In the study of technical analysis, investors and traders review a variety of chart patterns and Japanese candlestick formations that can yield relatively predictable results and improve the probability of success.

If you are at all familiar with cryptocurrency analysis, you might have encountered technical analysts and crypto traders talking about chart patterns such as triangles, wedges, flags, and head and shoulders. However, more complex patterns with specific parameters also exist, that can produce a reliable move that can be exploited if discovered in advance.

Such patterns are from the family of a less common trading term called harmonic patterns, which include the gartley, bat, crab, butterfly, shark, and more. In this guide, we will describe how to identify a bearish or bullish gartley pattern, and how to trade the rare harmonic pattern.

What Is The Gartley Harmonic Pattern? Harmonic Patterns Explained

The gartley pattern is from the group of technical chart formations called harmonic patterns. Unlike other harmonic patterns that take the names of animals like bat, crab, or butterfly, the gartley pattern gets its name from Harold McKinley Gartley, which was first introduced in the book Profits in the Stock Markets. The pattern is occasionally referred to as the “222” pattern, due to the pattern being located on page number 222 in the book. In the book, H.M. Gartley called it one of the best trading opportunities.

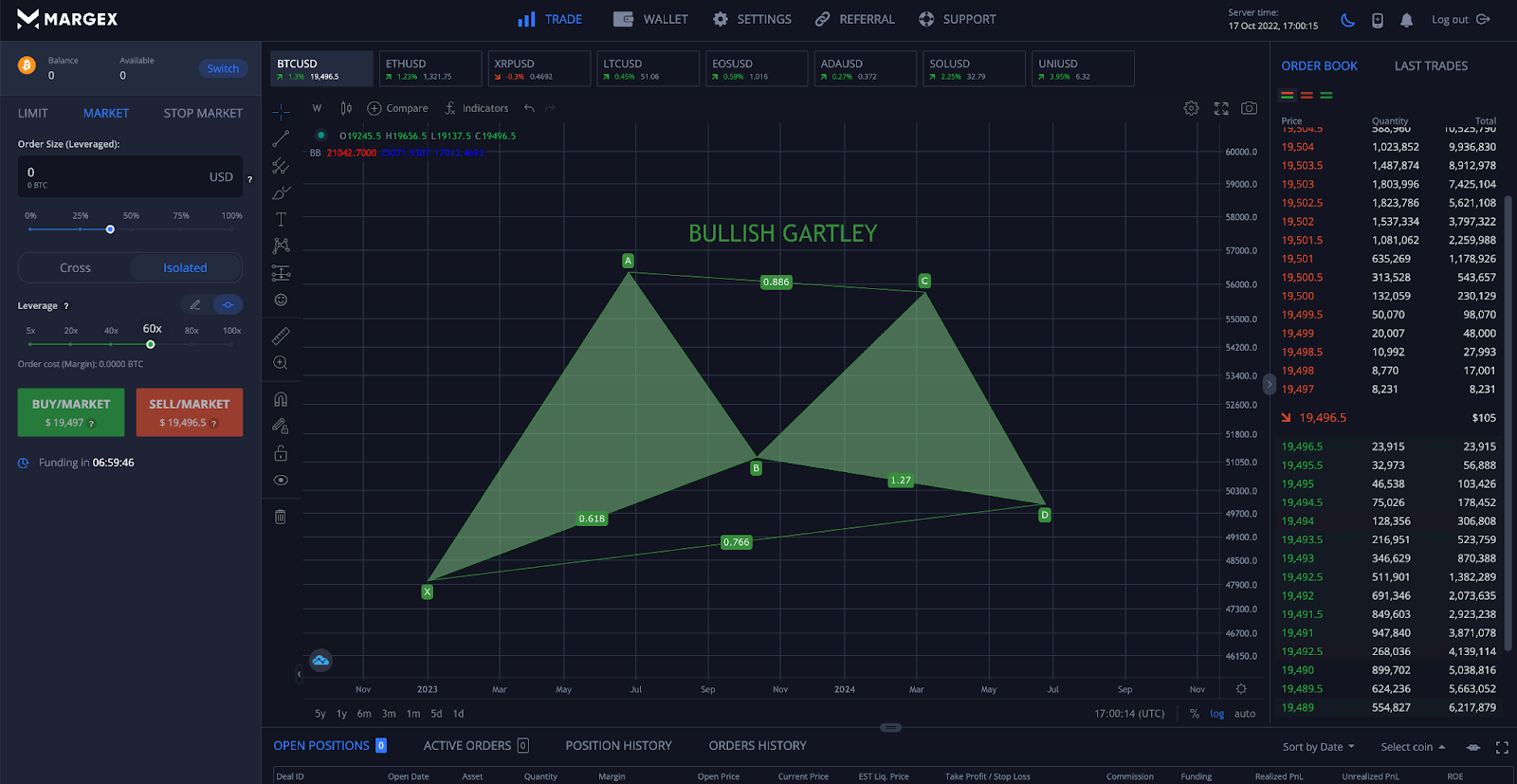

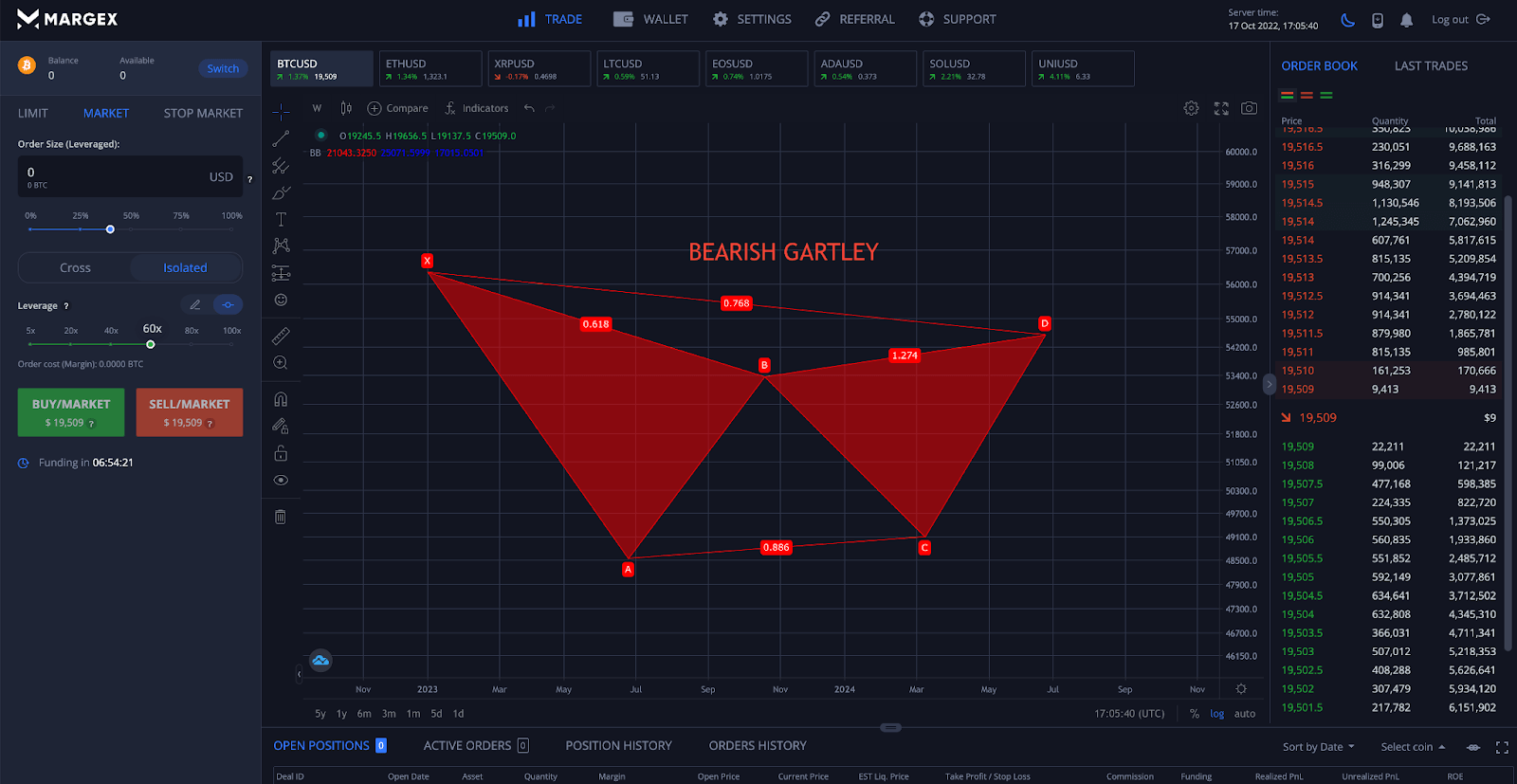

The gartley pattern is an XABCD pattern with four separate price movements labeled A, B, C, and D. At the termination point of the D leg, a position would be entered if the pattern fit specific Fibonacci-based measurements. X is the start of the pattern representing the prevailing trend marked as A. The first move against the trend results in the AB leg, followed by a BC leg in the direction of the previously prevailing trend. A larger CD leg moves opposite the prevailing trend direction, before breaking out and continuing the prevailing trend.

In the years following Gartley’s discovery of the “222” harmonic pattern, other analysts such as Scott Carney and Bryce Gilmore created other harmonic patterns like the crab, bat, and butterfly. Each of these harmonic patterns follow similar rules and guidelines connected to Fibonacci numbers much like the gartley pattern does.

Who Is Harold McKinley Gartley, Creator Of The Gartley Harmonic Pattern?

Harold McKinley Gartley got his start as a board boy and runner on Wall Street in 1912, later becoming a master technical analysis whose name is tied to chart patterns and various techniques nearly 100 years later. Gartley is best known for his book Profits in the Stock Market, where the pattern was first introduced. Although the book then sold less than 1,000 copies, today it is considered a collector’s item.

The New Jersey-born Gartley was one of the founding members of the New York Society of Security Analysts. His educational courses on technical analysis were fetching as much as $1,500 each in the 1930s.

How To Identify The Gartley Harmonic Pattern

The key to properly identifying any harmonic chart pattern is related to how each leg terminates in relation to Fibonacci ratios. If each leg does not at least come close to meeting Fibonacci targets, the pattern is not a valid harmonic pattern. This fact is a key differentiator between harmonic patterns and other types of technical analysis chart patterns. The Fibonacci ratios must be in “harmony” across each leg.

For the gartley harmonic pattern, the AB leg should terminate at roughly 0.618 of leg XA. Leg BC should terminate roughly 0.886 or 0.382 of the AB leg. The CD leg will terminate at roughly 1.272 or 1.618 of the BC leg. Once the pattern reaches the Fibonacci target of the D leg, the trade should be activated. The more accurate the Fibonacci ratios, the higher the likelihood you are dealing with a harmonic pattern.

Bearish and bullish gartley patterns take on the appearance of a large M or W shape, depending on if they are bullish or bearish. Since gartley patterns typically resume the overall trend upon completion, they are considered corrective patterns. Regardless of if the pattern is bullish or bearish, a gartley will adhere to the specific Fibonacci levels outlined above.

Types Of Gartley Patterns

As is the case with most chart patterns, harmonic patterns like the gartley pattern come in two forms –– with a bullish and bearish variety. Which pattern forms depends on the direction of the overall trend, and consequently, any price action that initiates the pattern near a significant swing high or swing low.

Bullish Gartley Patterns

Bullish gartley patterns are corrective patterns that occur during an uptrend. A correction of the prevailing trend creates a number of price swings and trading opportunities. However, the bullish gartley pattern must follow the precise Fibonacci ratios from above. When the pattern terminates at the D point of the pattern, the pattern ends and price will begin to move again with the prevailing uptrend.

Bearish Gartley Patterns

In contrast, bearish gartley patterns are corrective patterns that occur during a downtrend. A correction of the prevailing trend creates a number of price swings and trading opportunities. Like the bullish counterpart, the bearish gartley pattern must follow the precise Fibonacci ratios from above. When the pattern terminates at the D point of the pattern, the pattern ends and price will begin to move again with the prevailing downtrend.

How To Use The Harmonic Gartley Pattern To Spot Bullish And Bearish Reversals

The bullish or bearish gartley is a price pattern used by traders to anticipate and prepare for a potential reversal point as the pattern completes.

When attempting to find and draw gartley harmonic patterns, Fibonacci retracement tools are a must. Fibonacci retracement and extension levels often act as support or resistance levels and are based on Fibonacci numbers.

Alternatively, trailers can use the XABCD tool, which helps translate Fibonacci retracements and extensions in an easy-to-understand format. With the pattern drawn out, it is simpler for traders to see where to set a stop-loss point, what position size to take, and at what price target to potentially book profit.

It is important to know when the pattern is invalidated. H.M. Gartley came up with three potential issues that could invalidate the pattern. The D termination point cannot exceed the beginning point at X. The C leg cannot exceed the distance of leg A. In rare cases, a double top or bottom can occur at the 1.0 Fibonacci, but more commonly the leg terminates at 0.886 or 0.382. Leg B also cannot exceed the start point at X in the XABCD harmonic pattern.

Like any chart pattern, harmonic and otherwise, seek to pair these signals and termination points with technical signals. For example, if the D termination point in a bullish gartley happens just as the Relative Strength Index is reaching oversold conditions, then the bullish harmonic pattern is more likely to be valid and produce the expected upward move.

The gartley pattern can be paired with the Bollinger Bands, Parabolic SAR, Stochastic, and other popular technical indicators.

How To Trade The Harmonic Gartley Pattern Using Margex Trading Tools

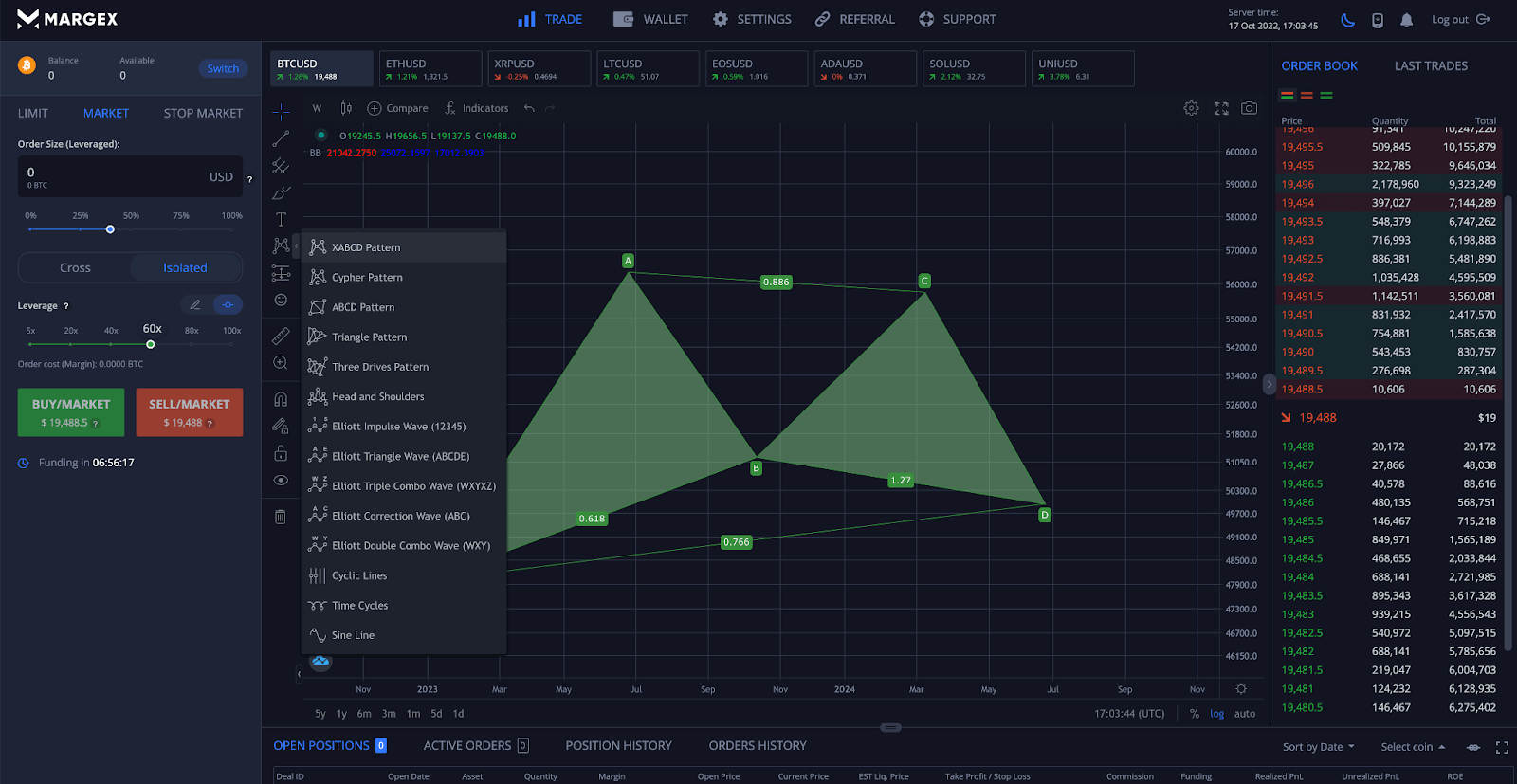

The Margex trading platform includes powerful technical analysis tools built directly into the platform. This allows traders to go at their own pace, properly identify, and successfully trade a gartley pattern.

Margex includes access to both Fibonacci retracement tools, and the XABCD drawing tool that makes drawing harmonic patterns like the bullish or bearish gartley like a breeze.

Here are the steps necessary to trade the pattern.

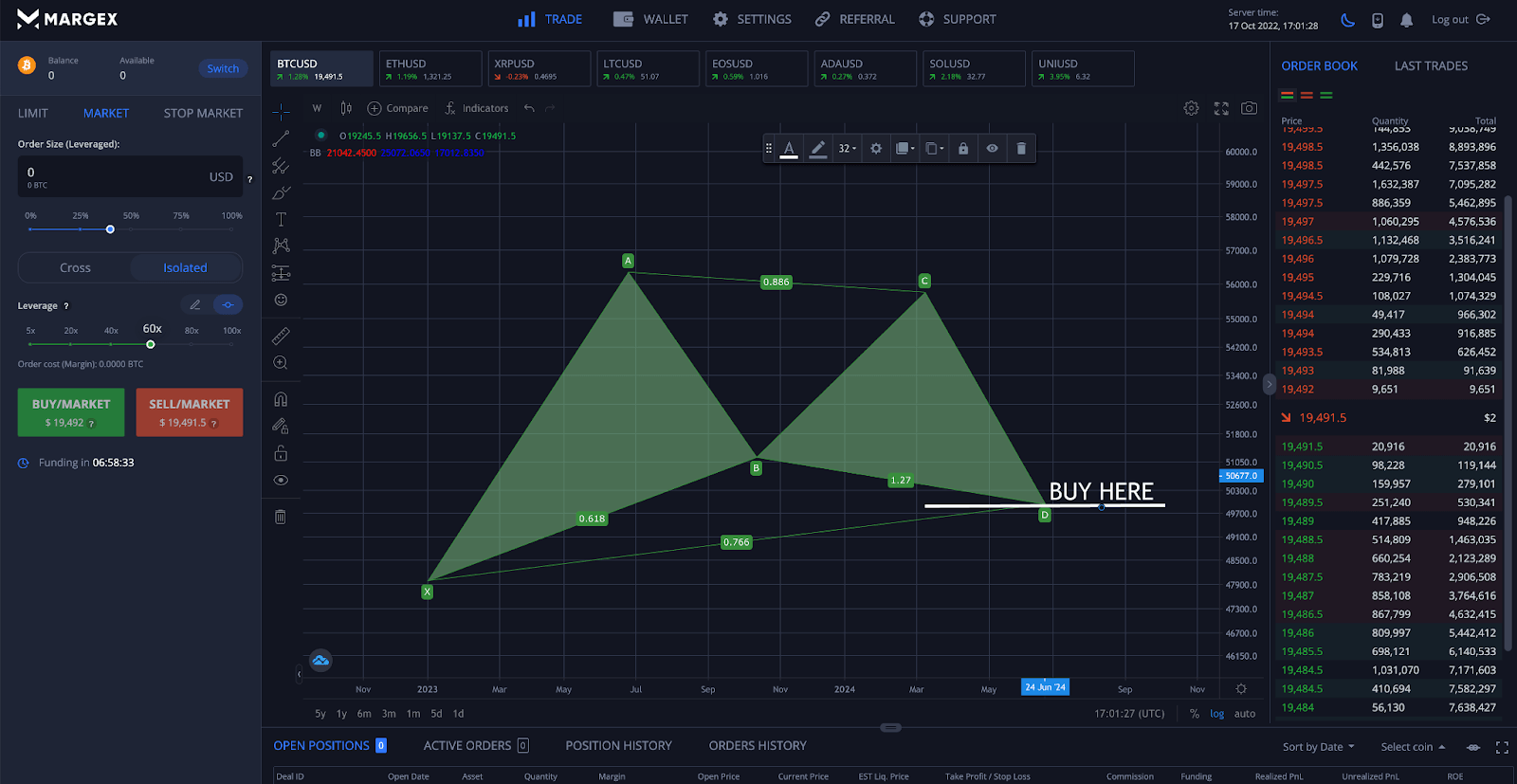

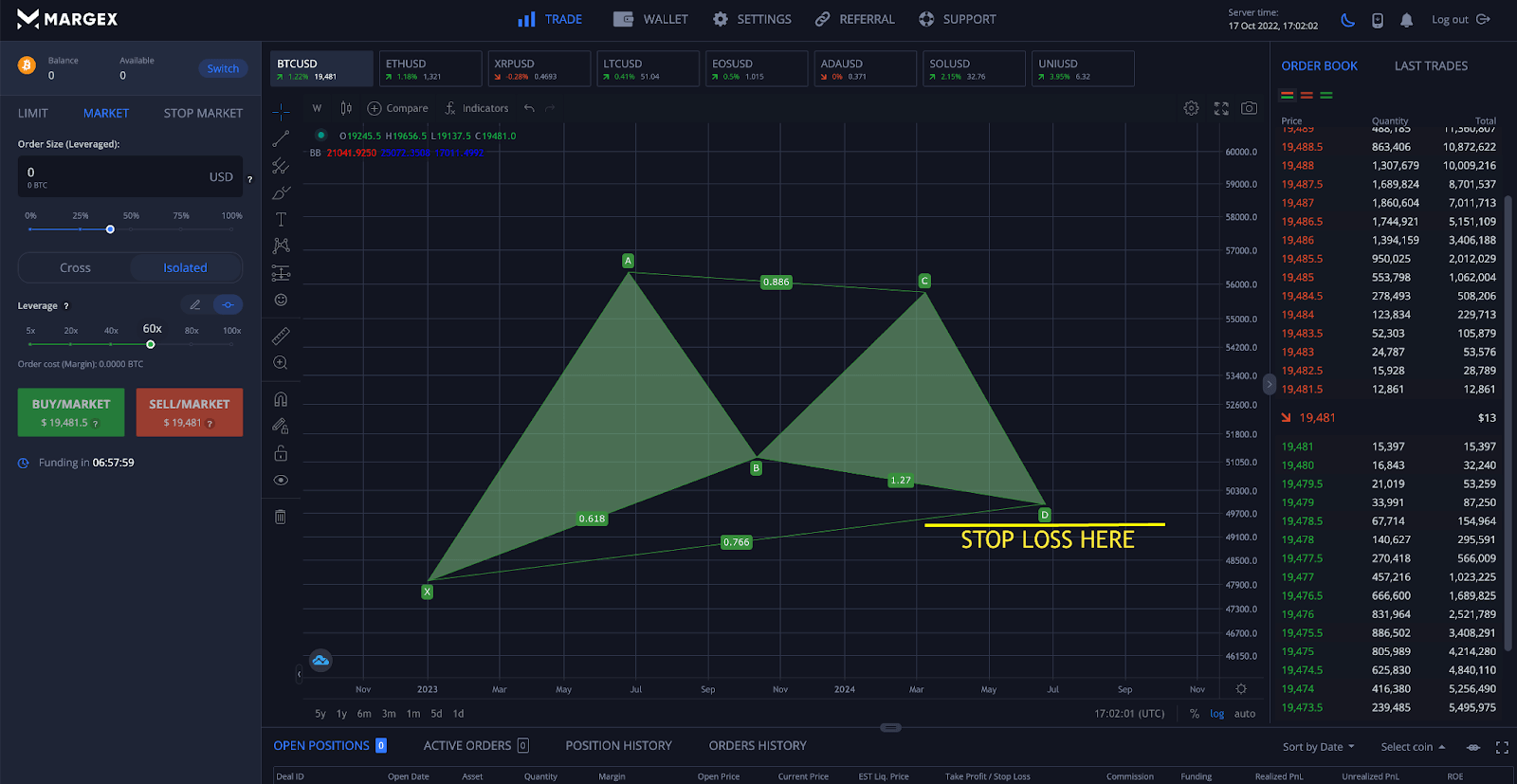

Step 1 – Margex conveniently offers an XABCD drawing tool to make measuring Fibonacci ratios as simple as possible. Using the built-in technical analysis tools, traders can draw out the pattern to properly identify a bearish or bullish gartley pattern.

Step 2 – With the pattern properly identified, traders can get prepared to take a long position at the termination point of the CD leg at the end of the D point. The CD leg should terminate at the 1.618 Fibonacci extension of the move.

Step 3 – Because the gartley gives us the termination point of a CD leg at precise measurements, placing a stop loss below the D leg should prevent extreme drawdowns if the pattern is invalidated.

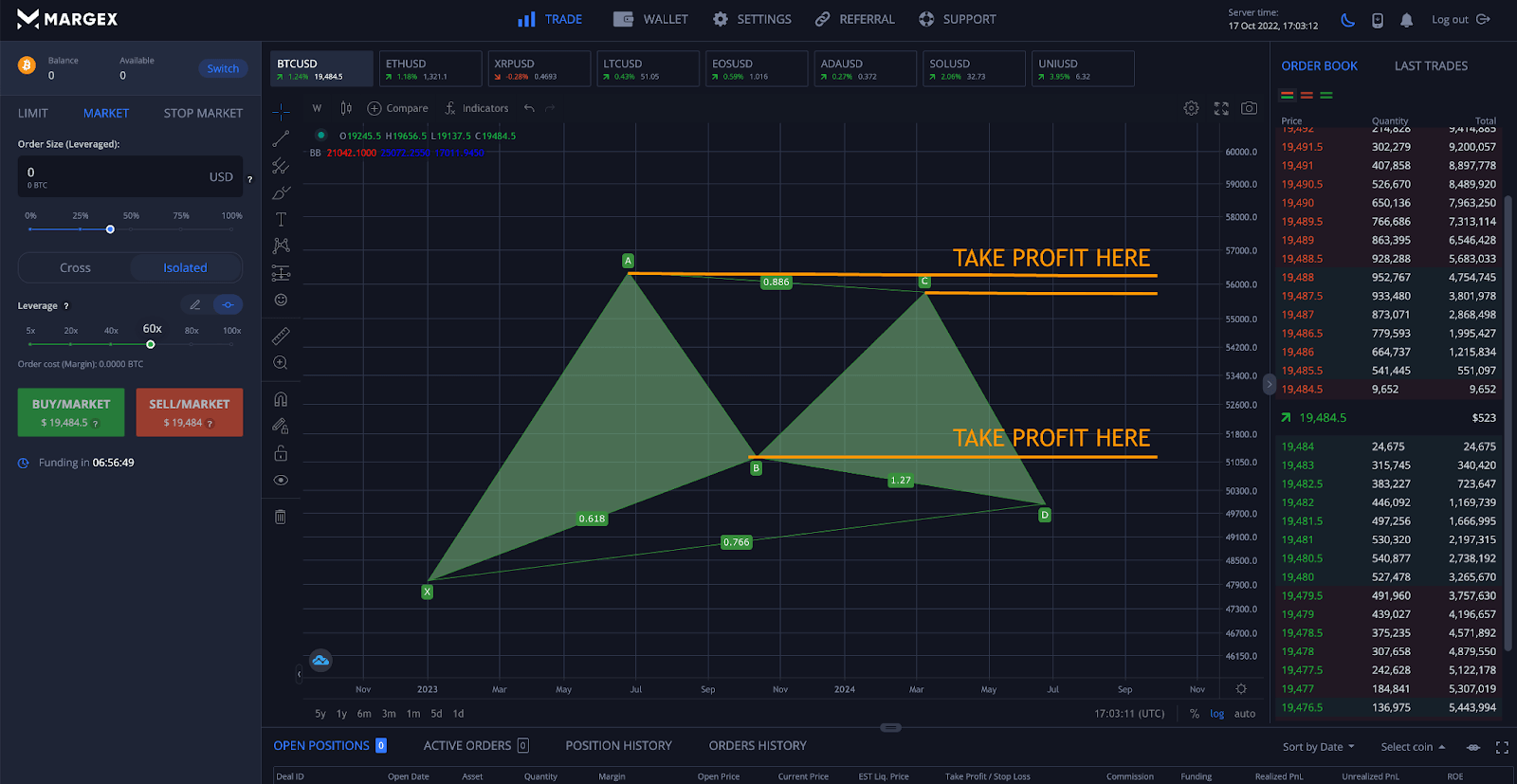

Step 4 – Choose take-profit levels far in advance. Traders can set up a more conservative price target or a more aggressive price target depending on their confidence level in the setup and resulting breakout. In the following section, we outline when to consider taking profit.

Congrats! You have identified and traded the gartley harmonic pattern.

The Advantages Of Using Gartley Patterns

Properly identifying any chart pattern using technical analysis can provide an advantage to crypto traders. However, harmonic patterns offer unique advantages in the sense that the specific price targets make the pattern more reliable.

In addition to helping know when exactly to take an entry and where to set a stop loss based on the termination point of the end of the pattern, gartley patterns also have various take-profit targets based on the several legs of the pattern.

For example, the most conservative take profit target would be the B swing point. The C swing, followed by the A swing would be increasingly aggressive trade targets. Finally, a full extension of AD at 1.618 is the most aggressive target to consider booking profits at. Be cautious, price action might never get to that target, hence the several more conservative targets. Traders can also reduce position sizing at each increasingly more aggressive price target.

The Disadvantages Of Using Gartley Patterns

Most of the disadvantages related to the gartley pattern revolves around misidentification of the pattern. Since the pattern develops across so many different legs, a trader patiently awaiting the D point of the pattern to take the trade entry will miss out on several trades in between. However, if a trader chooses to take positions before the pattern is complete, they risk the pattern being invalidated and the market moving against your position.

When the pattern is invalidated and the market moves below the D point and further beyond the start of the X point of the move, traders can be caught in a counter move and get stopped out. Since traders regularly take positions at Fibonacci retracement and extension levels, any break of these zones typically leads to a large move.

FAQ

How to use the gartley pattern?

Technical analysts and crypto traders use the gartley pattern and other harmonic patterns to get a reliable trading setup and safe entry into the market based on precise Fibonacci targets. After the conditions of the pattern are satisfied across all individual price legs, and the pattern terminates at the correct Fibonacci retracement level, traders can take a position with the expectation that the prior prevailing trend will continue.

Is the gartley pattern a reversal pattern?

The gartley pattern isn’t a reversal pattern, as much as it is a corrective pattern. It has several points at which price reverses. After the pattern completes, the resulting move continues in the direction of the prevailing trend. In that regard, you cannot call the gartley pattern a reversal pattern.

How do you trade gartley patterns?

Trading gartley patterns and other harmonic chart patterns involves measuring Fibonacci retracement levels and extensions. Utilizing the XABCD drawing tool makes identifying gartley patterns much easier. After the end of the CD leg, traders can take a position in anticipation of a reliable move. Since the level at which the leg should terminate is known, it also helps with proper spot loss placement.

What are some other harmonic patterns?

Other common harmonic chart patterns include the bat pattern, butterfly pattern, shark pattern, crab pattern, gartley pattern, three drives pattern, five drives pattern, and A-B = C-D patterns. All harmonic chart patterns involve Fibonacci retracement and extension levels to some degree.

What are Fibonacci ratios?

Fibonacci retracement crypto levels include 0.236, 0.382, 0.500, 0.618, and 0.786, while Fibonacci extensions are 1.272, 1.618, 2.000, 2.618, 3.618, etc. Users can customize which Fibonacci levels they want to see using the Fibonacci drawing tool. These numbers are ratios based on the Fibonacci sequence.