Rumours over one of the largest banks in the world, Credit Suisse, facing a survival issue has picked up speed intensively on the social media grapevine in recent days, with some pessimists even drawing a parallel to the 2008 Lehman implosion.

As bearish spectators started giving out pieces of information describing just how dire the situation at the Swiss bank is, many investors are worried, yet confused as to what is happening due to the information flow being largely disorganised and disjointed.

Here, we try to piece together the events and help our readers make sense of the situation to help them decide if they would want to reduce their exposure to the markets.

How Did The Trouble Start?

The situation has been brewing for several months but has picked up in intensity over the past week after the CEO of the second largest bank in Switzerland wrote a memo to assure employees that the bank would ride out this critical moment – a move which was viewed as an admission of crisis by the market.

The trouble for Credit Suisse started with two costly business mistakes that resulted in losses of several billion dollars to the bank.

The first error was having invested in Greensill, which filed for bankruptcy in March 2021. Greensill was a supply chain and accounts receivables lender that specialized in business financing and repackaging of business debts as derivatives to resell to its investors. The business failed after COVID hit and Credit Suisse had invested more than $10 billion in it.

The second failed move, which was the fatal blow, involved its investment banking division, which had failed in its risk assessment and lent $30 billion of trading credit to a family office named Archegos Capital Management, which subsequently filed for bankruptcy in the Spring of 2021 after losing a big portion of the funds Credit Suisse lent to it for speculation.

Deutsche bank analysts, after analyzing the assets and liabilities of Credit Suisse, determined that the beleaguered bank has a $4.1 billion funding gap that needs to be filled before the end of October to avoid having to file for bankruptcy.

Indeed, the bank has promised investors that it would present a strategic transformation plan to save the bank on October 27, which many speculate would include the sale of its troubled investment bank, to recover losses. The trouble is, who is going to buy it?

Credit Suisse Default Insurance Spikes

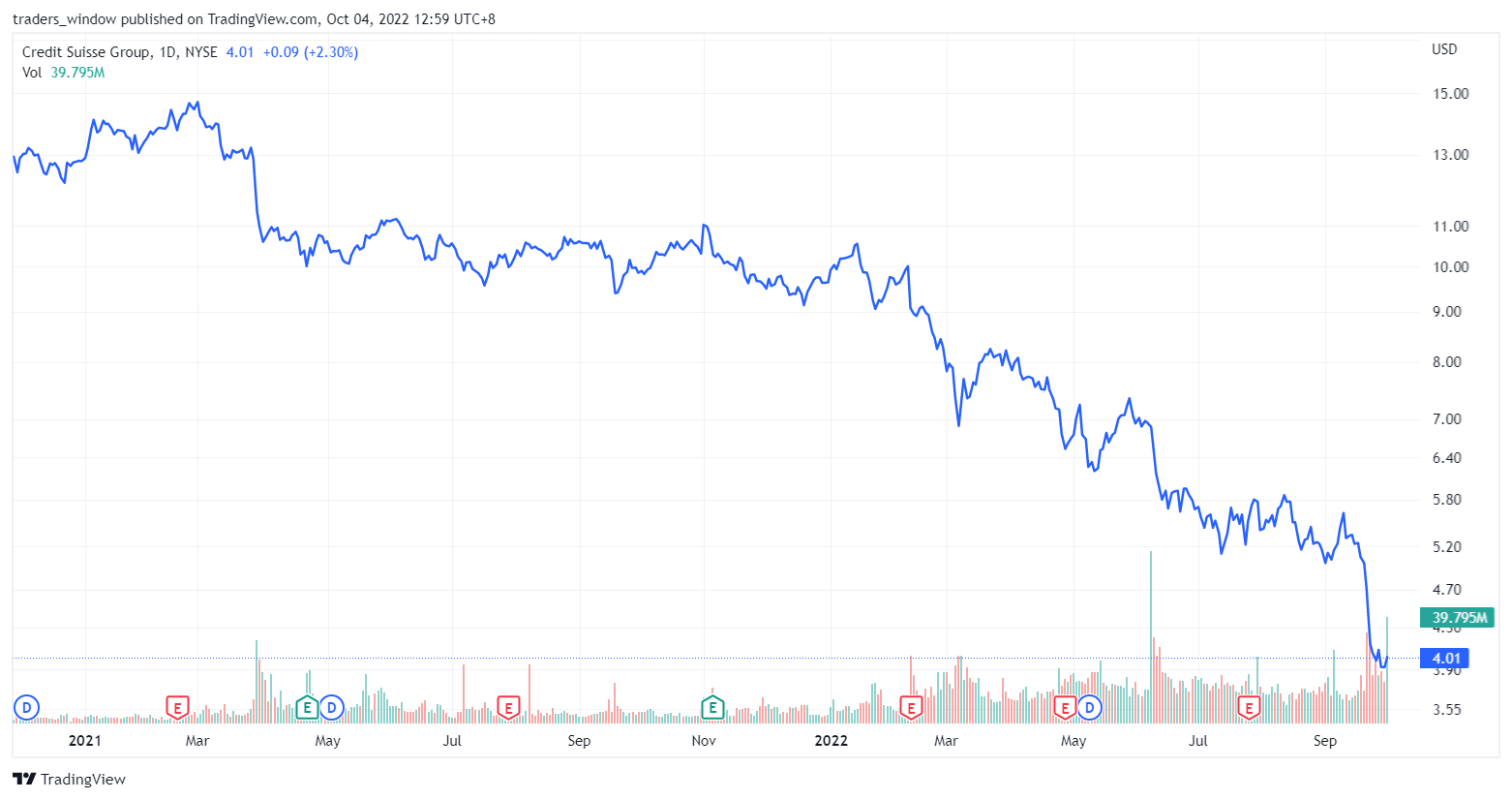

While the bank still has some time to find a suitor for its assets which are now more like liabilities, its share price has been sinking in recent days, with the last check on October 3 seeing it trade at $4, its lowest in history, at a price-to-book ratio of around 0.23. A healthy bank’s price-to-book ratio should be around 1.

As market participants start pricing in the chance of the bank going bust, its credit default swaps are soaring through the roof. Credit default swaps, commonly abbreviated as CDS, is a tradable insurance product investors can buy to protect against the default of companies.

These products come in tenors of 1-year, 5-years and 10-years. As the possible default of Credit Suisse is less than a month away, its 1-year CDS has spiked through the roof as of October 3 as seen in the below diagram, showing the market’s lack of confidence in the bank’s turnaround.

How Will Credit Suisse Affect Other Banks?

With the failure of yet another bank no longer a faraway possibility, investors are wondering how this would impact other banks as well as the overall financial markets, especially when the businesses of global banks are complicatedly intertwined.

First of all, to put things into perspective, the problem with Credit Suisse appears to be unique to the bank due to its bad investment decisions, and not a systemic one that is also experienced by other banks.

However, counterparty risks should definitely not be ruled out, especially when large banks and the global financial system are so interconnected. Credit Suisse Group itself has over 50 different business units, and at the moment, it is still too early to determine how deep counterparty risks would go due to a lack of information – the bank has an embargo on its situation until it makes an official announcement on October 27.

The silver lining is that in the aftermath of the Lehman crisis, the global banking sector has implemented a reform package specially chartered to prevent future bank failures, and if a bank failure cannot be avoided, to minimise the contagion from spreading to other financial institutions.

Known as the Basel III framework, international banks have been made to increase minimum capital requirements for market risks, increase their liquidity coverage ratio, as well as increase their net stable funding ratio. This framework applies to Credit Suisse and all other European and US international banks. Annual stress tests have also been regularly conducted to ensure that the recommendations are followed and that risks are well-mitigated by the entire banking system. Since the implementation of Basel III in 2009, the yearly stress tests have all been passed with flying colors by the respective banks within their jurisdictions.

Hence, while the possibility of upheavals coming out from the Credit Suisse debacle is there, a global financial crisis of the Lehman magnitude is not likely to repeat, unless there are structural unknowns within the global banking system that have not been made known to the public.