Amid the crypto market’s weakness, something unusual happened to Litecoin (LTC). The hashrate of LTC actually went up against the tide, even at a time when the hashrate of the leading crypto Bitcoin (BTC) is starting to decline.

Rush to Mine Litecoin After FTX Implosion

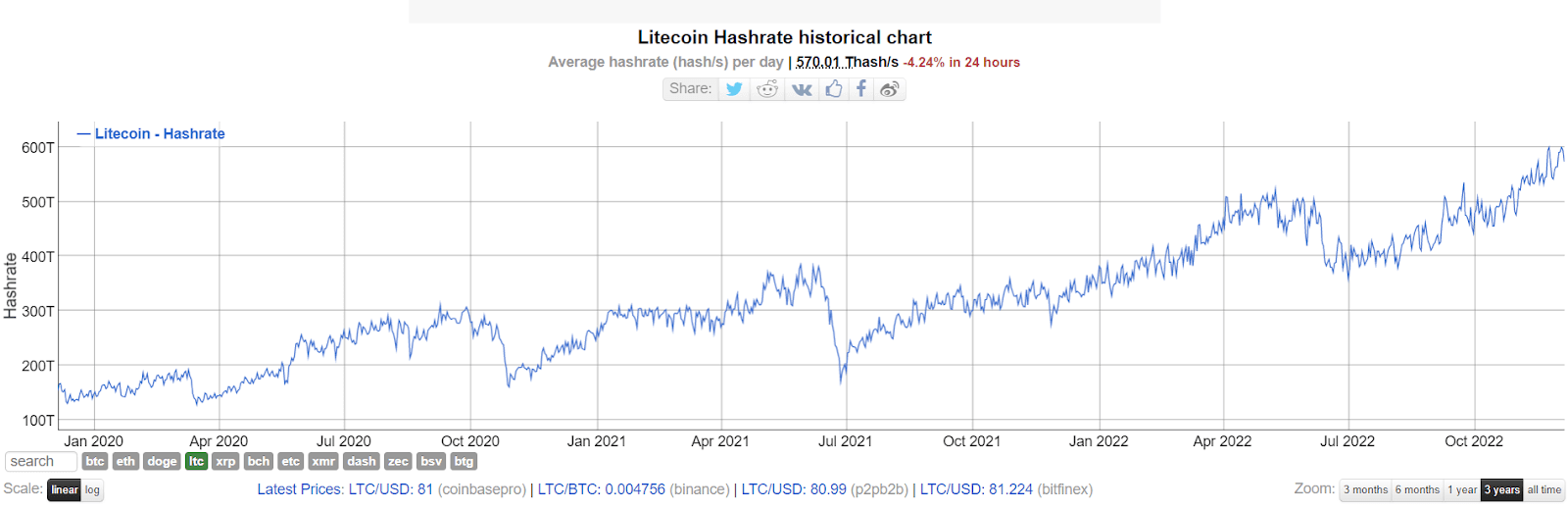

Following its last significant dip in July, LTC’s hash rate has rallied by 64% within the last four months, with the implosion of FTX seemingly not having an impact on LTC’s hashrate. In fact, the FTX saga appears to be helping LTC’s hash rate. As can be seen in the below LTC hashrate chart diagram, since the implosion of FTX in early November, the hash rate of LTC has quietly been climbing, hitting a new all-time-high (ATH) of around 620 TH/s on December 5.

Even though at the point of writing, the hashrate has retreated to about 570 TH/s, it is still far higher than what it was before the FTX saga broke out.

Furthermore, according to data from Messari, on December 3, the LTC network’s average mining difficulty hit its highest level of 19.42 million since its inception, having reached the level at block height 2,379,925.

These hashing metrics are showing clear signs that people are pouring in to mine LTC, and the rush appears to be picking up after the FTX debacle.

Why The Sudden Interest in Litecoin?

Several reasons could be behind the sudden increase in mining activities for LTC. First, the implosion of FTX has not only caused confidence in centralized entities to be greatly eroded, it has also brought to the attention of crypto players, the pitfalls of proof-of-stake blockchains as many saw the demise of popular blockchains like SOL and NEAR in the wake of the FTX debacle, which are run on the proof-of-stake algorithm. During the FTT led selloff in the crypto market, several native tokens of proof-of-stake blockchain were locked up for staking, which resulted in their owners not having access to them to be able to sell. Secondly, a couple of blockchains even halted the chain or extended the lock up period for users’ staked tokens to prevent a mass selloff from crashing their prices. Incidences like these may have led some crypto users to not trust a proof-of-stake blockchain as much as they would have before, resulting in a confidence shift to proof-of-work blockchains like BTC and LTC. This may have prompted some people to start mining LTC instead of becoming a validator on a proof-of-stake blockchain. This may also explain the counter trend move of LTC’s price in the aftermath of the FTX debacle. As the entire crypto market fell lower and only started recouping some gains recently, LTC had actually gained in price.

Litecoin Outperformed Top Coins in November

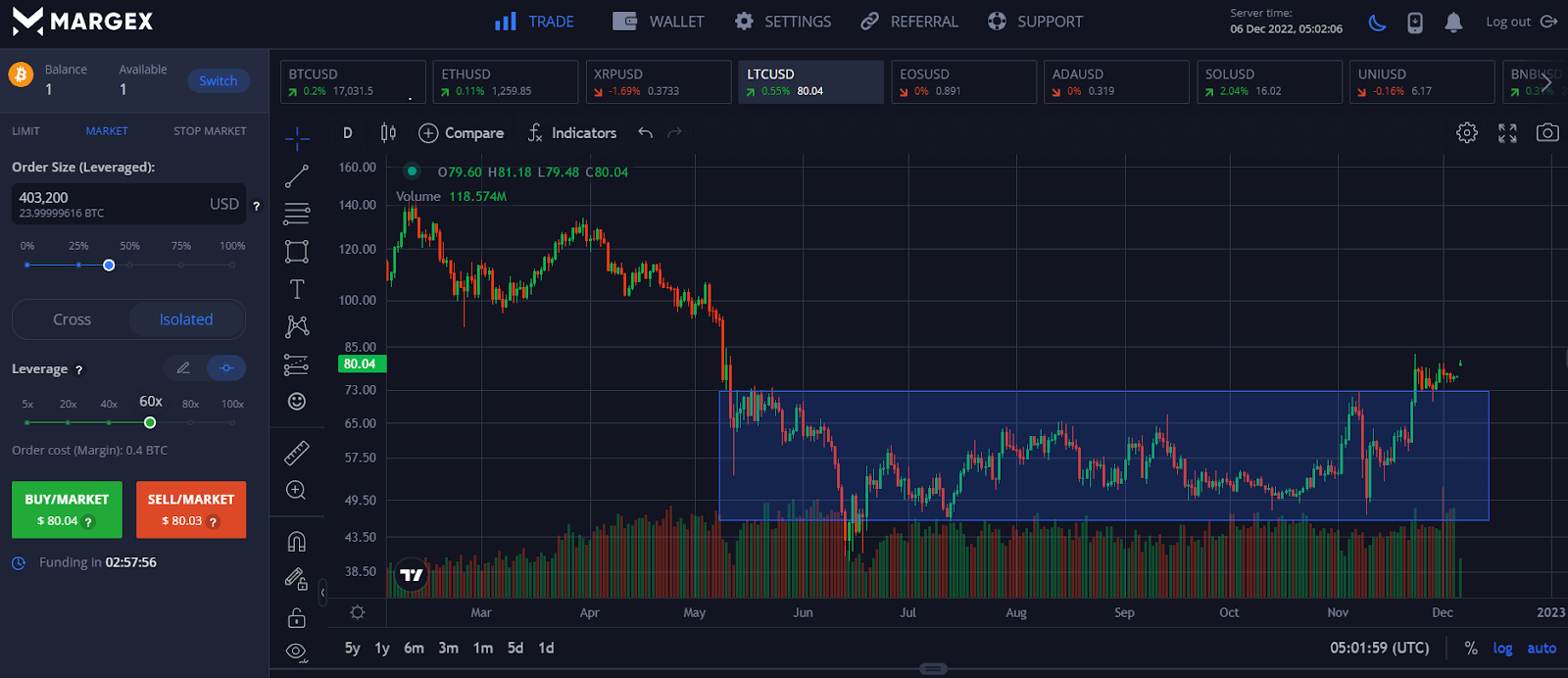

According to market data, during the worst of the FTX selloff, LTC’s price fell momentarily to $49.58 before rebounding sharply to commence its rally. As a result, LTC closed the month of November rising by 25%.

Since the second half of November when the dust around FTX started to settle, LTC has outperformed the market by gaining 57% as opposed to ETH’s gain of 12%, and BTC’s gain of 3%.

Currently, the price of LTC is still trading higher at around $80, appearing to have broken out of a consolidation range of between $43 and $73. The break of this range could imply that LTC may potentially move towards a price of $103 in the coming days and weeks ahead, where the token is expected to meet with selling pressure at around $100 as it is an area of strong resistance, both on the technical charts, as well as on a psychological level.

Other Reasons For Litecoin’s Popularity Surge

As the negative Fed rate hike impact and FTX bankruptcy narrative gets played repeatedly over the past weeks and months, the crypto market is in need of a positive catalyst to keep hopes alive. However, news flow within the space has been confined to only interest rates and FTX contagion, which is starting to bore traders. With a market starved of a new narrative, the LTC halving play has just about come in at the right time to give traders something different to focus on. This could be why LTC has been hogging the limelight and becoming one of the favourite coins of the moment, finally catching up with the kind of growth seen in other top coins like Bitcoin and Ethereum.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and are only meant to be informative in nature. Thus, they should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.