Traders who have found the most significant success in cryptocurrency use a methodical approach and carefully limit their risks. A long-term investment strategy is a disciplined plan that aims to achieve specific monetary objectives over at least five years. Investors may devise plans to fund future goals, including education, homeownership, and retirement.

The topic of this article is focused on how to trade crypto. Cryptocurrency trading, like many other aspects of the cryptocurrency market, might first seem complex and challenging to grasp. Cryptocurrency trading platforms, however, have made global, real-time trading simpler than ever before.

Furthermore, these companies have made trading cryptocurrencies like stocks and bonds a comparable experience by providing user interfaces similar to or identical to their conventional online trading platforms.

This article is a beginner’s guide on how to trade cryptocurrency for profit, read on to find out!

What Is Cryptocurrency?

Cryptocurrencies are digital currencies in which transactions are validated, and records are kept by a decentralized system rather than a centralized authority utilizing encryption. It may be defined as any money that exists solely digitally, has no central issuing or regulating body, and depends on encryption to prevent counterfeiting and fraudulent transactions.

Cryptocurrencies have worth even though we cannot see or touch them. Cryptocurrencies may be held in a ‘digital wallet’ on a smartphone or computer, and its owners can transmit them to others to purchase goods.

Bitcoin is said to be the first cryptocurrency ever developed. It originally appeared on the scene in 2009 and was created by a guy who went by the moniker, Satoshi Nakamoto.

Today’s most popular cryptocurrencies are Bitcoin, Dogecoin, Litecoin, Ethereum, Cardano, Ripple, XRP, Stellar, and Tether.

Nowadays, it is typical for customers to make purchases using cash or a debit card, which enables them to spend money they already have in their bank account.

A series of events occur when someone uses a bank card to purchase anything at a store. The individual gives the business their bank information, and the shop then gives that data to the bank, which verifies its records to determine whether the client has enough money in their account to pay for the item. Once this is verified, the bank informs the business that the transaction is complete and changes its records. Cryptocurrencies, on the other hand, operate in a fundamentally different manner.

These digital currency exchanges are known as ‘peer-to-peer’ transactions, indicating that no banks or third parties are involved. Instead, every transaction is recorded on a gigantic database known as a blockchain, which is like a giant spreadsheet.

Each transaction is represented by a block added to the bigger chain; thus, the term blockchain and all transactions are permanently stored in the blockchain. A blockchain is not concentrated in a central location but is dispersed throughout a vast network of computers that are maintained safely at all times by complicated processes. This makes it almost hard for anybody to tamper with a blockchain and protects the security of all transactions and users.

What Exactly Is Crypto Trading?

Cryptocurrency trading refers to speculating on the price of cryptocurrencies via a contract for difference (CFD) trading account or directly buying and selling the coins on an exchange. Bets on Bitcoin (BTC) price fluctuations may be made via Contracts for Difference (CFD) trading, a sort of derivative, without actually owning any Bitcoin (BTC).

If you think the price of a cryptocurrency will go up, you may “go long” (purchase), whereas if you think it will go down, you can “go short” (sell). Both are leveraged securities, giving traders total exposure to the underlying market with just a little initial investment (via a process known as margin trading in cryptocurrency). On the other hand, leveraged cryptocurrency trading multiplies both profits and losses because they are still calculated based on the overall quantity of the investment.

Further, traders employ bitcoin options to hedge their bets or broaden their exposure to the market. The term “derivative” is used to describe a financial instrument based on the value of another asset, in this instance, the price of the underlying cryptocurrency, and “options” is the common term for trading in such instruments.

In-depth familiarity with the underlying assets and technology of cryptocurrency trading should precede any severe consideration of entering the market. Thousands of other digital currencies have sprung from Bitcoin’s original roots.

Trading cryptocurrencies may be as complicated as trading stocks or futures on another financial exchange. Bitcoin was the first digital asset introduced in 2009 and continues to dominate the sector in terms of market value and popularity.

Over time, a whole market for different digital goods that may be traded for money has emerged. The term “altcoin” refers to any cryptocurrency that is not Bitcoin (ETH).

Learn the ins and outs of crypto trading with this thorough book that covers everything from the basics of cryptocurrency to the ins and outs of technical and fundamental analysis, as well as the many trading styles and platforms available for trading cryptocurrencies.

How To Select Investments When Trading Crypto

There is no one most significant cryptocurrency, but there may be one that is optimal for a specific use case. For example, due to its broad acceptance and a limited quantity of 21 million coins, Bitcoin is the most significant cryptocurrency to utilize as a store of value asset.

Most significant cryptocurrency projects have market capitalizations in the top 50. Most small-cap cryptocurrencies have dubious use cases or have failed to deliver on their promises. Small-cap cryptos are often riskier than larger-cap currencies such as Bitcoin and Ethereum.

Investing in cryptocurrencies with a strong team behind them is critical. Studying the whitepaper of a cryptocurrency is advisable to learn more about it. This will give you an overview of how cryptocurrency works and what it is supposed to be used for.

Metaverse coins have been a popular asset class since the beginning of 2022. Tokens such as MANA and SAND are in-game money for the blockchain-based metaverses Decentraland and The Sandbox. This year’s momentous event is Ethereum’s transition to proof-of-stake (PoS) in the summer of 2022 when the network moves away from the ecologically destructive proof-of-work consensus process.

However, the transition to PoS will not likely minimize network transaction costs, one of the consumers’ most significant pain points. One solution in 2022 is the continuous development of layer two scaling solutions such as Polygon. Polygon networks seek to lower gas prices and transaction delays on the Ethereum blockchain, making it more accessible to consumers.

Ethereum has witnessed substantial growth due to the creation of DeFi and NFTs, with other altcoins also witnessing significant value increases over the last year. Ethereum is popular owing to the wide range of financial applications developed on its blockchain and the opportunity for developers to bring blockchain ideas to reality.

How To Trade Crypto On Margex For Beginners

There is not a single best strategy for trading cryptocurrencies since there are several. Learning the fundamentals of cryptocurrency trading is a prerequisite to entering the market. Risks and rules relevant to a specific situation must be understood to make informed choices.

Sign up for a cryptocurrency exchange

If you do not already hold cryptocurrency, you must create an account with Margex.

To create an account with Margex, you must provide personal identifying information like a stock brokerage. When you create an account, you must provide your email address, a form of identity, and other Know Your Customer (KYC) requirements.

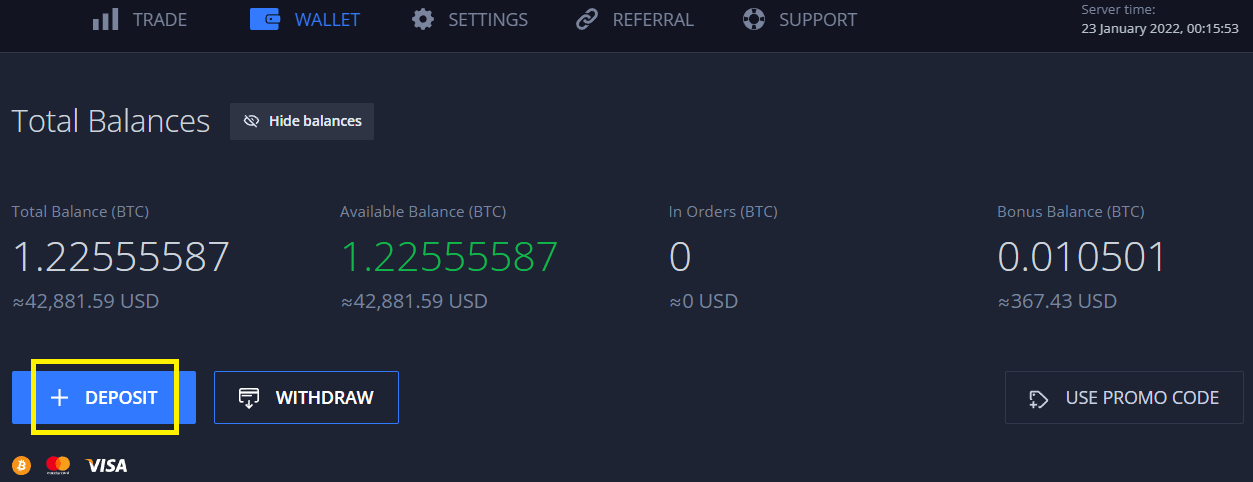

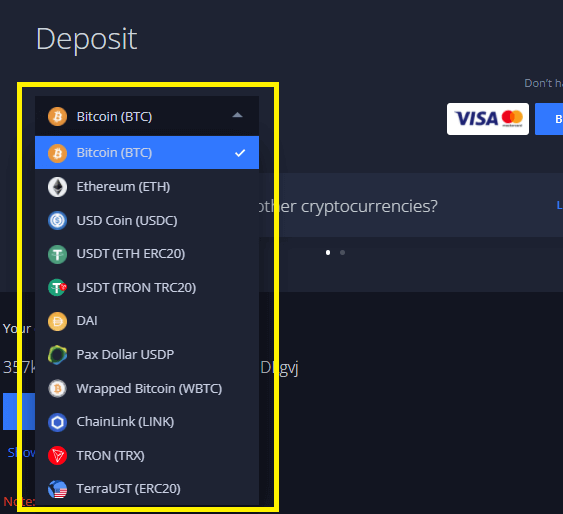

Fund your account

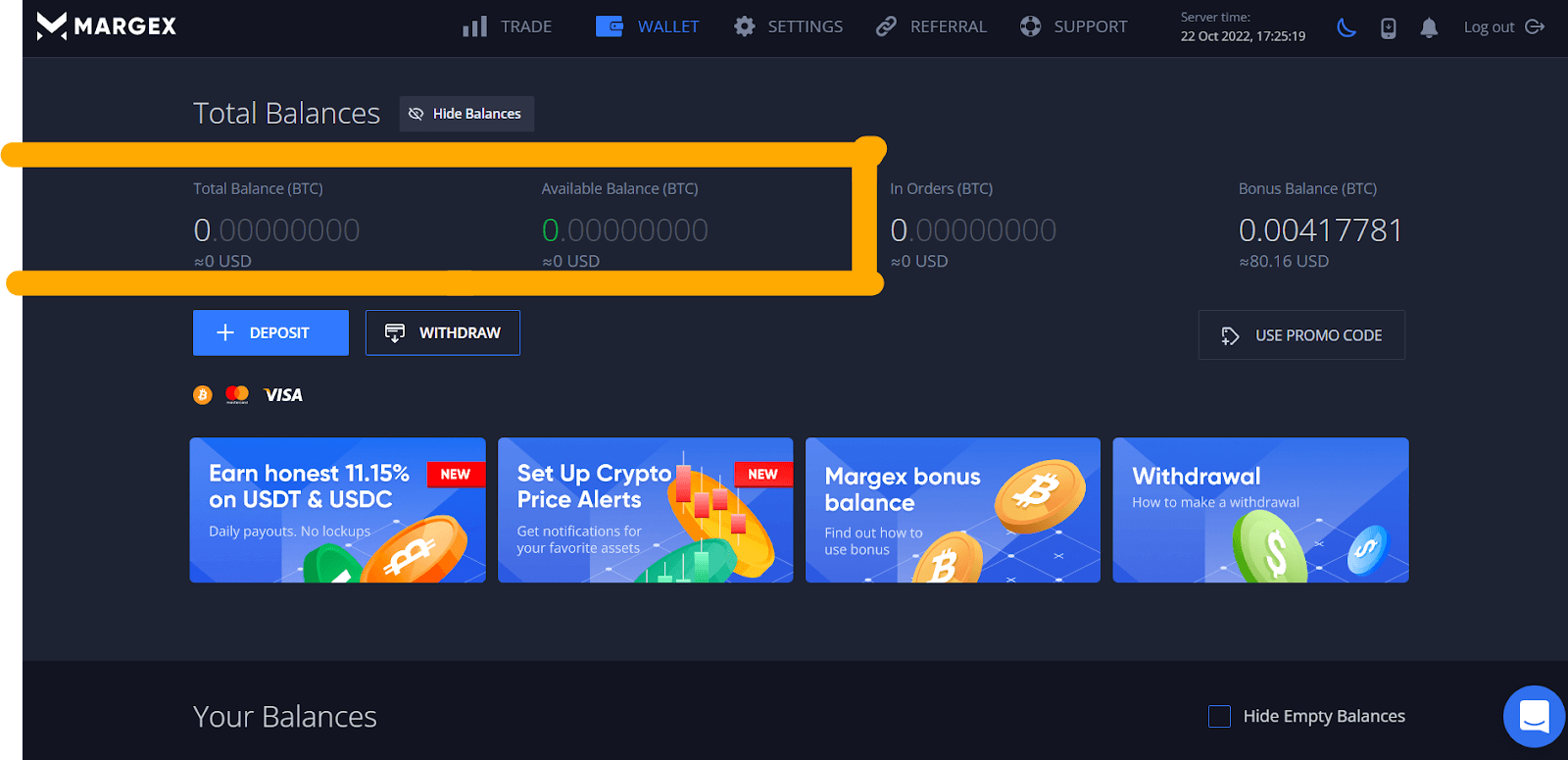

After you have joined up with Margex, you will need to link your bank account.

Margex, like many other cryptocurrency exchanges (such as etoro and Binance), allows bank deposits in the form of debit cards and wire transfers.

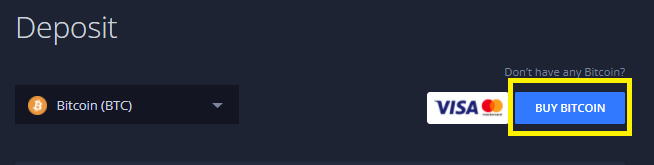

Choose a cryptocurrency to invest in

The bulk of cryptocurrency traders invest in Bitcoin and Ether. However, since significant cryptocurrencies move more reliably than smaller altcoins, trading using technical indicators is conceivable.

Once you’ve clicked the “Buy Crypto” button, follow the steps given by Changelly to complete the transaction.

Many cryptocurrency investors invest some of their funds in altcoins. Small mid-market size cryptos have more significant upside potential than large-market cap cryptos, albeit riskier.

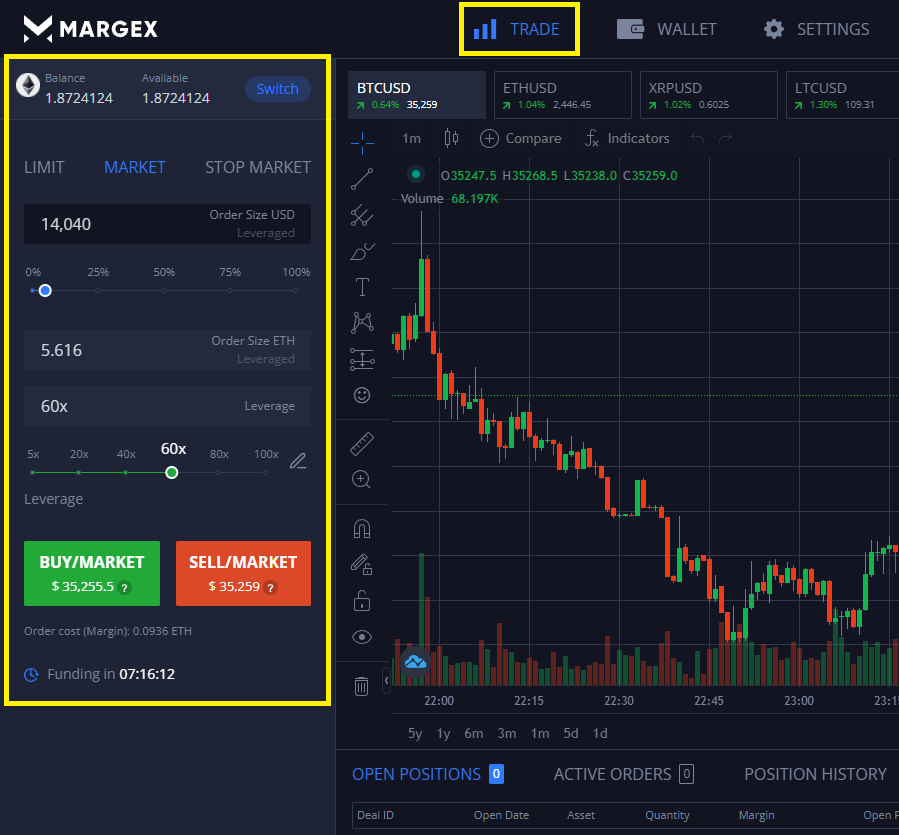

Begin trading

You might consider automated crypto trading using software if searching for a crypto trading technique. Crypto trading bots use a technique that is meant to offer you the highest potential profits depending on your investing goals.

With crypto automatic trading, you may earn money quickly, maintain your coins, or diversify your portfolio in a prudent, neutral, or aggressive manner. You may even experiment with actively trading cryptocurrencies on specific sites while automating trading on others.

Store your cryptocurrency

If you are actively trading BTC, you must maintain your money on the exchange to access them. You should get a Bitcoin wallet if you purchase bitcoin for the medium to long term.

There are two kinds of bitcoin wallets: software wallets (also known as e-wallet)and hardware wallets. Both are secure, but hardware wallets provide the maximum security since they store your bitcoin on a physical device that is not linked to the internet.

The Fundamentals Of Crypto Trading

Bitcoin’s worth fluctuates minute-by-minute, day-by-day, thanks to a 24-hour market. Bitcoin, a decentralized digital asset whose value is established by an open market, has special issues related to volatility compared to more conventional currencies.

For this reason, even casual participants in the crypto trading economy would benefit from a basic understanding of how to trade cryptocurrency for profit so that they can trade securely.

Bitcoin trading may be as fundamental as exchanging one Bitcoin for another or a fiat currency like the U.S. dollar or as sophisticated as employing several trading pairings to ride the market to expand one’s investment portfolio successfully. Naturally, a trader’s exposure to risk grows in proportion to the amount and complexity of a crypto deal.

Let us start by reviewing some fundamental ideas.

Blockchain-based currency exchange structure

There must be both a buyer and a seller in each bitcoin exchange. One party to a deal (the buyer or seller) will always benefit more than the other. As a result, there can only ever be one winner and one loser in each trade transaction. Knowing the ins and outs of the cryptocurrency market’s function may help reduce the risk of loss and maximize the reward.

When a buyer and seller agree on a price, the deal is completed (via an exchange), and the asset’s market value is established. Most orders are placed by buyers, who often select a lower price than sellers. The two halves of an order book are thus formed.

Cryptocurrency prices rise when demand exceeds supply, as shown when purchase orders exceed sell orders. The opposite occurs when there are more sellers than buyers, and the price falls. Numerous marketplace front-ends use contrasting hues to denote the purchase and selling of items. This is done so the trader can quickly read the current market situation.

As a trader, you have probably heard the old phrase, “Buy cheap, sell high.” The adage gives a simple picture of the motivations of buyers and sellers in a marketplace, but it may be difficult to traverse since high and low prices might be relative.

You probably want to spend as little money as possible on any purchase. If you are trying to sell anything, you probably want to maximize your profit. This is sound advice in general, but there is also the question of whether to “long” or “short” an asset.

To “go long” on an asset is to purchase it with the expectation that its value will rise in the future. In contrast, shorting an asset is selling it with the hope of purchasing it again at a lower price and making a profit from the decline in value. However, shorting is more nuanced than this simplified explanation suggests since it entails selling assets that have been borrowed and will be repaid at a later date.

Understanding The Markets

To the average person, “the market” may seem like a sophisticated system that only a professional could hope to comprehend. However, the fact is that it all boils down to individuals buying and selling. At first glance, learning how to trade crypto may seem to be an obscure notion. However, the concept becomes more apparent once you get the hang of it.

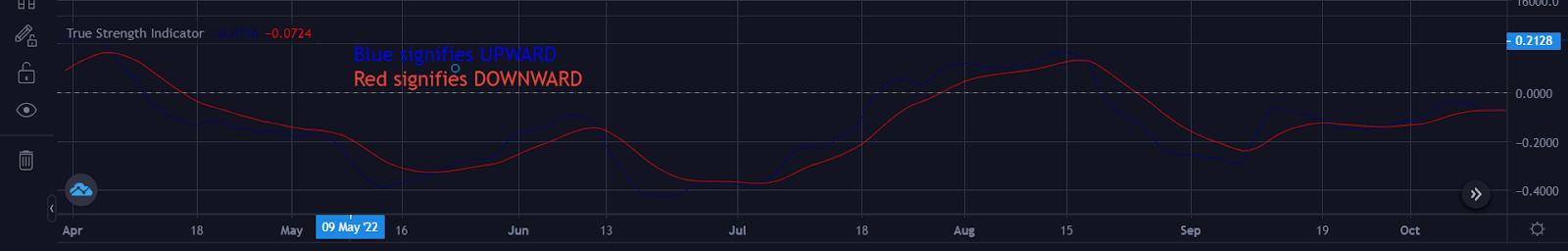

The sum of active buy and sell orders is a snapshot of a market at any particular time. Reading the market is the continual process of identifying patterns or trends that traders may act on overtime. There are two market patterns in general: bullish and bearish.

When price activity looks to be consistently increasing, the market is said to be “bullish.” These price hikes are sometimes known as “pumps” since the inflow of purchasers raises the prices. A “bearish” market, sometimes known as a bear market, happens when price action looks to be constantly decreasing. These adverse price fluctuations are sometimes known as “dumps” since large sell-offs cause the price to fall.

Bullish and bearish trends may coexist inside broader negative trends, depending on the period used. A tiny negative trend, for example, may occur inside a more significant long-term positive trend. An uptrend generally causes price movement to make higher highs and lower lows. Lower highs and lower lows are characteristic of a decline.

When the price trades sideways or inside a range, the market is said to be in “consolidation.” Consolidation periods are often simpler to detect on larger time frames (daily or weekly charts) and occur when an asset is cooling down after a dramatic upward or negative trend. Consolidation often occurs before trend reversals or when low demand and trade volumes are low. During this market situation, prices effectively trade inside a range.

FAQs

What is the most efficient technique to trade cryptocurrency?

There is no one optimum method for trading cryptocurrencies. Whatever meets your long-term or short-term investing objectives is the ideal strategy for trading cryptocurrency.

Is it worthwhile to invest in cryptocurrencies?

Yes, cryptocurrency trading may be lucrative. Some seasoned traders earn a career solely from digital trading currencies. Trading cryptocurrencies, on the other hand, is very dangerous and not recommended for everyone.

Crypto markets are highly volatile, making it simpler to incur significant losses, primarily if you use leverage. Do not invest more than you can afford to lose, as with any other investment.

What factors influence the price of cryptocurrencies?

Like any other market, the cryptocurrency market is influenced by supply and demand. The supply and demand of cryptocurrencies may be affected by several variables.

- Trepidation in the Market, according to Recent News

- Developments in technology

- Issues of politics and governmental rulemaking

- The state of fiat currencies

How can I get started with cryptocurrency trading?

Begin by establishing a goal and devising a plan. This will aid in determining the following stages: selecting a trading platform that matches your needs and determining which cryptocurrencies to trade.

When is the ideal time to invest in cryptocurrencies?

Because the cryptocurrency market is open 24 hours a day, seven days a week, there is no ideal time to trade because price fluctuations may occur at any moment. Furthermore, since cryptos are traded all over the globe, the market is constantly active someplace due to the varied time zones.

Although round-the-clock trading provides additional possibilities to trade, it also necessitates using risk management solutions to provide peace of mind when you are not there to watch the market.

Cryptocurrencies may be traded at IG at any time between 4 a.m. on Saturday and 10 p.m. on Friday (UK time).