Ethereum and Ethereum Classic cryptocurrencies are investment options in the digital asset market. But sometimes, many people confuse them, given that they’re both Ethereum. So, what is the main difference between them? Is one better than the other, and what is the future of both networks?

Comparing Ethereum vs. Ethereum Classic shows that ETH is more popular and keeps expanding, while ETC is not. Ethereum ETH doesn’t have a supply cap and is traded on many crypto exchanges, while ETC has a supply limit and hasn’t expanded since the hard fork.

Ethereum ETH has grown to be the hub of smart contracts, DeFi projects, and non-fungible tokens (NFTs). Many developers prefer to deploy their projects on the Ethereum blockchain, and with the upcoming Merge upgrade, the network will host more projects. But even though Ethereum Classic ETC recorded some price increase in 2022, the price hasn’t skyrocketed like ETH.

Find all the juicy details on ETH vs. ETC below.

Difference Between Ethereum ETH And Ethereum Classic, ETC?

While both networks exist as Ethereum, they are not the same. Here are some differences between ETH vs. ETC;

Origin

The major difference between Ethereum vs. Ethereum Classic is in the originality of both blockchains. The Ethereum network is the original offset of the blockchain. It existed before the era of the hard fork. After the fork, the chain became even more robust. Notably, the peer-to-peer network is the most popular and traded version of the two.

But Ethereum Classic is the product of the hard fork that occurred on Ethereum to recover the 3.6 million ETHs stolen from the DAO.

Supply

Ethereum ETH doesn’t have a fixed supply. But ETC currently has a total supply cap of 210,700,000. It reduces the miners’ reward by 20% after the five millionth block. Also, it will keep reducing the block reward percentage by 20% for every 5 million blocks.

Development

Ethereum keeps evolving and operates on more advanced technology. Ethereum is set to upgrade to a proof-of-stake consensus mechanism, slated for September 15, 2022. After the upgrade, the network will become even more scalable and developed.

Ethereum Classic, on the other hand, was created in 2016. Since then, it has always been in its original state, functioning on the same code.

Market capitalization

Ethereum is the second largest cryptocurrency in market cap after bitcoin. According to coinmarketcap, ETH reached an all-time high of $4,891 in November 2021. But ETC is not as commonly traded as it is with ETH. ETC price hasn’t broken past the $200 mark since the split. Its market cap stands at $4,562,159,580, and it hit its all-time high of $176.16 on May 6, 2021.

An overview of Ethereum Classic (ETC)

Ethereum Classic is a product of the hard fork on the Ethereum network after a hacker stole millions of ETH. The network was launched in 2016. It operates as a smart contract network capable of hosting decentralized applications. The native token on Ethereum Classic is ETC.

The founders of Ethereum Classic remain Vitalik Buterin and Gavin Wood. The splitting of the main network was due to a major hack of its DAO, leading to the loss of 3.6 million ETH. Due to the disagreements, a small group opted for the division.

According to the developers, the ETC community runs on a permissionless “do-ocracy” open to anyone. Ethereum Classic emerged to keep the original network without changing anything. The network uses the proof of work consensus mechanism. The gas fees on the network are given to the miners following the PoW mechanism.

The digital asset is available on most exchanges, including Binance, Houbi Global, and OKEx. Its current price as of August 27 stands at $33.24.

The future of Ethereum Classic

Ethereum Classic has consistently recorded a gradual price growth. Experts in the crypto space predict its price action as follows: $42.75 by the end of 2022, $63 by 2023 end, $92 by 2024, $184.96 by 2026, and $279 by 2027

The figures above are predictions from TradingView analysts. The price growth of ETC depends on certain factors. One factor is the migration of ETH miners to the chain after the successful completion of the Merge. Moreover, Ethereum Virtual machine is now compatible with Ethereum Classic. This signifies that ETC can now operate with the dApps of Ethereum.

Additionally, following the upgrade, the Ethash hashrate will be moved to ETChash. The chain (Ethereum Classic) revealed this information on March 18 in a blog post captioned Ethash Miners.

This event will further push up the power of the ETC network hashrate, reducing the chances of a 51% attack.

An overview of Ethereum (ETH)

Ethereum is the more evolved version of the original network. It is a decentralized open-source computing network that facilitates transactions via smart contracts. Ethereum blockchain is also the hub for decentralized app and NFTs development. It is the second crypto in the list of cryptocurrencies by market cap.

The Ethereum founder officially launched it in July 2015 with the codename Frontier. But from then till now, it has undergone many network updates, such as Constantinople in 2019, Istanbul later on December 2010, Muir Glacier in 2020, Berlin in 2021, and the London Ethereum fork that took place on August 2021.

Ethereum network native token is ETH, a fungible token without a supply limit. ETH uses the ERC-20 standard to enable smart-contract-enabled tokens to be exchanged with others. The network developers are constantly pursuing the goal of making it a global platform for dApps. It also hosts many other crypto tokens via its ERC-20 technical standard.

So far, the number of ERC-20 tokens launched on the Ethereum blockchain is above 280,000. Some of these tokens include BNB, USDT and LINK, and others.

The future of ETH

Since its launch, Ethereum developers have continued to expand its functionalities. The latest event is the Merge upgrade, expected on September 15, 2022. Ethereum blockchain platform will discard the proof-of-work consensus mechanism for proof-of-stake, replacing miners with validators. As a result, many people in the Ethereum community expect a price push after the upgrade.

That’s why the price prediction of the digital currency is optimistic. Many analysts, including WalletInvestor, see Ethereum price at $2,138.85 by the end of 2022, $3,334.86 by 2023, and $4,542.88 by 2024. As for the ETH price of 2025, WalletInvestor predicts a trading price of $5,741.

Other analysts seem bearish given the 2022 crypto winter, the ongoing inflation, and the Fed’s decision to be hawkish in their fight against it.

ETH Vs. ETC: Which Is The Better

Ethereum (ETH) and Ethereum Classic (ETC) are similar. But they have distinctive features, making some investors wonder which is better. So, let’s make the ETH vs. ETC decision based on the following:

Network concept and goals

Ethereum emerged to fix the loopholes in the Bitcoin network. Vitalik Buterin created it to support the development of smart contracts. These digital agreements have evolved for simple transactions such as real estate sales and complicated codes for decentralized exchanges such as Uniswap, NFTs, and DeFi apps.

Ethereum Classic is also capable of performing these functionalities. But the development community moved to Ethereum instead. Also, a series of 51% hacks on Ethereum Classic since it doesn’t have support.

Transaction speed and utility

The average transaction speed of Ethereum and Ethereum Classic stands at 12-15 TPS. But the speed of receiving depends on the amount of ETH gas fees paid. If the user pays higher, the speed becomes faster too.

Moreover, all the transactions on the Ethereum blockchain are paid with ETH, and even the ERC-20 tokens use it. Therefore, the coin will always be in demand, given the number of projects hosted in its ecosystem.

Most importantly, after the Merge, the transaction and speed on Ethereum will improve beyond the heights of Ethereum Classic.

Supply and distribution

The Ethereum network has an unlimited supply of ETH. It has a yearly supply limit that keeps decreasing. Also, the Merge will further reduce the supply of the top altcoin after the miners have stopped operations.

For the Ethereum Classic network, its supply of ETC tokens mimics the pattern of Bitcoin. The network has a fixed supply capped at about 210 million ETC.

Developers

Ethereum boasts of more developers in the crypto space. Bitcoin has only 680 developers. But as of January 6, 2022, Ethereum developers have reached above 4000. This number is more extensive than others by a wide margin, pushing the worth of ETH to increase

The other networks competing with Ethereum for developers are Binance Smart Chain, Polkadot, Cosmos, and Solana.

But Ethereum Classic was ditched in terms of developers. It presently depends on teams, individuals, and volunteers who choose different tasks and execute them to support the network. Top shots in the industry, such as Grayscale investments, funded the development of Ethereum Classic.

How To Make Profit From ETH, ETC, Or Other Crypto

There are many ways to profit from Ether, ETC, BTC, or other cryptos. Some include staking, lending, investing, trading, mining, airdrops and forks, and crypto social media.

But trading is perhaps the fastest way to gain from your crypto asset. This is because trading helps you gain short-term price changes with the proper technical and analytical skills and the right platform.

Margex is one of the best trading platforms with reliable cryptos. You can trade crypto derivatives on Margex with 100x leverage. Also, the newly launched stablecoins staking feature allows you to trade staked assets and earn high rewards. Trading staked assets offer 8.8% APY on stablecoins and 5.5% APY on Bitcoin.

Margex offers many deposit options, including credit/debit cards and crypto assets, such as BTC, ETH, USDC, DAI, LINK, USDP, wBTC – ERC20, USDT – ERC20, and TRC20.

With Margex mobile app, you can trade on the go with innovative features and advanced tools. All crypto assets on Margex, including BTC, USDT, USDC, DAI, ETH, Link, wBTC, USDP, can be used as trading collaterals.

How to trade ETH on Margex

Create a trading account, make a deposit into your Margex wallet then follow the steps below to start trading:

- Step 1 Open a trade

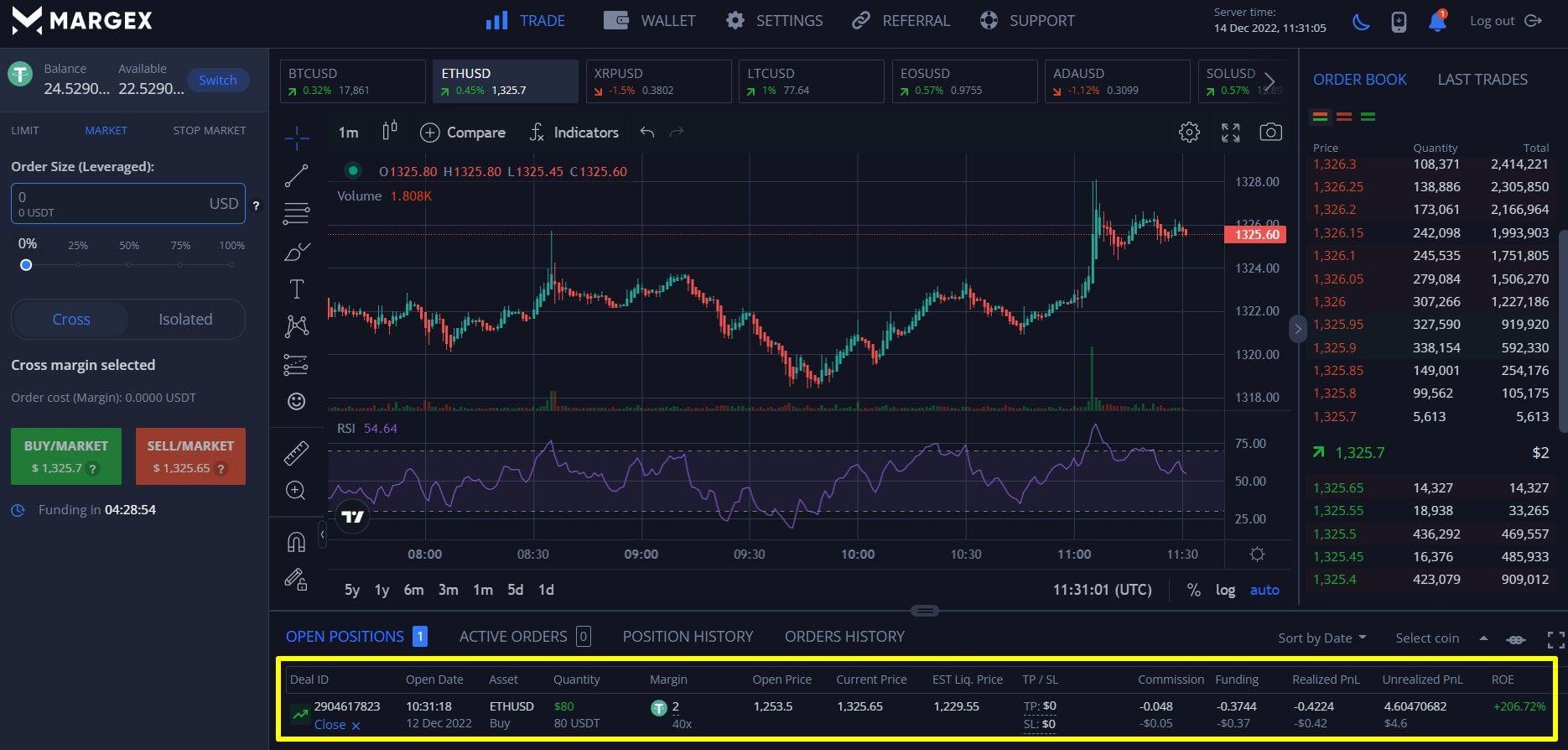

You can open many trades in different or the same directions, as Margex uses an isolated margin. Apply the leverage you want up to 100x leverage. But chose lower leverage to reduce risks as it gets higher with more. For example, in the chart above, we open a $1000 trade at 10x leverage.

- Step two. Choose your position

Choose your position depending on where you expect the market to move. You can choose the long or short position. Let’s go LONG (Buy) Market order on ETH/USD.

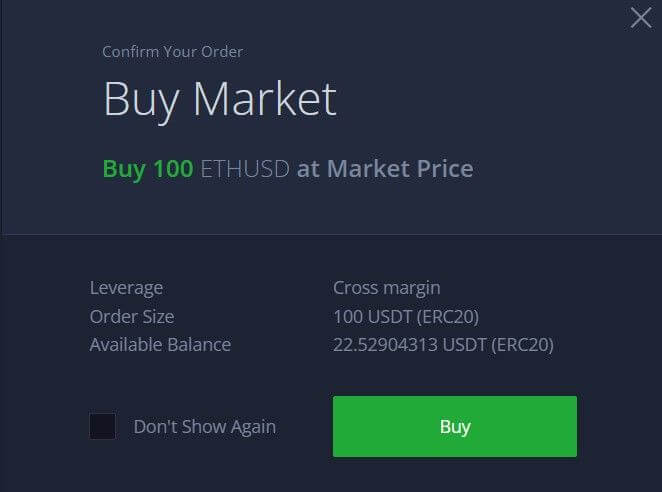

- Step 3 Confirm your order.

After choosing the LONG position, click BUY on the next window above for confirmation.

- Step 4 Check your Position

Once you’ve clicked on BUY, the order will be executed immediately, and the open positions tab below the Margex chart, as seen above, will show it.

FAQ, Further Questions on ETH VS ETC

Ethereum and Ethereum Classic can perform the same functions. So, it gets confusing to choose one. Find the answers to some of the questions relating to Ethereum Vs. Ethereum Classic.

Is Ethereum a good investment option?

Despite the bearish trend of the cryptocurrency market, Ethereum is worth investing in based on your own risk acceptance level. One major factor to consider before you invest is the Merge upgrade in September 2022. It will migrate users from the Proof-of-Work mechanism to Proof of Stake.

Also, there is a rapid increase in the use of the blockchain platform worldwide. For example, Ethereum supports NFT – a billion-dollar industry, and is also the top network for defi (Decentralized finance) projects.

How is the future for Ethereum?

Although every cryptocurrency asset is highly speculative and risky, experts believe that Ethereum will be one of the top projects in the future. Ethereum’s price hit an all-time high of $4380 in 2021. Ether has been widely accepted, consistently outperformed other altcoins, and is the ideal channel for peer-to-peer transactions.

Why is ETH so cheap?

According to Coinmarketcap data, the crypto market slumped from $3 trillion to barely over $2 trillion as of January 2022. Furthermore, cryptocurrency prices fell due to inflation and the ongoing crypto winter.

Also, as of June 18 and 19, 2022, the ETH price fell below $1000 due to the collapse of the Terra blockchain. Ethereum’s current price might skyrocket if another bull market occurs or dip further if crypto winter continues.

Is it good to invest in Ethereum in 2022?

Investing in Ethereum or other financial products is risky. However, the decentralized blockchain hosts numerous transactions and is popular among users. When the migration to Ethereum 2.0 is complete, the price might be more stable.

Generally, from expert predictions and indications, the currency is set to go on a bullish run at some point in 2022. However, every investment carries its own risk, as with foreign exchange. So, you should invest wisely.

What will be the worth of 1ETH in 2030?

There is no sure prediction for the price of Ethereum. But while some price predictions were more conservative at $8000, others raised the bar to $48,000. This positivity is for the Ethereum Merge alongside its possibilities and implications for the future. However, some other analysts feel that caution must be applied as the project can end up unsuccessful.

Will Ethereum ETH price keep rising?Ethereum can rise with time. The network’s focus is on providing smart contracts and decentralized services. With developers expanding the network with new projects and the scalability from the upcoming Merge, it is safe to say Ethereum can grow like bitcoin with time. Some crypto experts even feel it might outperform bitcoin in the long run.