Since the invention of Bitcoin by Satoshi Nakamoto, thousands of other cryptocurrencies have emerged. Typically, these cryptocurrencies have different visions that deviate from that of Bitcoin, the first cryptocurrency.

However, in 2018, Bitcoin SV hit the crypto market. Craig Wright launched the token intending to fulfill Bitcoin’s roadmap. Since the launch of BSV in 2018, the cryptocurrency has gone through several highs and lows.

Bitcoin SV has also swung along with the crypto markets, having its peaks and valleys. Currently, BSV has an estimated price of $52. Several crypto traders and investors have given BSV a “fair value.” This article will discuss the fair value of BSV in the coming years and what factors could affect the price of the volatile asset.

What Is Bitcoin Satoshi Vision (BSV)?

Bitcoin Satoshi Vision is a decentralized cryptocurrency that runs on the blockchain. As the name implies (Bitcoin Satoshi Vision), the crypto asset was created to align with the exact vision of Satoshi.

BSV is like Bitcoin and Bitcoin Cash in many ways. However, the main thing distinguishing the token from its parent tokens is its larger capacity to scale. According to BSV proponents, this makes the token the “original Bitcoin”.

BSV’s scalability capacity has made it a suitable token for peer-to-peer payments and a blockchain network that supports decentralized applications. Bitcoin lacks technical capabilities, which has prevented the network from achieving full dominance. However, Bitcoin SV fills this gap, offering the technical capabilities lacking in Bitcoin.

Bitcoin SV has a larger block size than Bitcoin. The size capacity of a Bitcoin block is 1MB. When Bitcoin Cash was created, it came with a larger Block size of 32MB. Thus, Bitcoin Cash would be able to process transactions 32 times faster than Bitcoin. Then, Bitcoin SV, a hard fork of BCH, kicked off with a block size of 128MB. Eventually, the block size was scaled to 2000MB after an upgrade in 2021.

Further upgrades improved the block capacity of the BSV chain, and theoretically, the blockchain can scale infinitely. This means that the Bitcoin SV chain can process as many as 100,000 transactions per second, unlike Bitcoin, which can’t even process 10 transactions every second.

Bitcoin Satoshi Vision (BSV) Launch And Origin Story

Bitcoin SV is a fork of Bitcoin Cash (BCH), a decentralized cryptocurrency. In 2017, the original Bitcoin code was modified to create BCH. This hard fork was due to concerns about Bitcoin not living up to its supposed standards in its whitepaper. According to Satoshi Nakamoto, Bitcoin was meant to be a peer-to-peer currency for electronic payments.

While Bitcoin has always been decentralized and will always meet the P2P requirements, it was found unsuitable for financial transactions in some instances. As the Bitcoin network grew, transaction fees increased sporadically. Further, transactions on the network took a lot of time to finalize. Thus, Bitcoin cash, which had a larger block size, was invented to meet the payment requirements that Bitcoin failed to satisfy.

As time passed, Craig Wright and his associates scrutinized Bitcoin Cash (BCH) and concluded that the cryptocurrency was deviating from Satoshi’s goals. According to Craig, the only development Satoshi would have wanted for the Bitcoin blockchain was to expand its block sizes. Any other scaling method was regarded as incompatible with its plans of Satoshi.

Thus, Craig went on to fork Bitcoin Cash. The BCH fork was named Bitcoin Satoshi Vision (BSV), indicating that this new crypto asset would stick to the goals of Satoshi Nakamoto. After a lot of deliberations, Bitcoin SV was eventually launched in 2018.

What Protocol Is BSV Built On?

The BSV protocol has a blockchain that uses the Proof-Of-Work (POS) consensus mechanism to validate transactions. This means that BSV tokens can be created through mining, and the network is secured.

Bitcoin SV miners use computers to solve complex mathematical puzzles. The tasks are comprehensive, and block rewards are issued to the fastest computer to solve the puzzles. As more miners join the network to solve complex computational problems, the hash rate of Bitcoin SV increases.

An increase in hash rate has a positive effect on the network but a negative effect on miners. An increase in has rate means that mining becomes more difficult. Often, miners need to upgrade their mining devices when the hash rate rises to increase mining efficiency.

On the other hand, a hash rate increase boosts network security. It increases decentralization and makes it more difficult for a 51% attack. A 51% attack can be executed on the protocol if more than half the mining power on the network decides to be manipulative.

What Makes BSV Different From Other Cryptocurrencies?

There are over 20,000 cryptocurrencies in the market, but Bitcoin SV stands out. Bitcoin Satoshi Vision (BSV) is the only crypto asset bent on sticking close to the original vision of the first cryptocurrency.

Other forks of Bitcoin have tried hard to stick to Bitcoin’s vision, but BSV has a unique perspective. Bitcoin SV has achieved scalability without deviating from Bitcoin’s whitepaper.

Further, Bitcoin SV has an unbounded block size, taking it far ahead of its competitors. The protocol seems more ready for blockchain adoption by the masses than any other. Last year, the Bitcoin SV network successfully mined over 1GB blocks. This made it the first blockchain to reach this feat.

In 2021, the blockchain achieved a block capacity of 2GB. Perhaps, the most intriguing aspect of these feats is that block capacity on the network will continue to increase as further developments in the underlying technology of the network are unveiled. BSV is now outperforming traditional payment processors like Visa and MasterCard.

BSV also offers a conducive platform for users and developers. With developers migrating from the Ethereum network due to scalability issues in the last few years, BSV might be a more suitable platform to build enterprise applications using blockchain technology.

Users also enjoy low transaction costs and live without the fear of a fee hike when more users troop into the BSV ecosystem. Bitcoin SV’s massive capacity to scale and loyalty to the Bitcoin whitepaper makes it stand out in the crypto ecosystem.

What Factors Determine the Price of BSV?

Like Bitcoin and any other cryptocurrency, several factors affect BSV price. Bitcoin SV is a volatile asset, and its price has seen massive all-time highs and lows. Here are some factors that have affected the price of Bitcoin SV in the past and will likely affect the tokens’ price in the future.

Demand

Demand is the most important factor affecting any token’s price, especially in the long term. Imagine if no one ever accepted Bitcoin as a means of payment since its introduction to the crypto markets in 2009. Undoubtedly, the currency would have been close to useless.

However, demand for the asset has given the digital currency a perceived value. And now, investors, crypto traders, or “hodlers” are unwilling to part ways with the asset because of higher demand, and use case projections in the coming years.

Similarly, demand for Bitcoin SV has driven the price of the asset up in the past. Also, a lack of demand or rejection by a significant portion of the market has driven the price down. For example, in April 2019, some exchanges announced that it would be delisting BSV. This loss of demand stirred reactions from BSV investors, and the coin plummeted by about 10% during that period. Eventually, though, BSV recovered from the slight dip caused by its delisting.

Supply

Supply is the amount of BSV tokens available. Supply triggers scarcity, and BSV has limited supply. The total supply of BSV is 21 million tokens, just like Bitcoin. Currently, there are more than 19 million BSV tokens in circulation.

Bitcoin SV can be mined, and the coin’s proponents strongly believe that BSV will eventually become scarce when all 21 million coins have been mined. Tokens with excessive supply usually do not have a high projected future price, while tokens like BSV with limited supply typically have more optimistic price projections.

Black Swan Events

Black swan events are extremely negative events that take the market by surprise. For example, in March 2020, when the COVID pandemic became intense, the prices of stocks crashed violently. The prices of cryptocurrencies also tumbled within the twinkling of an eye.

BSV traded around $228 at the start of that month. However, when the general market dump occurred, BSV lost close to 50% of its value, trading at around $117.

Another event that caused a catastrophe in the cryptocurrency market was the extreme volatility experienced in May 2022. The extreme crypto market volatility shook the price of UST, making the token depeg. This resulted in extreme fear in the market, and traders sold off most of their tokens. Billions of dollars were wiped from the general crypto market. During that period, BSV lost about 25% of its value within a few days.

Craig Wright’s Law Suits

The pioneer of Bitcoin SV, Craig Wright, once claimed to be the real Satoshi Nakamoto. His claims attracted a lot of attention, and Wright once filed a copyright claim against a crypto company for the original Bitcoin Whitepaper.

Notably, there has been no solid evidence that Wright is Satoshi, although, at certain times in 2019, the legal case seemed to be going in his favor. Following the speculations in 2019 about Craig Wright being the creator of Bitcoin, the price of BSV skyrocketed. BSV soared from around $60 to $195 in May.

Following that, the court ruled against Wright several times, and the price of Bitcoin SV responded negatively to the news. In January 2021, some reports claimed that there could be evidence suggesting that Craig Wright’s claims are right. BSV rose to its all-time high of $441 before eventually tumbling when the claims lacked evidence.

Bitcoin Satoshi Vision’s Past Performance: A Complete History of BSV

Bitcoin SV had an all-time low of $36 in 2018, shortly after the token’s launch. The release of BSV stirred mixed reactions among traders and investors. While many were skeptical and regarded the project as a false version of BTC, some other investors bought the idea of having digital cash that would truly be decentralized, suitable for payments, and scalable.

In December 2018, BSV had an opening price of $97 and eventually traded well above the $100 mark that month but failed to sustain the pump. BSV had a monthly close of $85. In January 2019, things failed to fall in place for the cryptocurrency.

Scandalous reports about Craig Wright caused a further value depreciation of the asset. BSV lost more than 25% of its value that month. The price of BSV eventually followed that of Bitcoin and the general crypto market from the start of 2019 until May, when Craig Wright claimed to own the license to the Bitcoin Whitepaper. That month BSV rose by more than 200% giving investors more confidence in the “original Bitcoin.”

The joy did not last long for BSV holders, though. Following a series of rulings against Craig’s claims, BSV’s price returned to its roots, eventually closing the year at around $97.

In January 2020, Bitcoin had a price boost of over 20%. Bitcoin SV had an even more intense bullish move, rising from below $100 to above $400. Bitcoin SV eventually closed the month above $273 after several investors made a profit.

Bitcoin SV eventually declined even more intensely in March 2020 due to the global market bearish crash. Although, BSV fell to a low of $88 that month, it recovered the following month, closing above $200 in April. For the rest of 2020, most of the assets move synced with Bitcoin.

At the start of 2021, though, BSV soared again. Like many other major cryptocurrency moves, the high price could not be sustained. BSV eventually fell back shortly after that. Then April came, becoming the most significant month for the crypto asset. In April, BSV reached its all-time high of $491.

The following month, Bitcoin crashed hard, pulling down its forks and all other altcoins. From June to November, BSV was priced between $100 to $200 with no significant bullish or bearish momentum. Then in December 2021, Bitcoin SV investors’ worst nightmare happened again. The crypto market experienced a dip, and BSV fell well below the $100 mark.

The crypto asset recovered a bit in January, trading above $120 at some point. However, from February to date, BSV has failed to reach the $120 mark.

How Is BSV Doing Now?

BSV is currently valued at $43,26 and occupies the 49th position in the ranks of cryptocurrencies by market capitalization. Bitcoin SV has lost about 16% of its value in the past week. The recent BSV price in value harmonizes with the dip in the price of Bitcoin.

The crypto market has been generally bearish in 2022, and BSV is undoubtedly affected. The coin has strayed far off from its all-time high (ATH). BSV is almost 90% below its ATH, achieved over a year ago.

The volatile asset has a market cap of $1 billion. BSV is just 44% above its all-time low. The approximate BSV return on investment (ROI) is -40%. This implies that investors who purchased at launch price would have an unrealized loss of 40% if they have not sold the asset.

Current Price Prediction For BSV

BSV now trades around $43, with a daily high of $47 and a low of $35. Now, any significant move in the price of BSV may only be triggered by Bitcoin movements. Without extreme price fluctuations, BSV looks to trade within $35 – $39 for the day.

Notably, the Relative Strength Index (RSI) on multiple time frames indicates that the cryptocurrency has been oversold. While this may be a good buy signal, investors are not recommended to rely on RSI alone as a market strategy to make investment decisions.

BSV Price Prediction For February 2023

With the current bearish market trend and BSV coin past record, the month of September hasn’t been very favorable for BSV. Since its launch, Bitcoin Satoshi Vision (BSV) has experienced a more bearish trend in September. In 2019, 2020, and 2020, BSV’s closing prices in February were well below its opening prices, as they say, history repeats itself.

Short Term BSV Price Prediction For 2023

2022 has already been very bearish for BSV and virtually all other cryptocurrencies. The table below shows the short-term BSV price prediction for 2023.

Long Term BSV Price Forecast for 2023, 2024, and 2025

Given BSV’s use cases and fundamentals, 2023, 2024 and 2025 could be the year that BSV takes the market by the horn. In 2024, BSV could undergo its halving, increasing mining difficulty, and slashing rewards. A full-blown bullish season may resurface if market sentiments are considered just like in previous years for the likes of Bitcoin prices. Quarterly BSV price prediction for 2023-2025

Long Term BSV Price Forecast For 2026 – 2030

Investors always look forward to long-term price predictions. The table below shows the price prediction of BSV between 2026 to 2030.

Long Term BSV Price Estimations By Experts

Some experts have also predicted the price of BSV. Changelly and Trading Beast have been following the prices of BSV closely for some time now, and both have come up with price predictions. Like every other long forecast, these predictions always come with a disclaimer. It’s impossible for any cryptocurrency expert to accurately predict the future price of an asset. The prices forecasted are just an expected average trading price and should not be considered a piece of financial advice.

BSV Forecasts By Changelly

Changelly projects the price of BSV to be around $474 in the next five years. Changelly’s predictions have further estimated that BSV will have a minimum price of $461 and a maximum price of $559 in 2027. Changelly also predicts BSV to trade above the $2000 levels in 2031. Because of human imperfections these forecast can be flawed, please do your own research and do not invest more than what you can afford to lose.

BSV Price Prediction By PricePrediction

Cryptocurrency experts on Priceprediction forecast the price of BSV based on past prices and fundamental analysis, the price of BSV would go to a high of $1,400 and could be traded for an average of $1,300. Always do your due diligence and avoid putting more than what you can afford to lose.

BSV Price Prediction By Trading Beast

Trading Beast has a very pessimistic price projection for Bitcoin SV in the coming years. According to Trading beast’s analysis, BSV would fall as low as $0 in 2023, and the cryptocurrency would fail to recover in the coming years. Trading Beast strongly believes in a continuous downtrend for BSV until 2030 and beyond.

BSV Price Prediction By Margex Technical Analysis

The Margex trading platform has a robust on-chain and technical analyst with sound technical knowledge to forecast and compare with automated price predictions offered by other AI technologies used for asset predictions. However, always do your research and due diligence before you invest in a crypto asset. The analysis should not be taken as financial advice.

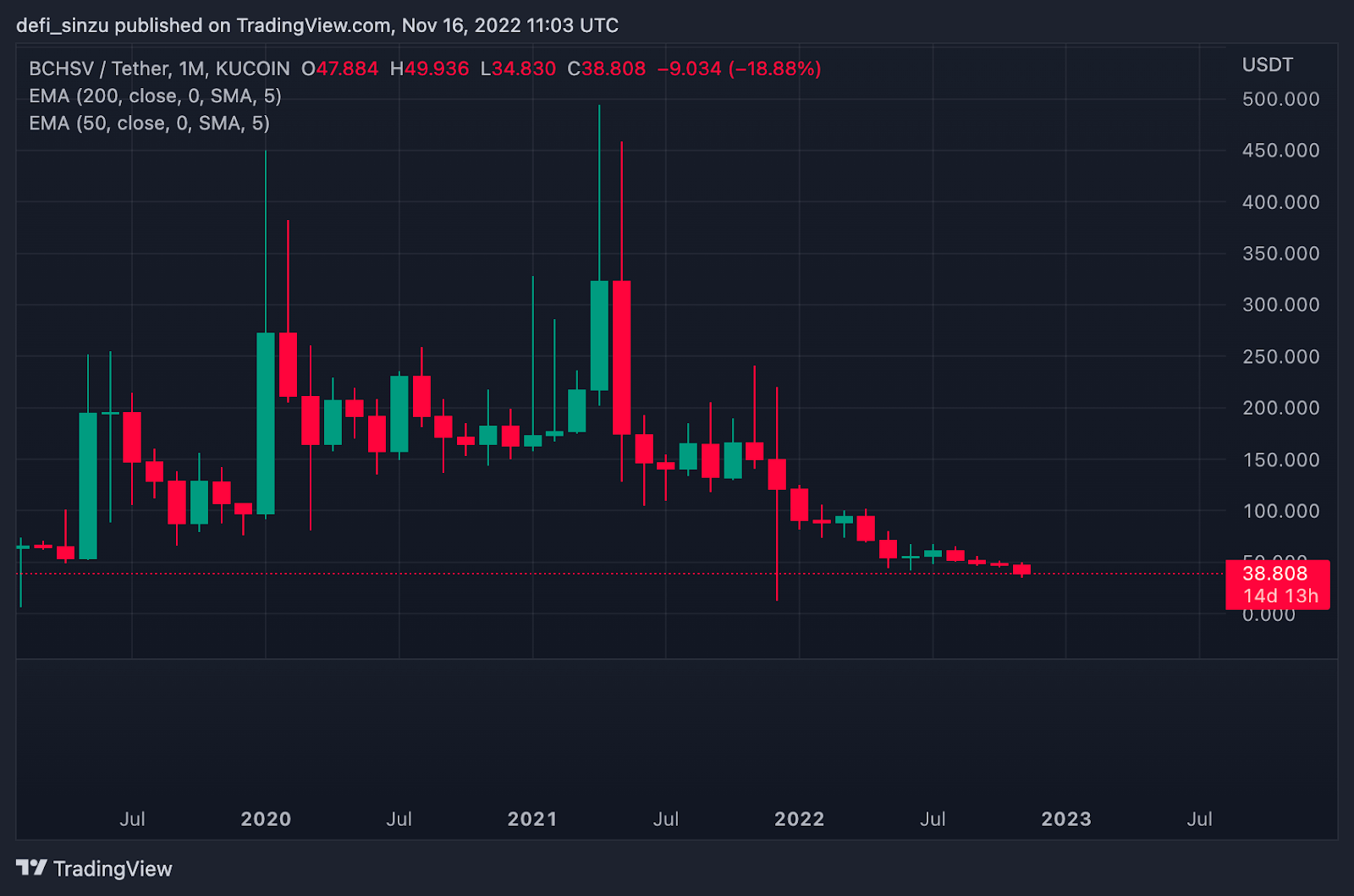

The chart above shows that BSV has been on a long downtrend. BSV has strong support holding around the $30 region. Should the support be broken and retested, traders would likely open more short positions. On the other hand, if the support holds, BSV may be in for an upward ride. A break in structure to the upside would mean a lot for bullish traders and investors.

Crypto As A Financial Instrument

Cryptocurrencies have multiple uses. Among the multiple uses, cryptocurrencies have more potential when they are traded. Traders can actively open buy and sell positions and make money from the regular price fluctuations. Long-term investing may be a better option for individuals who are limited in time.

Notably, though, anyone can launch a project due to the decentralized and open nature of cryptocurrencies. This exposes users to risks as some crypto tokens are mere pump and dump schemes rather than actual projects with fundamentals.

To protect oneself from the extremely risky pump and dump schemes, traders can utilize renowned trading platforms like Margex. On the Margex exchange, cryptocurrencies are vetted well before they are listed on the exchange. This helps to ensure that users don’t fall for rug pulls. Additionally, the Margex exchange does not manipulate asset prices, and users enjoy a smooth user experience on the platform. Margex as a bitcoin-based derivatives exchange platform allows traders to trade crypto assets with leverage up to 100x. Margex connects traders to global crypto markets.

BSV Price Prediction Crypto FAQ: Frequently Asked Questions About BSV Cryptocurrency

Is BSV Better Than Bitcoin?

BSV is superior to Bitcoin in terms of scalability. Technologically, BSV has a better blockchain than Bitcoin’s, and it supports dApps and NFTs. Transactions done on the Bitcoin SV chain are executed at lightning speed. However, Bitcoin has grabbed a larger chunk of the crypto market, is first in the market ranks, and will always be perceived as number one by many crypto users.

Is Litecoin Better Than Bitcoin SV?

Users who fancy privacy may prefer Litecoin to Bitcoin SV. However, Bitcoin SV’s large block size implies that transactions done with SV are faster than Litecoin transactions.

Is Bitcoin SV The Real Bitcoin?

Bitcoin SV is not the real Bitcoin invented in 2008/2009. However, Craig Wright, who is a Satoshi proponent, strongly believes that Bitcoin SV is serving the purpose of the original Bitcoin as outlined in its whitepaper.

Why Is BSV So Cheap?

BSV, a fork of Bitcoin Cash, is expected to be cheaper than Bitcoin and Bitcoin Cash, its parent cryptocurrencies. Notably, though, its recent low price can be attributed to the general crash in the prices of cryptocurrencies. Also, BSV is relatively new to the crypto ecosystem. If the coin discovers its value in the coming years, as some proponents believe, BSV may be much more expensive to buy.

What Is Happening With Bitcoin SV?

Although the initial hype with BSV has died down, the team is still actively developing the ecosystem. In August 2022, BSV was introduced to developing countries like Nigeria to adopt the token and its technology in the real world. Also, the number of NFT projects launched on the Bitcoin SV chain is gradually growing. The BSV token was also listed on the Latoken exchange on the 1st of August 2019, while pursuing a case against some major centralized exchanges for delisting.

Is Bitcoin SV A Good Buy?

While there is no direct answer to this question, many factors can be considered. BSV has solid fundamentals, scalability, and high throughput as its selling point. It has almost the same features as Bitcoin, the most embraced cryptocurrency. While its unique characteristics give the asset a chance of soaring in the future, it also faces competition from higher-ranking altcoins that are highly scalable and more popular.