Crypto whales are one of the most interesting phenomena in the blockchain space, and their influence in the volatile market elicits debate. Their influence stems from holding large amounts of tokens within a blockchain network. We’ll be exploring in this article who crypto whales are and how they work.

Who Is A Crypto Whale?

In cryptocurrency, Whales are individuals, institutions, and exchanges that hold large amounts of a specific cryptocurrency’s tokens.

However, depending on the cryptocurrency, there are different yardsticks for determining the “whale” status. Nonetheless, a crypto whale is typically a wealthy individual or institution moving large amounts of cryptocurrency. As a result, no ordinary person can become a crypto whale.

In the case of Bitcoin, for example, a whale is an account that contains 1,000 Bitcoins or more. Pantera Capital and Fortress Investment Group are two well-known whales. Satoshi Nakamoto, who is said to have mined over a million Bitcoins, is another popular—yet widely speculated—whale.

Furthermore, because cryptocurrencies are designed to protect the identities of its holder, it is difficult to link accounts directly to specific people or entities. As a result, it is difficult to determine who each whale is, where they are, what job they have, what institution they belong to, who their network is, and why they are making this transaction.

However, by inspecting the blockchain data of those who have made their public addresses public, it is possible to identify at least some of those who own significant amounts of various coins. In fact, some of these individuals are well-known Bitcoin whales.

Who are the bitcoin whales?

Bitcoin ownership has become less concentrated as cryptocurrency investing, and its use has grown in popularity. However, studies show that a small group of investors controls a sizable portion of the total Bitcoin supply. For example, according to a 2021 National Bureau of Economic Research study, only 10,000 investors worldwide own one-third of all Bitcoins.

Bitcoin whales are closely watched by crypto traders due to their apparent concentration of ownership, as their buying and selling activity can affect prices in the short term.

For instance, It’s estimated that Bitcoin’s creator, Satoshi Nakamoto, owns one million BTC. In addition, 1% of all Bitcoin was once owned by the Winkelvoss twins, who Armie Hammer portrayed in The Social Network. Large Bitcoin wallets are also rumored to exist on exchanges. Although most of these funds are owned by their users, moving money between crypto exchanges doesn’t significantly affect the market.

There are many more Bitcoin whales; these are just a few of the well-known ones. For instance, Tim Draper, Barry Silbert, Michael Saylor of MicroStrategy, and formerly Tesla are some other well-known Bitcoin whales.

How Do Whales Affect Cryptocurrency?

Cryptocurrencies are bought and sold on exchanges, which use an auction system similar to the stock market. Because of the concentration of cryptocurrency that a whale may possess, any movements they make could result in significant price fluctuations.

If a whale makes a large transaction, such as selling a significant portion of its holdings, ‘whale watchers’ may follow suit, resulting in a significant price drop.

Whales can also cause significant price increases. For example, when Tesla announced in February 2021 that it had purchased $1.5 billion in bitcoin, the price of bitcoin increased by 17%.

For example, If a Bitcoin wallet purchases large amounts of cryptocurrency, the whale’s activity may reduce the supply of Bitcoin on the market, causing prices to rise. In contrast, whale selling may increase supply, temporarily lowering Bitcoin prices.

They can create a “sell wall” effect

A sell wall is the exact opposite of a buy wall. In this case, a single large sell order or a large number of sell orders at the same price can create a wall-like block of entries in the order book of a cryptocurrency.

This time, the wall restricts price movements to the upside rather than the downside. However, the trade-volume boost works similarly for both types of walls. When it comes to inspiring higher trade volumes, large sell order volumes can be just as convincing as large buy orders.

They can capitalize on the fear of missing out (FOMO)

Whales frequently artificially inflate the price of the tokens by placing massive buy orders, which is the opposite of the “sell wall” effect. As a result, they increase interest in cryptocurrency tokens, which motivates buyers to increase their offers. By doing this, they also draw in the interest of additional investors who are anxious about passing up a fantastic investment opportunity.

Investors believe that since there is more interest in the token, they should also be able to purchase some of it. Whales can sell some of their tokens in this way and make a respectable profit.

In plain terms, whales impact the other token investors through a ripple effect. They can influence the market in their favor by raising and lowering prices. You must pay attention to the movement of whales as cryptocurrency traders.

You can do this by using blockchain analysis to keep track of accounts with high crypto token valuations, subscribing to analytics platforms that monitor cryptocurrency prices on your behalf, following whale alerts on Twitter and other social media platforms, and following whale alerts on other social media platforms. Numerous factors influence the volatility of cryptocurrencies. Whales are an important component. Make sure to consider whales in your buying and selling decisions to ensure that your trading is profitable.

How To Become A Crypto Whale?

You don’t have to be freaky rich to become a whale. At ICOs, large projects sell their tokens at extremely low prices. You might become a whale if you make the right decision. This is if the token’s value skyrockets, so make sure the project is worthwhile.

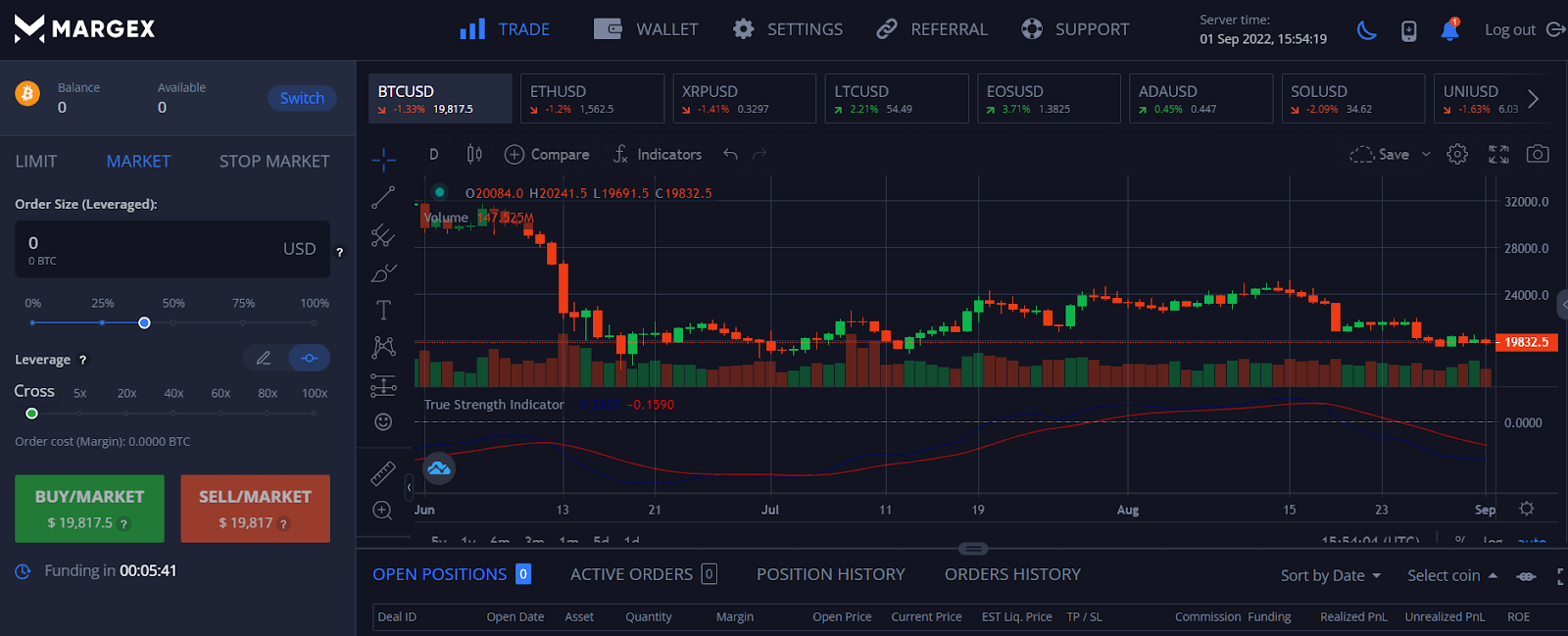

Margex also offers an ideal platform to purchase cryptocurrencies in large quantities to become a whale. In addition, Margex offers world-class trading solutions with up to 100x leverage on Bitcoin, Ethereum, Ripple, Uniswap, Litecoin and other popular digital assets. It also provides a unique staking feature that has rapidly gained adoption within the crypto community.

How Much Cryptocurrency Do Whales Hold?

You need to hold no specific amount of crypto to be considered a whale. The whale status for a particular cryptocurrency depends on the price and supply. For instance, a Bitcoin whale is one of these large Bitcoin holders.

Bitcoin had a market cap of nearly $609 billion as of the end of May 2022. A Bitcoin whale is generally defined as a wallet that owns at least 100 Bitcoins – or $3.2 million in Bitcoin at the time of writing.

Why Do Crypto Whales Matter?

Crypto whales are individuals who own a large number of coins and can drive the market on their own. As a result, they can cause a surge in volatility due to the concentration of wealth, triggering small holder speculation and making prices more dependent on it rather than fundamentals.

They can create waves for other, smaller fish because they are the largest creatures in the ocean. This means that if the majority of a coin’s supply is removed from circulation, the price of the coin remaining in circulation rises. As a result, if many coins are suddenly liquidated, their value will fall.

Do I Need To Whale Watch?

Every cryptocurrency whale wants their coins to be worth a lot of money, with the exception of those who intend to completely exit the market for some reason. Unfortunately, it will take a lot of time and effort to ride every wave a Bitcoin whale makes. A better long-term strategy that can assist you in identifying and avoiding whale manipulation is to ensure that you are generally keeping an eye on the market and understanding why things are moving the way they are.

How to find whales in cryptocurrency

Given these whales’ influence on cryptocurrencies, “whale watching” is a common strategy among cryptocurrency investors.

Fortunately, anyone can track cryptocurrency whales without the help of outside resources, thanks to the open nature of blockchains. Through tools like BitInfoCharts and Etherscan, you can keep track of the wallets of the biggest holders of bitcoin, dogecoin, or ether. As an alternative, many websites also provide information on the best wallets for various currencies and the most recent transactions.

FAQ

Here’s are some frequently asked questions about crypto whales.

How much does a crypto whale make?

Crypto whales capitalize on creating a Sell Wall and on the FOMO of small investors in the crypto community to turn the crypto market trends to make profits. They create a sell wall by putting a large ‘sell order’ at a lower-than-market price, forcing the smaller investors to sell off their holding, thereby causing the price to fall.

How do whales affect crypto prices?

The role of whales in controlling the crypto-market trends can be realized from Shiba Inu in October 2021, Ether in February 2021, and the case of Bitcoin in 2017 and 2020. These whales used the strategy of price pumping to benefit from the FOMO of many investors. For example, in 2017, the Bitcoin price surged to $20,000 per coin due to price pumping by a single Bitcoin whale.

What coins are whales buying?

The top 5 best cryptocurrencies that crypto whales are buying in 2022 include

Bitcoin, Ethereum, Litecoin, XRP and Cardano.

Why do whales buy cryptocurrency?

Like every other person in the crypto space, whales buy cryptocurrency to make profit. And having a huge purchasing power gives them the ability to control what happens in the market when they buy or sell their holdings.