The financial market, such as cryptocurrency, stocks, forex, and others, gives most traders and investors a difficult time making a living. However, it is no secret that this market provides endless opportunities with the right skills, psychology, and an edge to remain profitable.

Many traders who seek to remain profitable in this crypto market despite its ups and downs look to continuously build their trading skills and psychological skills to compete with big market players and institutions who are always looking to create an upset for smaller traders.

Traders go as far as learning skills like chart patterns, oscillators, and indicators. In contrast, others adopt this technical analysis with other proven strategies to have a better confluence.

In this article, we will go in-depth on how we can use the balance of power indicator as a trading tool to identify trend reversals and how to combine this BOP indicator with other technical analysis skills for better profitability as a trader while reducing risk.

What Is The BOP Indicator And How Does It Work?

The balance of power indicator, also known as the BOP indicator, is a technical analysis tool used by crypto traders to determine the overall strength of buyers and sellers in the crypto market and other financial markets they find themselves trading on financial assets to make profitable returns.

The BOP indicator oscillates around the zero line; the positive end indicates bullish market sentiment, and the negative end indicates a bearish market sentiment for traders participating or trading with crypto assets.

The balance of power indicator is a smooth indicator on its own and, as such, is paired with other indicators, such as the moving average indicator, for better and more profitable trading results as trading the BOP indicator alone is not ideal because of how volatile the crypto market is and could lead to fake signals.

The balance of power indicator is quite choppy and is best paired with another indicator that can compensate with unparalleled smoothness. On most occasions, it is paired with the smooth moving average (SMA) to help produce better results and filter out extreme price actions associated with trading in the crypto market.

The balance of power indicator is a unique price-based indicator used by technical analysts to watch the strength of both buyers and sellers by measuring the price trends for both buyers and sellers. This BOP indicator also measures the buyers’ total strength compared to the sellers’ total strength.

Because of its usefulness, many traders and investors use this trading tool in major financial markets as it helps to lead prices and expose hidden activities by huge institutions trading in the crypto market.

On the daily chart, the BOP indicator employs the 14-day moving average, though this may vary depending on market sentiment and the timeframes used by the trader. The BOP indicator aids in the identification of overbought or oversold levels, trends, and price divergences. Traders interpret a change in the BOP trend as a warning, and confirming a change in price direction is prudent.

What Does The Balance Of Power Indicator Tell Traders?

The balance of power indicator tells traders and investors about the activities in the crypto market. It gives a better picture of structured buying being carried out by institutions or structured selling being carried out by whales and huge investors. The ability of the BOP indicator leading price movement in the crypto market makes it an interesting tool.

Despite being known as a simple indicator, what makes it stand out from other indicator is its ability to trace divergencies in the crypto market, as the price of an asset and the BOP tends to move side by side.

A market divergence occurs when the price reaches a new high, but the BOP indicator fails to confirm this movement. Furthermore, its movement above and below the Zero Line is independent of price. It has its distinct method. A price movement above the Zero Line indicates structured buying, while a price movement below the Zero Line indicates structured selling.

How To Calculate Balance Of Power Indicator?

Calculating the balance of power indicator is quite complex but can be reduced to somewhat simple for easy comprehension. The BOP indicator is calculated as follows;

BOP = (Closing price – Opening price) / (High price – Low price)

Using the formula for the balance of power indicator directly could be tough; that’s why you have this indicator on crypto exchanges like Margex, where you can apply it directly to your trade with no stress of calculating the BOP indicator manually. Using the BOP indicator with other technical analysis tools or technical indicators will help reduce false signals with a better result for a trader.

The balance of power indicator above the zero line indicates positive sentiments, as bulls are more dominant than bears in terms of trading activity. The movement of the BOP indicator below the zero line indicates the bears are in control of the market activities. The simplicity of the balance of power indicator makes it interesting as it traces market conditions in real time.

Pros And Cons Of BOP Indicator

Like other indicators, the balance of power indicator has its pros and cons as different traders apply this indicator to different trading strategies. Let us consider some of the pros and cons of using the BOP indicator.

Pros

- It is simple and unique as it helps traders and investors to spot the systematic buying and selling of crypto assets

- It can be used with other indicators like moving average and relative strength index (RSI) for better trading results

- It can be used conveniently to trade multiple assets

Cons

- Sometimes the BOP indicator is not installed on some exchanges which makes trading this tool difficult. You can access this tool on Margex

- The balance of power indicator can be difficult to use, especially for new traders

- Identifying signals formed by the balance of power indicator can be tough to find without understanding the indicator

How To Use The Balance Of Power Indicator In Trading (Step-By-Step Guide With Screenshots From Margex)

Margex is a bitcoin-based crypto exchange that allows traders to trade with up to 100X leverage size while simultaneously staking the same crypto assets with the help of Margex’s unique staking feature, one of its kind.

Traders and investors can earn up to 13% APY returns for their staked assets while trading with the same assets. There are no lockup periods, and all staking rewards are sent to the staking balance daily.

Due to the volatile nature of the crypto market, with the help of Margex MP shield protection, traders and protected from pump-and-dump coins as these assets are properly regulated.

Let us discuss how to use the BOP indicator on Margex;

Step 1: Open A Margex Account/ Login

To access the balance of power indicator and trade with it on Margex, you need to create an account for a new user, but for existing users, you only need to login to access all of Margex’s trading tools.

Step 2: Click The Trade Button

After success deposit using the wallet button, click on trade to access all of Margex’s free trading tools to help boost the trading experience and result that comes from your trading.

Step 3: Click Indicator Button

Click the indicator button to search for the preferred indicator – in this case; this will be the balance of power indicator. Click on the indicator as it appears to enable it on your technical analysis.

Best Trading Strategies With BOP Indicator

Traders and investors use different technical analysis tools to carry out trading of crypto assets, which could mean using oscillators or indicators and even combining the use of chart patterns and other indicators to find trend reversal, divergencies, overbought and oversold levels. The indicators include RSI, MACD, and Stochastic.

Bullish Divergence

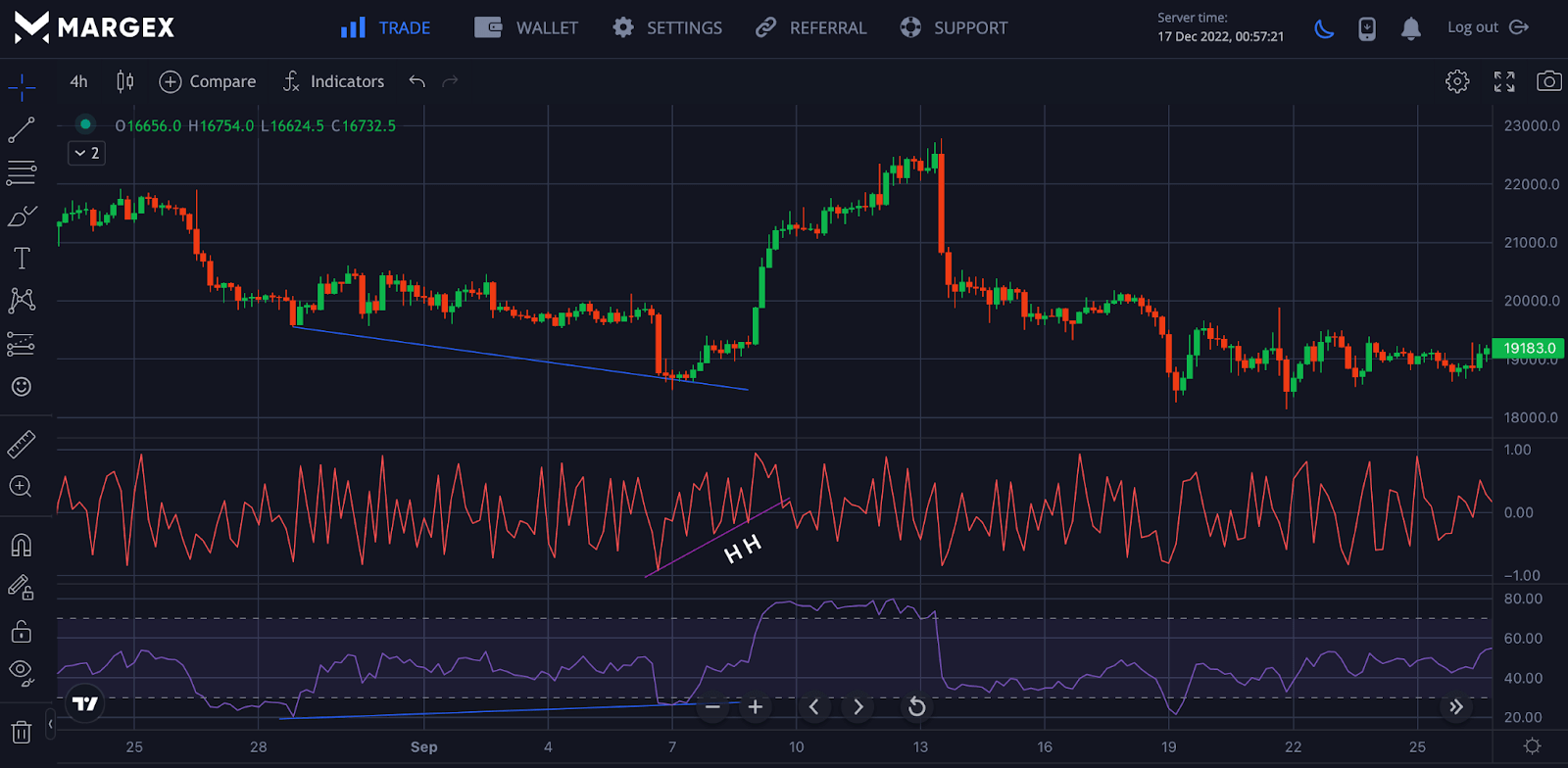

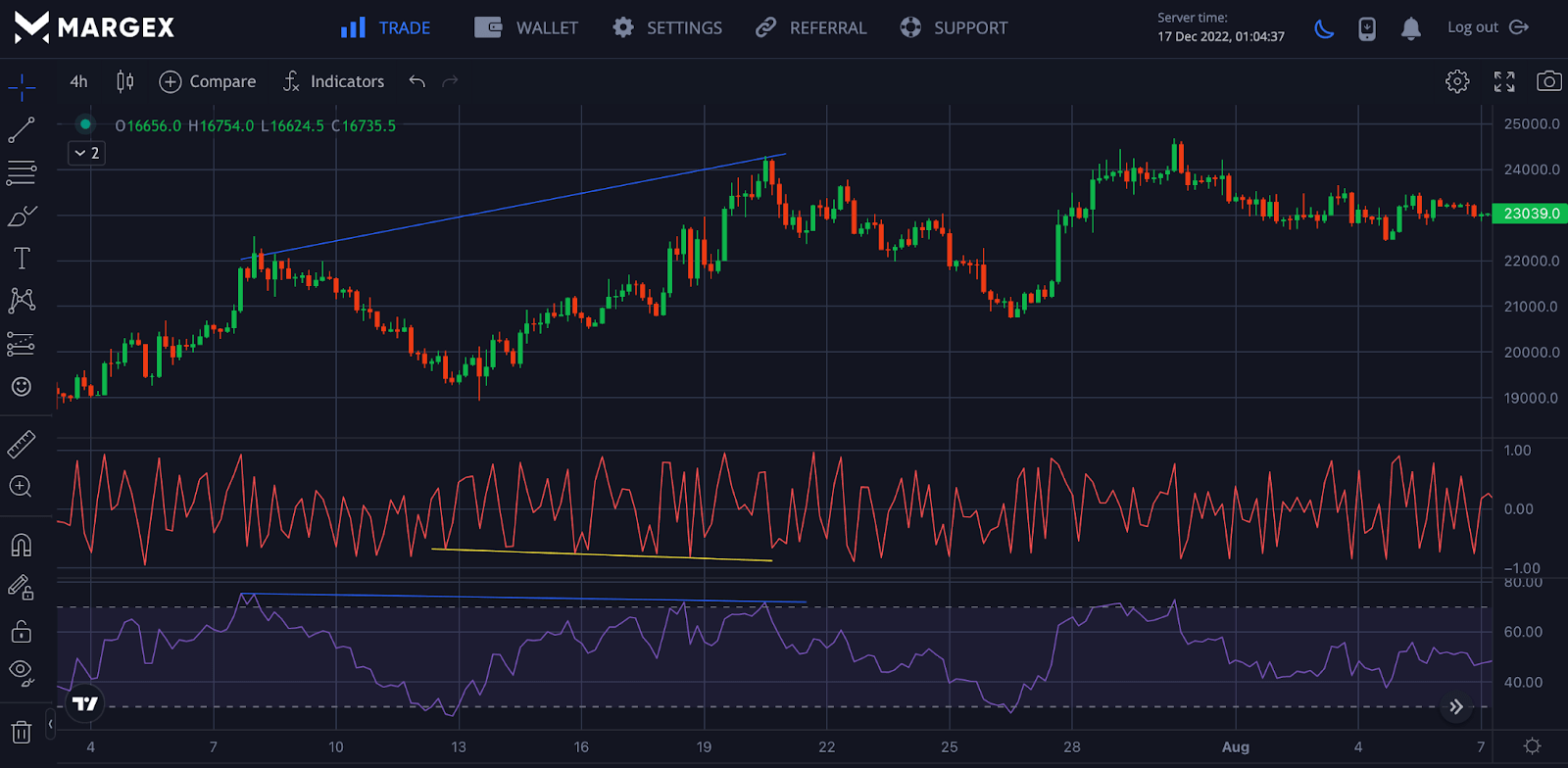

The balance of power is used to identify divergencies such as the bullish divergence, but trading the BOP indicator in isolation would not be ideal, considering how volatile the crypto market is. After the price of Bitcoin formed a bullish divergence on the 4H chart, this was confirmed as the balance of power formed a swing high ( Higher high) with the price responding accordingly, rising to a high of $22,000.

Bearish Divergence

A bearish divergence can be identified by using the BOP indicator, but this produces better accuracy than the balance of power indicator used with other indicators for better confluence and profitability.

Frequently Asked Questions About Trading The Balance Of Power Indicator

Is Balance Of Power A Good Indicator?

The balance of power indicator helps traders and investors to trend reversals and systematic buying and selling by other traders. Trading the BOP indicator with other indicators will produce better profitability results.

How Do You Trade With The Balance Of Power Indicator?

You can trade the balance of power indicator on the Margex platform; due to its complexity in calculating, Margex helps you to trade your crypto assets by adding this tool to your technical analysis.

How Do You Use A BOP Indicator?

The balance of power indicator can be used to identify trend reversals and systematic buying and selling by whale wallets and institutions.

Due to its simplicity and uniqueness, traders combine it with other indicators for probable results.