Unless you have been living under a rock in the investment space, you will know that the US dollar has risen quite a fair bit this year on the back of rising interest rates. While the headlines read that this is due to the Fed trying very hard to bring down inflation, most experts agree that there could be other unwritten reasons, some of which we will be exploring below.

The US Dollar is the Cleanest Dirty Laundry

The key index that tracks the strength of the US dollar against currencies in the developed world is the US dollar index, commonly referred to as the DXY. You would often hear of experts referring to the dollar’s movement by referencing how much the DXY has moved.

The DXY contains six component currencies, namely, the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona and the Swiss franc, in the order of weightage. As can be seen, the euro, yen and pound hold the highest weightage in the DXY. The EU and the UK have been under tremendous economic pain made worse by the Russian-Ukraine conflict, causing their currencies to plummet, while the yen is weakening due to Japan seeking a different monetary path with the rest of the world – Japan is still doing quantitative easing while the rest of the world are doing quantitative tightening.

Hence, with Europe mired in a worse economic situation than the USA, the US dollar is the “cleanest dirty laundry in the room” compared with the other components in the DXY. This is why the DXY has been surging, it is more a relative gauge than a show of absolute strength of the US dollar.

That said, at the moment, even commodity dependent currencies like the Aussie and Canadian dollar are down against the US dollar because commodity prices have fallen sharply in the last couple of months, causing them to weaken against the US dollar.

European Energy Crisis Further Strengthens the Dollar

The worsening energy situation in Europe is threatening a full meltdown in the European economies by early next year, that is, if they even manage to survive this winter. The energy crisis was sparked off by EU nations’ attitude towards Russia as a result of the Russia-Ukraine conflict, where EU nations have banned the import of Russian oil and gas due to sanctions.

However, because the EU is almost completely dependent on Russian fuel to provide power to their businesses, households and everything else, the sanction has so far penalized European nations very heavily, with reports from factories in Europe claiming to not have enough electricity to meet basic production needs, causing industrial production to slump.

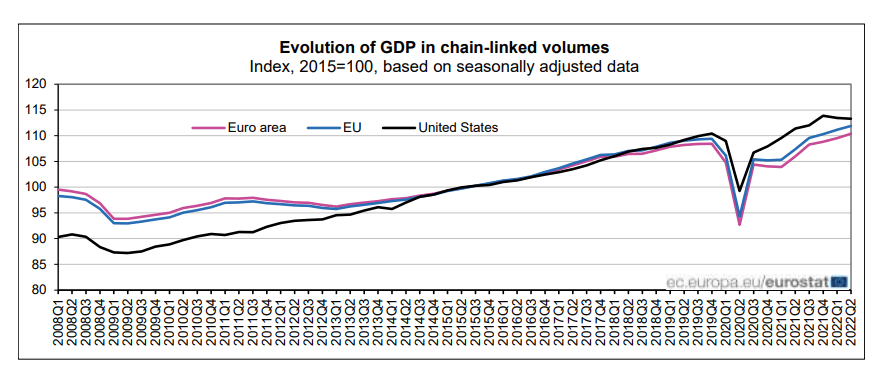

Thus, even when the US GDP has been faring better than the EU nations since 2019 as shown in the diagram below, expectations are for the GDP figures out of the EU to be much worse than that of the USA in the coming months, and perhaps, even years.

While this situation can be avoided should the EU politicians reduce or lift energy sanctions on Russia, they have thus far not shown any signs of relenting, but instead, are asking businesses and residents to reduce power consumption. This lack of electricity is hitting the EU nations hard and experts fear the worst may just be getting started as winter approaches.

With the European economies in tatters, no sane investor will put their money in Europe. A shift of hot money away from Europe will naturally benefit the US dollar since the USA is the largest open economy.

Conflict With Russia Braces USA’s Resolve to Look Strong

As the leading nation of NATO, the USA needs to look strong and powerful in order to get other nations to respect and follow in its decisions. One of the best ways to get other nations to sit up and obey, is to have the strongest currency. The need for the US dollar to be strong has become especially crucial after Russia has begun to trade with other nations like China, Iran and even India, using their native currencies in order to circumvent US sanctions. While still a small fraction of international trade, this shift away from US dollar usage could start a trend and eventually threaten the world reserve currency status of the US dollar and make the US dollar lose attractiveness to other world nations. To safeguard its reserve currency status, the USA will need to quickly increase demand for the US dollar. What better way is there to induce demand than by offering a high interest rate to hold the US dollar?

While one may argue that the Fed hiking interest rates is to stem inflation, the magnitude of the hikes is telling when compared with other nations experiencing even higher rates of inflation. For instance, inflation in the UK for the month of August was 9.9%, while that in the US was much lower, at 8.3%. However, the Fed has hiked rates by 275-bps so far, compared with the UK’s meagre 215-bps. Could there thus be other reasons besides inflation that is causing the Fed to be more aggressive than its peers? This aggression leaves room for the imagination indeed.

When Would the Dollar Weaken

This strength in the US dollar, while possibly able to last for quite some time, is not likely to be permanent. Eventually, when the US economy starts to falter and fall into a deeper recession, the Fed would be forced to pivot and change its stance from raising interest rates to cutting interest rates. However, the Fed has cautioned that such a situation is still some time away even if the USA were to fall into a recession, which means this change could still be many moons away.

Conclusion

While we have listed above the common unspoken reasons that are on the back of the minds of many veteran investors, they are not exhaustive and other reasons could also come into play. Furthermore, the above reasons are the personal opinions of the author to create awareness and should not be taken as the official view that Margex holds.