The latest US CPI data out of the USA last Thursday was a pleasant surprise to many market watchers, who had expected the headline inflation to continue increasing. October’s CPI only grew 0.4% from September while expectations were for a 0.6% increase. On a year-over-year basis, the growth of inflation had eased as well, gaining just 7.7%, with the pace of increase slowing more than analysts expected. Market participants were expecting a 7.9% rise, down from September’s 8.2%. Thus, this reading was pleasantly surprising as it shows that inflation is easing faster than analysts expected.

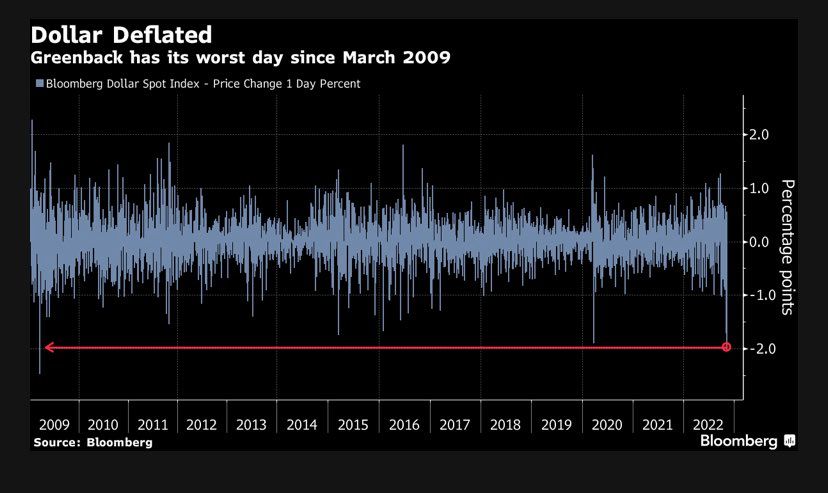

Dollar Crush Last Week Worst Since March 2009

Ever since the Fed started raising interest rates, the long dollar trade had easily been the most crowded trade of all, with almost every trader out there longing the dollar against the euro, pound, and especially the yen due to the interest rate differential between the yen, which is at a negative 0.1%.

As a result of the “shock” reading of the CPI number, the dollar fell drastically against all its peers, putting in its biggest fall in almost 14 years.

The USDJPY, which was the most piled into forex trade of 2022, dropped 6% to its biggest two day fall since 1998. Such a huge one-sided drop is highly unusual in normal trading conditions and only spoke of the excessively big amount of long dollar-short yen positions that have been caught on the wrong side of the data release and got liquidated. With such unusually high volatility even on the currency markets, which normally do not move more than 2% a day, traders in the forex markets and even stock markets need to exercise caution and not over-leverage as the technical rebound could be equally fierce in magnitude.

This is especially so since Fed Powell and most other Fed officials had already pre-warned that “one data set does not make a trend” and more tightening will be forthcoming until inflation eases to 2% and stays there. Hence, the markets could have overreacted to the CPI numbers.

That said, the dollar’s reaction against other currency pairs was more muted and had fundamental reasons to back up, since both the UK and the Eurozone are also aggressively raising rates, which would inevitably send their currencies trading higher. The dollar fell around 3.5% against the euro and 2.6% against the pound, which appears to be a more “normal” range.

Regardless, with the fall last week, the Dollar Index (DXY), which is a measure of the dollar’s performance against a basket of other currencies in the developed world, has broken below its key 50 and 100 day moving averages, which is technically a bearish signal.

The key beneficiary of the dollar drop was the stock markets, which had rallied very strongly. The S&P 500 gained 5.9%, the Nasdaq added 8.1%, while the Dow Jones was up 4.1% for the week since the CPI release.

Has the Dollar Reversed Course?

While the market’s reaction has been exceptional, it is still too early to tell if this is indeed a trend reversal for the dollar from bull to bear. As we have mentioned earlier, the Fed still has room to hike and the market could be getting ahead of itself far too early. However, until the next Fed meeting, which is scheduled for December 14, the market euphoria could continue. Until then though, another important data point that the Fed looks at to determine inflation is the core Personal Consumption Expenditure (PCE) price index, which will be released at the end of the month. Should this data set show a higher reading from the CPI, the dollar could rebound and stocks could start selling off again.

This concern can be seen from professional investors. Despite the seemingly bullish stock market reaction, institutional investors have been buying stock market puts, a move which signals that they are bearish. The daily amount of put options bought by institutional investors last Friday was the highest since 2008.

Hence, was last week’s record stock market rally simply a bull trap? No one knows for sure yet, however, seasonality trends post midterm elections favour the bulls.

How Will This Impact Crypto Markets?

Honestly, had it not been for the FTX bankruptcy saga, crypto would have reacted similarly as the stock market and we could have been in the middle of an altseason this weekend. However, had it not been the tamer CPI numbers which saved BTC from breaking to yet another new low and dragging all other coins with it, the situation over this weekend could have been a lot more dire for crypto. More liquidations could have taken place as prices break even lower and bankruptcies of more crypto firms could have come within days. That said, how much longer this positive shift in macroeconomic conditions can help support crypto prices will depend on the contagion effects from the FTX fallout in the coming days and weeks, at least until the PCE numbers are released and until the December Fed meeting.

Now, the crypto market has two tailwind risks that could potentially hit prices, the most important being the contagion effects from the FTX fallout, the second being what the Fed does and says at the December Fed meeting. Until then however, should the stock market remain euphoric like it was last week, crypto prices could consolidate between the ranges already put in last week and some altcoins could even put in some small rallies as the crypto market has become oversold. The mid-term outlook for crypto however, could hinge on the kind of repercussions the FTX saga has on other crypto firms, which could be revealed over the coming days and weeks. If no bad contagion comes out of this, crypto could begin a slow road to recovery. However, the chances of no contagion is low, as one of the largest crypto lenders Blockfi is already rumoured to have begun bankruptcy proceedings over the weekend. Could more such bankruptcies be on the horizon? Only time will tell.

The above is the personal opinion of the author and does not represent the official view of Margex. It is also not financial advice and should not be construed as a solicitation to trade. Readers should do your own research and conduct proper due diligence before engaging in any trading or investing as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.