In recent days, the crypto markets have sprung higher after a series of whale accumulation and global central banks like the Reserve Bank of Australia and Reserve Bank of Canada adopted a less hawkish tone. Although Bitcoin rose quite favourably in the market bounce, it was Ethereum that took the spotlight, out gaining Bitcoin and even beat most other altcoins to clock one of the best returns in the market over the past two weeks.

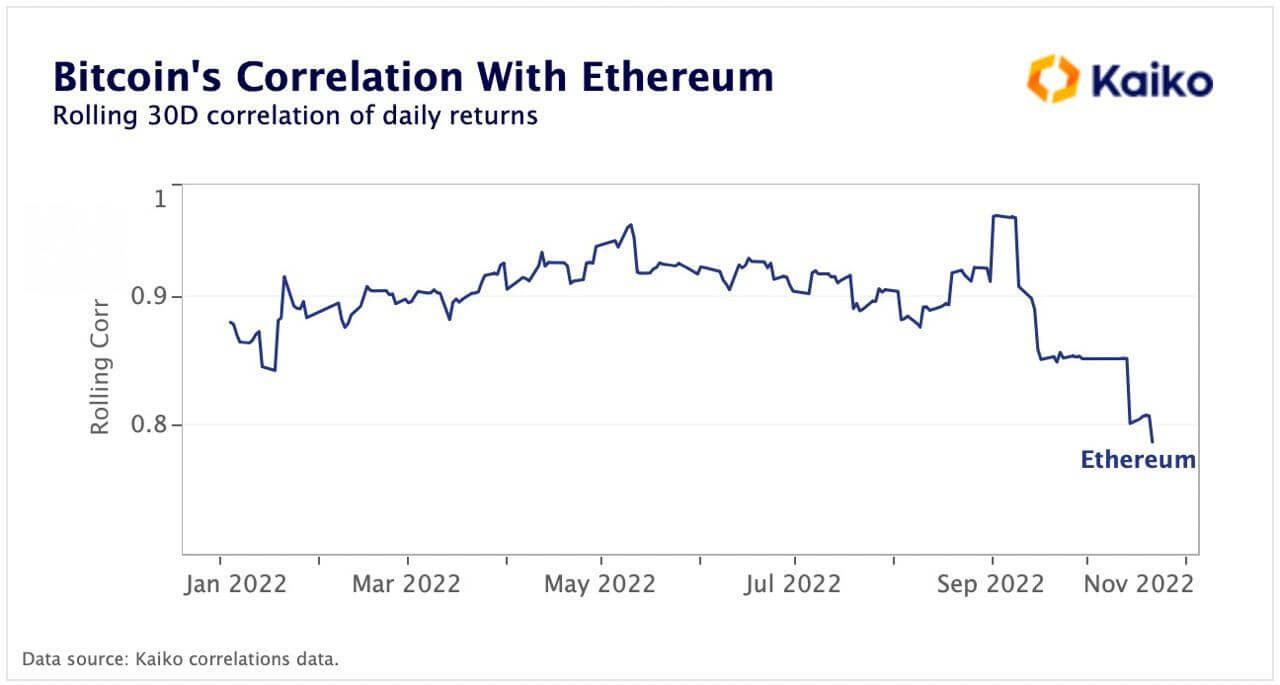

Ethereum’s faster ascent than Bitcoin has pulled its correlation to Bitcoin back down to 11-month lows as the second largest crypto by market cap has cast away Bitcoin’s shadow and has been moving according to its own fundamentals since the end of October.

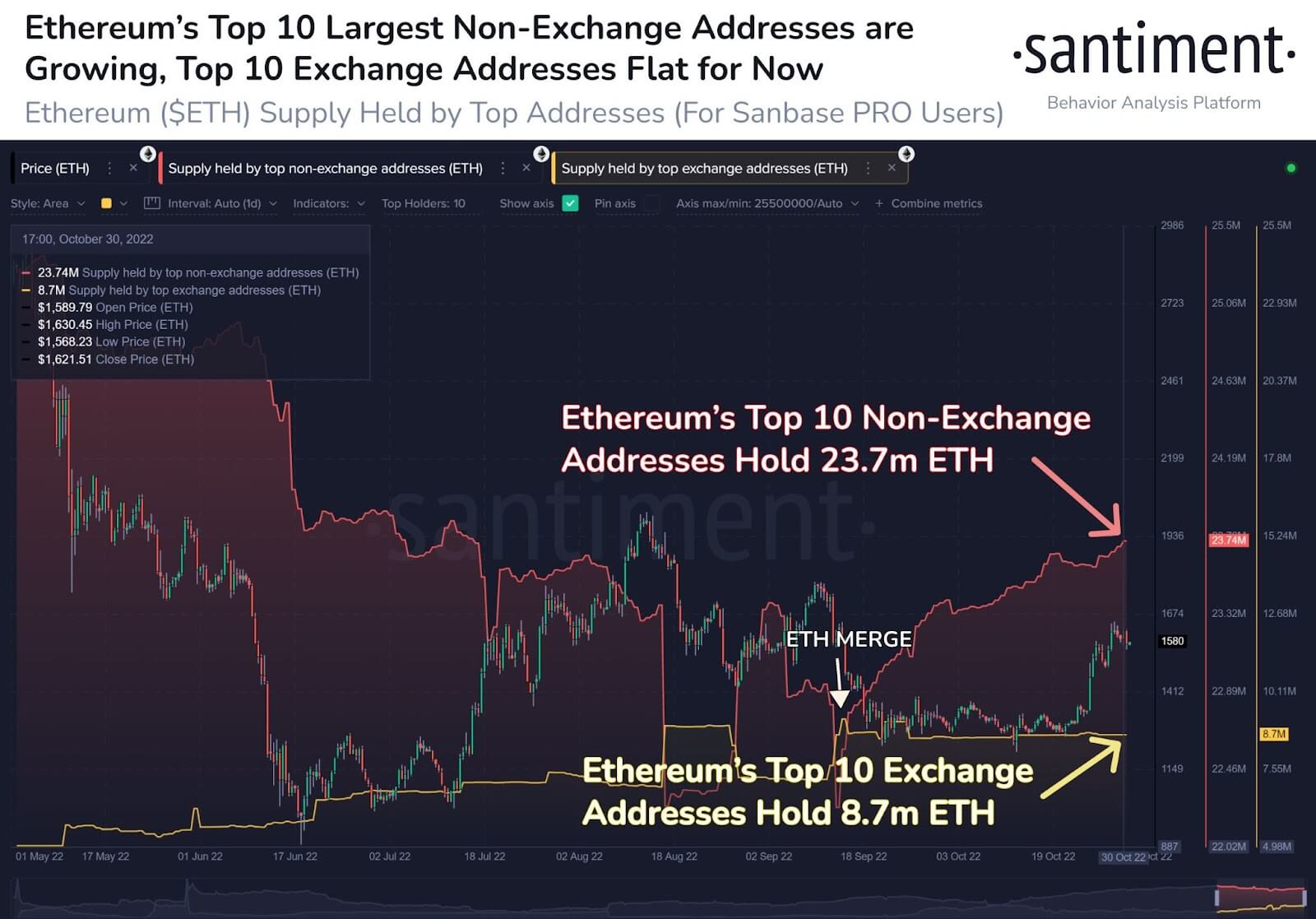

Whales have started to reaccumulate Ethereum again after worries about the Merge proved to be unfounded, which has helped support the price of Ethereum even despite a market pullback after the Fed’s decision to hike another 75-bps on November 2. Miners who did not like Ethereum’s move from proof-of-work to proof-of-stake and started dumping the token have also stopped their selling activities, perhaps because they have no more Ethereum to dump since Ethereum cannot be mined anymore.

Bitcoin Still Under the Mercy of Miners

Bitcoin, on the other hand, has got miners to worry about. Other than being under pressure due to a hawkish Fed and fears of an economic slowdown, news of Bitcoin miners having financial difficulties and facing bankruptcies by the end of this year have also affected the price of Bitcoin, as troubled miners may be forced to dump their mined Bitcoin to pay for expenses. Thus, with Bitcoin facing some potential headwinds heading into the final few months of the year, the falling correlation with Bitcoin is good for Ethereum at this point in time – Ethereum is almost free from the influence of miners after it has moved into the proof-of-stake mechanism. We say almost as some miners who used to mine Ethereum when it was still under proof-of-stake may still have some leftover balance to sell – however, in the month of September, most of miners’ Ethereum supply has already been sold as a show of displeasure at it moving to proof-of-stake, leaving only a small amount of Ethereum in the hands of miners. That is why while miners could still have some influence over the price of Ethereum to a small extent, the amount of influence is in no way comparable to their influence on Bitcoin’s price. This could be also the reason why the price of Ethereum has sprung up much more than Bitcoin in the latest bounce, and it could also underscore the trend for the coming months, where Ethereum will outperform Bitcoin.

Technical Chart of ETH/BTC Bullish

When comparing ETH with BTC, one would definitely need to look at the ETC/BTC trading pair to be able to see at one glance the price relationship between the two assets.

The ETH/BTC chart is bullish, with price moving in a rising but gentle channel since June 2022. Although ETH/BTC has fallen since September possibly due to fears of the upcoming Merge at the time, this fall has been broken to the upside since mid-October after the Merge did not cause any negative impact on the performance of the Ethereum blockchain. In fact, Ethereum has become deflationary as the number of newly issued Ether tokens is now less than the number of Ether tokens burned daily. This could be one of the reasons that prompted Ethereum to outperform Bitcoin in the current season.

From the chart, we can see that Ethereum is consolidating after a large increase against Bitcoin in what looks like a bull flag formation. Should the level of 0.08 BTC be taken out, we could see the pair trade till 0.09, which is the price target we could achieve using the flagpole of the bull flag as a reference.

Thus, other than fundamental reasons, even the technical picture is pointing towards a better performance from Ethereum when compared with Bitcoin.

How to Take Advantage of an Outperforming Ethereum

Traders can utilize the above information to help them in their trades in various ways. One way is to trade the ETH/BTC pair, where you will be trading to acquire more Bitcoin since your gains will be calculated in Bitcoin when trading BTC-based pairs.

Another way will be to buy more ETH/USDT since investors buying back their Ether tokens post Merge will likely support its price even in USDT in the near-term. Improving fundamentals with Ethereum becoming deflationary would likely also provide buying support on the second largest crypto as investors who previously only held Bitcoin for its store of value proposition may be drawn to also buy Ethereum now.

Another more adventurous way a trader can trade this is to buy Ethereum and sell Bitcoin. This is commonly known as pair trading where one buys the stronger asset and sells the weaker asset. However, this method of trading is highly risky and should not be attempted unless one is a very experienced trader who is adept at managing his risk.

That said, the above are simply the personal opinions of the author and should not be taken as financial advice nor are they representative of the views of the Margex platform. Readers are strongly encouraged to do your own research before doing any trading and to seek advice from your personal financial advisor should you have any doubts.