To better understand “Litecoin Vs. Bitcoin Cash”, two prominent cryptocurrencies that position themselves as substitutes for Bitcoin are Litecoin (LTC) and Bitcoin Cash (BCH) (BTC). In 2011, barely two years after Satoshi founded Bitcoin, Litecoin was released and immediately became one of the oldest cryptocurrencies. Litecoin’s transaction times are far lower than Bitcoin’s, and its Proof of Work mining consensus process (transaction verification technique) is somewhat different.

Bitcoin Cash was designed to address Bitcoin’s scalability issue or its inability to process a high volume of transactions. Bitcoin Cash may process more transactions than by Bitcoin due to Bitcoin Cash’s increased block size limit. Since transactions on the BCH network don’t have to compete as much to be included in subsequent blocks, transaction costs on the BCH network decrease as block sizes become more extensive.

We’ll look at the two cryptocurrencies, Litecoin and Bitcoin Cash, and see how they stack up in terms of hash rate (the “power” of the whole mining network), transaction fees, and past price movement.

Bitcoin Cash vs Litecoin Overview

By far, the most popular cryptocurrency is Bitcoin (BTC). Bitcoin’s value has skyrocketed since its inception in 2009. Early investors who could keep their BTC coins for many years got wealthy. Nonetheless, many cryptocurrency enthusiasts are seeking an alternative to this coin.

Why should anybody be looking for a cryptocurrency alternative to the most popular cryptocurrency in the first place? The cause is related to BTC’s widespread popularity. Bitcoin’s inventor (or creators), Satoshi Nakamoto, envisioned a robust peer-to-peer digital payment system. It contained security safeguards that avoided problems like double-spending. As a result, this digital money system garnered a sizable following.

However, it became clear after a few years that the BTC network was not designed to manage that many transactions. Consequently, this cryptocurrency system cannot compete with established payment systems such as PayPal. These systems can process millions of transactions every day. Bitcoin cannot scale up to fulfill such demands. As a result, new cryptocurrencies have evolved, with some attempting to improve on the capabilities and characteristics of Nakamoto’s original currency.

Litecoin (LTC) and Bitcoin Cash are two of the most popular Bitcoin alternatives (BCH). The former was created in 2011, making it one of the market’s oldest cryptocurrencies. It was, in some ways, a clone of Bitcoin. However, as of two years ago, Litecoin is already using a separate Proof of Work (PoW) consensus algorithm. Litecoin transactions are completed quicker than Bitcoin transactions. These characteristics have helped LTC become one of the top cryptocurrencies in market value today.

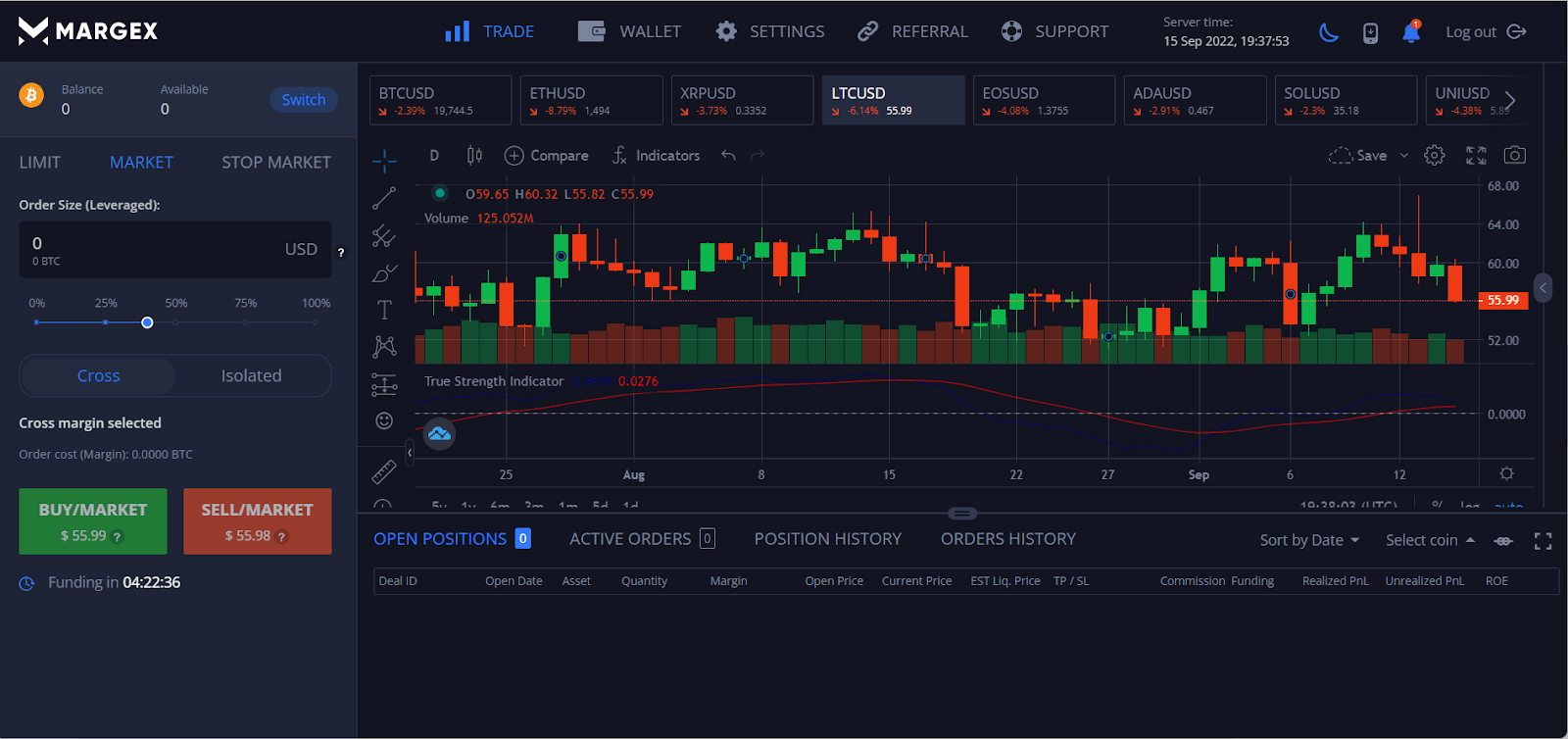

An illustration of Litecoin’s daily chart on the Margex platform

Bitcoin Cash diverged from the original Bitcoin network to address some of its scalability issues. As a result, Bitcoin Cash has a larger block size, allowing more transactions. In addition to increasing capacity, this method lowers transaction costs on the BCH network. Fees are much cheaper since transactions do not have to compete hard to verify. These characteristics have helped BCH become yet another top cryptocurrency by market valuation. It is almost on the same level as LTC.

We have discussed briefly how Litecoin and Bitcoin Cash compare to Bitcoin. However, it is also necessary to contrast Litecoin with Bitcoin Cash. A prospective investor may determine which of these two cryptocurrencies to purchase based on this comparison. What characteristics should be considered while comparing Bitcoin Cash with Litecoin? The following are some critical LTC versus BCH differences to consider as a prospective investment.

Price and Other Market Indicators LTC and BCH prices are very volatile. In the long term, it isn’t easy to compare them. Market capitalization is as well; Litecoin now has a market value of more than $9.1 billion. Out of a total of 84 million LTC coins, about 67 million are in circulation. LTC achieved an all-time high of $412.96 on May 10, 2021.

On the other hand, BCH has a market valuation of more than $9.5 billion and more than 18.8 million BCH coins in circulation. This cryptocurrency has a total quantity of 21 million coins. Its current all-time high was $4,355.62 on December 20, 2017, when it was exchanged; Maximum Block Size. Bitcoin Cash’s block size was initially set at 8MB since it was intended to make the original BTC network scalable. However, it was designed to be expandable to 32MB, its present capacity. The block size of Litecoin is smaller. Its inherent maximum size is 1 MB. However, after SegWit is implemented in the LTC network, this size can hypothetically be raised to 4MB; Average Block Time. This parameter is linked to transaction speed. It refers to the time the network takes to create a new block of transactions. The blockchain is then updated with each new block. So, the average block time for Litecoin is 250 seconds, whereas it is 600 seconds for Bitcoin Cash.

According to this comparison, Litecoin is quicker. However, one must keep in mind that the block sizes on both blockchains are not the same; Hashing Algorithm. Because Bitcoin Cash is a branch of the original BTC blockchain, it employs the SHA-256 hashing algorithm. This algorithm ensures network security. Litecoin, for its part, implements the Scrypt hashing method. This technique is faster and simpler than SHA-256, Average Transaction Fee. This characteristic is also significant for bitcoin acceptance as a payment mechanism. The average transaction cost on the BCH network is now 0.000014 BCH. This average transaction charge for the LTC network is 0.00019 LTC. BCH transaction costs are often cheaper when compared to the exchange rate of each cryptocurrency.

After considering these distinctions, you may consider whether to purchase Litecoin or Bitcoin Cash. As can be observed, several elements of both cryptocurrencies, such as market capitalization, are comparable. Both cryptocurrencies seem to have what it takes to be widely accepted. Let’s take a closer look at how these two digital assets compare. Then we can go through each one in further detail.

Bitcoin Cash Vs Litecoin: A Detailed History

History Of Litecoin

Charlie Lee, a Google employee, invented Litecoin in 2011. It was a Bitcoin fork, but there were some differences. Lee wished to establish a similar network focused on quick payments. As a result, Litecoin’s block generation time is four times faster. Instead of ten minutes, each block takes only 2.5 minutes. The Litecoin network employs a different consensus mechanism known as “scrypt,” which is less resource-intensive. In addition, because it was intended to be a low-cost cryptocurrency, the maximum supply cap was raised to 84 million coins.

The concept of Litecoin quickly gained popularity. Miners liked it because they could mine it on their laptops and computers. Litecoin appeared to be an independent currency, not standing on the shoulders of the primary

currency, as one of the first Bitcoin forks and proposing changes to the original code. Charlie Lee left Google after an initial development period to devote himself full-time to Litecoin development. Other developers joined the project in addition to Lee, and the coin now has its development team.

The sandbox for other cryptocurrencies

Charlie Lee, the creator of Litecoin, has earned a high level of respect in the crypto community. And while Bitcoin struggled with its legacy and was divided over future upgrades, the Litecoin team was able to make all necessary changes.

On September 20, Litecoin was utilized to test the concept of an atomic swap, with Decred and LTC being immediately exchanged for one another. Following that, the developers executed another successful BTC-LTC transaction. Nowadays, we witness a lot of atomic swaps across many different chains, but it was a novelty back then, and this technology was tested due to Litecoin.

Litecoin also supports the same technology as Bitcoin. Litecoin was the first network to activate the SegWit soft fork in 2017, eventually enabled on the Bitcoin network due to its comparable codebase.

History Of Bitcoin Cash

BCH is a consistent member of the top ten cryptocurrencies in market capitalization. But what precisely is Bitcoin Cash? It was founded in 2017 during the Bitcoin hard split as an alternate solution to BTC difficulties. These issues arose because BTC grew too popular to accommodate an ever-increasing number of users. The initial Bitcoin functionality limits become obsolete. Those constraints were set with good intentions, but their creators couldn’t have predicted the exponential development rate.

These constraints placed the system’s (a.k.a. blockchain’s) security above its efficiency (transaction speed). The number of Bitcoin users was minimal in its early days. As a result, speed was not a problem. And the great goal of ultimate security for everybody — one of Bitcoin’s fundamental principles — was certainly more significant. As the number of transactions increased, the need to scale Bitcoin down became apparent. The “word war” began as early as 2010.

Comparative history: Bitcoin Cash vs. Litecoin

To better comprehend the evolution of these two digital currencies, let’s take a quick look back at their respective pasts. Litecoin was introduced in 2011, as we said at the outset. It shared several aspects with the original BTC blockchain. The developer of Litecoin does not seek to replace BTC but merely to enhance it. This led to the development of Litecoin, a “lite” alternative to Bitcoin that uses a different hashing method and a more excellent total currency supply. More crucially, the block confirmation took less time.

Bitcoin Cash was forked a few months later, in August of 2017. This new coin was a branch aimed at fixing the scalability concerns of the original BTC network. Bitcoin ran well in its early years when the maximum block size was 1 megabyte. The Bitcoin network became overloaded as more and more individuals began utilizing this money. Consequently, the network was frequently crowded, raising the transaction costs.

The BTC network has to be expanded to fulfill the rising demand for its services. The Bitcoin community began to seek a resolution actively. Some people advocated a SegWit update to raise the maximum block size. Some people favored a soft fork, while others supported a firm one. The community was divided, and, in the end, the BTC blockchain split, and Bitcoin Cash was formed. Several well-known Bitcoin community members have publicly declared their support for the new cryptocurrency.

Eventually, differences among the BCH community triggered a hard fork in this coin. Bitcoin SV, a new cryptocurrency, has emerged. Since their launch dates, the value and use of these digital currencies have skyrocketed. There have been problems and debates along the road, though. In December 2017, for instance, Litecoin was the center of one of the cryptocurrency world’s most significant conflicts.

One of the top Litecoin engineers sold all his LTC during the 2017 cryptocurrency bull run. In the eyes of many, this action amounted to an effort to manipulate prices for personal gain. This cryptocurrency’s reputation took a hit due to the ongoing issue. Not many people paid any attention to Litecoin when it first emerged.

The LTC price increase occurred during 2017’s bull market. As time went on, its value declined, but unlike other cryptocurrencies, it did not suddenly plummet. Its worth has remained steady. Litecoin’s value has climbed by almost 1000% over the last five years. Contrastingly, Bitcoin Cash arrived immediately before the bull run of 2017. It was during that bull market that this currency hit its all-time high. However, like practically all other digital currencies, the price of Bitcoin Cash BCH plummeted in the subsequent years.

Litecoin vs. Bitcoin Cash: The distinctions

The most accessible indicator to compare is its market capitalization, which places LTC first. However, market volatility will guarantee that these data fluctuate even as this article is written. Here are some other particular differences:

BCH allows block sizes of up to 32 MB; however, LTC is still limited to 1 MB. Actual numbers are usually a tiny percentage of these figures. However, Litecoin is substantially quicker than Bitcoin Cash when it comes to blocking time.

Algorithms: Like Bitcoin, Bitcoin Cash employs the SHA-256 algorithm, but Litecoin uses Scrypt, as previously stated. Earlier in this article, we discussed the distinctions between these algorithms and their ramifications for investors. In general, Scrypt is more straightforward and quicker than SHA-256.

Speed: Bitcoin Cash Vs Litecoin

Bitcoin Cash generates blocks in the same amount of time as Bitcoin (600 seconds or 10 minutes). As a result, each transaction takes 10 minutes to be confirmed and posted to the BCH blockchain. A complete BCH confirmation may take 20-60 minutes, depending on the number of confirmations necessary by the receiving party (merchant or shop, for example). So, why is Bitcoin Cash often claimed to be quicker than Bitcoin? Generally, Bitcoin Cash is quicker when individuals employ zero confirmation transactions. This sort of transaction does not need confirmation to be considered legitimate. Payment may be cleared in less than a minute if the receiving party permits zero-confirmation transactions (usually 5-10 seconds).

The LTC network, for its part, adds a new block every around 2-3 minutes. Similarly, the overall time necessary to confirm a transaction is determined by the number of confirmations requested by the receiving party (merchant). Some exchanges might ask for up to 12 confirmations, which takes around 30 minutes. Other merchants may need one or two confirmations, which may take 3-6 minutes. On the LTC network, retailers often request six confirmations. It takes 15 to 20 minutes to complete all the essential confirmations.

If your transaction is thoroughly verified, the waiting time on each network is almost the same. When using zero-confirmation transactions, the distinction between Bitcoin Cash and Litecoin becomes clear. Such rapid transactions, however, come at a cost. Processes with zero confirmation transactions feature are not entirely secure. They are prone to double-spend assaults. However, an increasing number of shops are accepting this method of payment. For the time being, Litecoin has not adopted this technology.

Which is quicker, Bitcoin Cash or Litecoin?

Since the network is required for both currencies to authenticate trades, it takes time for the procedure to complete. With this number in mind, Litecoin was developed to facilitate transactions at speeds up to four times as fast as Bitcoin. Litecoin is much faster than Bitcoin Cash, completing transactions in 2.5 minutes instead of 10 minutes for BCH.

Fees: Bitcoin Cash Vs Litecoin

This statistic significantly influences a cryptocurrency’s usefulness as a payment mechanism. This characteristic is also significant for bitcoin acceptance as a payment mechanism. The average transaction cost on the BCH network is now 0.000014 BCH. This average transaction charge for the LTC network is 0.00019 LTC. BCH transaction costs are often cheaper when compared to the exchange rate of each cryptocurrency.

Block Size: Litecoin Vs Bitcoin Cash

When compared to LTC, BCH outperforms the competition in this category. When it comes to BCH block size, it is set initially at 8MB, which is also considered the default. But the most significant part is that BCH’s block size is extensible and can reach 32MB, which is 32 times more than what BTC offers.

The block size of LTC is the same as that of BTC (1MB), although the Litecoin networks have already begun inclusion with SegWit, allowing them to extend their block size to up to 4MB.

Hash Rate: Bitcoin Cash Vs Litecoin

When comparing Bitcoin Cash Vs Litecoin, hash rate comes next. The entire “mining power” miners or transaction validators devote to a specific network is called hash rate.

A greater hash rate indicates a more secure network. This is because a higher hash rate is required for any individual or group to acquire control of the network by acquiring 51% or more of the network’s hash rate (a “51% assault”). This needs money and technical skill (to set up mining equipment).

Regarding Litecoin LTC, the hash rate has been decreasing over the past year. It was about 430 TH/s in June 2019. By June 2020, the hash rate has fallen to about 230 TH/s per second. This suggests that fewer miners are protecting the LTC network, perhaps making Litecoin more susceptible to a 51% assault.

The Bitcoin Cash hash rate, on the other hand, has stayed relatively stable. Bitcoin Cash has a unique feature: Bitcoin (BTC) miners may help safeguard the network. If mining BCH becomes wildly successful, there may be a rapid increase in the Bitcoin Cash hash rate when BTC miners begin mining BCH.

Bitcoin Cash Vs Litecoin Community

Bitcoin Cash and Litecoin have active communities that advocate the progress of the respective tokens. Discord, Reddit and Twitter are some of the popular platforms that house these communities. There are several critical discussions that occur in these communities that shape the future of the tokens.

Mining: Bitcoin Cash Vs Litecoin

The mining of Bitcoin Cash vs Litecoin is a crucial comparison component. Mining is verifying transactions that will be added to the blockchain ledger. Miners are essential for a cryptocurrency and bitcoin blockchain because they validate transactions and keep the network safe. Miners are compensated with digital tokens and a portion of transaction fees in exchange for their services. You can make money passively if you become a miner. Should you mine one of these two cryptocurrencies? Which is the most profitable? Let us investigate this matter.

Bitcoin Cash Mining

If you’re used to Bitcoin mining, you’ll have no trouble with Bitcoin Cash mining. The same method is used to mine these coins. You will need the following to mine Bitcoin Cash:

ASIC miner using the SHA-256 hashing method. You must ensure that the miner is designed specifically for BCH mining; else, it will not operate.

A reliable Internet connection with a minimum speed of 1Mbps and 24-hour availability; a BCH wallet.

Expect to spend between $1,000 and $2,000 for the gear, depending on the ASIC miner you acquire. You may begin mining after you have the proper equipment. However, you may not get many prizes if you mine by yourself. Joining a mining pool will boost the profitability of your mining activity. A mining pool comprises numerous miners that pool their processing resources to locate blocks. The mining profits are then distributed according to the computer power given by each miner. There are several BCH mining pools, including BTC top, Antpool, F2pool, and others.

The BCH network’s hash rate fluctuates substantially. This figure represents the processing power of the network. It is the product of miners’ collective computer power. In other terms, the hash rate is the number of hash operations completed in a unit of time. This number is often expressed in Exahash per second (EH/s) for Bitcoin Cash. Currently, the BCH hash rate is at 1.789 EH/s. The larger the value, the less vulnerable the network is to a 51% assault.

Litecoin Mining

You will also need an ASIC miner to mine Litecoin. Litecoin, like Bitcoin, could be mined using a CPU or GPU in the early years of its existence. Because of the intense competition, it is no longer profitable. An ASIC miner that supports the Scrypt hashing algorithm is required in this instance. You will also want a fast Internet connection and an LTC wallet.

Similarly, joining a mining pool increases your chances of earning. LitecoinPool.org, ProHashing, and F2pool are three major LTC mining pools. The hash rate of Litecoin is commonly expressed in Terahash per second (TH/s). Currently, the LTC hash rate is at 217.916 TH/s. As a result, Litecoin is susceptible to a 51% assault. However, such an assault is very improbable to materialize.

Mining incentives for Litecoin, like Bitcoin, are halved every four years. The next halving will occur in 2024. Some years back the Litecash hash rate took a major dip following its halving in 2019 which led to fears that its network was susceptible to attacks. This fears were assuaged by the Litecoin team which stated that an attack if possible would result in little or no economic loss.

It should als be noted that mining Bitcoin Cash is more lucrative than Litecoin if the price is considered.

Controversy Over Litecoin And Bitcoin Cash

Bitcoin Cash and Litecoin both have a considerable debate around them. Litecoin’s creator, Charlie Lee, liquidated all of his LTC assets around the market’s top in 2017.

While it was a clever financial move, since he almost precisely timed the market peak, it did not inspire much trust in the Litecoin community. It would be similar to Jeff Bezos selling all his Amazon stock; many would question why he did so.

For Bitcoin Cash, the project’s leader, Roger Ver, is nearly always the source of contention. Ver is a divisive personality in the crypto field who isn’t hesitant to voice his thoughts.

He’s also not shy about promoting his currency. If you go to Bitcoin.com and want to purchase Bitcoin, the default choice is to buy BCH, which might be highly perplexing for folks who are new to cryptocurrency.

Aside from his contentious marketing techniques, some in the cryptocurrency community believe that Roger Ver has diluted the value of BTC by forking Bitcoin. Would the price of BTC be more excellent if BCH did not exist? We’ll never find out.

One thing that Roger Ver has going for him is that he is a persistent proponent of cryptocurrency and is constantly attempting to get influential individuals and businesses engaged with blockchain. His efforts to increase bitcoin acceptance may surpass any adverse consequences of Bitcoin forking.

Bitcoin Cash Vs Litecoin: In Summary

Bitcoin is the most popular cryptocurrency on the market and will remain so. It aspires, like its competitors, to create a decentralized currency system in which transactions are validated by the network rather than an individual authenticator. This produces a verifiable ledger with less susceptible to manipulation transactions.

In reaction to BTC, several cryptocurrencies have emerged, many of which try to address one of its significant flaws: its limited scalability. Bitcoin Cash is a hard fork derivative that, among other things, provides bigger block sizes and hence improved scalability. At the same time, Litecoin was presented as a “lighter” form of Bitcoin that offers quicker processing times.

When it comes to choosing a selection, investors have a lot of options. You should keep an eye on the type of blocks, algorithms, processing times, transaction fees, market caps, and special features enabled by each currency, such as smart contracts and zero-confirmation transactions.

On top of that, the market is volatile, and data will continue to fluctuate regularly. Investors will need to do market research and keep current on all cryptocurrency varieties in the future.

Litecoin and Bitcoin Cash share many characteristics. They both position themselves as speedier Bitcoin alternatives. However, Bitcoin Cash has the upper hand because of reduced transaction fees, a larger hash rate, better price movement, and Roger Ver’s strong marketing of BCH (vs. Charlie Lee sold all of his LTC).

In any case, both projects are intriguing. Perhaps this article comparing Litecoin vs. Bitcoin Cash has helped determine which currency you’d want to use and invest in.

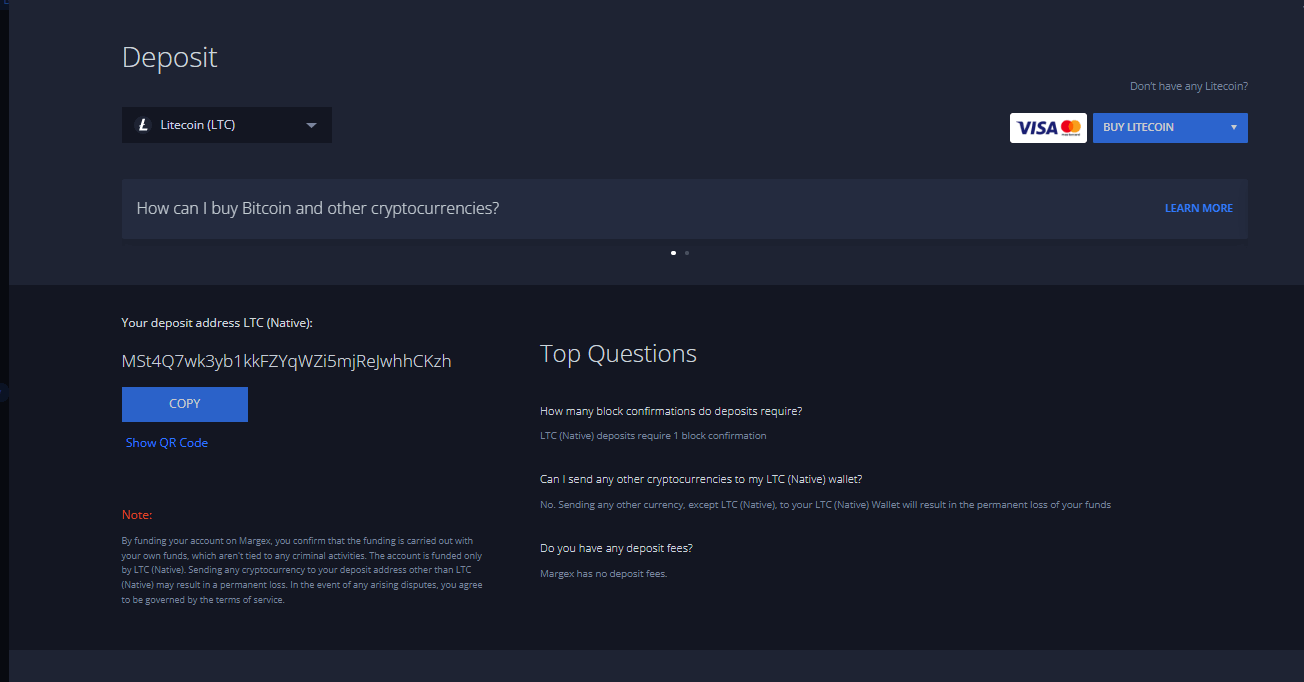

If you’ve decided to purchase Litecoin, Margex offers the perfect exchange to go about your business. Users can deposit Litecoin, trade them using the multiple options, and use them as collateral for the recently released staking feature.

Margex also allows users to use Litecoin as collateral for their staking feature. Another benefit of trading with Margex is that all Litecoin can be used to trade different assets, such as Bitcoin, Ether and so on, without owning them. So, for example, you can use Litecoin to trade BTC and have income in Litecoin.

Apart from this Margex offers world-class trading solutions with up to 100x leverage on Bitcoin, Ethereum, Ripple, Uniswap, Litecoin and other popular digital assets.

Bitcoin Cash vs. Litecoin: Which one is better?

The answer to this question is contextual, requiring consideration of the user’s objectives, intended use, and attitude toward cryptocurrencies. Litecoins may be created more quickly than Bitcoins, although the latter is more valuable. If you’re looking for more purchasing power per coin, Bitcoin might be the way to go, while Litecoin could be the way to go if you’d rather have more coins at a lower value.