As the crypto market starts to rebound, many altcoins that have been beaten down very badly in 2022 are beginning to recover off their lows, exciting many crypto investors who largely hold altcoins and hope their favourite tokens will start climbing back higher again. However, just as many are hopeful, there are many others who are skeptical of the small rebound, afraid that it will turn out to be a bull trap and prices could fall deeper into the red once they load up the truck.

Although there is an altseason index that measures whether we are in an altseason, the measure is as laggard as it can be, typically only showing you that you are in altseason when the altseason is coming to an end. Hence, many crypto investors search high and low for a consistent method to know if an altseason is imminent so they can get buy ahead of time.

We list down a couple of factors that our experts at Margex would look at to determine the chances of an altseason emerging.

What is an Altseason?

For the uninitiated, an altseason is a period of time where altcoin prices rise more than Bitcoin’s price in percentage terms. Simply put, altseason begins when altcoins start to outperform Bitcoin (when prices of altcoins rise in comparison to Bitcoin), and altseason ends when Bitcoin outperforms altcoins.

Readers need to note that altseason only applies when prices are going up. When altcoin prices fall less relative to Bitcoin, that is not altseason. It is usually difficult for altcoins to fall less than Bitcoin due to the way altcoin prices are calculated, however, due to the fact that most coins are now paired with stablecoins, it is not impossible. It could happen when Bitcoin price is under tremendous stress and falling sharply lower while there is less selling pressure on altcoins. However, this subject matter is beyond the scope of this article and we will thus just focus on discussing about altseason.

Ethereum Outperformance

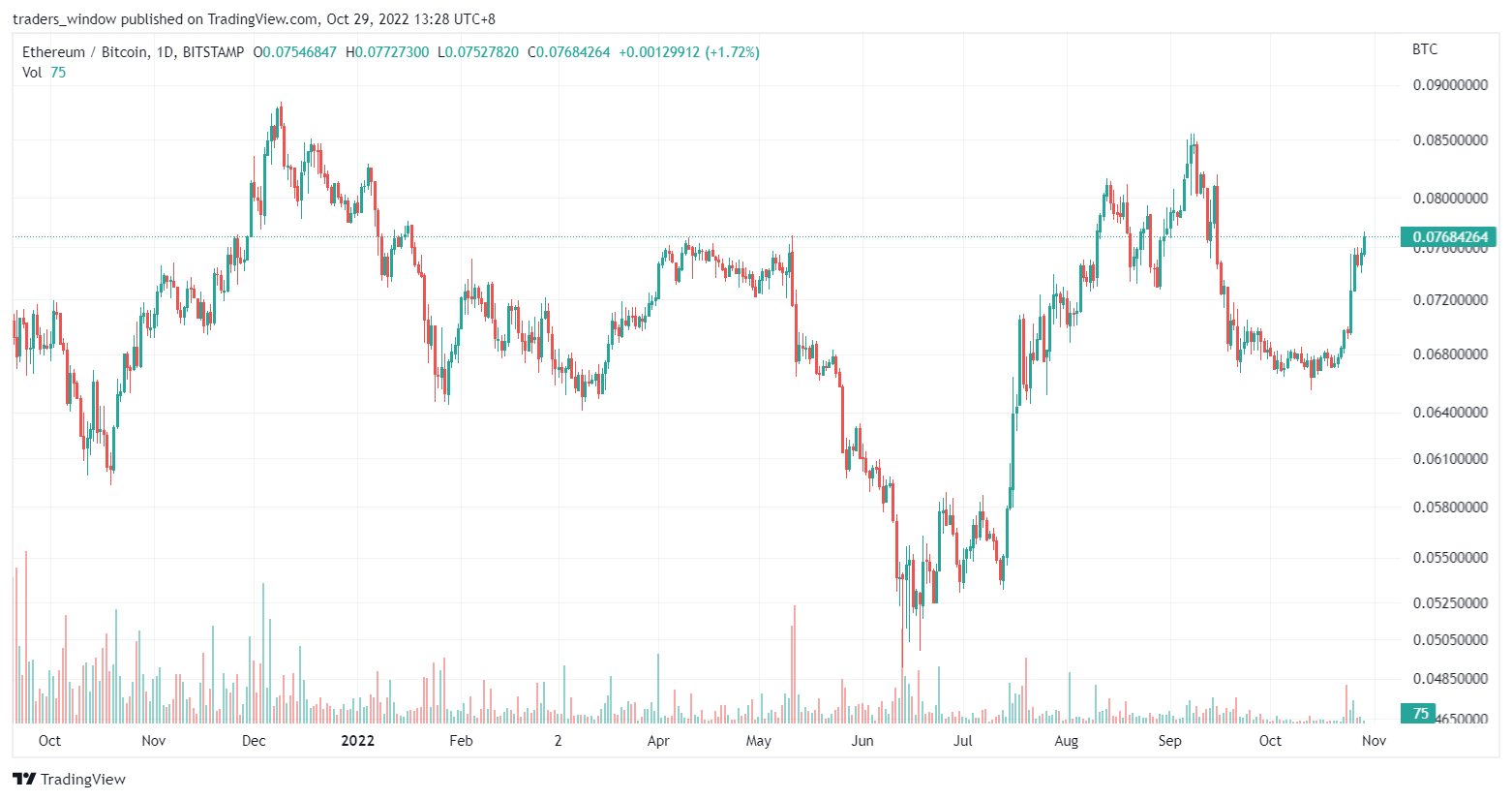

First of all, one cannot say an altseason is imminent without the leader of altcoins, Ethereum, outperforming BTC, and for that matter, any average altcoin. In the history of crypto trading, Ethereum has always been the leading indicator of an altseason – you never would have seen altseason start off without Ethereum flying off to the races first. This could be due to the fact that many large traders and whales use Ethereum as a sentiment gauge. If Ethereum is outperforming Bitcoin, it means money is flowing out from the safety of Bitcoin and stablecoins, which is a sign that large investors are having a risk-on mode, this will then encourage whales to start playing other altcoins. Large funds and whales always test out the market by using Ethereum since it is the largest cap altcoin. If Ethereum can hold on to its price increases, it is an affirmation that investors are in the “high risk high return” mode that favours altcoins. This appears to be the case for the current rally as Ethereum has not only managed to hold on to its gains, but has gone on to move even higher. The performance of Ethereum relative to Bitcoin can be easily tracked by looking at the ETH/BTC pair.

From the ETH/BTC chart above, one can see that ETH has broken out of a consolidation since September and rocketed higher. It paused for a few days and has only started its next breakout, which could take it higher to test the region of 0.085 BTC. This means that Etherum still has room to outperform Bitcoin, i.e. the first condition of an impending altseason has been met.

BTC Dominance

The second condition that needs to be fulfilled to have an altseason is for Bitcoin dominance to be falling during a period of time when average crypto prices are rising.

The above is the Bitcoin Dominance chart, which is a measure of the dominance of Bitcoin’s value in the entire crypto market cap. This measure has been falling as the crypto market matures as a result of more new coins taking up a larger share of the market, which naturally reduces Bitcoin’s dominance. During a bear market, Bitcoin’s dominance usually rises slightly as Bitcoin is the de facto safe haven of crypto and some investors may like to park their funds in the safety of Bitcoin because it is less volatile than altcoins. However, when risk-seeking mode is on, Bitcoin dominance falls as altcoins start to pump.

In the above chart, the dominance of Bitcoin has just broken down from a rising trend into a falling trend. This movement is favourable for altcoins as the Bitcoin Dominance chart looks bearish – it could possibly retest the 39% low or even break lower as this can also be seen as a bear flag in the process of being played out.

While it is still a bit early to know if the break will be sustained, both the ETH/BTC chart and the Bitcoin Dominance appear to be reinforcing the same story – that Etheruem could outperform Bitcoin and Bitcoin’s dominance could start to fall. This usually is the precursor of an altseason.

Note that between May and September, even though the Bitcoin dominance was falling, due to the fact that the entire crypto market was crashing during that period of time, it cannot be classified as altseason as we have explained earlier that altseason applies only when average crypto prices are rising. When prices are falling, it is called a bear market.

By using ETH/BTC and Bitcoin dominance as leading indicators, we hope to give our readers the unfair advantage of knowing that the recipe of an altseason is in the making and they may want to take advantage of this advanced knowledge and make a list of the favorite altcoins that they would like to buy and get in early.

Of course, our experts may not be 100% correct and therefore, please note that the above is the personal opinion of the author and is only meant to be an informative post. It should not be construed as a solicitation to trade nor is it financial advice. Should you be in doubt as to whether you should be investing, kindly speak with your personal financial advisor.