If you’re a crypto-curious individual, a trader, or an investor, you must know how the market moves. These movements are known as bullish and bearish trends. When the dollar-cost price of cryptocurrencies is climbing, traders describe it as bullish.

It is a period to make gains on crypto holdings. Also, you will hear phrases like bull run, uptrend, and stress-free decisions. But when there’s a prolonged price downtrend, the market is bearish.

These trends describe the movement of the cryptocurrency market. But note that the terms are also related to stocks, real estate, and other assets. So, keep reading to find the details of these movements below and how to maximize a bull run crypto market on the Margex trading platform.

Describing How The Crypto Market Works?

The crypto market often shows positive and negative price movements with notable volatility. Some factors that affect the crypto market value include demand, supply, perceived utility, media, hype, internal governance, and competition. These factors can push a bear or bull run.

The definition of a bull market is when prices increase for a long time, leading to more investors’ confidence and increased buy. Rising stock prices also characterize the market, and the fear of missing out will make investors utilize several prominent strategies to cash in. The bull run also leads to the recovery of asset prices that might have fallen in the past.

But when the charts are showing red, the market is bearish. For instance, since May 2022, the crypto market has been red. The bear market has lasted for many months; the reversal in downtrends started lately.

What Are The Characteristics Of A Crypto Bull Market

To invest wisely, you must identify the bull-run actions and attitude. That will help you utilize prominent strategies investors use in an upward movement of a market.

Some of these characteristics include:

- Price increase

During a bullish market, the prices of cryptos grow for a long period. This is different from the usual pullback in the market. For instance, from 2020 to 2021, BTC prices grew from $5000 to over $60, 000

- Increased demand

When the bulls are in charge, the demand for crypto assets skyrockets so fast that supply won’t sustain it. For cryptos like bitcoin, the price will move upwards.

- Overpricing

Due to the weak supply in the face of high demand, investors sometimes overprice assets to grab more.

- Prices react to any news.

When the market is bullish, positive news will push the price of crypto assets. In the same vein, if the news seems bad, a slight fall in prices follows.

- More interest and hype

Bull markets usually cause a lot of hype and interest. The media outlets will talk about cryptocurrencies, and celebrities and influencers will join the sector due to fear of missing out.

- Higher confidence levels

A bull market run increases the confidence of investors. Given the sustained price increase, both institutional and individual investors will join to grab a share for every increase.

- Increased ICOs

In bullish markets, developers launch different cryptos with additional functionalities. The stock markets also record a large amount of IPO during a general bull run which serves as an indicator of economic expansion

Why is a price increase called a bull market?

The term Bull market is as old as the stock market. It was used to describe speculative buying with stock price increase expectations. But sometime later, the term was now used to describe the buyers. It is why the name seemed appropriate and not a metaphor for the movement.

Secondly, the characteristics of bulls made the reference more appropriate. Normally, bulls are known to attack by thrusting their horns upwards into the air. Also, check the Merriam-webster for more descriptions.

What leads to a bull market?

Many factors cause a bull market run in the crypto space. Some of them include;

- Increased demand

A bullish market follows when the demand for cryptocurrencies rises due to increased usage. For instance, the first bitcoin bull market occurred in 2011 following the growth of its market capitalization to $1 million.

- National crisis

In 2013, Bitcoin prices skyrocketed due to the increased debt in the United States. As many feared the rising debts, their attention turned to BTC as a possible store of value leading to high demand.

- Major Milestones

When a major milestone is achieved in the crypto market, it leads to a bull run. For instance, the 2013 bullish trend also resulted from Bitcoin entering the mainstream financial space.

- Increased utility

When the development of diverse projects with impressive value propositions emerges, a bullish market can occur. For instance, the 2017 upward trend was due to an influx of projects and many ICOs.

- A rise in perceived value

When the perceived value of crypto projects increases, demand rises, leading to a bullish market.

How long does a crypto bull market last?

A bull market can last for multiple months or a year. Historically, bull markets in the space have lasted for 6 months or one year. As long as the demand for crypto continues to be higher than the supply, the price will continue to skyrocket.

Analysts have linked bullish markets to bitcoin halving cycles. This event occurs every four years and can last for one year or less.

What indicates that a bull market is ending?

A bull market lasting many years hasn’t been recorded yet. Some indicators of an ending bull market include:

- Decreasing demand for cryptocurrencies; the speed at which people buy crypto reduces

- Dramatic market sell-off by large holders, whales; wallets with large crypto holdings will start selling

- Bitcoin dominance level will fall below 30%

- Sustained crypto price fall, longer than a pullback

- A decline in Relative Strength Index (RSI)

- More selling from miners

- Decreasing hash rate

Characteristics Of A Crypto Bear Market

Many actions and activities characterize the bear market. Some of these indicators include:

- Crypto prices depreciate due to pessimism toward investing

- The supply of crypto assets is higher than demand as more holders dump them

- Low investor confidence due to falling prices

- Negative talks about crypto skyrockets on different news outlets and social media platforms

- The effect of any news on crypto prices becomes insignificantly low

- Backlashes against crypto projects by traditional finance, economists, and analysts

- Low crypto trading volume

- Increased rate of unemployment in the sector and loss of jobs

Why is a declining price called a bear market?

Like the bull market, the bear market was coined from the animal’s characteristics. Bears usually attack their prey by striking them downwards. In the crypto market, this downward movement is referred to as the bear attack. The prices will go down instead of moving upward like the bullish trend.

What factors lead to a bear market?

Generally, it’s hard to pinpoint some factors that can trigger a bear because crypto is still an emerging industry, unlike the stock market with many years of operational data.

But in the stock market, some of the factors that can trigger a bearish market include

- High unemployment

- Political instability

- Global pandemics

- Geopolitical Crisis

- Bursting market bubbles

- Drastic shifts in the economy

- Government intervention

- Unexpected fluctuations

- World recession

So, a declining economy characterized by the above factors can still lead to a crash. For instance, the US Treasury’s fear of an interest rate hike triggered the 2022 crypto bear market. This means that macros can lead to bear markets in crypto.

Bull Vs. Bear Markets, How Do They Differ

There are many differences between bull and bear markets. Check them below

- Price movements

The period of bullish trends is when the prices of both stocks and cryptocurrencies increase. But when the bears take over, every asset price reverse to the lows.

- Supply

During a bullish market, the supply of crypto assets is fragile compared to its demand. But in a bear market, the supply is high because everyone is selling.

- Demand

The demand for crypto assets increases during the bull run. But when the bears lead, the demand falls because nobody wants to buy.

- Investors confidence

The bullish trend galvanizes investors into making large moves into the market. But when the bearish trend emerges, their confidence dwindles.

- Liquidity

Bullish markets are characterized by high liquidity as more trades occur at lower costs. But the period of bearish trends leads to lower liquidity.

- Growth

When the crypto price is on a steady rise, more projects, newer investors, and larger investments enter the sector. But the opposite occurs during periods of downward trends.

- Trading positions

During a bull run, traders can make returns on long positions. But when the market is bearish, short positions pay better.

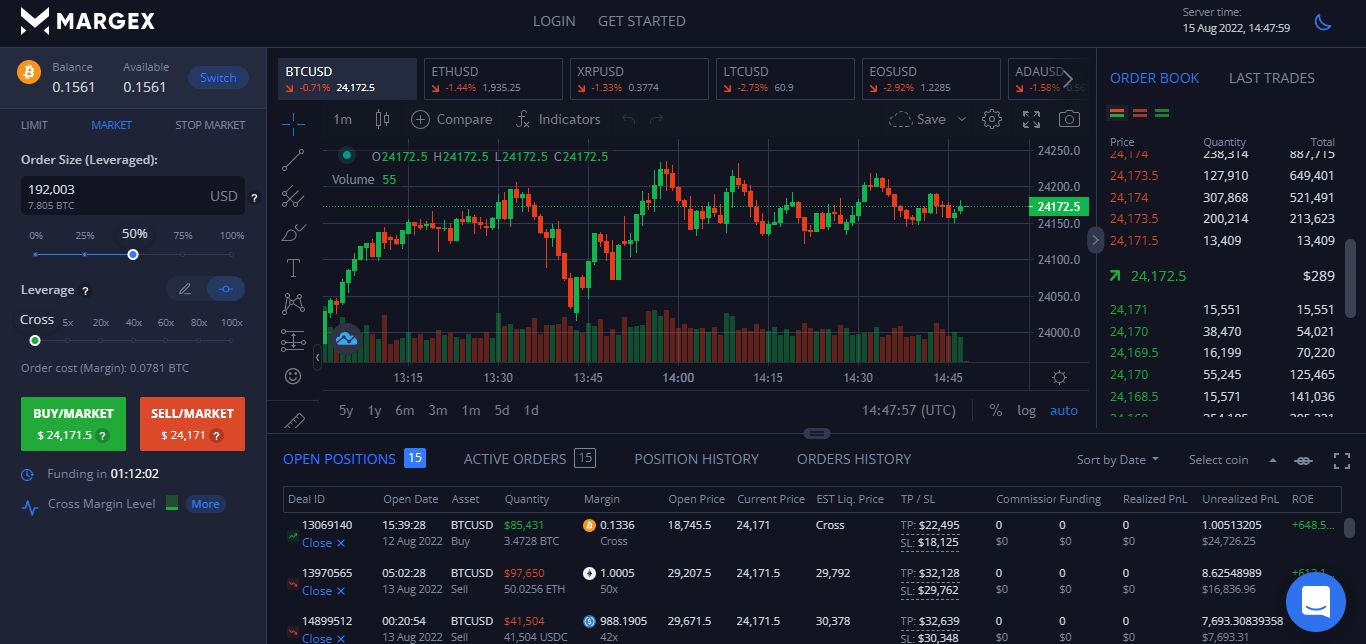

How To Gain From The Bull Run On Margex?

Margex is a crypto derivative platform where you can make gains trading bitcoin with 100x leverage. You don’t need derivative trading expertise to take advantage of the bull run on Margex. Take the following actions:

- Confirm the onset of the bull run by watching when there is the third touch of an asset price action on a single line. Once you notice that, buy the crypto and go long. But place a stop loss order below the bottom or trend line.

- To make more trading profits, always lock in profits regularly. But when you think the bull run has ended, you can short-sell. Note that the fourth touch on the green bullish trend line means an imminent breakout shown in red.

FAQ

Read below for some of the questions in the community on the bull and bear crypto markets.

Will a crypto bull run occur in 2022?

The market is presently gloomy, but analysts anticipate a bull run this 2022. This optimism is due to a history of bull runs after bitcoin halving. Also, a six-week high last month and moving away from the “extreme fear” sector have again increased confidence.

What did past crypto bull runs teach?

Each bull run follows after bitcoin halving. Other lessons to learn from crypto bull runs include the importance of paying attention to signals, indicators, and market forces. Also, many analysts pointed out that major events can trigger a bull run.

When will the crypto bull run end?

The Crypto bull run will end when there’s a steady price decline in the market. Also, it ends when the supply of crypto assets records a steady rise, signaling a sell-off. Sometimes the bullish market lasts for six months or one year before it ends.

Is this bull run any different from previous bull runs?

The 2021 bull run differed from the 2017 experiences because it surpassed its records. For instance, during the 2021 bull market, more money moved from fiat to bitcoin and remained. Bitcoin dominance doubled, and more people accumulated crypto instead of trading.

How to invest in a bull market?

First, you must recognize the trend earlier to buy faster than others and hold the assets to sell later. You can also use short-selling techniques to make gains quickly in full-swing trading. But when you notice an emerging bear market, move funds to other assets such as metal or cash.

Is it better to buy in a bull or bear market?

It is better to buy in a bear market than in a bull run. In the first instance, prices are down, and supply is high. But when the bulls take over, prices skyrockets, and supply dwindles.