Ever since the Ethereum Merge, where Ethereum moved from the old proof-of-work consensus model to the new proof-of-stake one, there have been concerns from the Ethereum community that it is becoming too centralized and not in line with the original ethos of Ethereum being the people’s decentralized network.

In a proof-of-stake (PoS) model, validators participate to secure the network by locking up their tokens in a process called staking, and receive a staking reward for their act of putting up their tokens as collateral to exchange for the opportunity to be selected to add to the next block of transactions. Only the adder of a new block gets to earn a staking reward, and the chances of being selected increases with the amount of collateral staked.

How Did The Problem Come About?

While initially introduced with the hope of getting as many common men around the world to participate as possible, the high amount of collateral needed, as well as the complexity of the staking process, have made it difficult for the average Joe to be able to participate in Ethereum PoS. This has resulted in the birth of staking pools, where a business entity gathers the Ethereum tokens of individuals and groups them together as a collective unit to stake together. The individual in the process, relinquishes his rights to the blockchain over to the staking pool, which is essentially a centralized business entity. This is how this centralization issue has come about – operators of Ethereum staking pools have now been given power to influence the blockchain using their customer’s Ethereum. Collectively, it is possible for such influence to overwhelm the network as Ethereum staking pools are the largest stakers on Ethereum, which is a real threat to decentralization.

The dominance of only a handful of large holders on Ethereum since it went proof-of-stake made the community uncomfortable that these small groups of people may be able to manipulate the network.

Only Two Large Wallets Control Ethereum Now

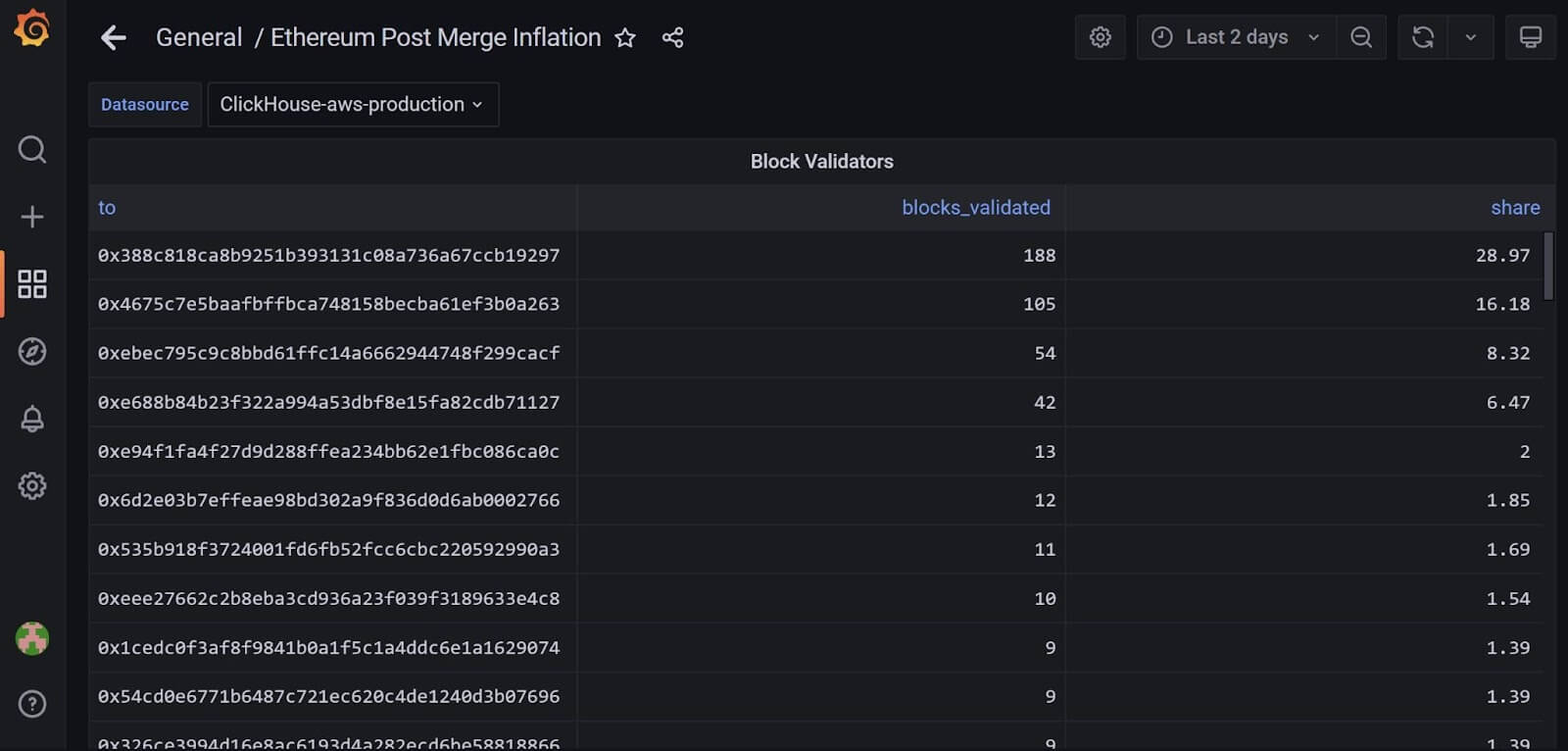

Post Ethereum Merge, data revealed by blockchain analytics firm, Santiment, shows that under proof-of-stake, more than 46% of Ethereum’s nodes are controlled by only two large wallets, which belong to Lido Finance and Coinbase. Coinbase is a centralized crypto exchange, while Lido is a DeFi platform. Both platforms are centrally operated businesses. The wallets belonging to the two platforms have the highest numbers of blocks validated, as can be seen from the below screenshot taken from Santiment, which shows their combined power adds up to 45.15% (28.97+18.18).

Other crypto experts, like Gnosis co-founder Martin Köppelmann, further point out that the top seven entities are controlling more than two-thirds of block verifications, something which disappointed many blockchain enthusiasts.

Publisher Bitcoin Magazine also flagged that the top four Ethereum validators take up a whopping 57.85% of market share, citing data from blockchain analytics firm Glassnode.

Such concentration of power in the hands of centralized entities would make Ethereum lose its censorship resistant quality that has made it valuable in the first place, as regulatory authorities would be able to issue decrees to make these controllers of validating power on Ethereum do as they warrant, including censoring certain entities from using the blockchain, or a complete freezing of assets on the Ethereum blockchain.

This fear came to the forefront recently as the US Treasury sanctioned Tornado Cash, issuing notice to various crypto exchanges to ban certain blockchain addresses that used the Tornado Cash mixer. A validator hosting service on Ethereum PoS known as Flashbots, which is used by more than half of all validators on Ethereum, even went to the extent of barring wallet addresses who had ever used Tornado Cash from connecting to the Ethereum network through them. Such a move totally goes against the spirit of decentralization.

Ethereum Co-Founder Shares Same Concern

This concern has been echoed by Ethereum co-founder, Anthony Di Iorio, who brought up this issue in an interview with Kitco News on September 29, specifically pointing out the influence that centralized platforms like crypto exchanges are having in the Ethereum network currently.

Iorio expressed disappointment that the centralization being witnessed at the moment is not aligning with the Ethereum project’s initial dream of having more people participate in the asset’s governance, and warned that if the problem persists, it might have a negative impact the businesses run on the Ethereum network, and in a worse case scenario, affect the regulatory outlook on Ethereum.

The SEC is Watching

Already, the US SEC is dishing out a preemptive warning. Gary Gensler, the chairman of the US SEC, specifically mentioned in a Congressional hearing just hours after the Ethereum Merge that he thinks most proof-of-stake cryptocurrencies are securities and that the SEC will actively pursue regulatory oversight on crypto assets that it deems are securities.

While Iorio ended his interview on a positive note by expressing optimism that decentralization will eventually be achieved in the future as the proof-of-stake model improves, the market does not appear to be as optimistic.

Ever since the issue of centralization was raised, the price of Ethereum has retreated by about 35% compared with a 24% decline in the price of Bitcoin within the same period. While some may argue that the steeper decline in Ethereum is due to it being an altcoin as opposed to Bitcoin’s leading crypto status, one cannot help but wonder if Ethereum’s underperformance could be linked to fears about the SEC.

Until the SEC gives Ethereum PoS the all-clear, this blanket of uncertainty may continue to weigh on the price of Ethereum. In this regard, the centralization concern may be a justifiable one that investors may want to keep in mind.