Chainlink (LINK), the crypto world’s most popular Oracle, has commenced the staking of its LINK tokens on the Ethereum Mainnet. What does this mean and what could it imply for LINK? Read on to find out.

What is Chainlink (LINK) and Oracles?

Chainlink (LINK) is a bridge broadly used to provide live information to decentralized applications so they will be able to run smoothly. Have you ever wondered why a decentralized exchange is able to tell you the price of an asset, or if a decentralized weather application is able to tell you weather conditions? This is where LINK comes in. Essentially, LINK gathers details about what type of information a decentralized application would need to be able to operate optimally, and sends this information to them. This information is gathered through countless computers across the world that run the LINK node, each providing a variety of different real world data to feed back into a smart contract, which is then dispersed to different decentralized applications which require a variety of such data.

These nodes, which operate as real-world data bridges that are connected to blockchain-based smart contracts, are referred to as oracles. Every oracle within the LINK decentralized oracle network is incentivized to provide accurate and timely data with a reputation score assigned to each. Examples of factors that could affect an oracle’s reputation score include, total number of assigned requests, total number of completed requests, total number of accepted requests, average time to respond, and amount of penalty payments. When oracles follow the software’s rules and provide useful and accurate data, they are rewarded with the LINK token.

The developer of a decentralized application will program into their codebase about when and where LINK will be needed to provide information and then the application will be ready to roll once it is deployed. This essentially means that the accuracy of the data provided to the smart contract is crucial to the success of the application since if wrong information is being fed to the smart contract, the application would not function optimally and arbitrageurs would be able to take advantage of the application, or worse still, the entire decentralized application could incur losses due to inaccurate information input and execution. Thus, achieving data consistency and accuracy for the oracles are extremely important, yet difficult. While sounding like a very tedious task to achieve, LINK has solved this problem using their proprietary algorithm when the team worked out how to retrieve and share information from oracles without putting the security of the blockchain and the smart contracts they run at risk.

The LINK token is the fuel needed by all these decentralized applications to use the oracles. An application that wants to use LINK’s oracle will need to use the LINK token to interact with them, and this implies that the use of the LINK token will be required every time the application needs to gather information from the bridge. This means that LINK will eventually not be blockchain specific and can be run on any blockchain. However, since its inception in 2017, LINK has so far only been run on Ethereum, making it an erc-20 only token for the moment.

We think that there is no hurry to deploy LINK on other blockchains soon anyway since there is not as much consistent adoption on other blockchains as yet since the industry is still nascent and evolving. This explains why LINK staking is being offered only on Ethereum Mainnet.

LINK Has Commenced Staking To Incentivise Oracles

After almost five years since its birth, LINK has finally rolled out its reward program to its oracles via a staking program on December 8.

The program, which is currently running on beta version and not yet officially live, lets people earn rewards for maintaining the protocol’s performance and keeping it more secure. The program is currently paying out 4.75% in annualized rewards to stakers in the form of LINK tokens. According to a LINK spokesperson, around 7 million tokens, valued at about $51 million, were staked in the first 30 minutes of launch. The beta version has an initial limit of 25 million LINK, with plans to scale up to 75 million LINK over time.

According to LINK co-founder Sergey Nazarov in an interview with Coindesk at the launch, this staking program allows LINK to scale up the ecosystem by giving incentives to the people who can help the ecosystem to grow. As we have explained earlier in our article, the accuracy as well as timeliness and consistency of an oracle is very crucial and as LINK gets more adoption from a greater number of decentralized applications, the level of performance these oracles provide is growing in importance and visibility. Thus, it is timely to roll out the incentive program now, especially at a time when decentralized exchanges are growing in popularity post the FTX saga, and when web3 adoption is expected to be the next driving force behind the blockchain revolution.

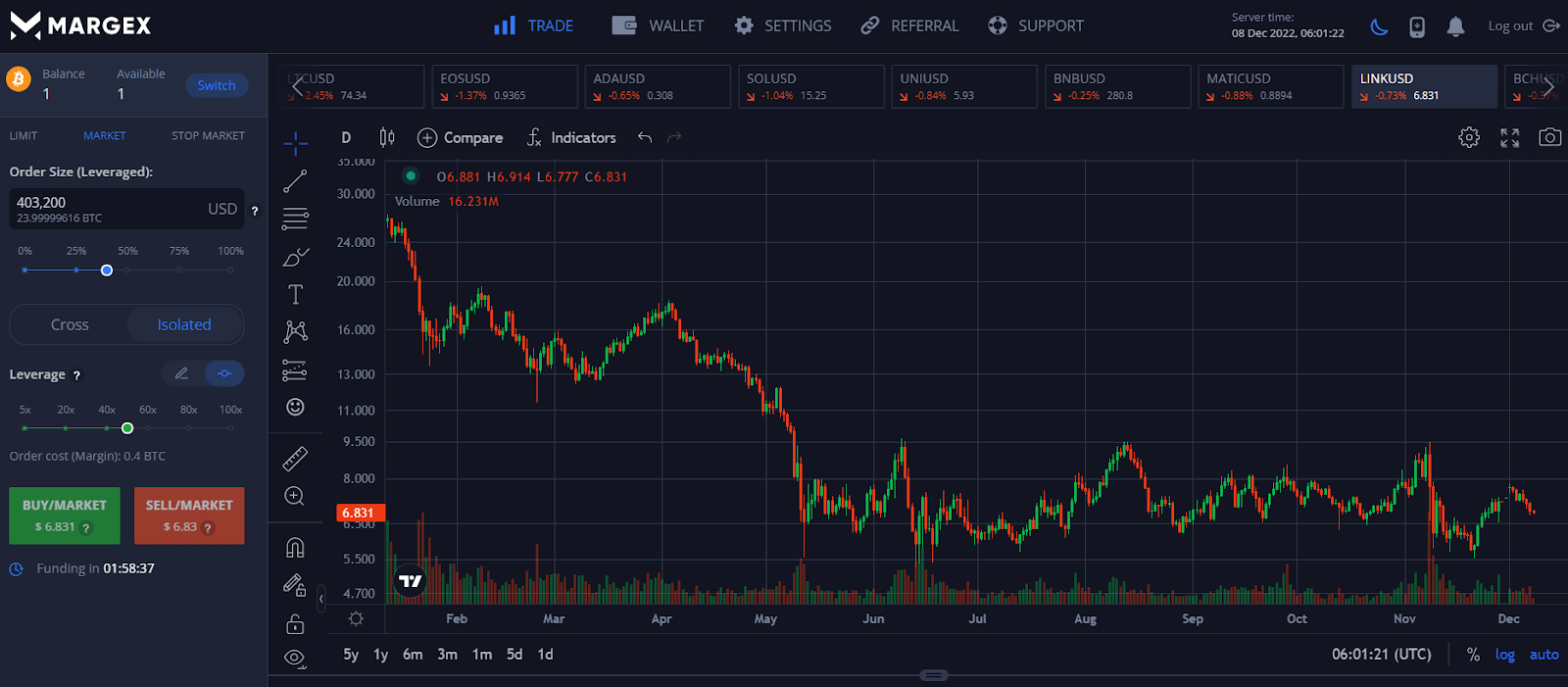

LINK Token Rose on Announcement But Sold After Launch

In the lead up to the exciting launch of staking on LINK, the LINK token had been bought aggressively as crypto investors hoped to join the rewards program. However, as more details were revealed, some investors were disappointed to learn that their LINK tokens, as well as their staking rewards, would have to be locked up for between nine to twelve months until the next upgrade of the staking protocol is released. This has caused the LINK token to retreat in recent days. However, since the announcement of the start of the staking program in November, LINK has gained about 35% from a low of $5.60 to a high of $7.60 and is currently trading at around $6.80, which is still around 20% higher than its November low.

While the staking news did bring the price of LINK higher initially, this seems to pretty much end up becoming a non-event for the price of the token, as it has fallen back into range. That said however, should the price of LINK make a higher low and not drop below the area of $6.40 and move higher to break the resistance of around $9.00, more upside could be forthcoming.

Currently however, the token appears to be falling back into the middle of its range trading “buy zone”. Should its price revisit around $6.40 or lower again, traders could use the opportunity to buy at the lower end of the range to sell at the upper end of the range which is between $7.80 to $9.00.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and are only meant to be informative in nature. Thus, they should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.