Cryptocurrency markets are volatile by nature. A market has different cycles and price trends. Most times, after a major bull run, a bearish reversal takes place. What, then, is a bear market in crypto?

In a bear market, the value of cryptocurrencies will fall by at least 20% of its former value. This price reversal could be a result of various market forces at work.

Learning how to trade in a bear market is a critical skill for crypto traders. The bear markets allow traders to buy when the price is low and sell when the market goes on a bull run.

Keep reading for more facts about this market phenomenon.

Explaining The Bear Market In Cryptocurrency?

Bear markets are part of a cycle where a prolonged price decrease exists. They are not unique to the crypto market alone but occur in stocks and commodities.

A market is said to be in a bear phase when the prices of assets fall by at least 20%, representing a strong downtrend. A crypto bear market is more volatile and can see assets lose most of their value. This 20 % price drop should be in 60 days before pronouncing it as such. This market phase occurs mostly after a strong bull run to maintain balance in the market.

A bear market can last for extended periods or wrap up in a few weeks, depending on investor sentiments. But such trends should not be mistaken for corrections since the latter is short-lived and will not exceed two months at most.

A crypto bear market presents an ideal investment opportunity. However, it takes skill to identify the bottom of a bear market.

Characteristics Of A Typical Crypto bear market

Fear, economic problems, and negative media reports are some features of a crypto bear market.

Fear

Investors are mostly overwhelmed with fear of losing their tokens in a bear market. In the Crypto world, some projects lose all their value overnight. Bitcoin, the apex Cryptocurrency, also feels the effects of the bear market.

Most investors would rather hold positions and manage risks than gamble on falling prices.

Economic problems

Bear markets often correlate with external global and regional financial factors. One striking characteristic is that it occurs mostly during a period of rate hikes and inflation.

Negative media reports

When the media begins to question the credibility of a market during a downtrend, it signals that a bearish phase might be in place. Negative reports about cryptocurrency in mainstream media are signals of a bearish run.

Causes Of A Bear market?

A death cross, low liquidity, negativity, and changes in the interest rate and regulation can trigger a bear market and a decline in the price.

Death cross

This technical indicator is a chart pattern that shows a reversal or price trend from bullish to bearish. This phenomenon occurs when an asset’s 50-day moving average crosses the 200-day moving average.

Mass dumping of assets usually follows the death cross, as investors sell to avoid total liquidation.

Low liquidity

When traders are uncertain, they refuse to open positions, thereby leading to a bearish market trend, pushing trading volume very low.

Negativity

An ill-timed comment by financial experts can push investors into sentimental decisions. A noteworthy case was Bitcoin when Jamie Dimon, CEO of JPMorgan, labeled the project a fraud, making the price collapse shortly.

Also, the collapse of Luna’s stablecoin TerraUSD created negative sentiments among investors towards cryptocurrencies.

Change in interest rates

Government fiscal policies can also create a bearish trend in the market. In 2022, the US government rate hike also correlated with the crypto winter observed in the market.

Regulation

Government clampdown on cryptocurrencies in some regions can also trigger a bearish trend. Investors can decide to liquidate their holdings if they find it difficult to transact freely with their tokens.

What Is The Duration Of A Crypto Bear Market?

Bear markets differ historically and have no definite cycle. On average, a bear market lasts up to 289 days; however, it can exceed or fall below this range.

If the downtrend does not last up to 60 days, it may be a price correction.

Notable Bear Market Phases

Historically, there have been numerous bear market phases. Here are the detailed phases of bear markets:

Phase 1: Preliminary phase

This phase kicks in most times after a strong bull run. The general market sentiment is still positive, even with a slight dip in the price level. Investors will likely settle for long positions with leverage.

Phase 2: Early stages

The price will see significant dips and rally quickly in the early-stage bear trend. Traders and investors are still optimistic about making good recoveries. In this phase, the recoveries will no longer cover the drawdown. More red candles will appear on trading charts.

Phase 3: Full bear market

Here, the price dip will be obvious, with little or no positive rallies noted. Most investors panic sells and ends up aggravating market conditions. This is a sentimental phase where many traders rely on emotions.

Phase 4: Late-stages

In this phase, the downtrend wave has reached its maximum capacity, called a “bottom.” At this point (the bottom of a bear market), few sellers are left; investors will mostly try to take advantage of the low prices and start a positive rally.

Crypto influencers like whales will also have a say in this new trend due to the large market volume of their trades. This action will drive demand up and might slowly turn the market around and kickstart a bull run.

What Are The Signs Of A Bear Market End?

The end of a bear market is characterized by an uptrend and an increased trading volume for buyers. Identifying or differentiating a trend reversal from a brief rally might be difficult. One technical indicator to look out for is the Golden Cross. This chart pattern is formed when the 50-day average crosses above the 200-day average.

Also, if the trading volume increases, it is an indicator that investors are backing the asset with their portfolios.

Bull Vs. Bear Market: Key Differences

These two distinct price movements have clear features that differentiate them.

Strategies For Crypto Bear Market

For crypto investors, the traditional bear market presents opportunities to profit with the right understanding. Assets like Bitcoin and Ethereum (eth) might be quite expensive for some investors; a bear market will be the best entry point for such traders.

Buy the dip

This strategy relies on buying when the price of an asset is on a downward trend and holding to make a profit when there is a price increase. Some investors already holding positions will buy more assets to consolidate their positions, hoping to make a profit.

The downside of this strategy is knowing if you are buying the dip. A dip is meant to be a temporary price reversal. Some investors have made the mistake of “buying the dip” and seeing the prices fall even lower: incurring losses and increasing vulnerability.

Consider dollar-cost averaging

In this method, investors invest in an asset in small increments instead of all at once in a period. This smart investment strategy hinges on the principle of compounding for wealth. The investments are made regardless of the changing cryptocurrency prices.

Dollar-cost averaging seeks to protect investors’ capital from short-term market volatility. The downside is additional trading fees for placing multiple trades instead of one. Margex offers affordable trading fee rates for dollar cost averaging.

Using this strategy can increase traders’ profit in the long term and ensure that losses are minimal.

Diversify your investment portfolio

Classic mistake beginner investors make is to rely too heavily on one asset. It is wise to diversify your crypto portfolio despite Bitcoin’s dominance; it is wise to invest in other altcoins (shitcoins) and stablecoins.

These strategies are also applicable in a traditional financial market. Diversification is essential to stay afloat in the volatile world of cryptocurrency. Different crypto assets can be monitored using a crypto portfolio tracker.

Projects like dogecoin are also viable options with shorter-lived gains that can boost investor confidence. Dogecoin is evolving to adopt web3 technology and can make for interesting broker-dealer exchanges.

In 2022 alone, the price of Bitcoin with its crypto-native token BTC has seen a volatile decline generating pessimism from investors. An investor with different assets can easily cut losses if one of the assets plunges suddenly.

Understand and use technical indicators

These indicators help traders identify price movements and trends and make a profit in a bearish market.

They are divided into four main classes: Trend, Momentum, Volume, and volatility.

Trend indicators will identify if the market is bullish or bearish and if it is truly a trend or a brief rally. Popular examples include Ichimoku Kinko Hyo and Moving Average Convergence Divergence (MACD), among others.

Momentum indicators measure the strength of a trend and highlight possible reversals. Relative Strength Index (RSI) and Stochastic Oscillators are under this category.

Volume indicators show variance in the volume of assets over some time. An example is the Klinger Volume Oscillator.

Volatility indicators show the variation in prices over a given period. Volatility is what most expert traders seek to exploit to make a profit. Examples include Bollinger bands, Donchain Channels, and Average True Range (ATR).

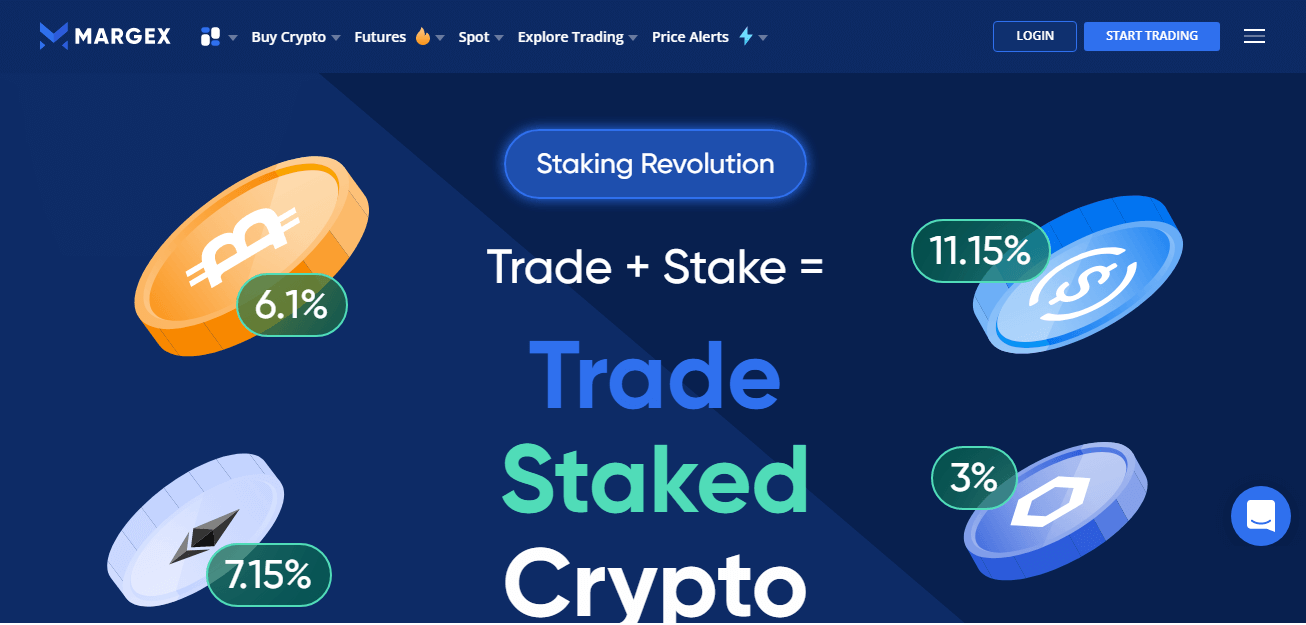

Stake crypto

Staking another bear market strategy that preserves the value of your tokens. When you stake cryptocurrencies, they are locked in a pool and earn rewards for the investor. This is a preferable strategy to holding your crypto and waiting for a reversal.

Reliable platforms like Margex offer users staking facilities and the ability to trade the same tokens simultaneously.

Consider derivatives

During a bear market phase, crypto derivates are a reliable option for investors to use. Derivates are contracts that have their value tied to a valuable asset. Crypto futures, options, and perpetual contracts are all types of derivates.

With Crypto futures, buyers and sellers agree on a specific price to sell an asset in the future. Derivatives help in hedging investors’ portfolios from unnecessary risks. An example of this is the INX token, which is tied to Ethereum.

Bear Markets Vs. Corrections

Every bear market is a long-term correction. If a correction persists beyond two months, it is classified as a bear market. Here are the key differences.

Bear markets occur with lesser frequency but last for extended periods, causing unfavorable market conditions. Corrections are minor setbacks that might act as support levels for the next bullish rally.

Short Selling In Cryptocurrency Bear markets

Shorting is an investment move that involves investors speculating on the future price of crypto and predicting a price decline. Similar to traders buying crypto on a bull run, short selling is another way to profit from a bearish trend.

Traders can hold leveraged positions to increase their lot size and make higher profits.

How To Invest And Make Money In A Bear Market On Margex?

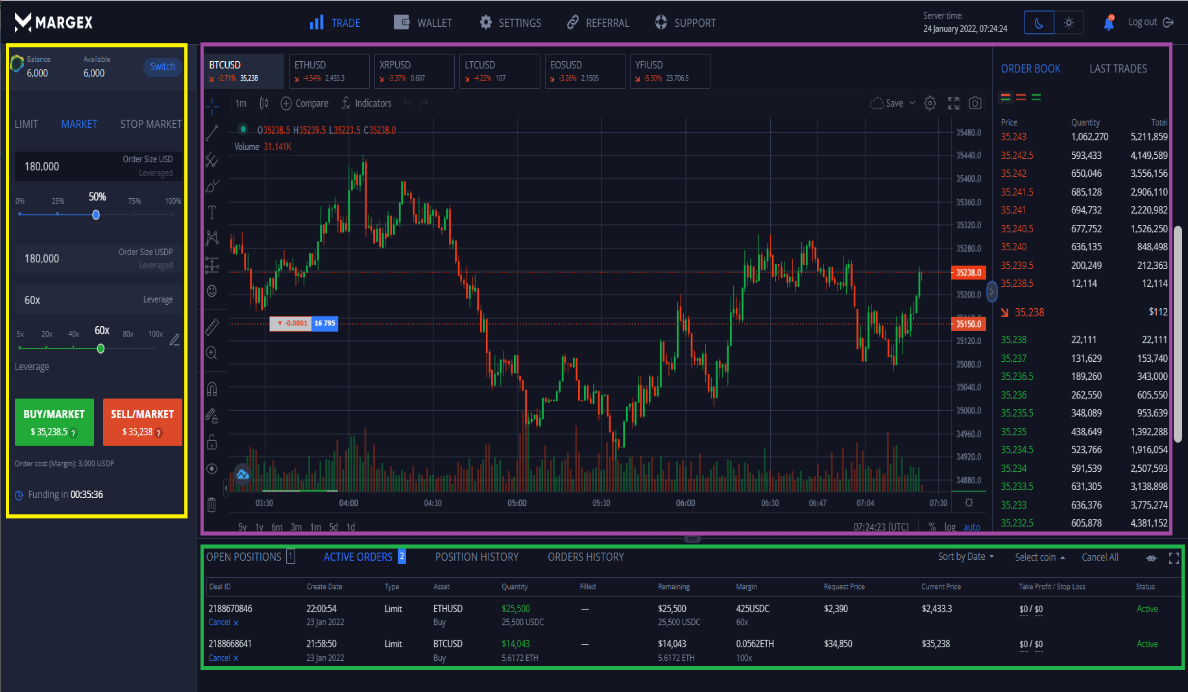

On Margex, users have access to the right tools and platform to trade profitably in a bear market. You can profit from a bearish trend on Margex’s platform using the following methods:

- Trading: Using the right technical indicators combined with fundamental knowledge, you can take advantage of downtrends. There are also free materials available to beginners once you sign up.

You can engage in margin trading and short the bear market to profit.

- Margex also allows users to leverage trade positions up to 100x of their initial stake.

- Staking: Margex offers users the option to stake their tokens. Bitcoin, Ethereum, Tether (USDT), USDC, and Chainlink are available on the platform. Users can earn up to 11.15% returns depending on the coin staked.

Also, Margex allows users to still trade with staked tokens, a unique feature that makes the platform stand out. Security is also highly assured, as Margex is a registered platform.

Users are offered unlimited access to numerous technical indicators and a host of other altcoins. Investing in other cryptocurrencies helps to diversify your portfolio and is the best option in a bear market.

FAQ: Common Questions On Bear Market

Find helpful answers on this topic below.

What is a crypto bear market duration?

A crypto bear market has no specific length, since no bear market is the same. However, it lasts 289 days on average, according to data from previous bear markets.

What does the bear market mean in crypto?

A bear market in crypto is a sustained price downtrend where assets lose at least 20% of their original price value. Any downward price deviation between 10-19% is a price correction, not a bear market.

Is there an ongoing crypto bear market?

The Crypto world is experiencing a bearish trend that has persisted for several months. The bear market was confirmed in January 2022 when the total Crypto market cap dropped below $2 trillion.

How long will the 2022 bear market last?

There is no definite timeline for a trend reversal of the current bear market. However, some experts speculate that the end of the cycle draws near with each passing day.

What indicates the end of a bear market?

A sustained bullish rally is a sure indicator that a bearish slump is finally coming to an end. From a technical perspective, more green candles will form on the chart, with many bullish candle formations observed.