Last Friday, after a lot of nudging from the Japanese central bankers at the G7 summit in the week before which ended with no commitment from the USA to weaken the dollar, the Fed finally appears to be softening its stance regarding interest rate hikes.

Nick Timirao Fires His Clairvoyant Shot Again

First to start the ball rolling was Wall Street Journal (WSJ) reporter Nick Timiraos, who has been widely regarded as the Fed’s whisperer for his previous accurate predictions about what the Fed would do next. In fact, Timirao is being followed closely by Fed officials, and has often been touted as Powell’s unofficial advisor. Thus, his appearance “out of the blue” with an article on WSJ and his twitter account that the Fed may reduce the pace of its rate hikes in the December meeting has gotten traders sitting up and noticing.

Timiraos noted that while 75-bps is a done deal for the November 2 meeting, the December meeting could be the critical ground and important stage for discussing how to step down to 50-bps in the December meeting, citing that some Fed officials are already signaling their desire to slow down rate hikes currently. Timirao said the Fed may totally pause rate hikes early next year to avoid over tightening and then observe how the markets and economy react. According to Timiraos, the only issue these officials are concerned about is a pause causing a major melt-up in the stock markets.

Indeed, as expected, traders are already taking Timirao’s comments very positively, with the Dow gaining 2.47% on Friday alone after the WSJ report.

Mary Daly Immediately Seconds Timirao’s Call

Timirao was not alone in his assertion though, as even San Francisco Federal Reserve President Mary Daly said shortly after Timirao’s report at a meeting of the University of California, Berkeley’s Fisher Center for Real Estate & Urban Economics’ Policy Advisory Board in Monterey, California, that it is now time to talk about slowing rate hikes. Daly is a trusted aide of Powell and many have considered her as the mouthpiece for the Fed Chairman. Daly was the first person to suggest that the Fed needed to taper faster in November last year and we have seen how aggressive the Fed has become over the past 6 months. Thus, traders ought to take her comments seriously.

Daly said in the meeting that the Fed should avoid putting the economy into an “unforced downturn” by raising interest rates too sharply, and that even though the markets have priced in 75-bps hikes for the next two meetings, it will not be 75-bps hikes forever.

Daly thinks that the Fed projections released last month which showed that the fed funds rate will need to rise to between 4.5% and 5% next year to start bringing inflation down are still reasonable, but reiterated that they are not going for broke as what some market watchers are thinking and that the Fed is moving to the second phase in its policy tightening that is thoughtful and incredibly data-dependent.

Daly revealed that there are headwinds including the war in Ukraine, an economic slowdown in Europe and ongoing policy tightening by other central banks that the Fed will need to consider as it decides on how to go about the next phase as these factors would ultimately play a big factor in determining how high US rates need to go.

Afraid of making the markets get ahead of themselves with regards to a possible Fed pivoting however, Daly ended her meeting by admitting that it is really challenging to step down right now as inflation is still more than three times that of the Fed’s 2% goal and that the labour market is still strong. Daly specifically mentioned that this was not a pivot and more tightening is still needed, but that it is time to start talking about how to step down.

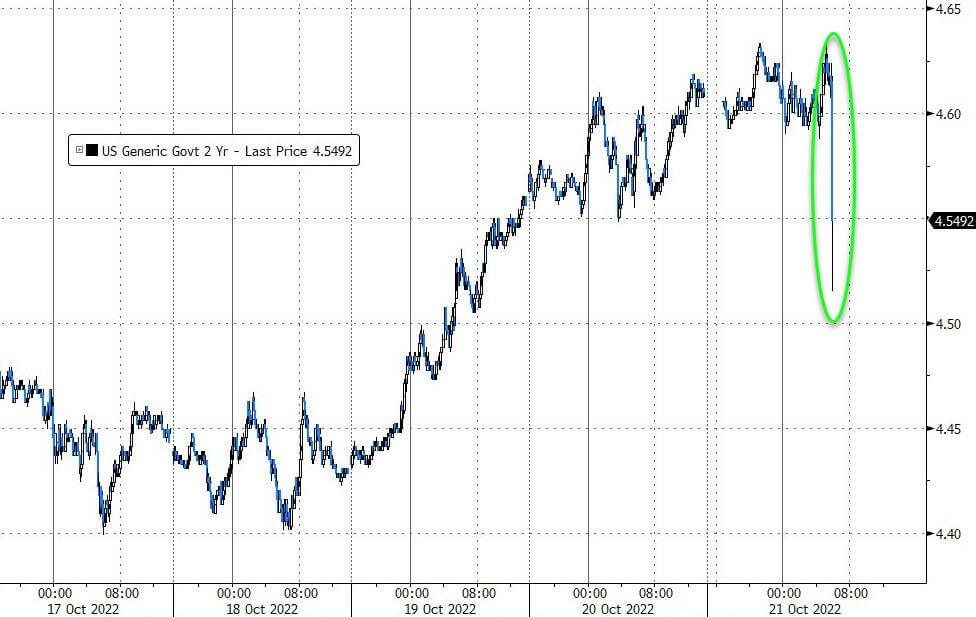

Immediately after Daly’s comments, fed fund futures started pricing in a 4.90% peak in rates, down from the 5.03% peak seen in the previous day. The 2-year Treasury yield also fell from 4.63% to 4.51%, and finally ended Friday at 4.55%, which is in line with the Fed’s forecast.

Comments Indicative of Change in Fed Narrative

The Fed will begin a blackout period effective this week until its November 2 meeting, where no Fed speaker will be allowed to comment in public about rates and the central bank’s move. Hence, Daly and Timirao appearing at such crucial moments, being the last speakers to give public comments about the path of the Fed’s rate hike cycle, is seen as a significant hint in a change of the Fed’s narrative.

These comments could have been served to prepare the market to become less hawkish so that the bond markets will not implode. Lately, as markets have started pricing in a very hawkish Fed, there has been a lack of buying interest in the bond markets. Should this lack of liquidity continue, the bond markets may unravel and the Fed could be trying to avoid this from happening.

While the Fed’s intention may be to calm the bond markets, with this last minute change of mindset however, traders who have been bearish in the stock market may need to adjust your trading strategies to avoid being caught in a possible short squeeze.