Bitcoin came first, created by the mysterious Satoshi Nakamoto. What the cryptocurrency’s creator didn’t realize he had also given birth to at the same time, was an entire industry of altcoins that would either try to improve on the original formula, or introduce compelling new features and attributes previously unimaginable.

For example, early Bitcoin advocate Vitalik Buterin went on to create Ethereum and broadly introduce the concept of smart contracts to the cryptocurrency industry. Cardano founder Charles Hoskinson was also an avid Bitcoin supporter, eventually developing his own coin and Ethereum competitor.

EOS is yet another altcoin designed with many of the same features as Ethereum, but promises to offer improved scalability and speed for enterprises and individuals alike. Despite these promises, EOS has struggled over the last several years in the cryptocurrency market.

This ongoing trend has many investors wondering if the woes EOS faces will ever turn around. Take a look at this EOS price predictions guide to better understand if EOS is worth buying and what EOS future price might be.

What Is EOS? (EOS)

EOS is a decentralized, open-source protocol consisting of the EOSIO blockchain and the EOS cryptocurrency token. EOS was created by block.one CEO and CTO Brendan Blumer and Daniel Larimer and is based on a whitepaper released in 2017.

Block.one launched what was at the time the largest initial coin offering in the history of the cryptocurrency industry, raising more than $4 billion in a year. Block.one later released the open-source software project in June 2018.

EOS is designed to be a decentralized operating system, providing dapp developers with a robust set of tools to streamline the building and scaling of various blockchain based solutions. For these reasons, EOS was instantly dubbed as an Ethereum killer, ready to give the largest layer 1 blockchain a run for its market cap. Today, EOS is ranked 45th on by market cap according to cryptoasset price aggregator CoinMarketCap.

EOS Launch And Origin Story

EOS was first conceptualized by Dan Larimer, a crypto industry veteran. Larimer got his start at BitShares, then later launched the blockchain Steem and associated application Steemit. Larimer left the project after serving as CTO, later becoming CTO for block.one.

In June 2017, Larmier in cooperation with CEO Branden Blumer, announced a one-year token sale with the goal of distributing EOS to ensure proper decentralization. Blumer helped form block.one in the Cayman Islands and launched the EOS initial coin offering. In 2018, Blumer was recognized as one of “The Richest People In Cryptocurrency.”

The token sale offered a total of 90% of 1,000,000,000 EOS tokens, exchanging 1 ETH for 306 EOS. In one year, block.one raised over $ 4 billion from the token sale, earning the title of the largest initial coin offerings in history. Citics, such as Dogecoin creator Jackson Palmer, called out the EOS cryptocurrency for providing “zero utility” and calling it “absolutely useless.”

EOS launched on the Ethereum blockchain as an ERC-20 token. Today it is on its own EOSIO mainnet. In the years following the ICO, the US Securities and Exchange commission filed a suit against block.one. The company agreed to settle and pay a $24 million penalty. This was seen as a slap on the wrist after raising $4 billion from ICO investors.

In 2021 Larimer resigned from block.one. Larimer has since returned to the EOS community, partnering with the EOS Network Foundation to take over the EOSIO codebase. The move is designed to help “put an end to the technical stagnation that EOS has suffered under block.one’s leadership,” according to ENF CEO Yves La Rose.

EOS Blockchain And Protocol

The EOSIO platform website claims the blockchain protocol is fast, flexible, and forward-driven. “EOSIO is a highly performant open-source blockchain platform, built to support and operate safe, compliant, and predictable digital infrastructures,” the website continues.

EOS is claimed to be fast and efficient, highly configurable, developer-focused, and focused on security and compliance. It also processes transactions extremely fast and for absolutely free. EOS also supports smart contracts like Ethereum and many top cryptocurrencies it competes with for market share. EOS, unfortunately, hasn’t had as much developer or community support, and as a result, the project has suffered tremendously.

EOS seeks to replace the functions of a standard computer operating system by offering decentralized cloud storage, user authentication, and more. By mimicking the functions of a decentralized supercomputer, EOSIO, in theory, should make dApp development a breeze for developers. The simplicity should lure more and more developers to the platform over other competitors.

The percentage of EOS tokens held translates into the amount of protocol bandwidth the developer will have access to. The free to use platform is a double-edged sword for investors. Although developers must hold EOS tokens to utilize protocol, EOS tokens aren’t required to pay for transactions and therefore aren’t as in demand as ETH for example –– which is regularly required to mint NFTs, access dApps, or use DeFi solutions.

Important Factors Influencing EOS Price Predictions Explained

Several important factors influence how volatile an asset is at any given time and drive the price action behind each change in trend. Altcoins like EOS can be especially volatile as recent investors have learned. Here are the primary factors influencing EOS price predictions.

Demand

All assets including cryptocurrencies, are in constant price discovery based on a balance of supply versus demand. Demand is one of the chief factors that has limited EOS price growth over the years. Block.one has failed to drive interest in the development community to move to EOSIO from other platforms like Ethereum.

Even despite its head start over platforms like Polygon, Solana, Avalanche, and more, EOS has sunk further down the list of top cryptocurrencies ranked by market cap. The primary factor behind this is a distinct lack of demand. Not only are developers not interested in the platform compared to other blockchain protocols, but EOS tokens aren’t required for transactions and therefore in far less demand than competitor cryptocurrencies. For these fundamental reasons, EOS is also in less demand with the investment community.

Supply

The EOS supply is also an ongoing issue for the crypto project. There was a massive initial coin offering where 90% of 1,000,000,000 tokens were distributed. The theoretical maximum supply of EOS is also infinity. The EOS supply increases per annum based on an inflation rate. This is in stark contrast to other cryptocurrencies like Bitcoin which have a strict hard-coded cap in supply. This makes EOS less popular with diehard cryptocurrency evangelists that seek out hard money concepts digitally.

The expansive supply that is constantly growing poses a further problem in the face of low demand. With demand nonexistent, this increase in supply dilutes the value and market cap of EOS as new tokens enter circulation. Knowledge of this process discourages new investors from participating in EOS.

Macro

Making matters much worse for EOS, is the current macro backdrop of war, inflation, a pandemic, supply chain issues, and much more. Cryptocurrencies like Bitcoin and Ethereum are risky enough, but given their past performance offer investors enough reward to entice capital to take positions in the asset class. However, with EOS producing negative returns for most of its existence, investors are staying away given the current economic conditions.

The Federal Reserve increasing interest rates making debt more expensive has led to an unwinding in the crypto market and stock market. EOS has taken a beating during this time, falling to new lows beyond what other assets set for their bear market bottoms. The lack of demand, high supply, and economic conditions nearing a recession have made EOS a high risk trade.

Competition

Further worsening the outlook for EOS future price, is the incredible competition EOS faces. In 2017 when the whitepaper was released, Ethereum was a blossoming smart contract platform and there wasn’t much competition outside of that. EOS was pegged as an Ethereum killer and the ICO instantly became a success.

Today, thousands of Ethereum killers now exist and EOS is nowhere to be found on the list of the most popular among these top coins. Competitors like Cardano, Algorand, Solana, and more have made it nearly impossible for EOS to regain its former status and drum up excitement around the coin and its community. The coin and community continue to suffer from extreme negative sentiment.

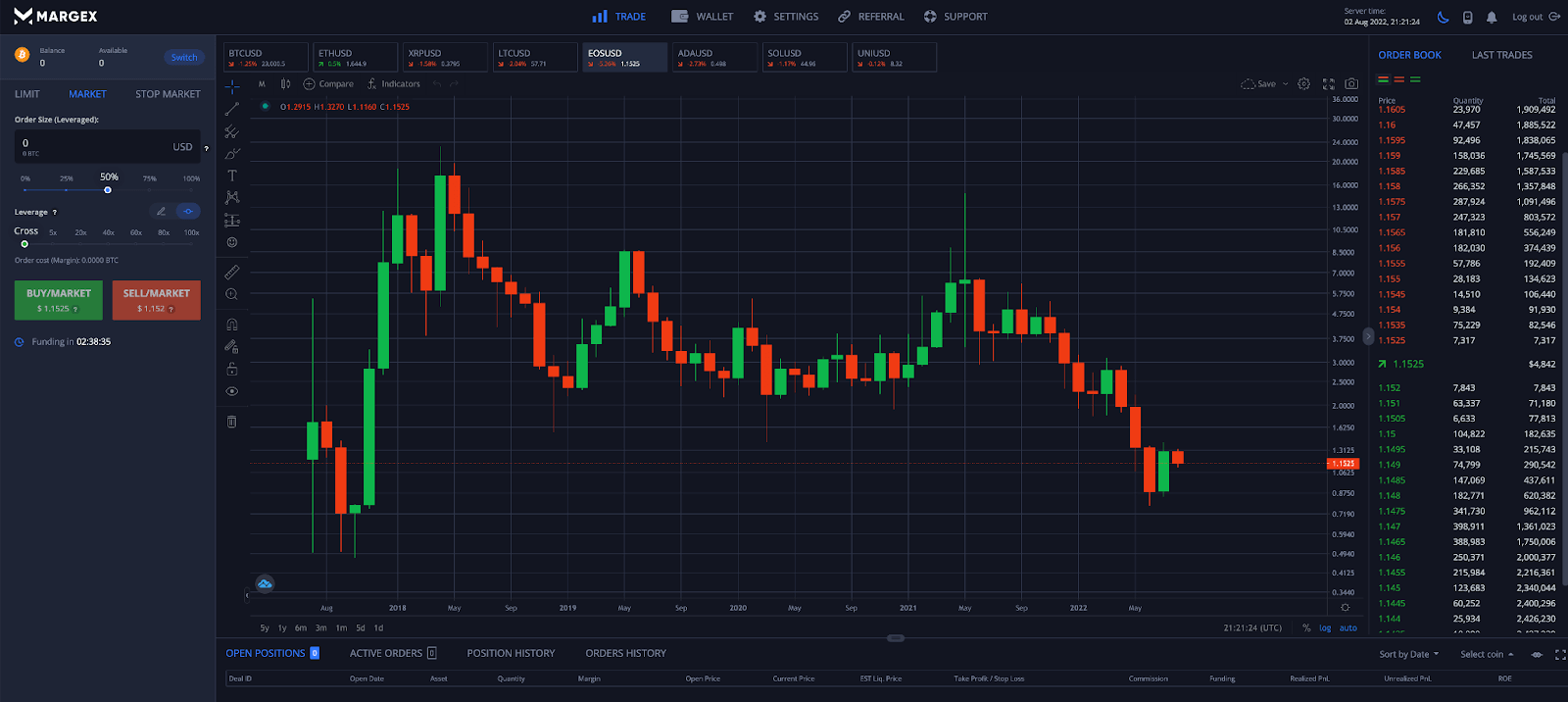

EOS Past Performance: A Complete Price History Of EOSUSD

EOS was first sold via a token sale and initial coin offering where 1 ETH was exchanged for 306 EOS tokens. Today, 306 EOS converts into roughly 0.2 ETH.

When EOS first began trading on exchanges, it was priced at around $0.40 and was highly volatile as buyers and sellers attempted to reach equilibrium. A large monthly candle was left behind with a large wick on either side showing indecision and a large price range. After a retracement, EOS rallied by over 4,800% in a five-wave impulse during the 2017 cryptocurrency bull run and altcoin season.

Following a peak at more than $23 per coin, EOS met its first crypto winter and bear market, falling by nearly 97% over the next several years. The first drawdown took 93% off of the price of EOS, reaching a low of $1.50. The cryptocurrency then had a surge in 2019 taking the altcoin to more than $8 per EOS. Shortly thereafter, EOS fell once again to around $1.40.

During the late 2020 crypto bull run, EOS made another attempt at reaching all-time highs, and instead left a volatile indecision candle with a high of $15 and a low of $3 in the very same month. EOS has been stuck in a downtrend ever since, falling as low as $0.74 and back to post-ICO pricing.

The price of EOS has experienced tough times in the bear market of 2022, as most other crypto projects saw more of a downtrend than an uptrend, with many speculating that the price could go lower. The price of EOS continued to hold pretty well above the region of $0.8 to $0.9, with the price looking to bounce off from this region.

How Is EOS Doing Now? Is EOS Bearish Or Bullish?

The current price of EOS today is $1 per EOS token. Unfortunately, the cryptocurrency is now considered more of a niche investment and isn’t popular among the crypto crowd, the development community, or institutional investors.

The trend has been bearish in EOS since 2018, with a strong expectation for the decline to continue. However, because so many investors are so bearish on EOS, and with prices retracing back to post-ICO support levels, EOS could experience a bullish contrarian rally or a short squeeze.

EOS could also grow as part of overall cryptocurrency industry growth. After a huge collapse in the cryptocurrency market, traders are recommended to wait until a new uptrend is validated by rising volume and returning interest before adding EOS to their portfolio.

Short-Term EOS Price Prediction 2023

The altcoin EOS has had a very challenging 2022, like other cryptocurrencies, but the ongoing crypto winter could soon be over, with the market showing some signs of relief and others calling for the bottom. The below chart displays automated EOS price predictions month-by-month for 2023.

Long-Term EOS Price Prediction 2023, 2024, & 2025

EOS at this point could become the dominant smart contract platform and might have overtaken Ethereum. The below chart displays automated EOS price predictions quarter-by-quarter for 2023, 2024, & 2025.

Long-Term EOS Price Prediction 2026 – 2030

The future is bright for cryptocurrencies and in another five to ten years, anything is possible for EOS and other altcoins. The below chart displays automated EOS price predictions year-by-year for the years 2026, 2027, 2028, 2029, & 2030.

Long-Term EOS Price Predictions From Experts

Getting a wide range of opinions from industry experts can help with any necessary convincing before taking the risk investing in EOS. Remember, experts are people too and humans can be incorrect. There is no way to always accurately predict the future, and the opinions below are based on probabilities and are not a guarantee of results or performance. Always do your own research in addition to reading the analysis of others.

CoinQuora

CoinQuora’s predictions are all over the place, with a bullish prediction topping out at $5.41, while a bearish prediction puts the coin back at $0.78. Meanwhile, they also say that “EOS price might also reach $10 soon.” Take the mixed predictions with a grain of salt.

Changelly

The Changelly blog continues to provide some of the most bullish predictions around for cryptocurrencies, and their targets for EOS certainly do not disappoint. By the year 2021, EOS will have reached a max price of around $60.40 per EOS, with a possible low of $49.33.

CoinPedia

CoinPedia’s predictions are a bit more reasonable, calling for prices of around $24.15 by 2025 or if prices continue to slump, a max of $13.49 by the same timeframe.

CoinPriceForecast

CoinPriceForecast sees more stagnant price action for EOS for the long haul. By the year 2034 for the longest possible forecast of all, EOS will be trading at a max of $4.06 per coin, with a possible low of $3.93/

LongForecast

LongForecast is the most bearish on EOS, with a prediction of $0.46 by the year 2024. Although they are named LongForecast, they provide one of the shortest forward-looking price targets of all.

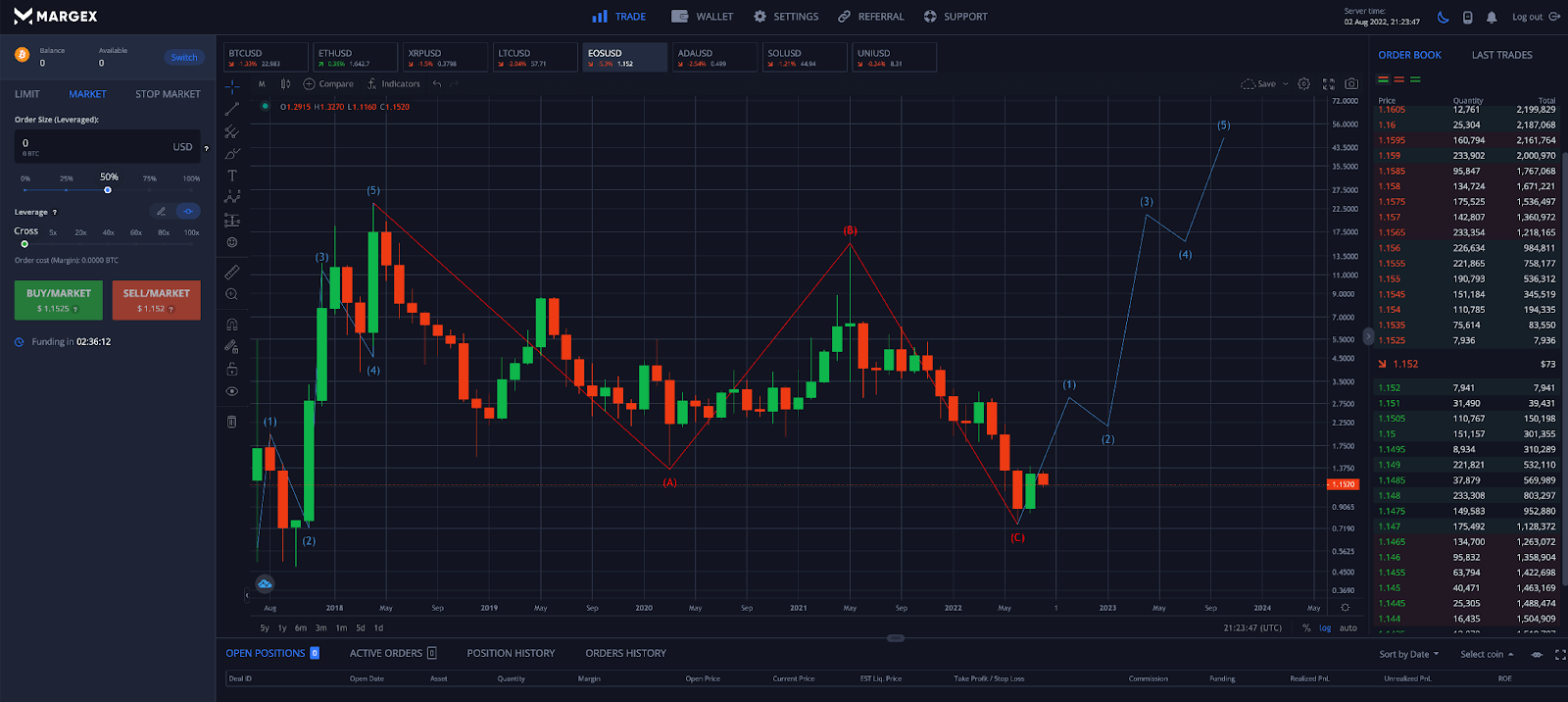

Price Prediction By Margex Technical Analysts

The Margex margin trading platform and its team of on-chain and technical analysts have provided a detailed EOS forecast to compare against the automated and expert EOS price predictions offered by others or through AI above. Please note, this is not investment advice and price predictions are subject to change. Always do your own research and never invest more than you can comfortably afford to lose.

The EOS / USD price chart exhibits a clear bullish impulse with five waves. Odd numbered waves move up with the primary trend, while even numbered waves are corrective in nature. Following the impulse, EOS suffers its first full bear market and an ABC correction. With the ABC correction potentially completed, a new bullish impulse is possible taking EOS to as much as $25 per EOS token in the next several years.

EOS Price Prediction Crypto FAQ: Commonly Asked Questions About EOS Cryptocurrency

EOS is the native cryptocurrency to the EOSIO blockchain. EOS isn’t required to send transactions like other cryptocurrency-based protocols, making it very confusing for investors seeking to understand the value of EOS on a fundamental and technical level.

This FAQ is designed to answer commonly asked questions related to EOS price predictions.

Is EOS worth buying?

EOS is possibly worth buying and adding to an investment portfolio simply due to how low the price is in contrast with historical prices. EOS in the past has traded as high as $23 per coin at its all-time high. The current price of around $1.20 would represent nearly a 20x return if the cryptocurrency would ever return to such prices. Even during past bear market rallies, EOS was able to produce as much as 4x returns. The current levels offer a great risk versus reward opportunity

Does EOS have a future?

Dan Larimer and the EOS Network Foundation are working to revive the community and help to give EOS a brighter future. With or without these efforts, EOS still has some type of a future, but it is debatable if the asset will grow in value or will sink further. EOS is an ideal crypto asset for margin trading, given the lack of direction about its future.

What will EOS be worth in 2025?

According to expert analysis and AI-generated price predictions, EOS will likely fail to reach a new all-time high by the year 2025. More time will be needed to bring excitement and activity back to the EOS development community after four years of being stagnant. However, later estimates prove to be much higher.

Is EOS a good investment in 2022?

EOS could present itself as a good investment in 2022 simply due to the risk versus reward setup of a cryptocurrency trading at such lows. However, given the demand for EOS, the current development situation, and the economic backdrop, EOS remains a risky investment and is better suited for margin trading.

What will EOS be worth in 2030?

Here is where EOS begins to start to make money again for investors. According to many prediction models, EOS could finally make a new all-time high by this time. The highest price predictions put EOS somewhere near $25 per coin.

Will EOS be the next Bitcoin?

EOS will most definitely not be the next Bitcoin. The cryptocurrency was designed for completely different intents and purposes, and EOS is miles behind Bitcoin and other cryptocurrencies in terms of popularity and market cap.

Can EOS overtake Bitcoin?

You should never say never, but it would be a shock for EOS to overtake Bitcoin in any capacity. EOS is ranked in 45th place while Bitcoin is the top ranked cryptocurrency by market cap. Part of the reason each BTC is priced so high is due to the large amount of capital across a small amount of coins. Bitcoin has a supply of 21 million BTC, while the max supply of EOS is infinity.

Is EOS an Ethereum Killer?

EOS was positioned as an Ethereum killer at launch but it has failed miserably to fulfill that role. EOS struggles to sustain any type of price support or drum up any development or investment interest. Ethereum, meanwhile, continues to grow and is the second highest ranking cryptocurrency by market cap.

Can EOS reach $100?

EOS could someday reach $100 per coin, but given the long-term price predictions by expert analysts, getting there could take a lot longer than most investors are willing to wait. Even a ten-year horizon of around 2030 only takes EOS to around $50 at the highest prices. Reaching two times as much price could take more than double as long.

How to trade EOS at Margex?

It is easy to trade EOS at Margex. The stylish and intuitive user experience makes it simple to place a buy or sell order for many of the most popular digital assets today. The platform also features built-in technical analysis tools so you can do your own analysis and make your own EOS price predictions.