One of the fastest ways to grow your wealth is by maximizing the benefit of trading to your advantage. This era has seen increased forex, futures, and cryptocurrency trading activities. This post will concentrate on trading in forex and futures markets and how they differ. So, if you haven’t fully understood their differences, find clear explanations below.

A key distinguishing factor in the forex vs. futures trading comparison is the time, pricing, and commodity. For instance, forex executes orders instantly under current market price conditions, while futures involve executing orders at a future date at a predetermined price.

This article is a forex vs. futures comparison guide to help you choose the best market for your plans. Read along to learn more.

Understanding Forex – A Brief Overview

Forex or FX are the shorter terms traders use to represent foreign exchange. It is a market for the exchange of diverse national currencies. The forex exchange market stands as the most liquid asset market worldwide. It allows people to trade different currencies as exchange rate pairs.

Some popular currency pairs include USD/JPY, USD/GBP, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. Also, on forex, traders can trade a cross-currency pair that doesn’t trade against the United States dollar but involves the Japanese yen.

Traders can access the Forex exchange market as derivatives offering futures, forwards, currency swaps, or options. They can also access it as a spot (cash) market. These forex markets enable participants to speculate on events, diversify their portfolios, or even hedge against interest rates or international currency risks.

What Does Forex Trading Mean?

Forex trading means the conversion of one currency to another. For example, it could involve converting USD to EUR or GBP to USD, also known as the pound-dollar. Apart from individuals, companies and banks also participate as FX traders.

Forex trading aims to profit from the difference between currency pairs. So, if a trader buys one currency pair or bets one pair against the other, they will gain or lose based on the price movements.

For instance, you can buy or bet on the USD/GBP currency pair. In this trade, the base currency is GBP, while the quote currency is USD. Trading this pair means you’re expecting to make gains after buying 1 GBP with some USD units and selling the same 1GBP above the rate you purchased.

If you buy 10,000 GBP at the rate of $1.1800 and later sell the same 10,000 GBP at a rate of 1.2500 USD, you have made $700. It means you spent $11,800 earlier and later made $12,500.

The exchange rate calculates how many units of the quote currency, in this case, USD, you need to buy or sell the base currency, GBP. So, forex traders buy a particular pair, in this case, GPB/USD, believing that GBP, will gain value relative to USD; they’ll sell GBP and make profits from the differences when it does. This action is called the “long position.”

Conversely, when the traders believe that the base currency GBP will lose value or depreciate, against the quote currency, USD, they’ll sell GBP and buy USD. Afterward, they’ll buy the base currency when the price has fallen. This action is called short position or going short.

Understanding Futures – A Brief Overview

Futures are derivatives contracts that investors or traders use to hedge or speculate on an asset price movement. These contracts are derivatives because their value is based on the underlying asset value. A participant can enter into a futures contract to sell or buy an asset at a predetermined price and future date.

A futures contract obligates a seller to sell the asset in question at the set date and price, no matter its current price at that date. Also, the buyer must purchase the asset at expiration and at a set price, even if it has fallen below the agreed price.

The assets in a futures contract might be financial instruments or physical commodities. The contract helps a seller hedge against unfavorable price loss and lets an investor speculate on favorable price movements. These contracts take place on a futures exchange.

In a futures contract, the parties must set the price of the commodity or asset and the expiration date for the contract. Some futures products include commodity, stock index, currency, U.S Treasury, and precious metals for silver and gold.

What Does Futures Trading Mean?

Futures trading is the contract between a seller and a buyer. It mandates sellers to sell the asset on or before the expiration date and at the set price. On the other hand, a buyer must purchase the asset at a fixed price at a future date. Both parties must fulfill this obligation, no matter the price movement.

Two reasons to engage in futures trading include hedging and speculation. In hedging, the parties aim to protect the assets against future price risk. For example, it could be a company or institutional investors seeking to manage the risks of owning the asset in their investment portfolio.

In speculation, the investor or trader aims to gain from an asset based on a favorable price movement in the future. These traders or investors who’re not the owners of the asset or commodity usually close their position before the expiration date to eliminate their obligation to it.

Day traders can gain from futures contracts but are always at a higher risk. One of the notable rules of a futures contract is that it can be sold or bought many times until the expiration date.

Key Differences Between Forex And Futures Markets

Despite the vast popularity of these terms, many people still think that the forex and futures markets are the same. Some differences can be found below in this forex vs. futures comparison.

The nature of the market differs.

One difference stands out clearly in the forex vs. future comparison: the nature of their market. Forex spot markets are usually regarded as “over-the-counter (OTC),” while futures markets are formal. The implication is that while the former is decentralized and many entities worldwide handle the exchange of the currency pair, the latter is centralized and occurs on futures exchanges.

For instance, one of the popular futures markets is the Chicago Mercantile Exchange (CME). This exchange is formal and ensures that everything involved in the contract, such as terms, security, and order execution, is carried out correctly. Also, CME offers better margins to offset your position.

But in decentralized forex markets, traders usually face counterparty risks, leading to massive losses and financial obligations. Also, your broker is responsible for both order feeds and the data you get, which might not be the real truth but the only option you have. Sometimes, forex traders experience speed bumps that delay orders from being executed at the right time. Thankfully, a forex trader can engage in spot trading and make instant gains. But if you want the trades to last longer, you can consider position trading instead.

Cost involvement is different.

In forex vs. futures cost consideration, two costs are the transaction cost and the cost to carry. During a transaction, forex attracts diverse costs while futures has a fixed cost.

In forex, the traders incur costs as a commission or spread to the brokers. Some brokers ask for fixed spreads, while others offer varying spreads. Other brokers charge a commission on the spread percentage.

Spreads represent the difference between the selling price and the buying price. You can also call it the bid price less the offer price. Some forex brokers sometimes use varying spreads, making it difficult for participants to know their actual costs.

Regarding the cost to carry, this is the cost a participant pays for holding a particular position. Forex attracts overnight funding charges or interest rate changes. However, futures contracts don’t attract direct costs, except for minimum margin requirements.

Regulation

Another notable difference in a side-by-side comparison of forex vs. futures is that forex markets are highly unregulated. No particular international organization or even a global agency monitors or oversees how currency trading occurs worldwide. That’s why big banks can manipulate the forex market.

Traders sometimes don’t have control over the fulfillment of their trade orders. Also, forex traders can execute trades without being sure of doing so at the best price. This is because there are no entry barriers into the market, and some brokers act based on their interests.

Futures markets are regulated and transparent. For instance, the U.S. Commodities Futures Trade Commission, CFTC, regulates the market operations. Also, transactions are conducted in centralized and regulated exchanges such as the Kansas City Board of Trade, the New York Mercantile Exchange, the Chicago Mercantile Exchange, the Minneapolis Grain Exchange, and the Chicago Board of Options Exchange.

These exchanges are all regulated and maintain high-level transparency in providing real-time information for all participants. All traders are treated equally based on FIFO, first in, first out, reducing the high risk of losing money.

Trading activities

When comparing forex and futures markets regarding the level of activities in each, it’s clear that forex takes the lead. Forex trades occur over the counter and represent the most liquid market globally. That’s why trading runs into trillions every day. Also, the market is not as regulated as the futures market, making it easier to enter.

Futures trading volume runs only into billions every day. The markets are not very easy to enter. They are regulated and take place on centralized exchanges. A central counterparty clearing also facilitates transactions to reduce counterparty risks. These institutions provide clearing and settlement services for futures contracts.

Leverage

One key difference in forex vs. futures is leverage. Forex trading comes with much higher leverage than futures. A forex trader has the opportunity to borrow a specific amount from his broker to invest in a currency.

This feature enables a trader to control a considerable investment fund even when he doesn’t have much money. Leverage in forex can be as enormous as 500:1. But beginners should limit the leverage to 10:1 at the maximum or 1:1 for more safety.

But futures trading doesn’t offer such high leverage opportunity. A futures trader can control enormous contract value even with his small capital. But this leverage is usually the initial margin or performance bond, usually from 3-15% of the contract’s cash value.

Numerous Benefits In Trading Futures Vs. Forex

Many often wonder about the right choice between forex and futures markets. However, there are many benefits to trading futures vs. forex.

An equal trading opportunity

Futures market ensure that all participants access the exact data for trading decisions. The institutional traders and small individual participants get detailed time and sales information from the centralized futures exchanges.

All the trades are posted in real-time to all participants. By operating with the FIFO rule, every trader gets the same treatment regarding order execution. These are not the same in the deregulated and decentralized forex market.

Upfront asset pricing

Futures contracts are completed at upfront fixed prices. The traders get accurate data from the exchange directly. There are no middlemen manipulating prices to suit their interests. So, from the beginning, futures traders know the transaction costs of their trade. That way, they’re not flooded with hidden fees. Also, futures don’t attract additional charges when held overnight.

However, forex traders get no fixed pricing. The prices of assets are usually different, and the brokers will never report the accurate price to traders. Brokers are usually the middlemen between the exchange and the traders. They have a strong hold on forex traders and provide spreads. Also, traders pay interest rate charges and carrying costs.

Accurate data for trading decisions

Accurate volume measurement is vital in forex and futures markets. Large trading volume indicates strong support and move for an asset under consideration. But when the volume is low, the reverse is the case.

Futures traders get accurate data to measure volume and make trading decisions. The exchanges make these data available for those trading futures to enable them to monitor volume for informed decisions.

However, spot forex traders can’t measure volume to help them confirm potential trades, given the decentralized nature of the market. Data comes from many sources, and the reliability of such data is usually questionable.

Diversification opportunities across various sectors

The futures market offers many products to diversify investments in forex vs. futures. Futures contract traders have so many derivatives products to consider under currency futures, commodities, and metals. Some can even consider interest rate futures, index futures, equity, etc. There is also an opportunity for indices such as Oil, S&P500, Gold, NASDAQ, etc. Traders can even choose to work with options on futures contracts.

However, forex traders don’t have that many diversification opportunities. Participants are limited to the available currencies in the marketplace only.

Trade Crypto Futures Easily On Margex Platform!

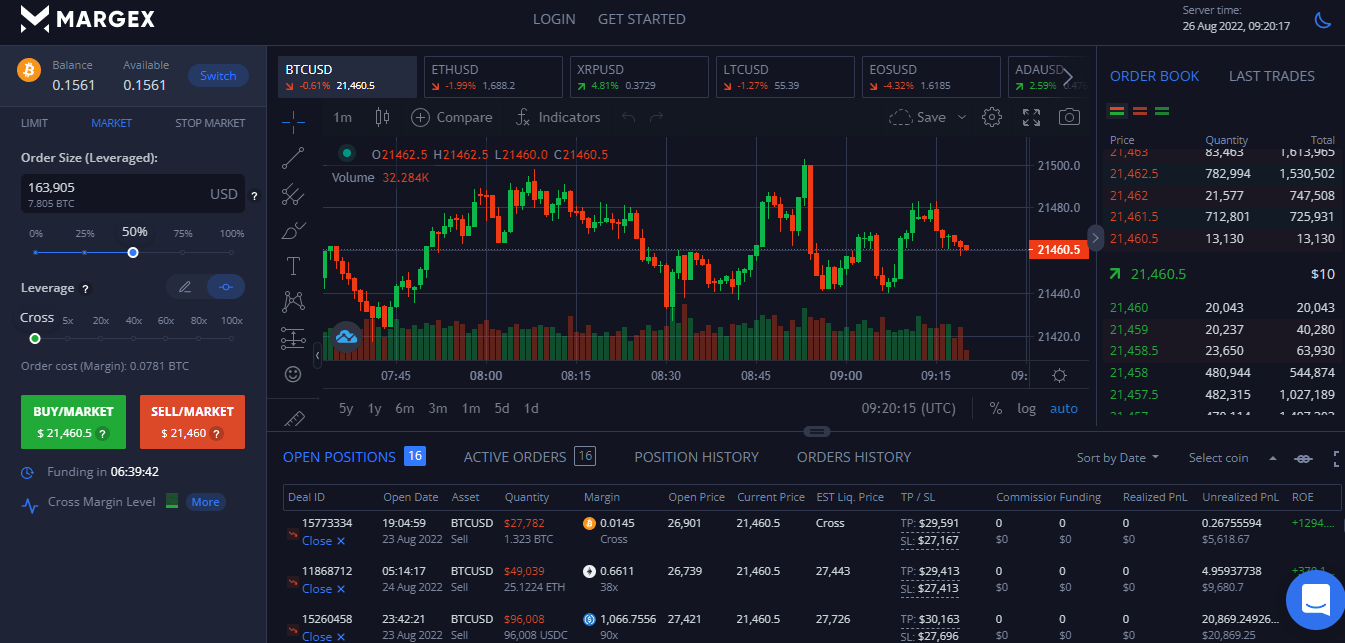

Crypto futures trading on Margex is the fastest and most straightforward way to boost your revenue. Margex has the friendliest UI in the industry – endorsed by Finance Magnates. Quick and easy start. You can start trading Bitcoin futures today with 100x leverage. Margex’s unique MP Shield ™ AI-based system protects users from price manipulation.

A bitcoin futures contract on Margex lets you track BTC price to take leveraged long or short positions. Moreover, you can trade some of the futures contracts in perpetuity or trade others with expiry dates. Some of the Bitcoin futures contracts on Margex include Standard bitcoin futures contracts, Futures with physical delivery, and Perpetual bitcoin futures contracts.

With the Margex expanded deposit options, you can add funds to your wallet through BTC, USDT erc20, USDT trc20, ETH, USDC, DAI, USDP, Tron, and WBTC. The best part is that Margex mobile app facilitates trading on the go without freezes or submission errors. So, open an account, add funds to your wallet and start trading futures.