price of $20 in 2023.

Avax Long-Term Price Prediction For 2023-2030

Avax Long-Term Price Prediction By Experts

So in this piece, we will look at some of the experts’ trading price predictions for AVAX by 2025 (note that none of those predictions are guaranteed).

Avax Price Prediction By Margex

Margex is a web-based derivatives exchange that facilitates the buying and selling of cryptocurrencies. Margex is a cryptocurrency exchange founded in 2020 and headquartered in Seychelles.

According to Margex, the price of Avalanche in April 2025 is predicted to be between $43.92 and $51.39. The predicted average price of AVAX is $47.15.

FAQ

Is Avalanche a good investment?

Yes, the Avalanche network allows AVAX currency hodlers to earn from their investment in methods other than speculating. As a consequence, AVAX should be valuable independent of its price movement in the future.

What is an Avalanche coin?

As previously stated, AVAX is the native currency of the Avalanche crypto blockchain network. It acts as a payment token for chain transaction fees. Avalanche’s many blockchains and the Avalanche consensus method have performed well. Transaction costs are cheap, and Avalanche claims its transaction time-to-finality is quicker than any other blockchain.

So far, Avalanche has grown at a rapid pace. It had more than $11 billion in total value locked (TVL) on its platform by the end of 2021, a 227% increase from the start of the year. As of April 2022, it was also rated fourth in TVL.

What will Avalanche be worth in 2030?

Any Avalanche crypto price projection so far out is sure to be inaccurate.

What distinguishes Avalanche?

DeFi applications are specific to Avalanche and help to speed up the transaction process. These are separated from the information saved on the block, allowing for speedy transactions. Price momentum is aided by features such as the atomic Avalanche wallet and security criteria.

Why is the Avalanche price rising?

AVAX is a distinctive attraction for purchasers of financial assets all around the globe due to its transaction speed. The platform has received much attention in the media, which has increased Avalanche pricing and market value even after the crypto market crisis.

How can I buy AVAX?

Before purchasing Avalanche cryptocurrency or any other altcoin, you must register an account with a cryptocurrency exchange such as Margex. On their platforms, cryptocurrency exchanges facilitate transactions, making purchasing and selling tokens simple.