Litecoin is a cryptocurrency designed to produce faster and more secure transactions. These transactions are carried out at lower costs, taking full advantage of its blockchain technology.

LTC uses a proof-of-work consensus mechanism that requires high computer processing power. The process can be profitable with the right mining machines (ASICs) and adequate processing power.

As a fork from the original bitcoin blockchain, Litecoin is regarded as a pure cryptocurrency. It has been adopted as a payment channel by many merchants due to fast transaction time and low costs.

Litecoin has a maximum supply of 84 million coins. It has a fixed supply of coins and undergoes halving every four years to reduce the circulating quantity. If you are wondering how many Litecoins are left unmined, they are less than 14 million coins.

Keep reading to learn more about the famous silver to bitcoin’s gold.

Halving In Crypto

Halving simply refers to the mining rewards being divided or halved at fixed intervals. Litecoin’s halving occurs every four years to curtail the effects of inflation on the price.

Each halving reduces the circulating supply, protects its value, and reduces miners’ reward. The last LTC halving occurred in August 2019, bringing down miners’ rewards from 25 LTC to 12.5 LTC.

The next event will further reduce the reward for LTC to 6.25 LTC per block. This event will take place in August 2023.

Litecoin halving is essential to its tokenomics. The block reward is reduced at every 840,000 blocks. This halving reduces the amount of Litecoin in circulation and will continue until the last Litecoin is issued in the year 2142.

The coin’s scarcity after each halving event preserves its value, unlike some other cryptocurrencies with infinite supply.

What Is Litecoin (LTC)?

Litecoin is a global cryptocurrency founded from a fork in the bitcoin blockchain. It was created in response to a dispute that bitcoin blockchain was becoming too centralized.

It optimizes open-source global payment that uses advanced Scrypt technology.

Scrypt was built to withstand most of the hardware attacks on crypto, thus making it a secure mechanism.

The crypto emerged to provide users access to fast and secure transactions at a minimal cost. The Litecoin network uses a consensus mechanism (proof-of-work) to secure the network. Litecoin has a block time of 2.5 minutes, faster transaction processing time than Bitcoin’s.

Litecoin is regarded as a pure cryptocurrency and is widely accepted by over 2000 commercial outlets worldwide. It optimizes transaction processing time and low cost, unlike Ethereum’s high gas fees.

Creation process

Litecoin was created using bitcoin’s protocol, but with a different hashing algorithm. As an open-source global payment network, it optimizes speed and scales down costs.

It was initially released through an open-source client on GiftHub on October 7, 2011. The network officially went live on October 13, 2011.

Charlie Lee – a former google employee, created the coin as a lite and smarter version of bitcoin. Litecoin is now one of the more popular altcoins in circulation with a wide range of applications.

Charlie Lee, the creator of Litecoin, referred to it as the silver to Bitcoin’s gold. Other co-developers of the Litecoin project include Xinxi Wang, Alan Austin, and Zing Yang.

In line with its drive to be a global payment network, users can build smart contracts on the network. This is done using software referred to as OmniLite.

OmniLite enables users to build decentralized applications and smart contracts on the network.

Significant Litecoin upgrade

Litecoin released the testnet of its MimblWimble upgrade in late 2022. The upgrade was aimed at promoting confidential transactions on the network.

On January 31, 2022, the Mimblwimble Extension Block (MWEB) was released as a part of Litecoin’s core 0.21.2 version release.

The upgrade focused on user privacy and also eliminated unnecessary data from the block. The MWEB extension blocks were fully activated on May 19, 2022. This upgrade created controversy with the delisting of Litecoin from some popular South Korean exchanges.

These bodies alleged that making the Litecoin network private would promote criminal activities and interfere with regulation.

Understanding How Litecoin (LTC) Works

Litecoin emerged to solve the dispute on the bitcoin blockchain. Users felt largescale miners had gained too much control, forcing the creation of the Litecoin fork.

Litecoin uses a different encryption method. However, the miners have remained resolute, adjusted their mining rigs, and expanded their mining capacity further.

Litecoin can be mined using ASIC miners. On the blockchain, a block stores transaction information. It is then thoroughly verified using mining software, then made visible to miners.

Once a miner verifies the block, the next block is created and added to the blockchain rewarding miners with Litecoin.

Litecoin has diverse functions, but is also used by many Litecoin investors as a store of value.

The Best Place To Buy Litecoin – Available On Margex!

Margex is a global cryptocurrency exchange platform where you can buy and sell the best cryptocurrencies. You can also trade your digital currency with help of the online resources on its blog and videos.

Margex is a licensed platform ensuring the easy and secure purchase of Litecoin. You can purchase Litecoin on the cryptocurrency exchange by following the simple steps outlined below.

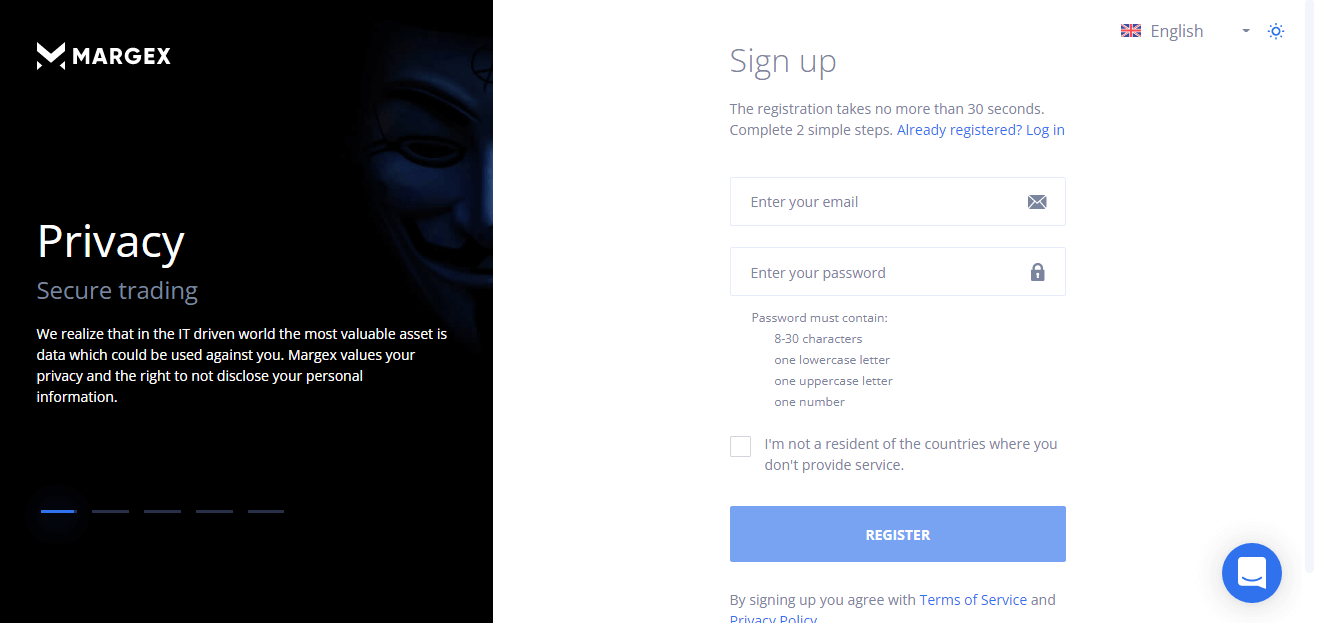

Step 1: Sign up or log in to your Margex trading account.

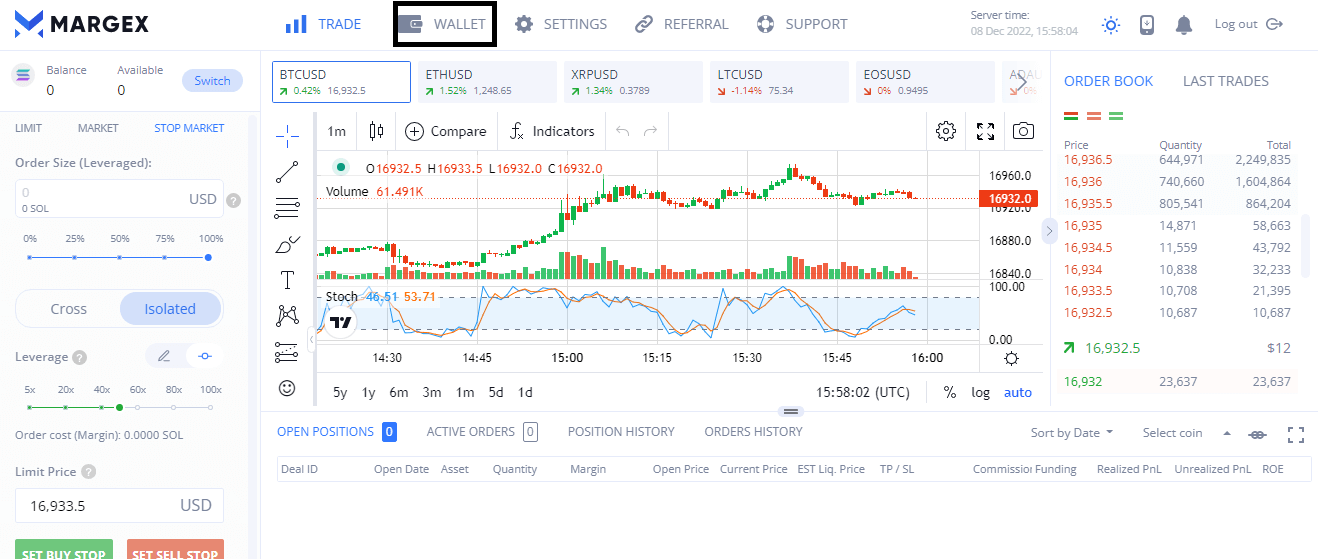

Step 2: Navigate the trade page and click on Wallet

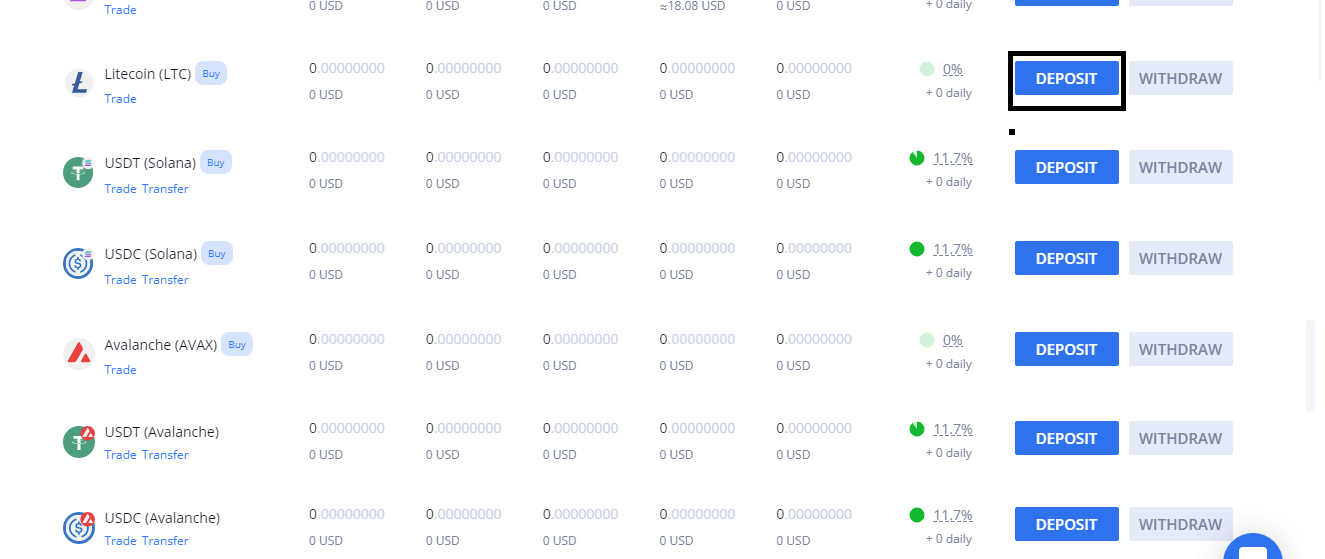

Step 3: Scroll down to where you have Litecoin on the list

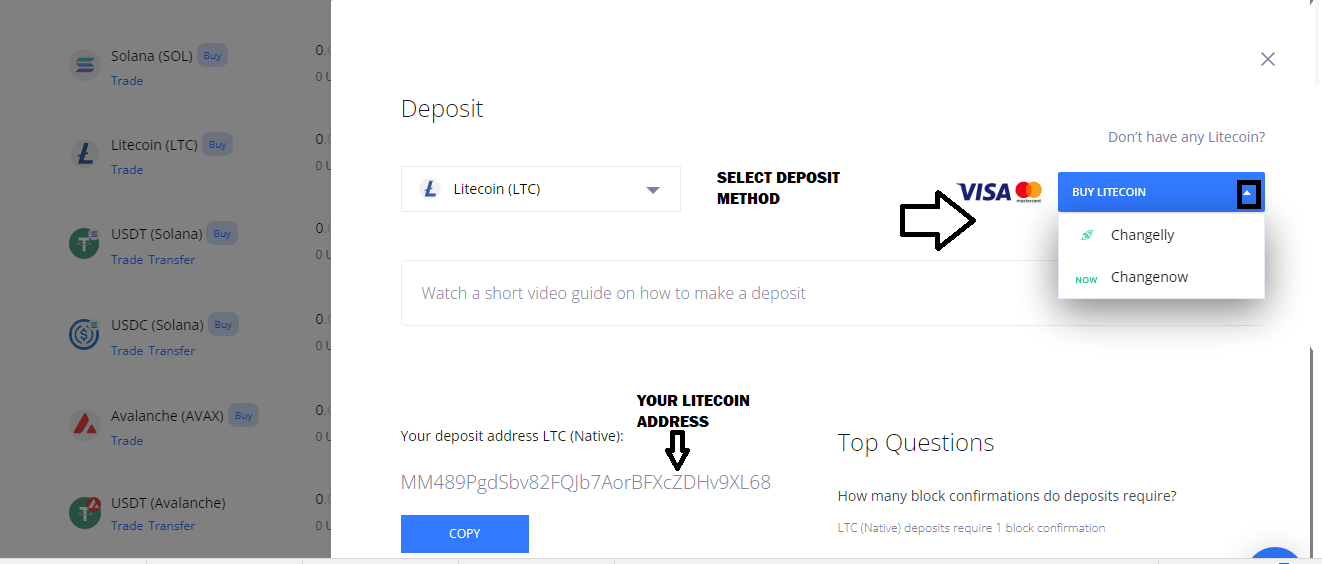

Step 4: Click on deposit and choose your payment channel. You can also watch the video on how to make a deposit.

Step 5: Once the process is complete, congratulations, you have successfully purchased Litecoins

You can trade your Litecoins on the Margex exchange platform and have access to detailed transaction information.

How Can You Mine Litecoin Cryptocurrency?

Litecoin uses a proof-of-work system, meaning it needs miners to secure the network, generate new coins and validate transactions.

In the mining process, individual nodes verify transactions and keep records on a blockchain network. To mine bitcoin, an individual must operate as a node on the network. Also, a miner needs a wallet to store private keys. Select a secure wallet like Electrum, for instance.

The first step involves downloading Litecoin Core and following the setup guidelines. Once the process is complete, your computer will be connected to the network, where you can add hash power to the LTC blockchain.

Also, you can opt for a Scrypt ASIC machine with pre-installed software. Mining hardware is quite expensive, and some miners opt to join pools to reduce costs and maximize profit.

Litecoin mining is competitive, and a solo miner or ASIC has a slim chance of solving a hash to get a reward. The larger pools and commercial miners always have the upper hand.

It takes around 8.5 days to mine 1 Litecoin at the current difficulty level at a mining hashrate of 9,500.00 MH/s consuming 3,425.00 watts of power for $0.10 per kWh and a 12.5 LTC block reward.

Factors That Influence Your Choice Of Mining Hardware

There are several factors to consider when choosing your mining hardware.

1. Cost price

The amount spent on purchasing a rig is critical to your profitability in the long run. The more you spend, the harder it is to cover the cost price. The Litecoin Miner L7, for instance, yields much profit; however, it costs a fortune to acquire.

There are also used ASIC miners, although some might not be in very good condition.

2. Your target

A miner must identify the purpose of mining Litecoin for it to be a good investment. Mining can be for profit or to mine and hold the Litecoin received as a reward.

Outlining your targets will help you strategize better as a miner.

3. Energy consumption and cost

An ASIC miner consumes a great deal of energy. This is a vital consideration in the mining process. For instance, the Litecoin ASIC miner -Antminer L7 consumes roughly $10 daily.

This is the energy cost required to power the ASIC miner. ASICs are notorious for producing excess heat as a by-product of the mining process. Also, they must be operated on 24 hours a day.

So, miners must find a way to vent the heat or spend more funds on cooling naturally.

4. Hashrate

This factor is critical since your profitability hinges on how fast your ASIC can hash. A faster hashrate makes you more competitive against the big players in earning block rewards.

A slow ASIC will hardly bring in profit and can become expensive to sustain in the long run.

Solo mining vs. pool mining

Both methods have their advantages and downsides. A solo miner will go for extended periods without getting block rewards. However, solo miners that are rewarded will collect the full reward of 12.5 Litecoin and the fees attached.

Pool mining, on the other hand, brings together a community of miners that contribute their hashing power to get rewards. This method is more effective in winning regular rewards.

However, pool participants will only earn according to the hash power contributed to the pool. This implied that all rewards gotten from mining a block successfully would be shared among participants.

Pool mining does not guarantee profit at all times but has a higher chance than solo miners.

Is Mining Litecoin Still Profitable?

Litecoin can be mined with the help of crypto mining hardware that includes ASICs. As the Litecoin blockchain increases, so does mining difficulty. The difficulty increases and decreases based on the total computing power applied by miners on the network.

Litecoin mining is still profitable if you find a cost-effective method of carrying out the process. Also, miners’ rewards are reduced with each halving event, and the mining difficulty increases.

Mining requires proper planning, just like any other business venture, to succeed. A litecoin miner can make a living from being consistent at the craft.

Also, it is important to be familiar with the laws in your locality regarding mining since it generates carbon emissions. For solo miners, look for a good location for your site.

Pros and cons of crypto mining

Like any other business venture, mining has its list of advantages and risks associated with it.

Pros

- Highly profitable

With proper research and due diligence, a miner can make quite a fortune from mining. During a bull run, the asset’s price will soar and can give unbelievable returns in a short while.

Many miners have become rich by sticking to a solid plan.

You can’t be bankrupt.

As long as cryptocurrency is still mined, it will retain some value even during a bearish market phase. Miners profit all year round as long as they keep hash power to the network.

Private keys keep your tokens safe.

Your tokens are safe with your crypto wallet and practically impossible to get stolen.

A reliable cryptocurrency exchange service can also provide an online wallet service for you and also a payment network.

This security feature makes mining attractive to crypto users.

Does not require much knowledge

You might not have the technical know-how, yet you can easily sign up for a mining pool or research how to start up. Contributing hashing power to the Litecoin network, for instance, boosts its security, and the miners are rewarded.

Adding to the circulating Litecoin supply is also an achievement in its own right for miners.

Cons of Litecoin mining

Energy-intensive

The Proof-of-work mechanism is highly profitable, but also energy intensive. Heat and noise are by-products of this process, added to carbon emissions. In some countries, such activities are frowned upon and could create a barrier to miners.

Also, the electricity consumption is high since much computation power is needed. The high cost of electricity has made mining less profitable over the years, and most cryptocurrencies are switching over to Proof-of-Stake.

Proof-of-Stake is more environmentally friendly, but does not reward miners.

Scarcity of mining hardware

Mining hardware is scarce to come by, since most mining corporations hoard them to increase their computing power.

Even when they are available, they are usually sold for expensive cryptocurrencies like bitcoins. This can be a real challenge for an individual miner.

Fraud In Mining Pools

Some mining pools are not properly registered and are looking to fleece investors of their money. Cloud miners can also be used to swindle investors of funds. Some mining pools, for no apparent reason, can withhold the earnings of miners or shut down completely.

Investors must always do proper research to find out registered and regulated mining pools. These mining pools must be reviewed and well renowned in the crypto space.

The volatility of cryptocurrencies

Although miners will always make profits, the price might fall and make the profit drop in a bearish market phase.

If the expenses exceed the mining profit, it is no longer practical, and miners must always readjust their strategies periodically.

Conclusion

Litecoin is a multifunctional cryptocurrency used for global payments and exchange services. It is not governed by a central authority and can be traded on crypto exchanges.

You might wonder how many Litecoins are there. There are 84 million Litecoins, with around 70 million already mined. The Litecoin supply is controlled by a halving mechanism every four years.

Litecoin mining is still profitable, as miners are rewarded 12.5 LTC for every block of transactions confirmed.

Litecoin has been adopted by many businesses all over the world. The network has faster transaction times of 2.5 minutes compared to bitcoin’s 10-minute time frame. It also offers users lower transaction fees compared to bitcoins and Ethereum.

Margex offers you a stable and reliable exchange to trade your LTC tokens. You can also learn a lot from the resources available for crypto traders and beginners on the platform.

Litecoin FAQs

Find more answers to aid your decision to mine Litecoin or not.

How many Litecoins have been mined?

There were about 70.248 million Litecoins in circulation at the beginning of 2022. Litecoin network uses the proof of work consensus and relies on mining for its coin minting and security.

How many Litecoins are left to mine?

Litecoin has a supply limit of 84 million coins. Since about 70 million have been mined, only less than 15 million coins are left for miners.

Is Litecoin supply limited?

Litecoin supply is limited, though it has more coin circulation than Bitcoin. Unlike Bitcoin, which has a limit of 21 million coins, Litecoin can issue four times more.

The maximum supply of Litecoin is approximately 84 million coins. Litecoins supply is designed to reduce after some time to protect its value.