If events in the last couple of weeks are still not clear enough to you that people are beginning to lose faith in their governments and their respective centrally-controlled fiat currencies, you may need to read our brief article below.

Just last week, a flight out of the British pound and the euro happened as both the pound and the euro collapsed to historical low levels against other currencies in the developed world, and especially against the USD.

After the new prime minister took office in the UK mid-September, new policies have been enacted as the new cabinet tries to revive the UK economy that has been on a decline ever since Brexit.

One such new policy that has been widely criticised was a strange reform package that would see tax cuts for the wealthy. The policy by itself was not the problem, it was the concern that the UK government’s coffers would not be able to finance this policy that was the issue. This fear started a domino effect, with worried investors wanting to flee from the British investment scene all beginning to to sell UK assets at the same time. This sent the pound to a free fall against all other currencies in the developed world. In particular, the GBPUSD even flash dipped by 5% in a few minutes to an all-time-low of $1.035.

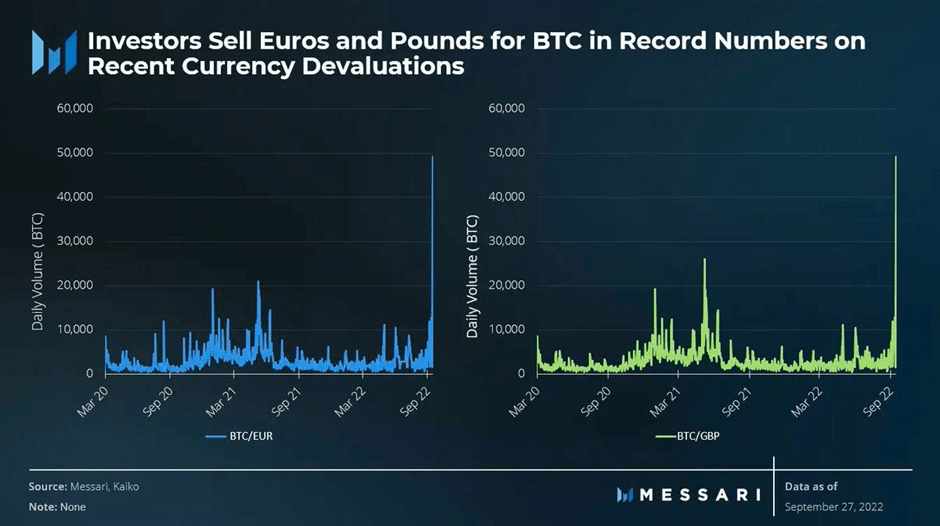

However, it was not just the USD that these investors were pouring their funds into. Another alternative asset that is independent from the fiat currency system saw trading volumes denominated in pounds skyrocket to unseen levels – that asset is Bitcoin.

Bitcoin Trading Volume Spikes in Europe

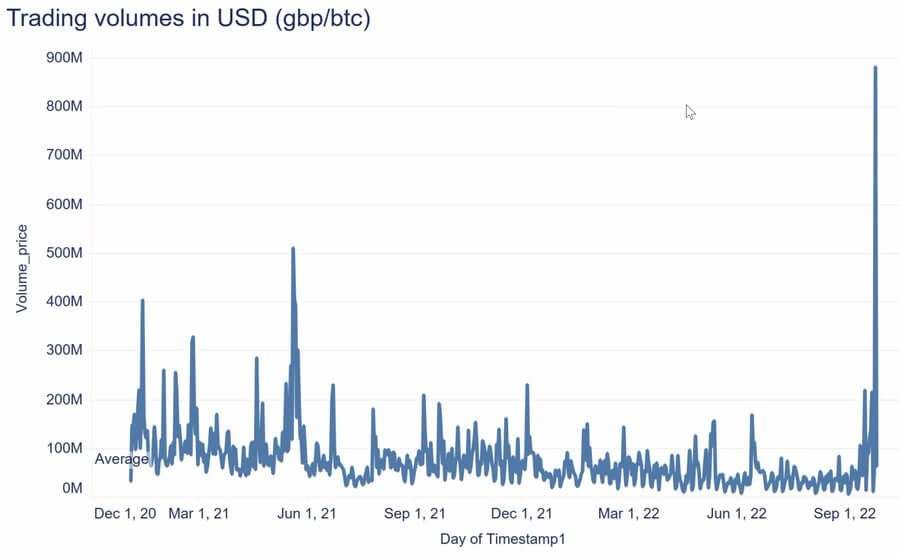

As the pound plummeted, the BTC/GBP trading pair saw a more than 10-fold surge in trading volume, a sign that pound investors were converting their pounds to Bitcoin at top speed. The trading volume just last week alone was $881 million, compared with a monthly average trading volume of only $70 million.

It was the same situation in Europe, as Europeans too, followed in the footsteps of the Britons by buying BTC as the euro fell. Even with the latest CPI figure out of Europe showing inflation at a historical high reading of 10%, investors are not betting for the euro to recover.

The phenomenon is understandable as the economic situation in Europe is being made worse by the day due the the energy crisis that is plaguing European nations due to the sanctions on Russia which bans the import of Russian energy resources.

The way things are appearing now, investors may be treating Bitcoin as an inflation hedge on top of a safe haven wealth protection asset as confidence in the euro-zone continues to fall.

Bitcoin’s Properties Makes It a Good Alternative Asset

Bitcoin’s nature of being censorship and jurisdiction resistant will be very helpful to those who are planning to leave or are in the midst of leaving Europe as the energy crisis comes to a head in winter. The ease of Bitcoin’s portability will also allow holders to easily bring their Bitcoins out of the country and continue using them in other countries without any hassle. Bitcoin holders may convert their Bitcoin into any other currency at their destination country for day-to-day transactions or simply use Bitcoin to conduct transactions, depending on the country they are in.

Hence, it makes perfect sense that investors are fleeing into the safety and convenience of Bitcoin, especially during a crypto bear market when Bitcoin is trading at a relatively lower price.

With confidence in Europe and the UK at such low levels and expectations of worst times to come, holding Bitcoin instead of the pound and euro which are depreciating at a faster rate could very well prevent investors’ wealth from being depleted indeed.

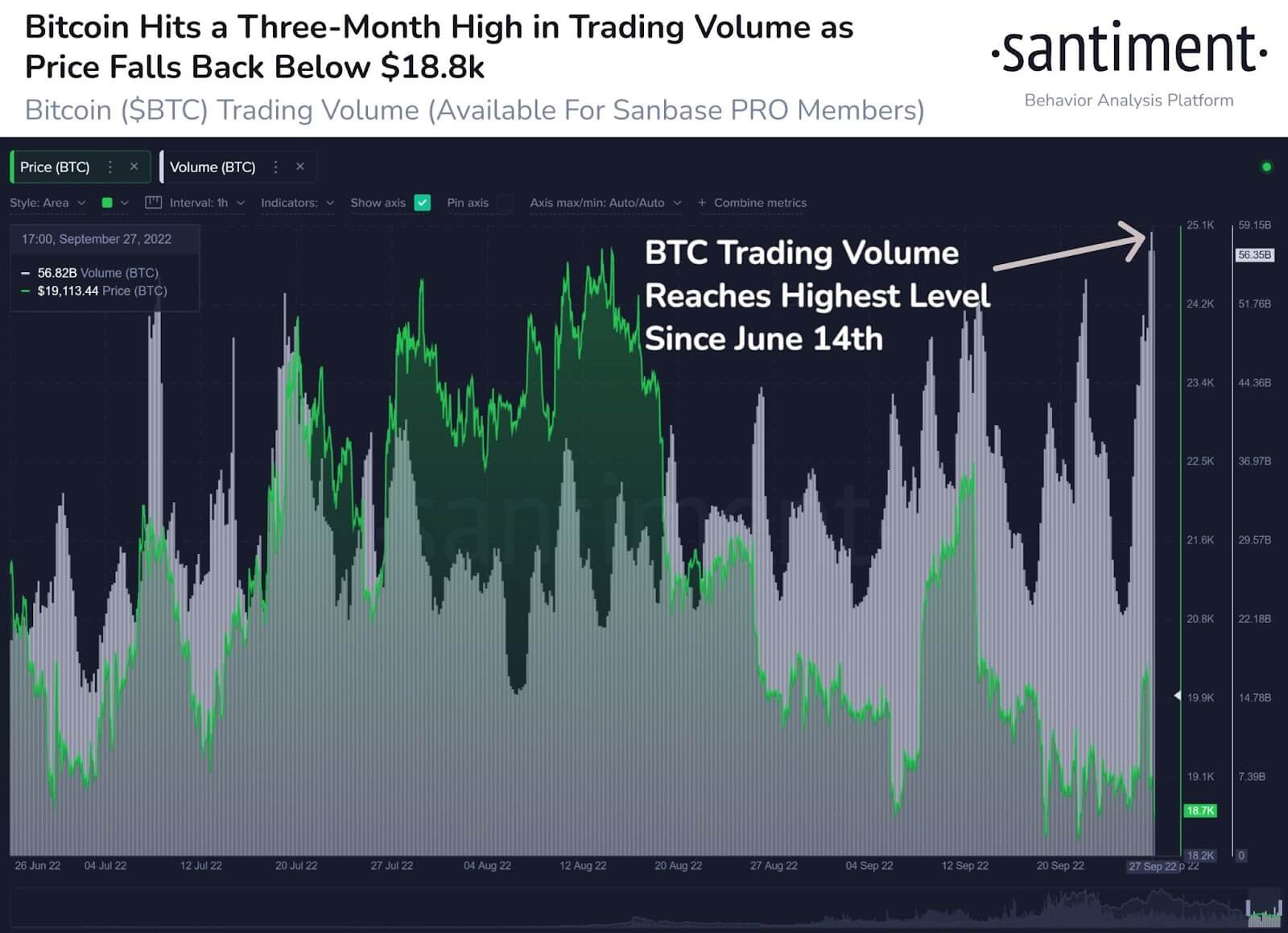

Trading volume of BTC in stablecoin-terms has also surged in tandem. These could possibly be caused by investors in the UK and Europe using stablecoins instead of fiat to purchase Bitcoin.

Regardless of the method investors use to buy Bitcoin, the recent event clearly shows that Bitcoin is gaining a foothold as the most viable alternative to the increasingly vulnerable fiat currencies that are centrally-controlled by central banks whose value could depreciate overnight due to bad policies enacted by a small group of people.

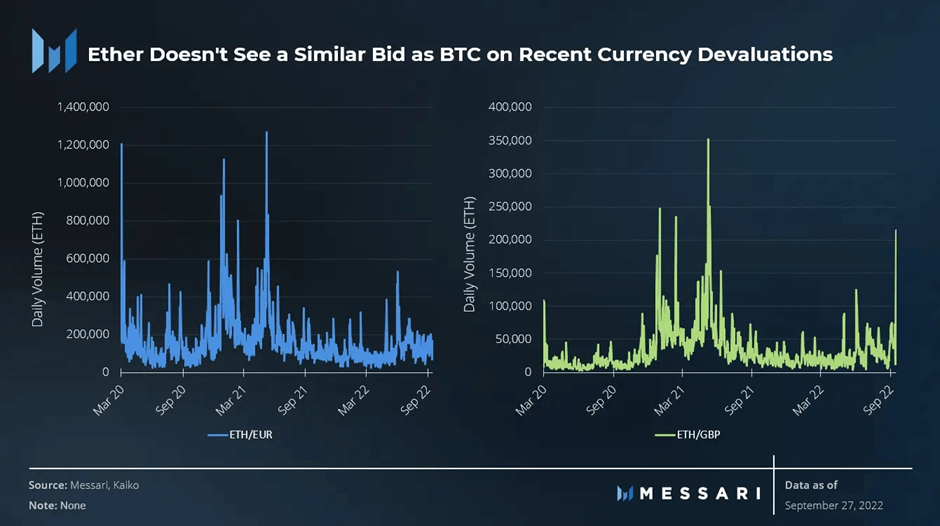

Ethereum Not Seeing The Same Inflow

Interestingly, this capital flight is unique to Bitcoin and the effect does not spill over into other cryptocurrencies. Even Ethereum, the second largest cryptocurrency by market cap, does not appear to be seeing a similar inflow, as Europeans did not seem to be buying Ethereum. While Britons did buy some as Etheruem’s trading volume in pounds did jump, it was not by as significant an amount as Bitcoin.

This goes to show that investors are only favoring Bitcoin as the safety asset and not other cryptocurrencies as yet. This is something crypto investors, especially investors that are pro-altcoins, may want to take note of.