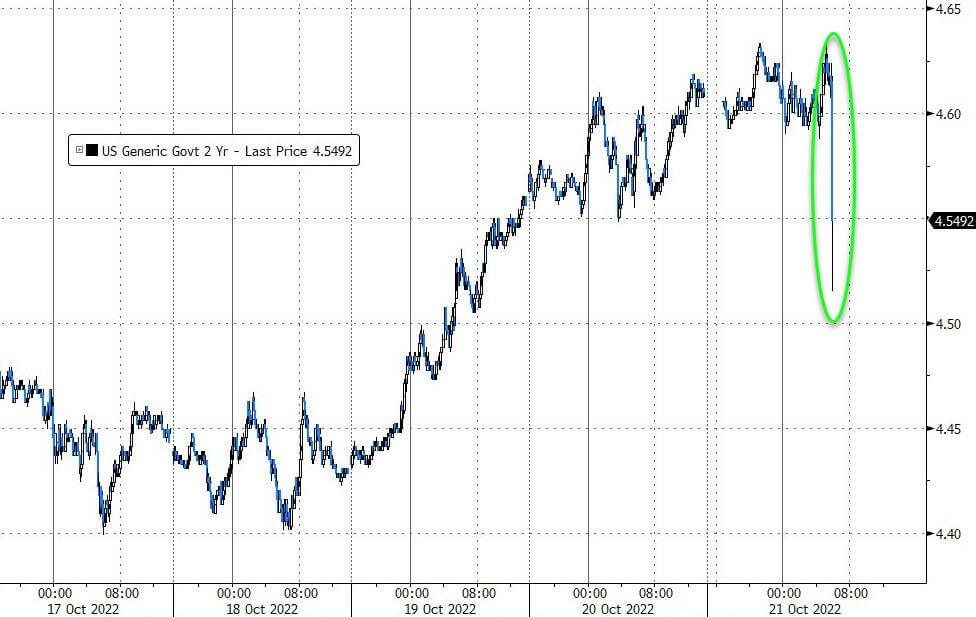

In the final week of October, the crypto markets sprang higher after market experts took the latest comment from Fed speaker Daly as a hint that the Fed was turning more dovish. Beginning 25 October, crypto markets made their highest percentage moves in over three months, exciting many crypto investors.

Record Ethereum Short Liquidations Led Market Higher

While Bitcoin rose 5% and many altcoins also moved higher, Ethereum was the main highlight as it saw a significant amount of short liquidations, which sent its price propelling upwards of 13% in just one day on 25 October.

While the total amount of short liquidations in the entire market on 25 October was more than $700 million, which was a high number, more than half of those were contributed by Ethereum shorts alone.

By the end of the week, Ethereum short liquidation amounted to more than $500 million as its prices crossed the $1,600 mark. This was Ethereum’s highest dollar value of short liquidations on record, showing the amount of late bears and how much Ethereum was being shorted for no apparent reason, and the most of the shorts came from one particular crypto exchange, FTX.

According to Coinalyze, by the end of the week of 25 October, the open interest of ETH futures on FTX had dropped from a maximum of 1.527 million ETH to 1.266 million, with FTX’s Ethereum short liquidations worth around $440 million when its total short liquidation was only slightly above $500 million.

Was an FTX whale trying to depress the price of Etherum in the futures market, but instead got killed by spot market bulls? The whale has since stopped putting up more Ethereum shorts, although the shorts are rising again due to many pump and dump groups urging followers to short Ethereum. However, readers need to be aware that trades in the futures market are not able to sustain a trend since they could get liquidated; it is always investors in the spot market that will be able to withstand volatility as investors who hold spot positions have holding power and do not get forced liquidations.

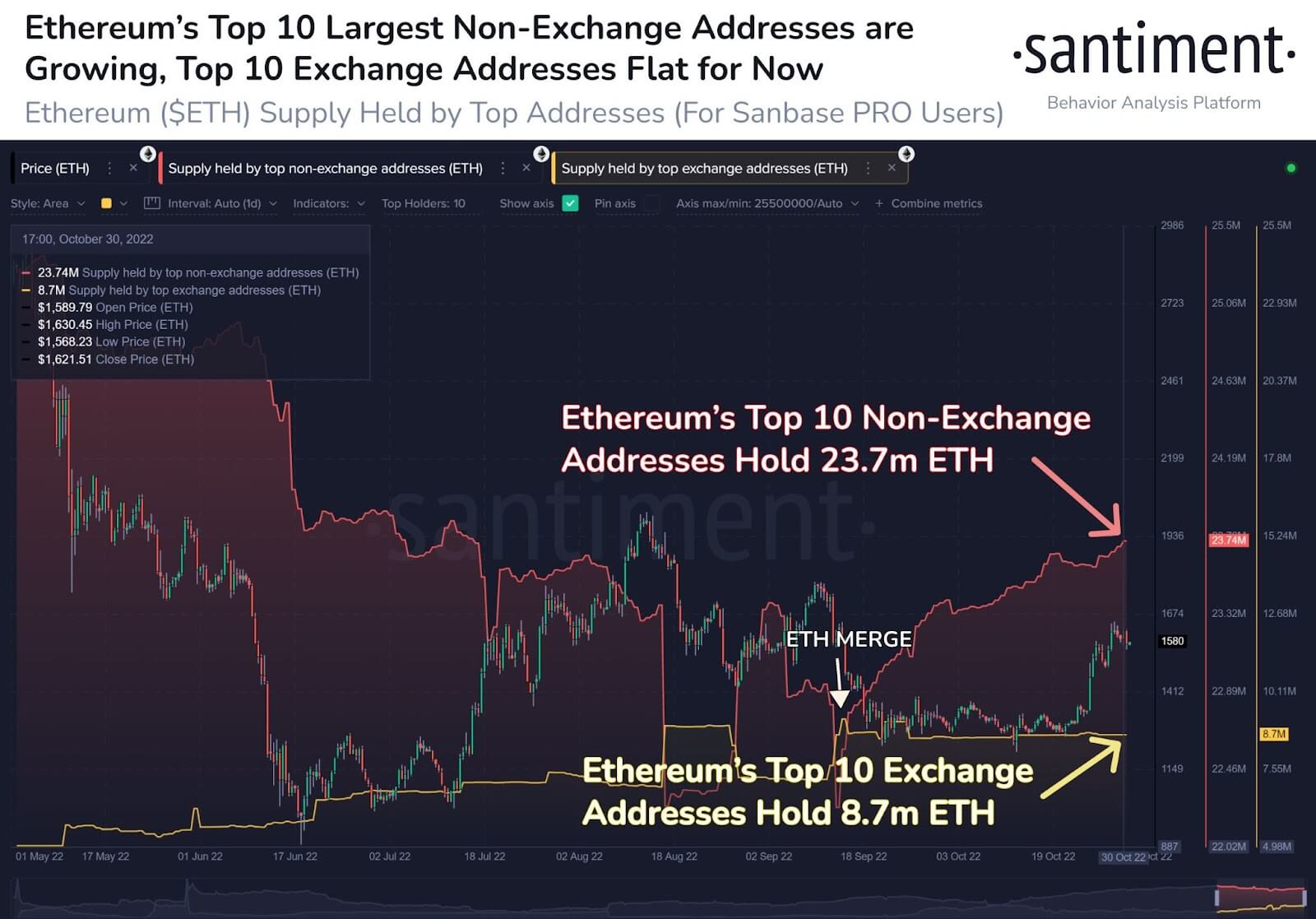

Ethereum Whales Back On Buying Spree

Spot market buying volume on Ethereum by whales has increased since the Merge on the back of the changing narrative of the Fed and Ethereum’s own fundamental story. Such a large increase in buying volume typically could reverse trends or signify a breakout, which is why this buying is significant and thus, bearish traders ought to take note. Even though many market watchers are still bearish and call this a bull trap, we should not discount such high volume moves as prices are already much closer to the bottom than they are to the top.

Ethereum Has Fundamental Reasons to Be Strong

As the number of transactions on the Ethereum network increases, more Ether is being burned under EIP-1559, which has caused Etheruem to finally become deflationary, i.e. its number of new coins issued now has become less than the number of Ether burned per day.

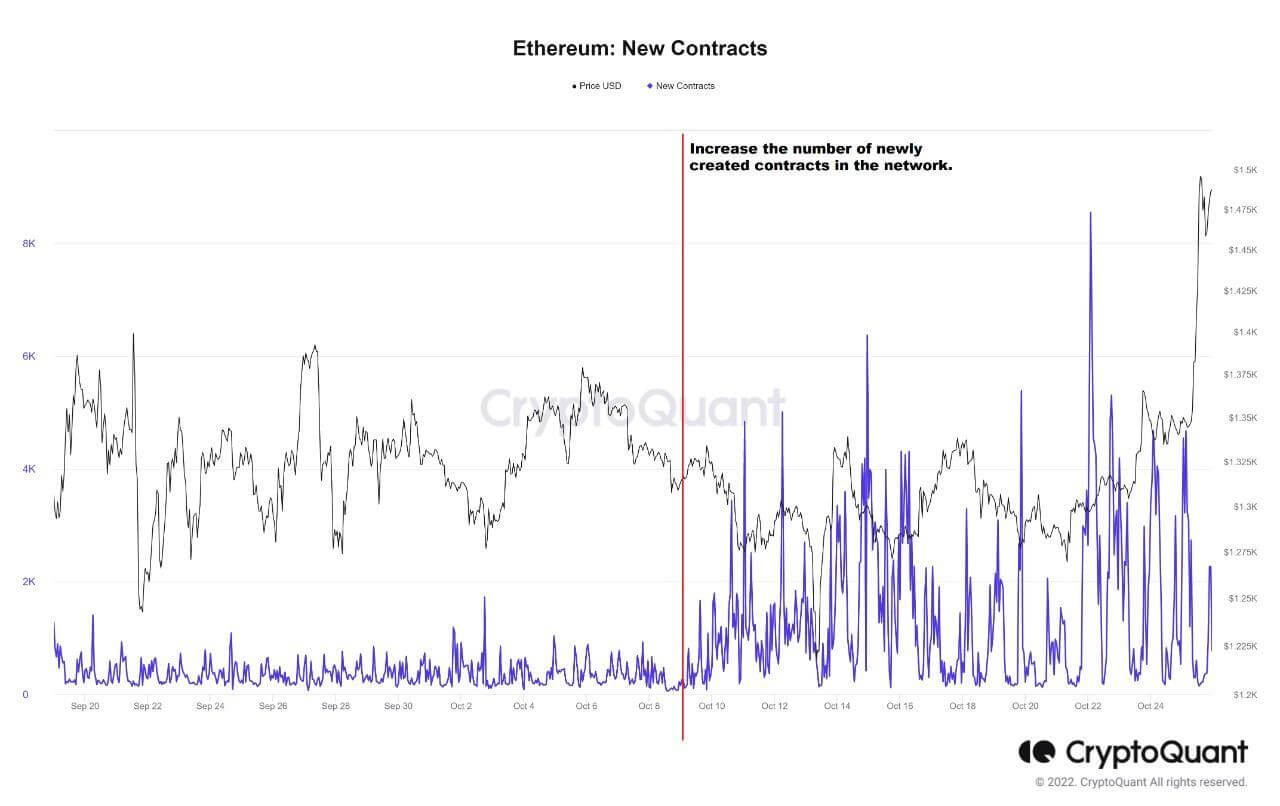

Furthermore, the number of smart contracts deployed on the ETH blockchain has increased significantly in October, which is a sign that projects are back building on and utilising Ethereum. Should this trend continue, it bodes well for the adoption for ETH under PoS, which will ultimately translate to higher prices since the more ETH is used and burned under EIP-1559, the more deflationary ETH becomes.

Hence, Ethereum’s buyers do have strong fundamental reasons to be bullish, and this may continue to squeeze out short sellers and see its price continue to march higher.

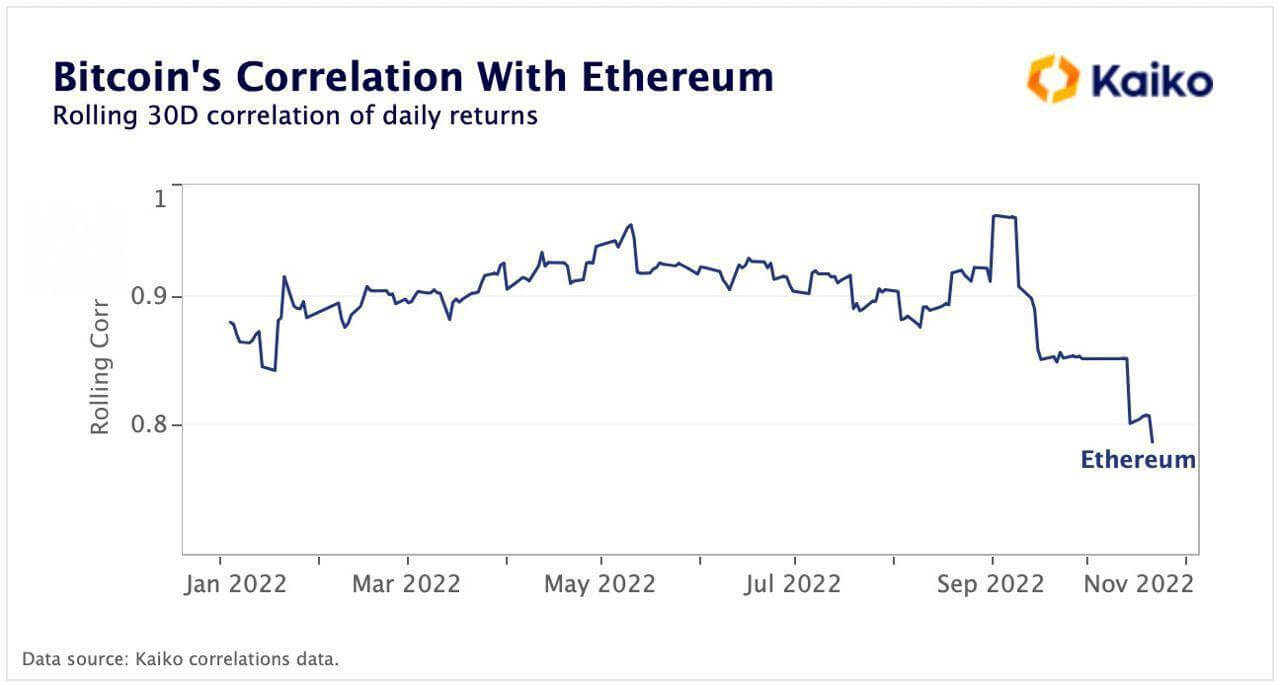

Falling BTC-ETH Correlation Hints of Altseason

Altcoins typically fare well when Ethereum does well since most traders use Ethereum as a gauge of market sentiment. As its correlation with Bitcoin falls, Ethereum would likely trade more in-line with its own fundamentals, which are improving. This could mean Ethereum could outperform Bitcoin in the near-term as Bitcoin does not appear to have a lot of positive developments in the meantime, but is still holding its ground well as an inflation hedge.

The above scenario is one of the best base situations for altcoins to pump and an impending altseason should not be ruled out.

Bitcoin Risk Lies In Miner Liquidation

While the bulk of the selling pressure in the crypto market appears to be from futures traders who are not as powerful as spot traders, the crypto market is not without negative developments. One major hurdle the market will need to overcome is the situation with Bitcoin miners, who are suffering financial pressure due to higher costs and a lower Bitcoin price. Some miners may be forced to sell their mined Bitcoin holdings, which may cause the price of Bitcoin to correct. However, with miners already having sold a large portion of their holdings over the past three months to meet capital expenditure, what amount of Bitcoin these miners have may not be substantial enough to depress the price of Bitcoin.

Furthermore, according to the MacroMicro website, miners’ cost of mining 1 Bitcoin currently is around $22,600, while Bitcoin is trading at around $20,000. Hence, it is unlikely that miners will crash the price of Bitcoin by dumping relentlessly and inflict further damage on themselves. However, should the price of Bitcoin recover to above $23,000, we could see miners start to sell their Bitcoin. Thus, this miner situation is not likely to crash the price of Bitcoin further, what it might do is to add some selling pressure when Bitcoin goes above $23,000.

Hence, traders who are waiting for the next leg down or shorts who are trying to capitalize on the miners’ situation after reading the news may eventually become disappointed. However, it could be for this exact reason that Bitcoin takes a backseat while Ethereum and altcoins get to shine.

With improving fundamentals for Ethereum post-Merge, Ethereum at the moment does have the capacity to take the entire crypto market higher with it and lead a market rally through its influence on altcoins. This may also mean that the crypto market could have already bottomed.

The above is the personal opinion of the author and is not to be taken as the official view of Margex, nor is it financial advice. It is also not a solicitation to trade, and readers are advised to do your own research and seek advice from your personal financial advisor should you be in doubt.