Ominous as it may sound, Bitcoin miners’ capitulating are actually deemed by crypto market experts to be a bullish development. Historically, the time when most miners large and small have sold off their mined Bitcoins, turned off their mining rigs and left the Bitcoin mining scene, was the time that the price of Bitcoin hit its rock bottom of that cycle’s bear market. Thus, many market watchers would watch out for signs of miner capitulation in order to try and gauge when Bitcoin would see its final selldown so that they can swoop in to buy at one of the best levels and timings possible. While many investors hope to capture this time period of the best dip-buying opportunity at every bear market, not many know how to spot the signs. Thus, we detail two important metrics that can help the interested reader see the tell-tale signs and spot when miners are in extreme stress and due for capitulation. The two metrics are, Bitcoin hash rate and miners’ Bitcoin balance.

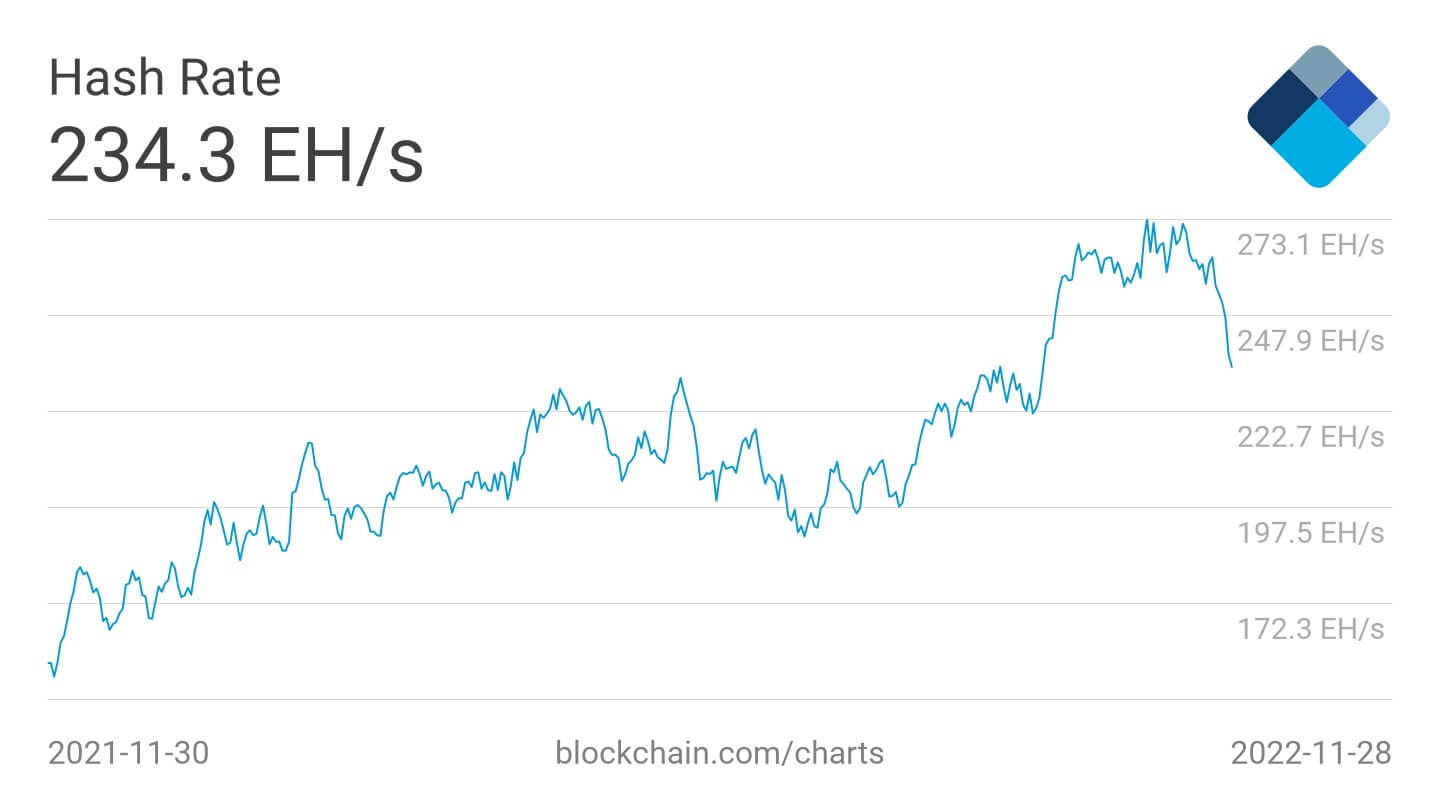

Hash Rate Big Dip Shows Miners Are Leaving

Over the past week, the hash rate for Bitcoin has started dipping sharply, from its all-time-high of 273 EH/s at mid-November to the current 234.3 EH/s as at the time of writing. This large and sudden drop in hash rate is an indication that a large number of miners are shutting down their mining rigs, possibly due to their inability to sustain their Bitcoin mining operations and are forced out of business. As we have mentioned before in one of our previous blogs most miners are expected to run into cash flow problems by December and some had already warned that they may have to file for bankruptcy by the end of this year if they are unable to raise enough cash to tide them through. Therefore, this sudden fall in hash rate could be one or some of these miners turning their machines off. With this situation coming into play now, more Bitcoin selling could come in the weeks ahead as these miners sell off their last bit of inventory to raise funds to pay off creditors and consolidate their financial positions to see if they will have to file for bankruptcy.

While the newsflow would certainly sound bearish, this is not an unusual phenomenon in the crypto space and is part and parcel of the weeding out of the less cost effective miners in every Bitcoin’s four-yearly cycle. Usually, this period of maximum pain and capitulation is followed by a period of price stability for Bitcoin after miners finish selling their coins, before a new bull market eventually begins.

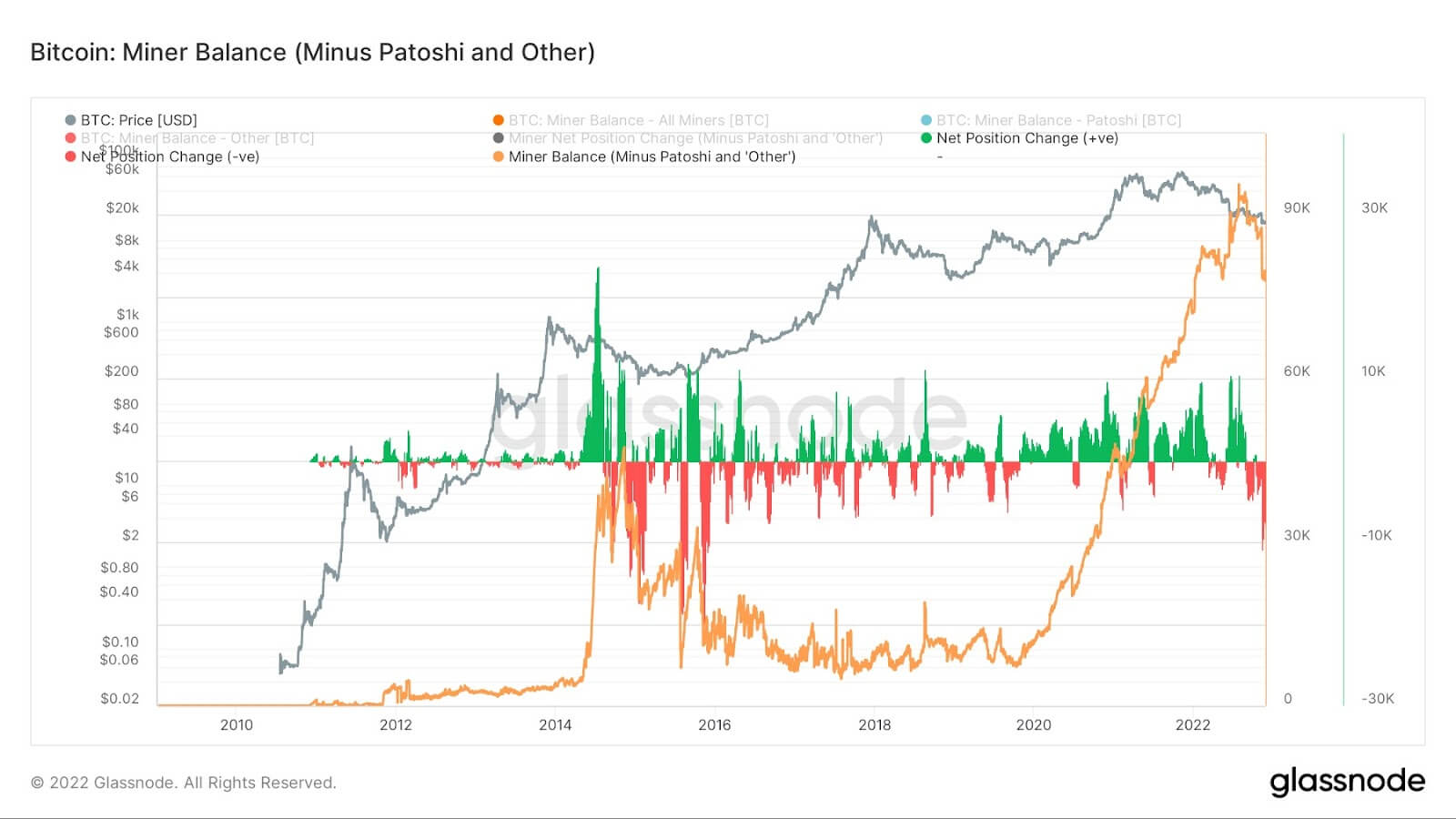

Miners Are Emptying Their Bitcoin Wallets

Another popular method to see if miners are under stress and selling their mined Bitcoin is to see the miner’s aggregate wallet balance. As can be seen from the below diagram, miner wallet balance is falling the deepest and fastest since 2016. Notice that after two big declines in miners’ Bitcoin wallet balance in 2016, the price of Bitcoin subsequently made a gradual but steep climb upwards as the start of the 2017 bull run commenced.

This begs the important question, in the case of our current market, could we see the same scenario play out? If we were to follow the 2016 trajectory, another miner dump could be in store, just like the second dump in the 2016 bear market, which was the final capitulation that put an end to the bear market at that time.

Should we follow the same storyline, then another miner led selloff could come in the coming couple of months which may or may not create another low in the price of Bitcoin (note that the 2016 second miner led selldown, the price of Bitcoin did not create a new low, it merely revisited the previous low).

The “Death” of Miners is a Sign of Market Bottom

Thus, while most traders are looking at the charts to watch for certain technical indicators to flash a buy signal, there are other types of indicators like waiting for Bitcoin miners to be pronounced “dead” as a sign of a market bottom. One way of knowing that miners are “dead” or “dying” is to follow the Bitcoin miner wallet balance above – if the wallet balance shows a big decrease, it is a sign that miners are being forced to sell Bitcoin, which is a sign of distress. Other signs that traders could keep a lookout for in the coming weeks include, a big drop in miners net position index, another big increase in Bitcoin’s selling volume, or news of big miners announcing that they are leaving the Bitcoin mining business or filing for bankruptcy. These are the easily observable telltale signs that the final capitulation is here.

Based on historical trends, investors would often reap one of the best rewards within a Bitcoin cycle if they buy during miners’ capitulation and hold on to the purchased Bitcoin in the following months, and up to two years, as miners’ capitulation has always signaled the final stage of a Bitcoin bear market.

Thus, while the news may seem unsettling to the uninitiated, Bitcoin miners going up in arms is actually what long-term crypto investors look forward to as it is one of the most historically accurate signs that the long crypto bear market is coming to an end.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.