Depending on whom you ask, a “fork” in blockchain may be described as “what happens when a blockchain diverges into two alternative ways ahead,” “a change in protocol,” or “occurs when two or more new blocks share the same block height.”

The fact that everyone involved in the blockchain must follow the same rules to preserve its history is directly tied to the occurrence of forks. When people aren’t on the same page, different chains might form. However, permanent forks (in the sense of protocol modifications) may also be used to undo the consequences of hacking, as with Ethereum and Ethereum Classic, or to prevent catastrophic errors on a blockchain, as with the Bitcoin split on August 6th, 2010.

The uncertainty produced by a hard fork isn’t the only thing that might affect the bitcoin market. One example of a strange event is the Bitcoin Cash hard fork. Forked coins are distributed to holders of the “parent” cryptocurrency in proportion to their original holdings.

Forks operate by making updates to the blockchain’s software protocol. They are often linked to the generation of new tokens. The most common method of producing new coins is from scratch to fork the current Bitcoin blockchain.

The most popular way is to create new tokens from scratch. This entails copying and pasting existing code, which is subsequently altered and launched as a new token. The network must be rebuilt, and individuals must be persuaded to utilise the new coin. litecoin, began as a bitcoin clone. The creators changed the code, people were convinced, and it is now a popular cryptocurrency.

The other option is to split the current blockchain. Rather than beginning from scratch, this strategy modifies the existing blockchain. As the network divides, two copies of the blockchain are formed. The development of bitcoin cash is a good illustration of this. Differing views on bitcoin’s future led to the formation of a new cryptocurrency (bitcoin cash) from the original cryptocurrency (bitcoin).

How do crypto forks occur in the blockchain world?

For starters, everyone who owns a bitcoin should know that even if the blockchain divides in two due to a hard fork, their bitcoins will remain completely secure. Hard forks have been politically maligned in the last year or two, but in reality, the vast majority of forks are just improvements to existing protocols. During a hard fork, the blockchain will divide in two. In such a case, a Bitcoin holder can do nothing except watch the split happen.

If the blockchain splits in two, there will be two new digital assets immediately after the hard fork. After the split event, Bitcoin owners with private keys can access their assets on both chains. You may sit back and relax while the split occurs in the background if you “keep your money” in a local wallet on your computer or mobile device. How the exchange distributes both token assets to clients is entirely at the firm’s discretion if you keep your funds on a bitcoin exchange. If there is a blockchain split, most significant industry exchanges have already said they would trade both assets.

In any case, users should remember that leaving cryptocurrencies on an exchange is not a good idea. As we’ve seen, following a blockchain split, clients who keep their bitcoins on a business must abide by the terms of that particular marketplace. To provide just one example, it’s feasible that exchanges would suspend withdrawals for a period of 24 hours to 48 hours before and after the fork. As a result, users may anticipate delays as conversations examine the issue, but credible exchanges should distribute both assets to clients immediately following the incident.

Accidental And Intentional Forks

Accidental forks occur when several miners discover a block at almost the exact moment, creating two blockchains. As additional blocks are added, one chain gets longer, and the other blocks are eliminated; these forks tend to resolve very rapidly. Thousands of miners are vying to generate a new block at all times. Due to the high hash rate at which blocks are being mined, multiple miners are not uncommon to simultaneously mine the same block. This results in the creation of a fork by mistake. When more blocks are added to one chain, the issue disappears. The network then stops working on the shorter link and continues on the longer one.

Many inadvertent hard forks have occurred on the Bitcoin blockchain. These occur far more often than you may imagine and are usually cured so fast that they are hardly noticeable.

Two miners discovering the same block almost simultaneously is the most common cause of unintentional hard forks. Both initially accept the block as genuine and continue mining on separate chains until either they or another miner adds the following block, reflecting the decentralized nature of network consensus.

When a block is added, it determines which chain will become the longest, forcing the other to be abandoned to preserve consensus. Since mining Bitcoin on the abandoned chain would now result in mining a split of the network, miners move on to the longest chain.

In the event of a fork, the miner who discovered the orphaned block will no longer be rewarded with cryptocurrency or transaction fees. This is because even though two blocks were found, they were identical and included duplicate transactions. Therefore no transactions would be revoked.

Short-chain splits occurred as a result of other inadvertent hard forks that occurred as a result of coding problems. In 2013, for instance, a block was mined and broadcast with a higher number of total transaction inputs than had ever been observed; yet, some nodes did not process it, resulting in a split. The problem was fixed when some nodes rolled back their software upgrades to establish consensus and reject this more significant block.

The network does not converge back to a single chain when a fork is created on purpose (this is known as “Intentional Forks”). Developers in the blockchain community utilize this fork type to provide new protocol features. Developers might alter the block size, duration, or consensus process via a deliberate fork. An intentional fork might be sharp or rounded. The two are distinct in terms of using the other chain and compatibility.

Intentional forks occur when there are disagreements among developers about how the program should function. The protocol rules are altered, and a new currency is born. If there isn’t enough interest, the token’s value will fall to zero, and mining will cease. However, if there is enough community support for a new currency, purposeful chain splits may be effective. Both assets have the potential to grow further.

Hard And Soft Forks

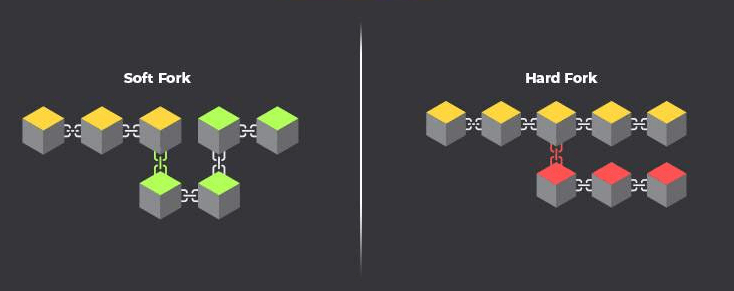

A hard fork occurs when incompatible modifications are made, forcing everyone to update the newest version of rules immediately. If specific nodes in the network do not update, the blockchain will divide into two independent chains. There are two possible outcomes: either both will continue to exist and function separately, or one blockchain will emerge as the clear victor.

A hard fork is a significant modification to the program that forces all users to update to the most recent version. Nodes operating on prior software older versions will no longer be accepted on the current version. A hard fork is a permanent break from the previous blockchain version. If the new version does not get universal approval, two blockchains may use a variety of the same software.

A hard fork or (hard-fork) is a drastic alteration to the protocols of a blockchain network in blockchain technology. In essential words, a hard fork divides a single coin into two and results in the validity of previously invalid blocks and transactions or vice versa. As a result, all developers must update the protocol software’s most recent version.

It is a drastic update that may render earlier transactions, blocks legitimate or invalid, and necessitates upgrading all validators in a network to a newer version. In addition, it has no backward compatibility. A soft fork is a backward compatible software update that allows validators in an earlier version of the chain to accept the new version as legitimate. Hard forks almost always result in a permanent chain split since the old version is no longer compatible with the new version. Because they share the same history, those with tokens on the old chain are also issued permits on the new one. A hard fork may occur for a variety of reasons.

To comprehend what a hard fork is, it is necessary first to understand blockchain technology. A blockchain is simply a sequence of data blocks that function as a digital ledger, with each new block legitimate only after network validators have validated the preceding one. Data on the blockchain may be tracked back to the network’s initial transaction. This is why the initial block of the Bitcoin blockchain can still be seen.

A hard fork is a permanent divergence from the latest version of a blockchain, resulting in the blockchain’s split as specific nodes no longer reach consensus and two distinct versions of the network are managed independently. It occurs when incompatible modifications are made, forcing everyone to update the newest rules immediately. If specific nodes in the network do not edit, the blockchain will divide into two independent chains. Either both will survive and function separately, or one blockchain will eventually win.

Sometimes, when a hard fork occurs, everyone involved is on the same page and willing to adopt the new regulations without any arguments.

This implies that a fork occurs on the blockchain, with one route continuing to follow its existing rules and the second path adopting a new set of rules. Because a hard fork is not backwards compatible, the old version no longer recognises the new one.

Because of the frequent chain split, hard forks are typically seen as unsafe. When the miners who safeguard the network and the nodes that help authenticate transactions divide, the network becomes less secure and more open to attacks.

A 51% assault occurs when a plot of miners obtains more than 51% of the processing power that protects a network and uses it to modify the blockchain’s history. It is a popular malevolent action against a blockchain. Specific networks built as a consequence of hard forks have been subjected to several 51% assaults in which bad actors double-spent the same cash. In these assaults, bad actors use their network’s greater computer power to restructure blocks, enabling them to double-spend.

Replay attacks are another potential weakness with hard forks. When an opposing party intercepts a transaction on a forked network, it duplicates the data on the other chain. When a hard fork occurs without replay attack security, both transactions become legitimate, allowing someone to transfer another user’s money without having authority over them.

On the other hand, soft forks are viewed as a safer, backwards-compatible solution, meaning that nodes that do not update to newer versions will still perceive the chain as legitimate.

Any modification that is backward compatible is referred to as a soft fork. When a soft fork occurs, older nodes (computers that connect to the cryptocurrency’s network) will continue to accept new transactions as genuine. Any mined blocks, however, will be regarded as invalid by the upgraded nodes. Soft forks need most of the network’s hash power to succeed. Otherwise, they risk becoming the network’s smallest chain and getting orphaned, thus creating a “hard fork.”

Soft forks may use miner-activated updates, in which the hash power of a new protocol must match a particular percentage before the upgrade is implemented. Dash’s controller nodes are used to implement significant modifications to blockchain technology.

A soft fork may also provide new features and functionalities without changing the rules a blockchain must adhere to. Soft forks are often used to add new functionality at the programming level.

Consider a simple operating system update on a mobile device or PC further to appreciate the distinction between hard and soft forks. Following the update, all programs on the device will continue to function with the newest version of the operating system. In this case, a hard fork would imply a complete switch to a new operating system.

Modifications made in a soft fork are often minor, opt-in, and compatible with older versions. Theree’s no need for anyone to upgrade. As users upgrade from the previous blockchain version, only one blockchain will be considered genuine.

Soft forks are less problematic since they are a modest software update that keeps them compatible with earlier versions. All network members don’t have to update to the current version to validate and confirm transactions. If the participant’s functionality is not updated, just the participant’s functionality is impacted. A soft fork is only conceivable if most users agree to upgrade to enforce new blockchain rules. Let’s go through the previous presentation sample again for a better understanding. In the last scenario, the colleague will continue with your presentation so that the original product is not separated into two halves and its meaning is not altered. It’s just a slight modification. For example, consider the block size restriction and BIP 66.

As a result, the fork is more than simply a piece of silverware for slicing meals; it has a particular connotation that significantly influences the blockchain.

Why do hard forks occur?

If hard forks may significantly weaken a blockchain’s security, why do they occur at all? The solution is straightforward: As blockchain technology evolves, hard forks are required to enhance the network. A hard fork may occur for a variety of reasons, not all of which are negative:

- Add functionality.

- Correct security threats

- Resolve a dispute within the crypto community.

- Blockchain reverse transactions

Hard forks may sometimes occur by chance. Often, these episodes are quickly rectified, and individuals who no longer agree with the primary blockchain return to it after recognizing what had transpired. Similarly, hard forks introducing new features and upgrading the network frequently enable people who have fallen out of consensus to rejoin the main chain.

There are countless past instances of cryptocurrency hard forks, and not all of them occurred on the Bitcoin network. Here are some of history’s most popular hard forks and how they shaped the business.

Famous hard forks

First example: Bitcoin Cash (BCH), which was forked from Bitcoin in 2017 and is doing well (BTC). Up to block 478,558, Bitcoin and Bitcoin Cash use the identical blockchain. Bitcoin Cash was sparked by internal discussions over Satoshi’s original intentions for the Bitcoin network, specifically around the optimal block size and the introduction of Segregated Witness ( the action of separating the transaction signatures).

Second Example: After over $50 million in ETH was stolen from The Decentralized Autonomous Organization (DAO), Ethereum Classic (ETC) was established as a successful fork of ETH. After much deliberation, the Ethereum community agreed to implement a hard fork at block 1,920,000.

A third example is Bitcoin SV which was forked from Bitcoin Cash in November 2018. It resulted from what was a civil war between two camps over the block size. While a group insisted on upgrading to Bitcoin ABC to maintain the block size of 32 MB, the rebel group composed of Craig Steven Wright insisted on increasing this size to 128 MB. This resulted in a new fork called Bitcoin Satoshi Vision (BSV).

Forks In Action

Forks on the blockchain are standard. In reality, they are one method of producing new coins. Some well-known digital currencies are the result of hard forks. Bitcoin Cash, for example, diverged from Bitcoin in August 2017. The Bitcoin Cash fork increased the maximum block size from 1 to 8 MB to 32 MB.

Ethereum Classic is another example of a hard fork. This was formed in October 2016 after a group of developers rejected new rules established via a hard fork. They instead chose to stick with the previous Ethereum blockchain, which was ultimately called Ethereum Classic.

Hard forks often take second place to soft forks in the development process since they have the potential to divide the blockchain community into two parties. For example, it was once assumed that changing the basic structure of transactions in Bitcoin’s SegWit protocol would need a hard split. However, the developers discovered a forward-compatible method and used a soft fork to create SegWit. Nodes not upgraded to SegWit continue to participate in the soft-forked Bitcoin network.

Anyone who owns cryptocurrency will benefit from understanding forks. For example, suppose a cryptocurrency you hold experiences a hard fork. In that case, this information will help you pick which branch to follow and will assist you in selecting a wallet provider or coin custodian.

The bitcoin ecosystem is profoundly affected by forks (for better and worse). While forks are a necessary part of the development and evolution of cryptocurrencies, they also have the potential to introduce chaos, heighten dangers, and stoke fears in the crypto community. Forks will continue to play a crucial part in the evolution of the cryptocurrency sector, especially as more individuals with different motivations enter the market.

FAQs

Is a fork beneficial to Crypto?

Communities often find forks to be upsetting. Traders and miners may feel they have to go their own ways when there are divergent opinions on the future of a cryptocurrency. Because forks may be used to improve network security and solve flaws in the original blockchain, many people believe they benefit from bitcoin. Investors now have additional alternatives for diversifying their portfolios, particularly in the event of hard forks, when new kinds of currencies are generated.

Developers plan some forks, and significant price variations may precede them as developers discuss the benefits of protocol modifications for the next fork. If you feel the fork will be favorable based on the fundamentals, now would be an excellent opportunity to buy or expand your position in the coin. When the blockchain forks, you’ll get “free” coins due to the split.

However, many investors often cash out their winnings after a fork, which may cause the value to fall. Investing before a fork may be a smart option if you intend to purchase and hold. However, if you are concerned about attempting to time the market or are a risk-averse investor, you should avoid crypto on the cusp of a split.

How does a fork impact cryptocurrency prices?

The first critical distinction is that a hard fork is not the same as a stock split. Some refer to it since it is a simple notion many already grasp. However, considering it in this light, you may be startled by any price movement resulting from a bitcoin split. When a firm does a stock split, it divides the business (and hence the corporate value) into two types of shares.

This divides a company’s liquid and illiquid assets and factors like revenue stream and predicted profits into two different corporations or listed shares. Suppose a corporation is worth £100 million and separates 10% of its business via a stock split. In that case, you may anticipate a new company worth £10 million, with the current company valued at £90 million (assuming each part of the business, projections, revenue, etc. are equal). All else being equal, each stock price should also reflect this.

A blockchain split would not be subject to the same restrictions. However, because the value of cryptocurrencies is based on the speculative anticipation of usefulness and broader acceptance at some time in the future, when there is a split, you cannot anticipate each chain’s price action to neutralise the price. For example, if bitcoin was selling at $4000 and the chain split to create a new currency that the market valued at $500, the old chain would not necessarily be priced at $3500.

Leading up to a fork usually results in a tumultuous market with substantial price movement. As with other things, it is generally the uncertainty that produces this. Will the new upgrade function correctly? Will the advantages of cheaper costs, quicker transactions, and enhanced decentralization become apparent? Should I invest in the original cryptocurrency before the split to have both currencies afterward? Should I buy/sell just before/after the fork?

What are forks in Ethereum?

Like many others, the Ethereum blockchain has struggled with scalability for a long time. This implies that there may be issues with completing transactions promptly and effectively. Things were not operating as smoothly as they might have, which meant that activities on the chain took longer to complete than users would have liked. Because of the scalability problem, transaction costs were higher than they should have been, which irritated consumers.

After all, one of the fundamental assumptions behind blockchain technology, particularly the decentralized finance underlying Ethereum, is that it is intended to make financial transactions more straightforward rather than harder. Of course, it didn’t help that the transaction fees were unpredictable, which meant you never knew how much you’d have to pay at any given moment.

The Ethereum hard fork intended to simplify things by switching from proof-of-work to proof-of-stake. Coin mining used to be a data and energy-intensive activity, which caused system delays and increased transaction fees. It also uses a lot of power, which is costly and ultimately harmful to the environment. Because of the Ethereum hard split, individuals may mine currencies depending on how many coins they hold. This decreases the energy demand and implies that transactions should be faster and, more importantly, less expensive. That explains the Ethereum hard fork. It is also referred to as the London hard fork and the Ethereum Improvement Protocol 1559 (EIP-1559). It became operational in early August 2021, successfully meeting the Ethereum hard fork deadline of 5 August.

When was the last Bitcoin fork?

The last Bitcoin fork was with Taproot. It is a soft fork that went active on November 12, 2021, after the mining of Block 709632. It was the first significant upgrade following the implementation of SegWit in 2017 and included three blockchain enhancement proposals – BIP340, BIP341, and BIP342. Schnorr signatures, MAST, and Tapscript were the BIPs in question. The upgrades are a little complicated, but they effectively improved the Bitcoin blockchain’s scalability, boosted anonymity, and enabled expanded smart-contract functionalities.

Is Ethereum 2.0 a hard fork?

Given the above, it should be evident that Ethereum 2.0 is not a hard fork since it does not introduce a new blockchain or fork. Instead, there will be a place for ETH 1.0 on the new 2.0 network. The sharded, scalable design of Eth 2.0 is going to be different from its predecessor’s, and proof-of-stake will be used instead of proof-of-work. However, the present Ethereum infrastructure will continue to evolve rather than be replaced entirely by ETH 2.0.

Even though ETH 2.0 is being implemented as a new chain, all contracts and accounts from ETH 1.0 will be migrated to one of ETH 2.0’s 64-shard networks. Therefore it is not a hard fork. This means there will be no changes to the record of past activity.

ETH is the token created for use on the Ethereum blockchain and will continue to function as a native or new asset on the ETH 2.0 network. Unlike other controversial hard forks, ETH 2.0 is a deliberate, consensus-driven improvement to the system (unlike Ethereum Classic). In the Ethereum 2.0 specifications, the word “fork” is mainly used for communications purposes. There will be no fork when the update is implemented since the network will not have numerous independent chains.