The financial market has seen some great development over the years compared to its initial stage, with many types of trading coming out. The stock, crypto, indices, and futures have all experience this growth. Traders need to keep themselves updated regarding the market’s current state and adapt their strategies to fit the market to reduce risk while building on an existing winning streak.

A good trading strategy built by a trader gives an edge in the market, trades better with good judgment, and helps to spot a potential opportunity to build a more robust portfolio. The crypto industry is a big place for so many opportunities as traders, investors, and institutional organizations look for ways to leverage the crypto space with razor-cut trading strategies and other forms of trading to remain at their top-best level of trading.

As cryptocurrencies such as Bitcoin and Ethereum gain popularity in the mainstream media, newcomers flock to exchanges. Spot trading allows those who are risk cautious to buy digital assets and hold them for an extended period. In contrast, futures trading attracts traders who want to capitalize on market volatility and price actions to make a considerable return on their investment.

One of the forms of trading we would discuss extensively is futures trading, where traders more gains with the help of futures contracts and the right trading strategies. Let’s dive deep into futures trading and the best futures trading strategy you can employ to trade more effectively as a trader.

What Are Futures?

Futures trading or futures contracts are financial contracts between two parties, the buyer and the seller, where agreements are reached through an underlying exchange like Margex in a market for a fixed price at a future date. A futures contract gives the buyer an obligation or a duty to buy the underlying market of assets, and the seller is placed under obligation to sell the asset on or before the futures contract’s expiry date.

With the help of the Margex exchange as a bitcoin-based derivative platform, you do not need to speculate the price of a futures contract will rise or fall. Since these assets are financial derivatives, you are not under obligation to buy or sell and will not not be taking ownership of the crypto assets in question. Rather you will have exposure to trade all crypto assets with up to 100X leverage sized, and you can speculate the price movement of the assets using the Margex technical analysis tools that will help make your trading experience seamless.

Trading with leverage can increase your profits and losses based on the market volatility and trade itself, not just the margin used to open the trade. This means that losses and profit could by far outweigh your opened margin size. As such, it is advised to trade with what you can afford to lose and not overexpose your portfolio to high-impact trades and volatility that come with market price actions.

Why Trade futures?

Investing in cryptocurrency futures contracts offer traders, investors, and institutions more opportunities to explore and grow their portfolio; hence many love the idea of futures contracts. Let’s explore why you should trade futures contracts more than spot trading on exchanges.

Trade With Leverage

Futures contracts trading are leveraged contracts enabling traders to receive an increase in market exposure at a small amount or reduced capital as low as $10 in most cases with what is known as margin.

When using leverage, keep in mind that your profit or loss is determined by the total size of your position, not just the margin used to open it. This means that there is an inherent risk that you will incur a loss (or profit) that will far outweigh your initial investment, and as such, you are encouraged to manage your risk accordingly during future trading.

Access To High liquidity

Margex platform, a trusted derivative exchange, allows you to trade with no issues regarding liquidity, as your orders would be filled in no time. Futures trading over traders and investors more opportunities for better liquidity than other forms of trading.

Go Long Or Short

Futures trading enables traders to go long or short on a particular asset, not minding the market’s direction. If the strategies and confluence are right for a particular trade, a trader could look to open a long or short position.

Speculate Varieties Of Crypto Assets

Futures contract trading enables traders and investors to have access to different crypto assets to trade with and provides more opportunities to build a great portfolio by leveraging on futures trading.

Top 3 Strategies In Futures Trading

The futures market is an exciting ground for many traders and investors because of its vast opportunities, allowing futures trading from various unlying assets. Because of the volatility associated with trading futures contracts and other assets, many traders employ technical analysis to help them position for high returns as the trade price swings of these assets. With the right technical analysis, and strategies to make informed decisions, sticking to well-reasoned, backtested strategies gives most traders an edge in executing their trades.

The futures market provides different futures contracts of an underlying asset and numerous opportunities to stay profitable by leveraging the price movement with the right trading strategies. Let us focus on well-tested futures trading strategies that work.

The Pullback Strategy

As the saying goes, whatever goes up must come down due to the force of gravity that pulls objects to its center, so it is with a pullback strategy in trading. A powerful futures trading strategy always occurs during a trending market when prices break above or below their resistance or support level and reverse in price to retest the broken level.

Support levels are areas or levels where a crypto asset finds it tough to go lower or break below that region, while resistance is when the price of an asset finds it tough to break above and trend higher.

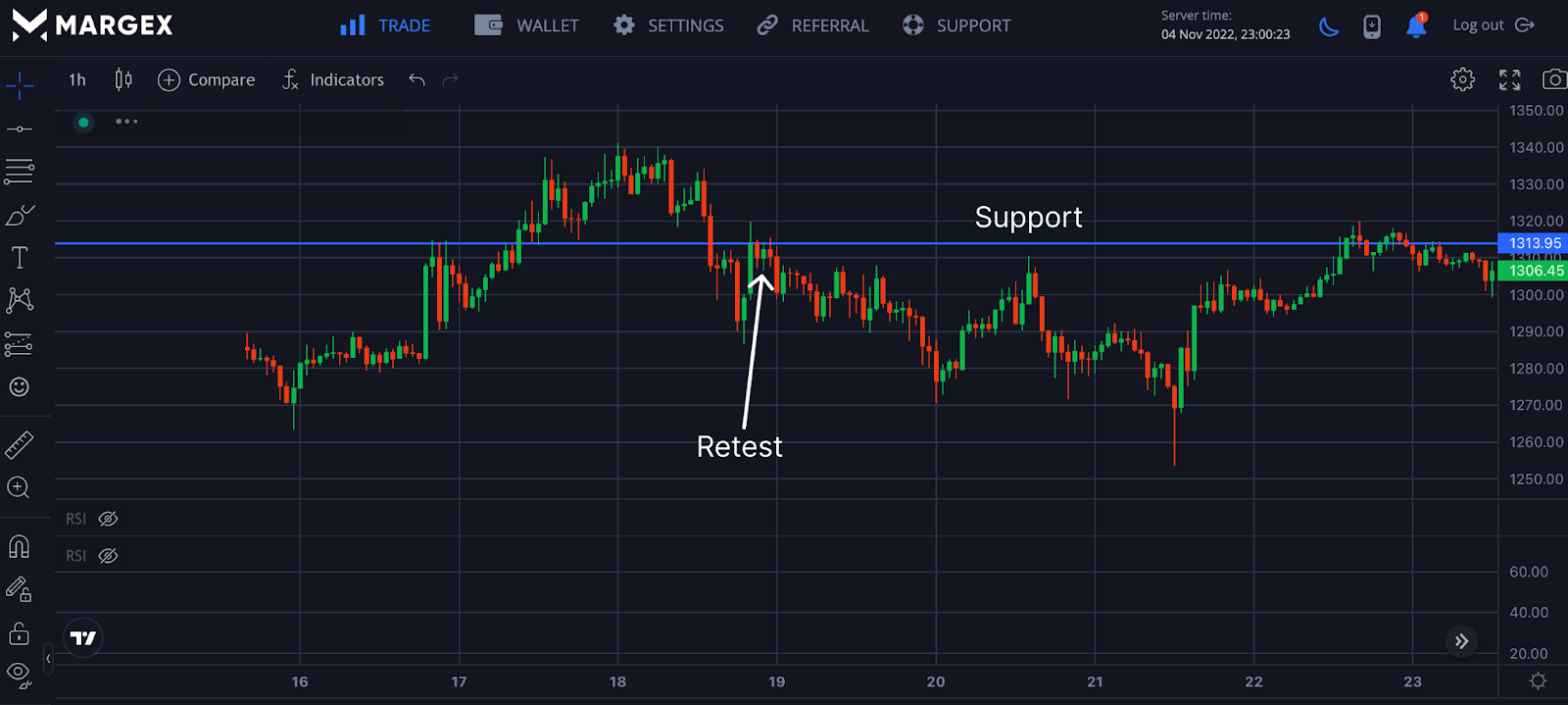

In the course of an uptrend, the price of an asset breaks above an established resistance level and reverses to retest the price at that level; after the retest, a complete trader would look too long the asset or open a long position in the direction of the underlying price direction or uptrend.

During a downtrend of a crypto asset, the price of an asset tends to break below already-established support, flipping it into resistance. When the price breaks this support, the price tends to reverse to retest the support level. A trader would look to open a short position in the direction of the downtrend for better profitability in this trade.

Pullbacks occur when traders begin to take profits, causing the futures price to move in the opposite direction of the original breakout. Traders who missed out on the initial price move can wait for the price to return to the resistance or support level to enter a more favorable price, causing prices to rise again.

From the chart above for the ETHUSD pair, the price broke below the support and made a retest before the price continued its downtrend; a trader would look to open a short position for this trade with the right risk management for futures trading.

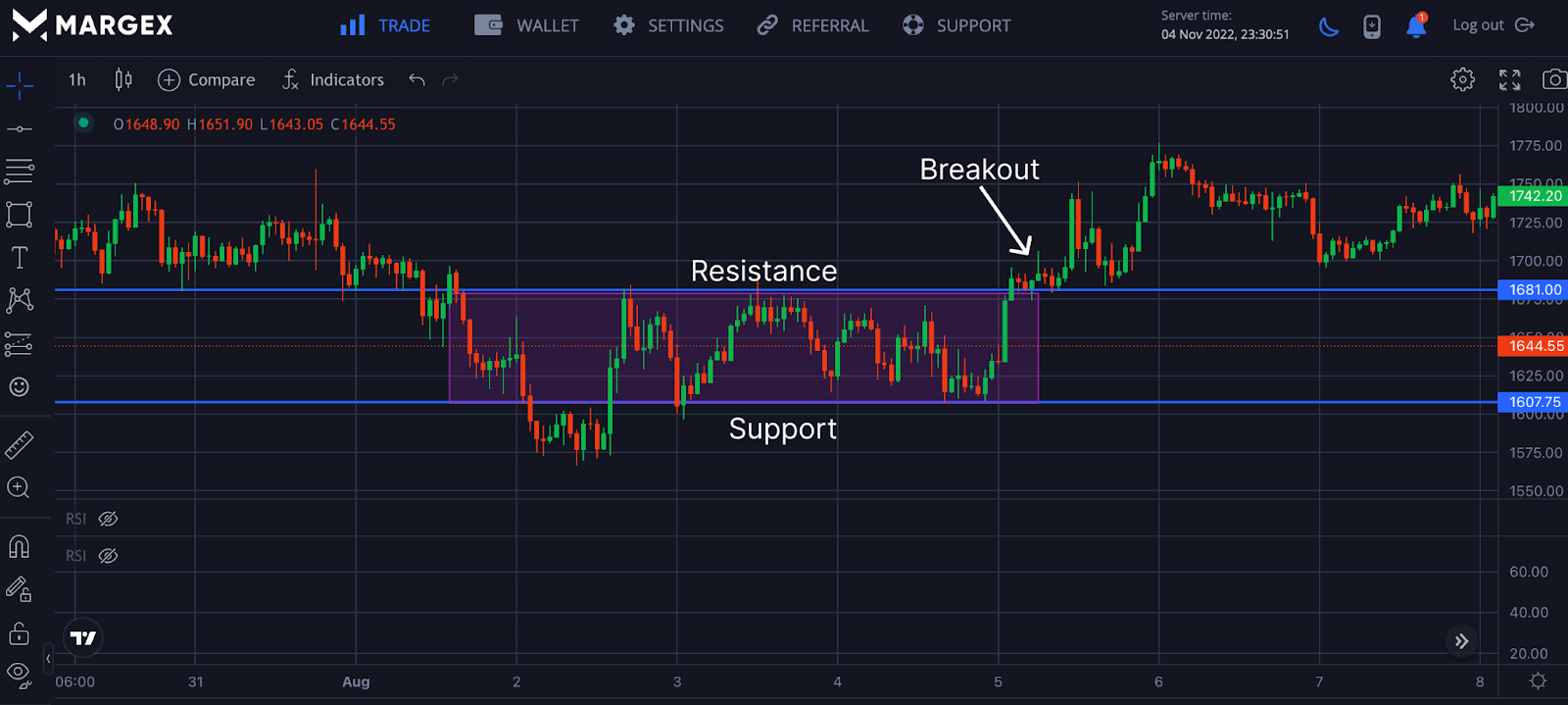

From the chart above, the price of ETHUSD broke the resistance, holding the price from trending higher; after a successful breakout, the price of ETH made a retest close to the resistance before the price continued to an uptrend. A trader with good trading knowledge would look to open a long position to make some profit from the underlying futures contract.

Trading The Range

Futures trading of the range price of assets is a skill that requires good knowledge of technical analysis and trading based on a bounce off from important levels such as support and resistance levels.

Most traders and market participant have their human emotions and memories, which a time ride on us, making it more difficult to trade in the crypto space and stay profitable, especially when prices struggle to break certain price levels. When a price faces difficulty in breaking upwards, it is referred to as the resistance level; when these prices reach the same level, some participants would want to take a profit while other futures traders would want to open a short position for this kind of trade setup there sending the price of the crypto asset in a downtrend price movement.

When the price, on the other hand, struggles to break below a certain level and then returns to that level, market participants who have been shorting the market may start taking profits. In contrast, others may begin buying at those lower prices, which will increase buying pressure on the financial instrument and likely send the price up. These levels are known as support levels.

From the chart above, the price of ETHUSD formed a range channel after the price faced difficulties breaking above or below, thereby forming support and resistance as the price continued its movement ahead of a major breakout. A breakout could be for a downtrend or an uptrend. In this case, the breakout was for an uptrend, with the trader looking to open a long position.

When trading a range, you determine if the underlying asset is in a range channel. To know that an asset is in a ranging market, there should be the absence of higher and lower lows, suggesting a lack of a trending market. Sometimes trend-following indicators are used to determine the type of market an asset is trading to adjust your trading strategies best.

Avoid staying in a trade when the asset breaks out of range if you are trading the range, and this can be achieved with the help of stop loss to reduce so much exposure to risk when carrying out futures trading.

Breakout Trading

The breakout strategy is one of the most important strategies employed in day trading. Breakout trading is a huge part of futures traders looking for a potential breakout to enter a long or short position. Futures traders catch the market’s volatility when the price of asset breakouts out from a chart pattern channel or a bullish continuation pattern like the triangle pattern.

Popular breakout trading chart patterns include heading and shoulders pattern, bull flag pattern, double top pattern, double bottom and triple bottom.

From the chart above, the price of ETHUSD formed a descending triangle with a breakout from this triangle to an uptrend suggesting this triangle is also quite successful for day traders.

Futures Trading Strategies To Avoid

While there is no question about how a good strategy impacts each trader’s success and risk-to-reward ratio, a good strategy builds good trading performance and gives us a good idea of trades to stay out of. Let us discuss strategies to avoid this.

Trading Highly Illiquid Markets

The market’s liquidity solely depends on the buyers and sellers present in the market. Considering trades like BTCUSD and ETHUSD pairs have high liquidity potential, traders are looking to jump into the trades at any slight opportunity. An illiquid market fluctuates a lot, and small trading orders take time to be filled, leading to losses.

Using the Margex platform helps you avoid illiquid markets. Margex has a unique staking feature that allows traders to stake their tradable asset to earn more with up to 13% APY, with staking rewards sent to the staking balance daily with no lockup periods.

Scalping Strategies

Scalping is a popular trading style employed by advanced traders to make quick gains from market fluctuations and volatility as they take advantage of short-term timeframes and price movement changes. Scalping is fast-paced and can be very attractive, but not for newbies traders learning how to trade. To become profitable with scalp trading, you need to be experienced and disciplined with the right mentality. To become profitable as a scalper, you should learn swing and day trading before treating futures trading.

Frequently Asked Questions on Futures Contract And Futures Trading

Futures trading comes with many opportunities, and many traders as questions on how to make a great profit trading. Here are some frequently asked questions.

What Is The Best Strategy For Futures Trading?

There is no universally best strategy for trading futures. What works for one person may not work for another. Therefore, consider your circumstances when choosing which strategy may work best for you. Some factors to consider are your risk tolerance level, your portfolio’s depth, how much time you have to monitor charts, and your trade objectives.

Some popular strategies to choose from are the pullback strategy, range trading, and breakout trading, among others.

What Is Futures Trading?

Futures trading is an agreement between a buyer and seller to trade an asset for a fixed price at a set future date. This type of trading goes beyond crypto and speculates the prices of stocks, bonds, and other types of financial assets. Because it usually involves leverage, it can potentially create huge gains for the trader. It can also amplify the trader’s losses.

What Are The Main Benefits Of Trading Futures?

- It allows you to enter significant positions with little capital. For example, a 100x leverage allows you to trade a $10,000 contract with only $100.

- When you execute it well, it multiplies your gains tremendously.

- It allows you to trade in any direction the market faces.

- You can use it to hedge an existing trade.

What Are Some Things To Avoid When Trading Futures?

When trading futures, guard against allowing your emotions to take control. Make sure you have a well-defined strategy beforehand and stick to it no matter what. Also, avoid trading in illiquid markets or leaving a trade running overnight or over the weekends.

Can Futures Trading Make Me Rich?

Yes, it can. It can also make you poor. Much depends on which asset you trade, what strategy you use, and how disciplined you are. Also, you don’t have to make everything in one trade. Consistent small wins will eventually pay in the long run.