With the current crypto market in a consolidation, investors are finding it harder to earn a consistent return through trading. If you happen to be one of these investors, fret not, as you can still do crypto staking and crypto mining to earn regular rewards that yield a more-than-satisfactory annual return. Given time to grow, these returns may even turn into bigger rewards when the price of these earned cryptos go up when the next bull market comes.

Hence, in order to help you determine if staking or mining is more suitable for you, we have put together a brief but concise summary below.

Crypto Staking vs Mining Differences

The key difference with staking vs mining is the algorithms used to validate and process new transactions, as well as add new blocks to the blockchain.

When blockchains first started to come into existence, the proof-of-work (PoW) algorithm was the main consensus mechanism used to verify cryptocurrency transactions. The bitcoin network is the most famous blockchain that uses the PoW algorithm to validate transactions.

In bitcoin mining, the PoW algorithm uses computing power to solve cryptographic puzzles during the creation of each new block of data. For anyone to unilaterally influence the blockchain, they would have to control more than half of the energy being used for mining bitcoin across the entire network, which is too costly for any single group of users to endure. This mechanism ensures that malicious actions on the bitcoin blockchain are economically unfeasible to attempt, which is why most first generation blockchains use this method.

However, due to its design of being energy intensive and thus, less environmentally friendly, newer blockchains are using a new consensus method called proof-of-stake (PoS) in processing transactions.

In PoS, instead of using computational power, a security deposit in the form of crypto coins of that particular blockchain is being used as collateral to make attacks or other malicious actions on the blockchain too costly to attempt. If a malicious actor tries to make changes to the blockchain, his security deposit will be confiscated.

Lately, with Ethereum, the second largest crypto network, moving from PoW to PoS, market participants have been actively discussing the two different methods. All eyes are on how much more energy efficient and less costly the Ethereum network would be to use after it changes from PoW to PoS this September 15.

In PoW, miners must first purchase and set up mining hardware which are called mining rigs. Once the mining rigs are set up and operative, miners can start to earn block rewards in the form of newly mined coins whenever they successfully add a new block to the blockchain. Which miner gets to add a new block is dependent on which mining rigs manage to solve a complex puzzle in the shortest time. Only the mining rigs who manage to add a new block will get the reward in the form of a newly mined block of BTC each time.

In PoS, stakers must first set up a node. A node is a computer that runs software which communicates with the blockchain. Stakers can simply download this software from the respective websites of the blockchain that they want to stake in. Then, stakers, who are more commonly referred to as validators, need to first stake or lock up their crypto coins on the network. The network will then assign validators who can add each new block based on a validator node’s size and amount of time staked. Validators who have successfully added new blocks get to keep the newly minted crypto coins as block rewards.

Crypto Staking vs Mining Profits and Rewards

While some users mine and stake to be a part of their favorite blockchains, most users are drawn to mining and staking because of the rewards and profits. However, while each has its own fans and critics, it is still quite difficult to pinpoint if staking or mining are more profitable due to too many variables that exist between them. This is especially so when each blockchain pays out rewards in the form of their own digital currency which can then be sold in the crypto market. Hence, with varying price of the reward tokens and different set up and operating cost of each network, the profit and reward comparison of staking vs mining cannot be easily determined.

For instance, while the rewards that come with mining are high, especially when you are mining a high priced crypto like bitcoin, the set up and running cost of mining is much higher than staking, which will eventually reduce your profit.

As for staking, the rewards will also vary depending on how long you lock up your coins for, how much is its market price and the ease of disposal, with a high volatility in price and unfavorable liquidity factors potentially affecting these profits adversely. Tokenomics like the size of the total supply of coins of the network is also different for each case.

Hence, a user will need to study these factors before he can determine if mining or staking is more profitable. That said, staking is a relatively easier and lower cost option for a beginner to get started with earning income from crypto.

Crypto Mining Coins vs Staking Coins

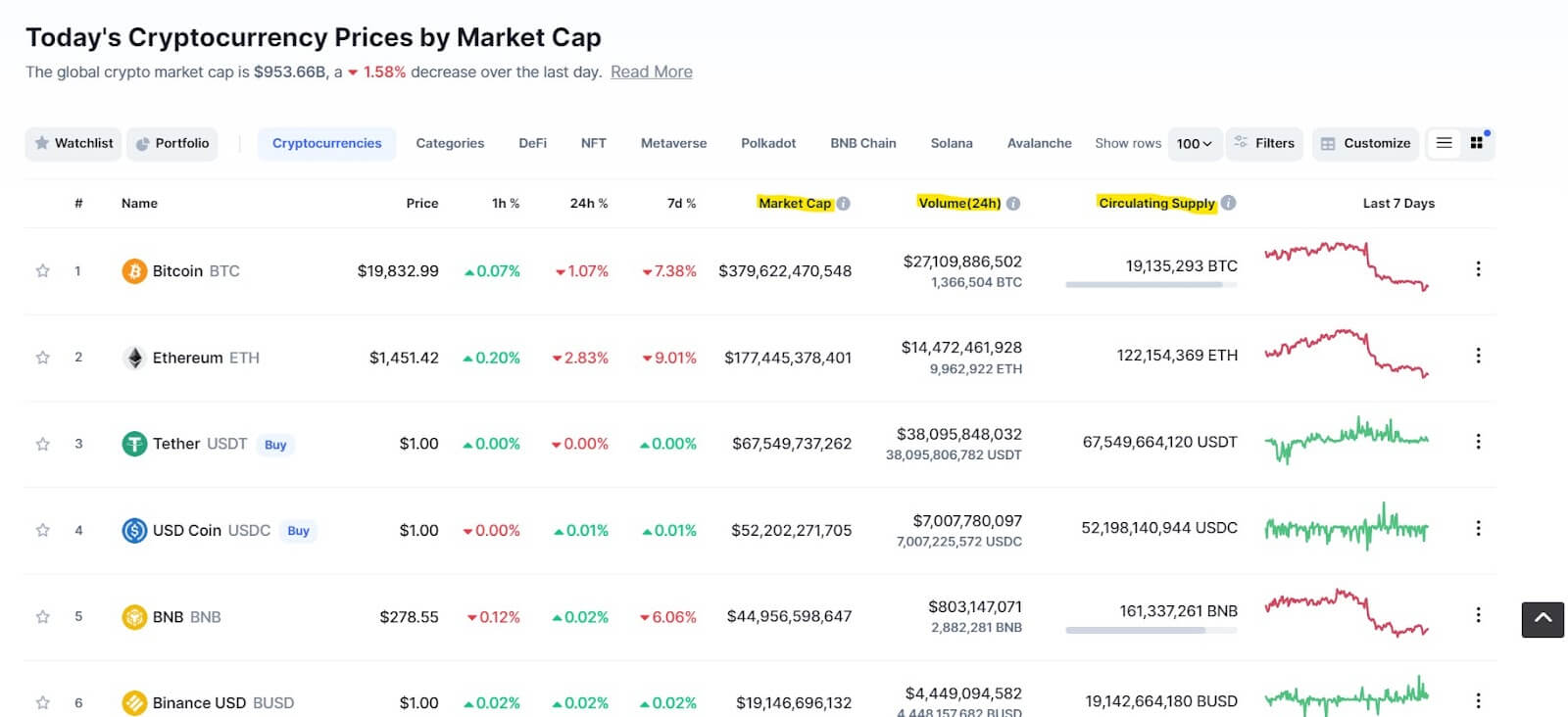

Even though the bulk of crypto coins use staking rather than mining, the total cryptocurrency market is currently still dominated by coins that use mining. This is due to the dominance of Bitcoin, Ethereum and Dogecoin. Bitcoin takes up almost 40% of the total crypto market cap, Ethereum takes up about 21% while Dogecoin takes up 1%. However, after Ethereum moves to PoS on 15 September 2022, the dominance of coins that use PoS will overtake PoW. In fact, Ethereum co-founder Vitalik Buterin has even suggested that Dogecoin should move to use PoS too, in a sign that the dominance of PoS coins would likely continue to increase as the industry matures. This is a good sign for most investors as this would mean that the opportunities to earn from staking will increase. As we have explained above, staking could be a more viable way for most investors to earn income from crypto, as opposed to mining, which is not as cost effective.

How to Use Margex Staking

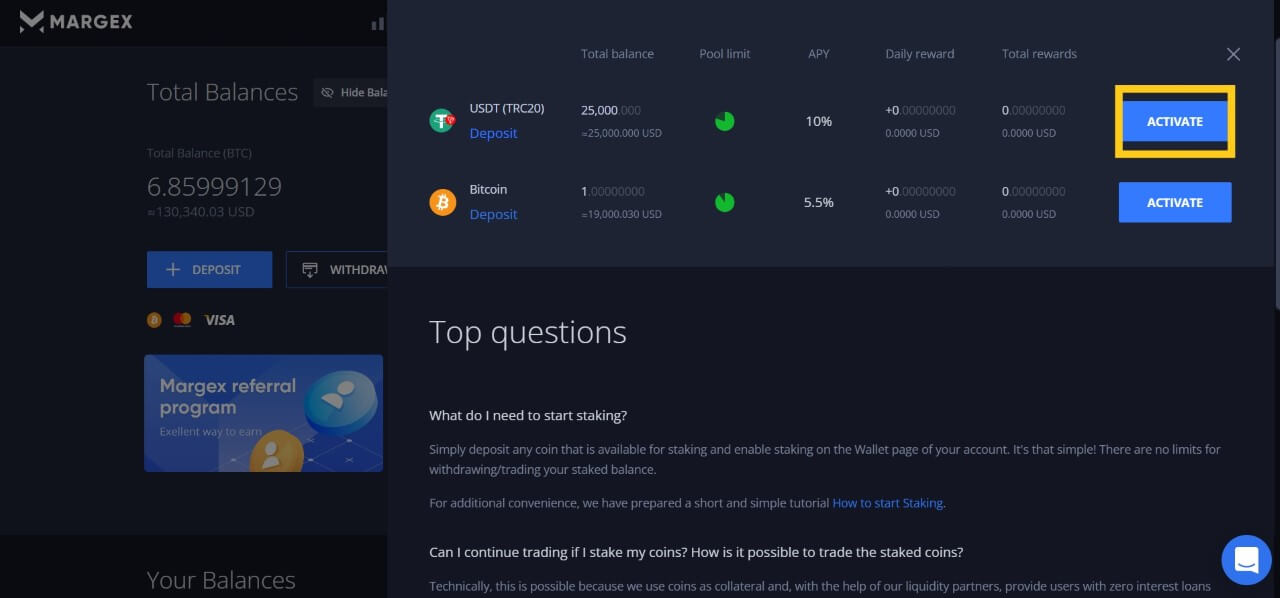

The Margex platform is one place that users can stake crypto and earn rewards. A variety of cryptos are available for staking on Margex, including Bitcoin and Ethereum, which gives stakers an annualized yield of more than 5% each. You can even stake stablecoins like USDT and USDC on Margex and get an annualized return of around 10%.

Simply log in to your Margex account, click “Try Staking” on the pop up window, deposit the coins you want to stake, and click activate on whichever coins you want to stake from the list of coins you have!

Furthermore, Margex is the first platform that offers the ability to trade with your staked crypto assets. No other platform offers this innovative service that allows users to use their staked crypto assets as collateral to trade and earn from the volatility of the crypto markets even as they continue to receive staking rewards! Talk about killing two birds with one stone.

Crypto Staking vs Mining FAQ

Now that we have examined the differences between staking and mining, let us go through some simple questions to help you understand the risks and rewards better.

Is There a Downside to Staking?

There are some small downsides to staking as it involves locking up your cryptos during the staking process. In order to gain a higher reward, one usually needs to lock up your cryptos for a period of time, which some people may not like, as locking up their cryptos may make them lose opportunities to trade their cryptos for profit. However, a platform like Margex allows its stakers to trade with the crypto tokens that they have staked, which can avert this opportunity cost.

Why are Staking Rewards So High?

Staking rewards are often very high so that the projects can attract a higher number of validators to join the network. The higher the number of validators on a network, the more secure and decentralized it is, which in turn contributes to the higher overall value of the network.

Can I Stake Shiba Inu?

Yes. You can stake Shiba Inu on its native decentralized platform called ShibaSwap, or on other staking platforms. In return for validating and verifying SHIB transactions, Shiba Inu stakers are rewarded with newly minted SHIB tokens which are added to the circulating supply.