Since September, even when stock prices continued to plummet on the back of rising yields, the price of Bitcoin did not fall in tandem with the decline with stocks. This phenomenon has been picked up by various crypto experts, who have since opined that Bitcoin appears to be back at trading as a safe haven again – something that is welcomed by crypto traders since this will reduce the contagion to the crypto market in the event of a stock market meltdown led by higher rates and a worsening macro-economic environment.

Furthermore, Bitcoin was never meant to be a risk asset that trades like a stock, it was meant to be a hedge against the fiat currency regime and ought to correlate more with safety assets like Gold.

Bitcoin Used to Be a Safe Haven

Bitcoin was trading as a safe haven for the most part of its life, until after the COVID crash when stock traders began to punt cryptocurrencies together with stocks, possibly attracted by cryptos’ high volatility. This has caused cryptocurrencies, in particular, Bitcoin, to start having a high correlation with stocks, especially with technology stocks, and for the past two years, Bitcoin has been mirroring the performance of the Nasdaq.

What is a Safe Haven?

A safe haven is an asset that is expected to protect its holder’s portfolio from decline during an economic downturn as they are either uncorrelated or negatively correlated to the broader economy. Throughout history, Gold has been the primary example of a safe haven asset until Bitcoin came along.

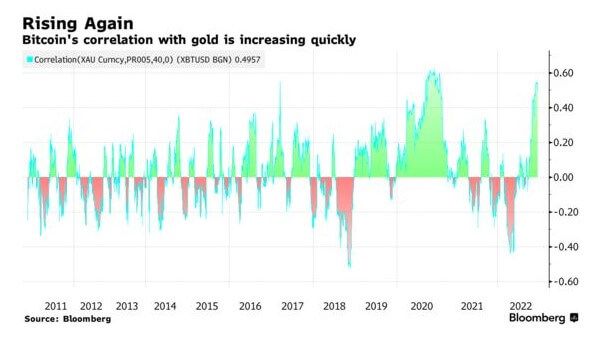

Bitcoin’s Correlation with Gold is Increasing

With recent macro-economic shocks from various countries like Turkey and the political drama from the UK, investors are flocking to Bitcoin to protect against the falling value of other fiat currencies, with the exception of the US dollar. This has resulted in the correlation between Bitcoin and Gold to increase, since people who want to protect against a fiat currency decline are also likely to buy some Gold for protection.

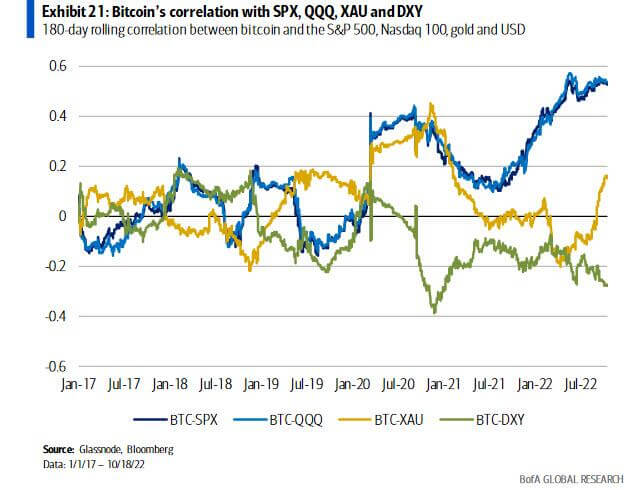

According to trading firm Barchart, Bitcoin’s correlation with Gold has risen to about 0.5 last week, up from 0 in mid-August when Bitcoin was still trading like a technology stock. Even though the correlation with stocks like the S&P 500 is still at a higher level of around 0.69, the correlations have been on a decline, while the sharp increase in correlation with Gold is notable.

Analysts Are Noticing and Are Bullish

Fellow analyst Charles Edwards, founder of crypto asset manager Capriole, noted that Bitcoin macro price bottoms are often accompanied by increasing Gold correlation. Hence, he views the increase in correlation between Bitcoin and Gold to be positive – it could mean a macro bottom for Bitcoin is near, or it could even be already here.

Scott Melker, the analyst and podcast host known as “The Wolf of All Streets,” also confirmed a changing relationship between Bitcoin and the Nasdaq. When interviewed by Cointelegraph, Melker noted that the short term correlation between Bitcoin and the Nasdaq has disappeared over the past few weeks since Bitcoin has been rising even when the Nasdaq has been falling, and he is happy with the latest development.

Even Bank of America analysts acknowledged in a recent report that the leading cryptocurrency now has a high correlation with Gold prices, suggesting that it is being used as a hedge against the wider market uncertainty. The report further mentioned that Bitcoin’s relationship with Gold has historically been used as a way to measure how confident investors are with Bitcoin as a store of value. They further noted that Bitcoin and Gold were closely linked from June 2021 to February 2022, but the correlation turned negative in March 2022. However, this correlation has climbed back into positive territory since September, and in early October, the correlation reached its highest point in a year.

The BofA team further pointed out that Bitcoin exchange outflows over the last 4 weeks were 3.6x larger than exchange inflows over the prior 4 weeks, indicating that investors continue to HODL instead of selling into strength. They explain that a decelerating positive correlation with the S&P 500 (SPX) and Nasdaq 100 (QQQ) and a rapidly rising correlation with Gold indicate that investors may view Bitcoin as a relative safe haven as macro uncertainty continues and a market bottom in stocks remains to be seen.

The report further detailed the dates of the correlations, noting that the correlation between Bitcoin and the S&P 500 reached all-time highs on September 13 of this year and the correlation between Bitcoin and the Nasdaq 100 (QQQ) reached all-time highs on the same day, while the correlation between Bitcoin and Gold (XAU), which is commonly viewed as an inflation hedge or a store of value, remained close to zero from June 2021 through February 2022 and turned negative on March 2 2022. However, the inverse correlation decreased from April 2022 through August 2022 before the correlation turned positive on September 5 and continued to increase.

The inverse correlation between Bitcoin and the US dollar (DXY) has increased since July 14, meaning that the inverse relationship with Bitcoin and the US dollar has increased.

Inverse USD Correlation Could Lift Bitcoin

With the recent change in tune by various central banks throughout the developed world including the US Fed to cut back on their rate increases, the increasing inverse correlation with the US dollar would benefit the price of Bitcoin as most experts think the US dollar has seen its peak.

Thus, the evidence does suggest that Bitcoin has returned to trading as a safe haven, and not only that, its strengthening inverse relationship with the US dollar should hold it in good stead under the new central bank narrative of cutting back or even pausing on rate hikes.