Online trading allowed more and more people to get involved on a retail level. However, several barriers still exist for newcomers to the stock market and other traditional markets. The emergence of crypto assets like Bitcoin has created a much more accessible financial market, encouraging more users to buy crypto assets using fiat.

After experiencing the notorious asset class volatility for themselves, crypto investors quickly realize that the large price swings can create lucrative trading opportunities, and thus try to become crypto traders.

However, unlike everyday traders who interact in a physical market or through the internet via eCommerce platforms, these crypto traders make their transactions on decentralized cryptocurrency platforms through the blockchain.

These decentralized platforms help to connect cryptocurrency enthusiasts through peer-to-peer trading, day trading, position trading and other crypto trading activities. Depending on your interests, you can choose what aspect of trading you want to get involved with.

On the outside, many people might think that the concept of crypto trading is complicated. But just like any other project, crypto trading requires dedication, skills, and planning. After all, there is nothing like easy money.

Why invest and hold, when each price swing above creates the opportunity to go long and short using Margex trading tools?

Who Is A Crypto Trader?

A crypto trader is simply someone that trades cryptocurrencies for other crypto assets or fiat. However, these investors do not suddenly wake up with the decision to transact mainly because the market is highly inconsistent and subject to short-term changes.

One of the features of digital currencies is characterized by how quickly the market prices can change. Unlike natural goods and services that react to the laws of demand and supply and sometimes inflation, cryptocurrency is in a world of its own.

Therefore, crypto traders take advantage of these short-term price alterations in the general crypto market. As a result, they profit by buying coins when the price is down and selling when it suddenly grows in value. With the “buying low” and “selling high” strategy, many crypto traders have become successful in the cryptocurrency market.

How Profitable Is Crypto Trading?

Naturally, the primary purpose of trading is to make a profit. Nevertheless, successful traders and business people still experience losses when making transactions. This principle also applies to crypto trading.

However, the irregularities of the crypto market could be a blessing or a curse to crypto traders looking for profit. Unlike local currencies backed by a central authority, digital assets are more decentralized.

Therefore, as a crypto trader, you should know that cryptocurrency has two sides to a coin because there are risks and benefits attached to it. Additionally, the digital market reacts to external pressure. For example, China banned Bitcoin mining in 2021 which eventually saw its value decline for a moment. The result of the ban saw many Bitcoin holders lose their investments in the crypto market. So how can you profit from crypto trading?

Successful crypto traders understand the risks of the market’s inconsistency, making it easier to diversify their investments and choose a strategy that works best for them. Additionally, as cryptocurrency adoption is improving worldwide, crypto exchanges have improved their services to help crypto traders achieve their short and long-term goals. Therefore, the market’s volatility makes crypto trading a profitable venture for investors that takes advantage of it.

How Much Do Crypto Traders Make?

Crypto trading is relatively new and less than a decade old and many traditional investors still shy away from trading cryptocurrencies. However the truth is that experienced crypto traders have pulled in profits from their investments over time.

According to a recent report, a U.S.-based crypto trader earns an average annual pay of $113,292. Additionally, the growth and adoption of cryptocurrency have seen the rise of blockchain companies taking over prominent industries, including finance, entertainment, sports, health, media and so on.

Consequently, there is an increased demand for enthusiasts wanting to build a career in the crypto sector.

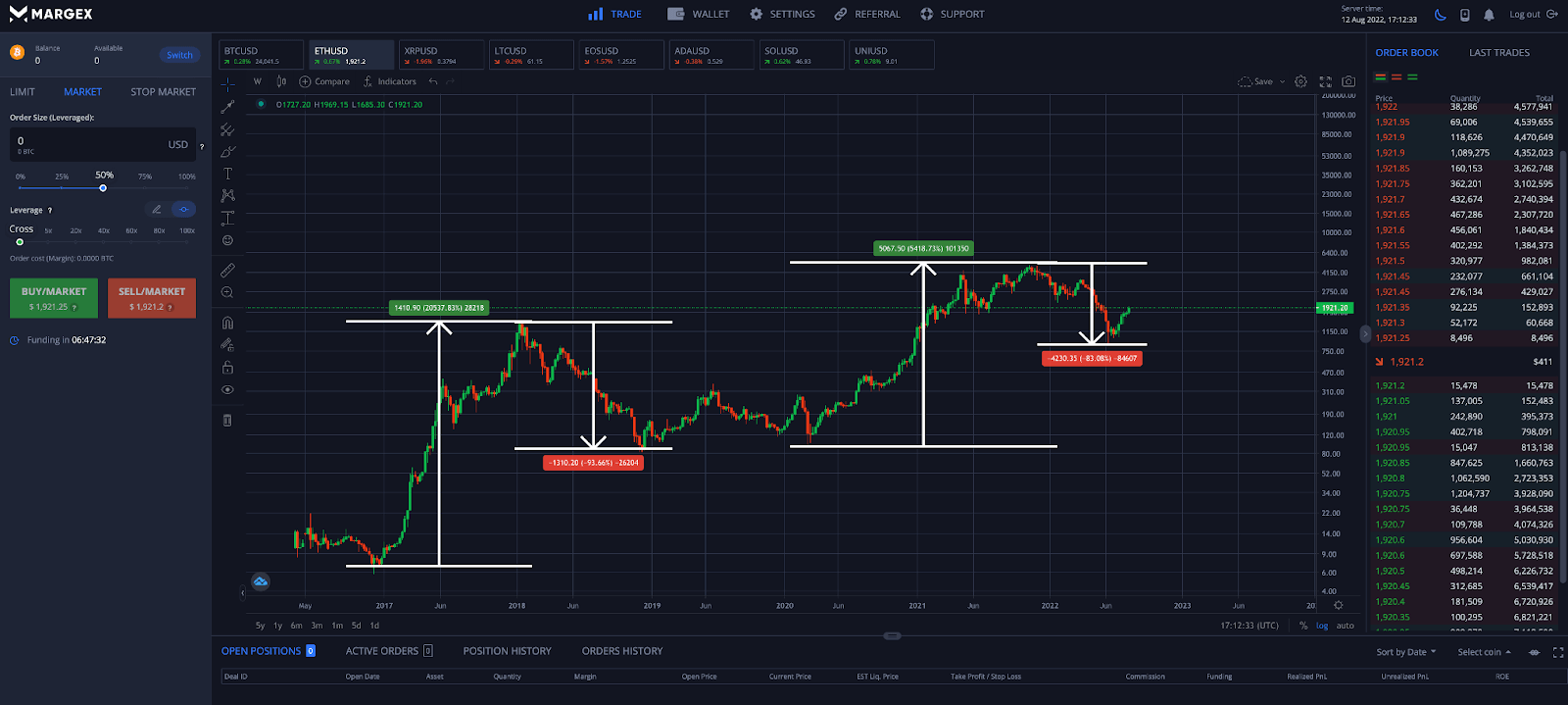

The Ethereum chart above provides an example of how much a trader can effectively make using Margex trading tools. A long position to start the bull trend would have resulted in more than 20,000% ROI. The following downtrend and bear market created another opportunity to go short for a 90% retracement. Another long trade brought Ethereum traders more than 5,000%, with yet another opportunity to go short once the uptrend concluded.

Steps To Become A Crypto Trader

The cryptocurrency industry is filled with many concepts, making it challenging to filter unnecessary noise against the relevant information. Therefore, learning about cryptocurrencies is essential to becoming a crypto trader, especially if you are a beginner.

Furthermore, there are essential tools you need to start trading crypto. Because of its decentralized nature, you cannot visit a traditional financial institution to buy or sell digital assets. Instead, cryptocurrency exchanges provide a platform for you to transact and exchange tokens with other crypto traders.

Additionally, you need a platform to store your tokens. Unlike banks that deal with local currencies and tangible valuables, a crypto wallet is a digital platform that keeps your digital assets safe. The crypto wallet protects your funds from hackers and other insecure crypto activities through a unique private key. Only the wallet holders can have access to this key.

To become a crypto trader, you should follow the steps below:

Choose the right broker

If you are new to crypto trading, you should consider choosing the right broker for your transactions. Like an investment broker in the physical world, a crypto broker acts as an intermediary between you and other crypto traders. In simpler terms, a broker connects buyers and sellers to exchange digital assets for fiat or crypto.

So what should you look for when choosing a broker?

To avoid the noise in crypto, you need a broker that provides an exciting environment to trade your digital assets. This is because the broker sets the prices and terms of the contract, which could be suitable for beginners.

A typical example is Margex, a leading crypto trading platform that provides independent financial advice to new crypto traders. Unlike other brokers, Margex has a convenient and exciting interface with low trading fees and lucrative trading offerings. Therefore, you can learn more about crypto trading from Margex.

Choose a reliable trading platform

It is usual for you to confuse crypto brokers with crypto trading platforms. While brokers link buyers and sellers together, a trading platform or exchange is basically the place where the transaction happens based on the market price of cryptocurrencies. So all you have to do is to transfer your digital assets to the exchange and wait for a buyer to purchase your crypto.

Additionally, most exchanges provide market data and information in cryptocurrency charts with fundamental analysis for users to follow the price movements and avoid making poor investment decisions.

Choose your crypto trading strategy

Before venturing into any market, you must have researched the price and quality of the goods or services you want to purchase. This strategy also applies to crypto trading because of the vast and volatile market. Hence trading crypto requires a plan.

A trading strategy is an in-depth plan that guides how you trade. This plan tells you when to enter or exit the market, buy or sell an asset, and how to manage risks. So instead of acting out of fear during a market crisis, your plan helps you make informed decisions.

You can form a strategy by answering the following questions.

- Why do you want to trade?

- What assets do you want to trade?

- What determines your entry and exit?

- What data do you need?

- When do you trade?

You need a strategy because cryptocurrency trading is a long-term activity requiring you to make tough decisions daily. Most crypto traders fail to become successful because they do not have the patience to create a plan. You will get a lazy result if you enter the market with a lazy mindset.

Examples of trading strategies include:

Day trading:

Day trading is the most popular form of active trading in the crypto industry because investors enter and exit their positions on the same day. In other words, it is a short-term trading strategy. Furthermore, this strategy allows them to take advantage of the slight price changes during the day. While most crypto exchange platforms operate all the time, day traders are time-sensitive.

Successful traders depend on solid market analysis to make buying and selling decisions. However, it is demanding and has a high failure risk when a decision is wrong. Often, many day traders panic buy.

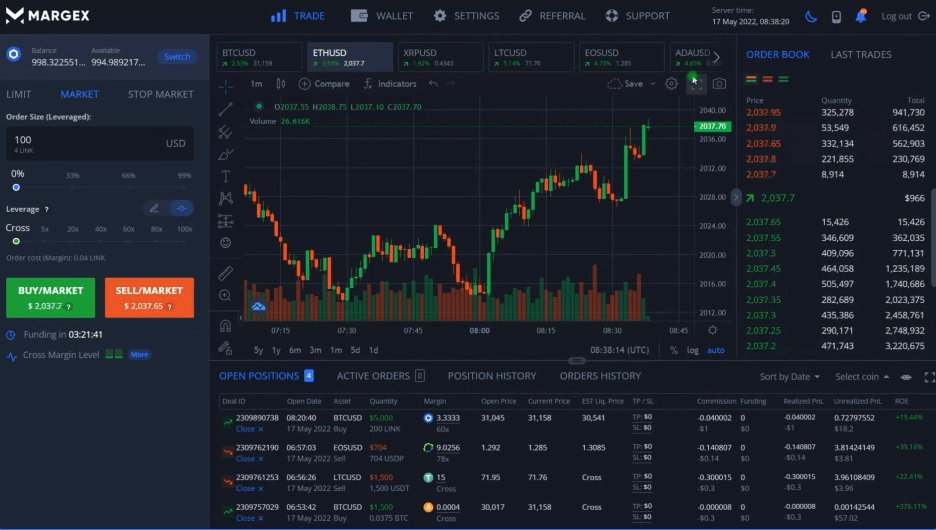

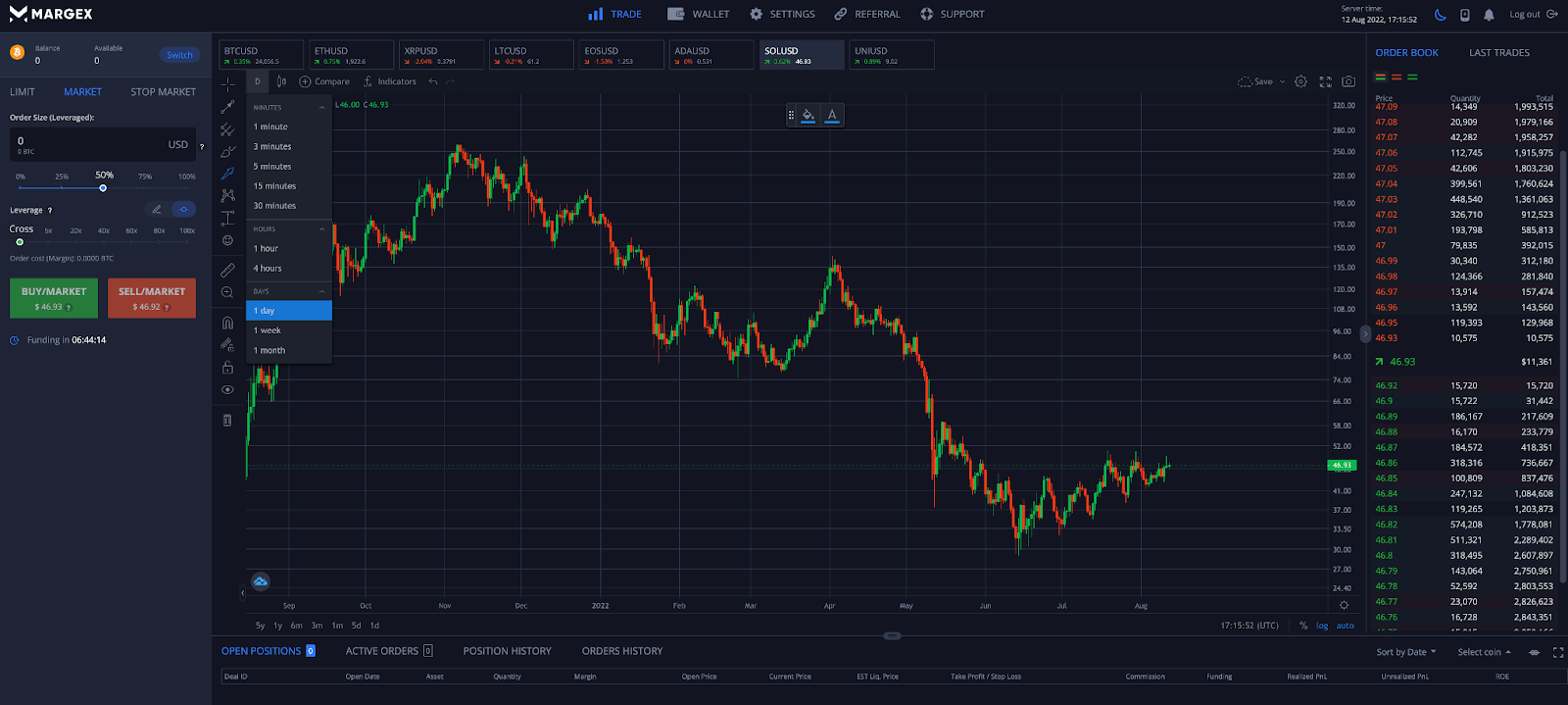

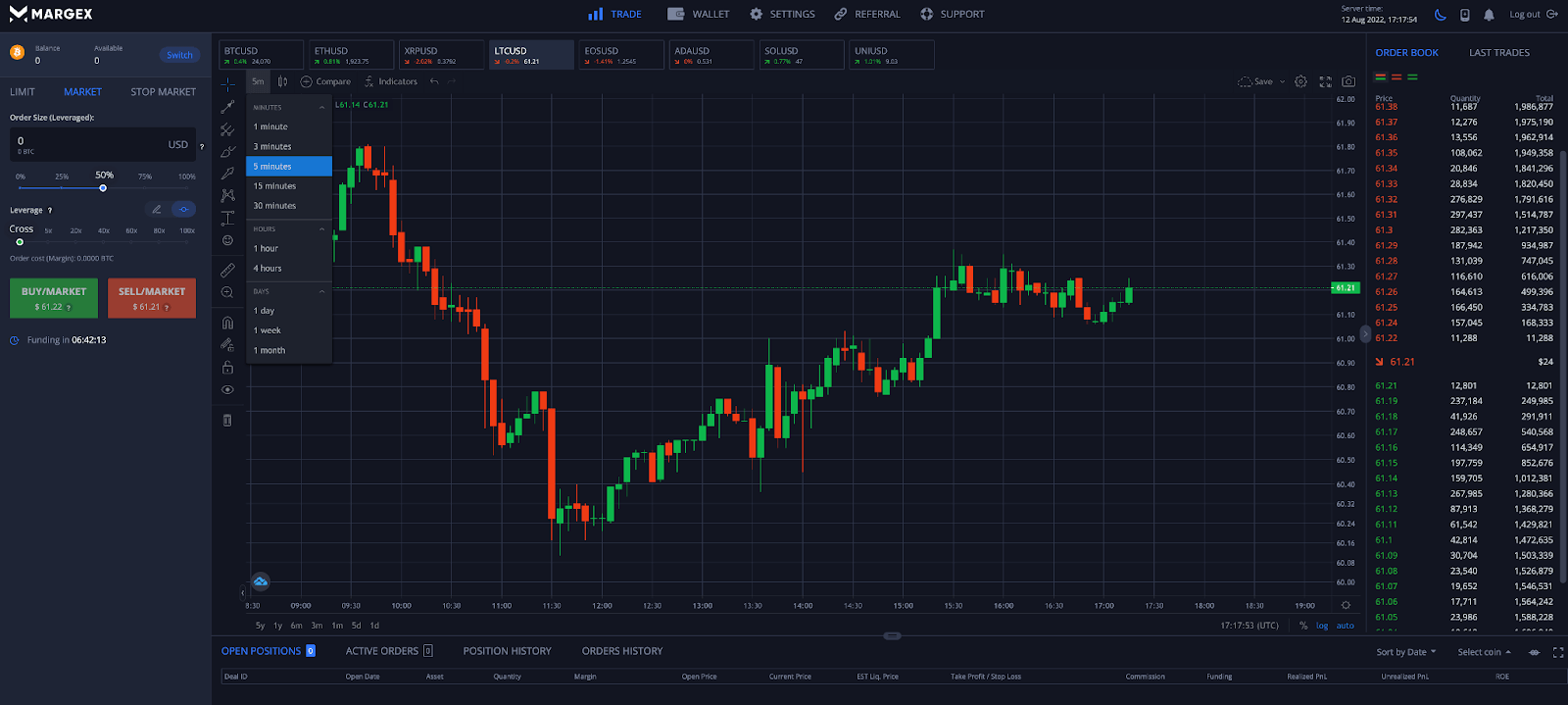

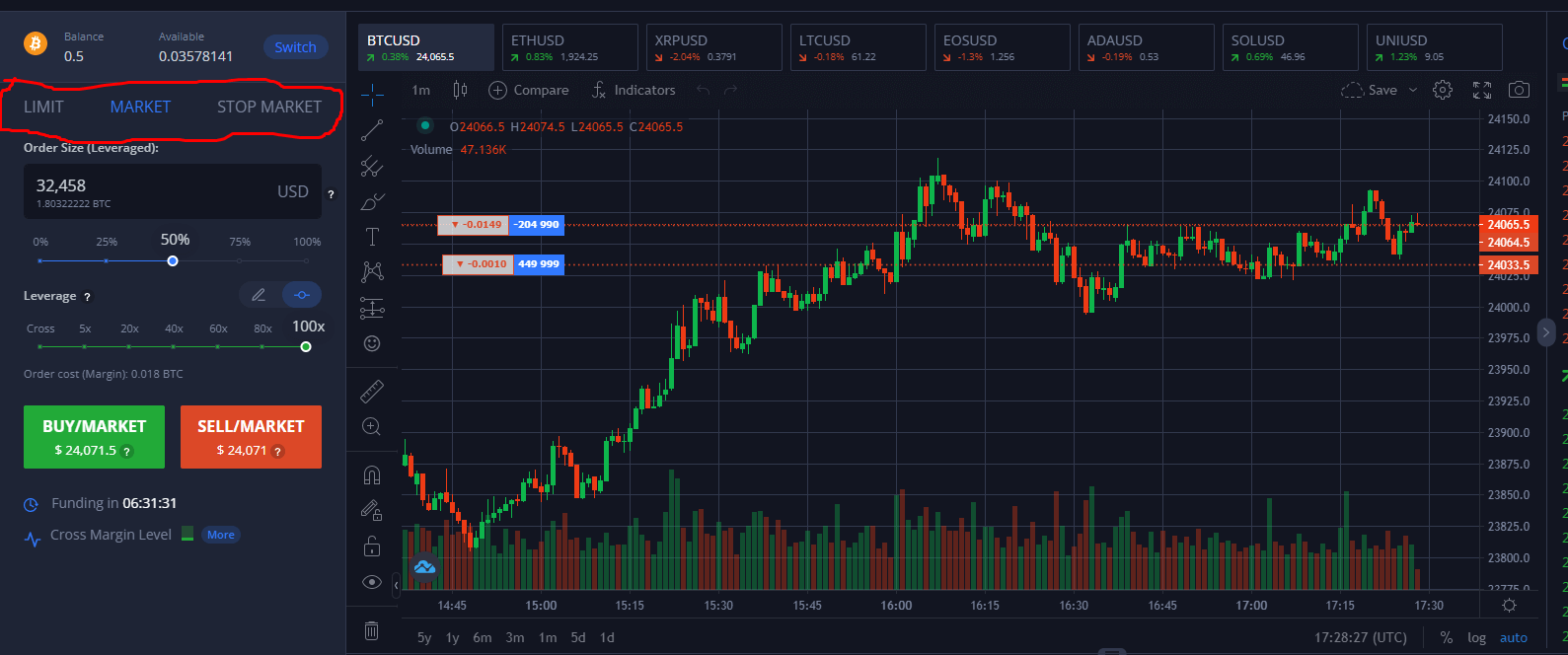

The example below shows the daily timeframe and the preferred setting for day traders.

Swing trading:

Unlike day trading, swing trading is a strategy where an investor buys and holds crypto for more than a day but sells before the end of a month. Therefore, they spend a long time observing the market change before making decisions. Additionally, swing trading may be an excellent strategy for new traders because they can reconsider their choices within a month.

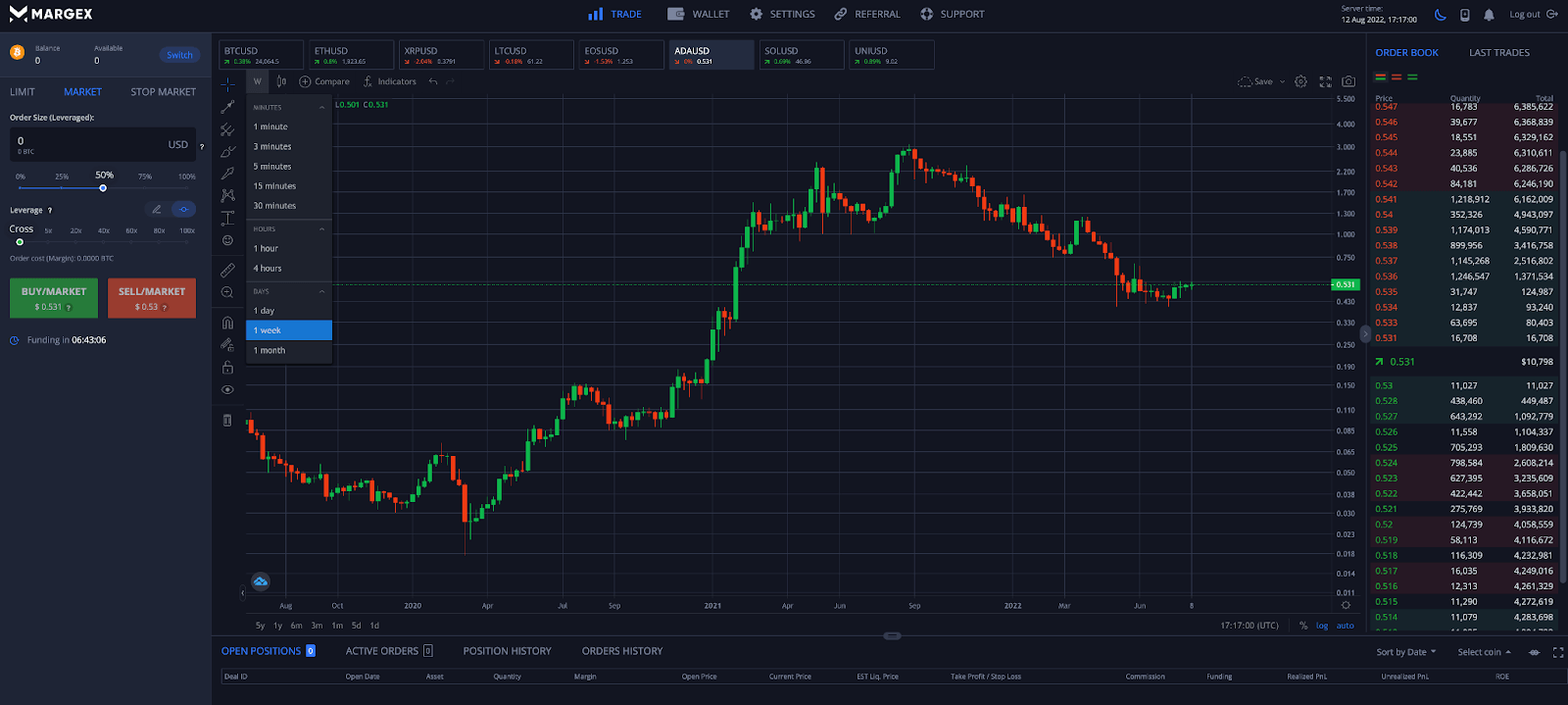

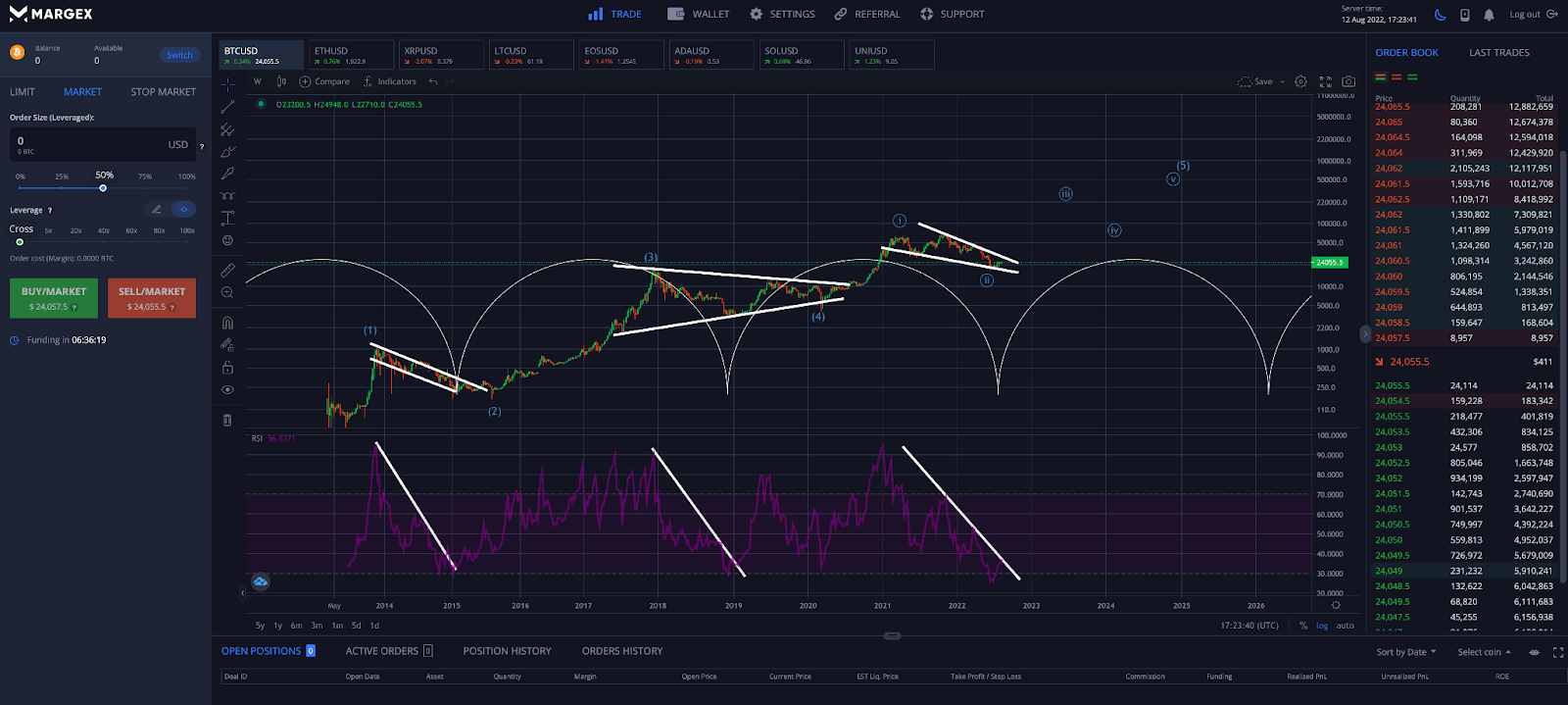

The below weekly chart shows the timeframe that swing traders would choose for longer time frame trades. Swing traders may also use the monthly chart.

Scalping:

Scalping is an active trading strategy that focuses on increased trading volumes to profit and usually enters and exits the market within seconds. Successful scalpers research the crypto asset, past performances and what time is best for entry before making a decision.

In the example below, scalp trades are typically taken using shorter timeframes, from 1 minute to one hour.

Trend trading:

Trend trading involves buying and holding assets for a more extended period, usually more than a month but not up to a year. During that period, the market prices would react to massive trends, allowing trend traders to take advantage of value changes among digital assets.

What You Need To Become A Successful Crypto Trader

What determines the success of a project is the mindset of the person behind the project. This view also applies to crypto traders who want to make a profit regardless of their strategies. While research and in-depth analysis are required to make investment decisions, you also need the right attitude to implement your plans. Therefore, there are tips that you need to become a successful crypto trader.

Risk management

As stated earlier, crypto traders need to understand the risks of transacting digital assets in the market. Therefore, as you get excited when there is a significant change in the market price, you should not forget the risks that come with such changes. Hence risk management helps you to control potential losses and provides volatility protection.

Some risk management steps to take include:

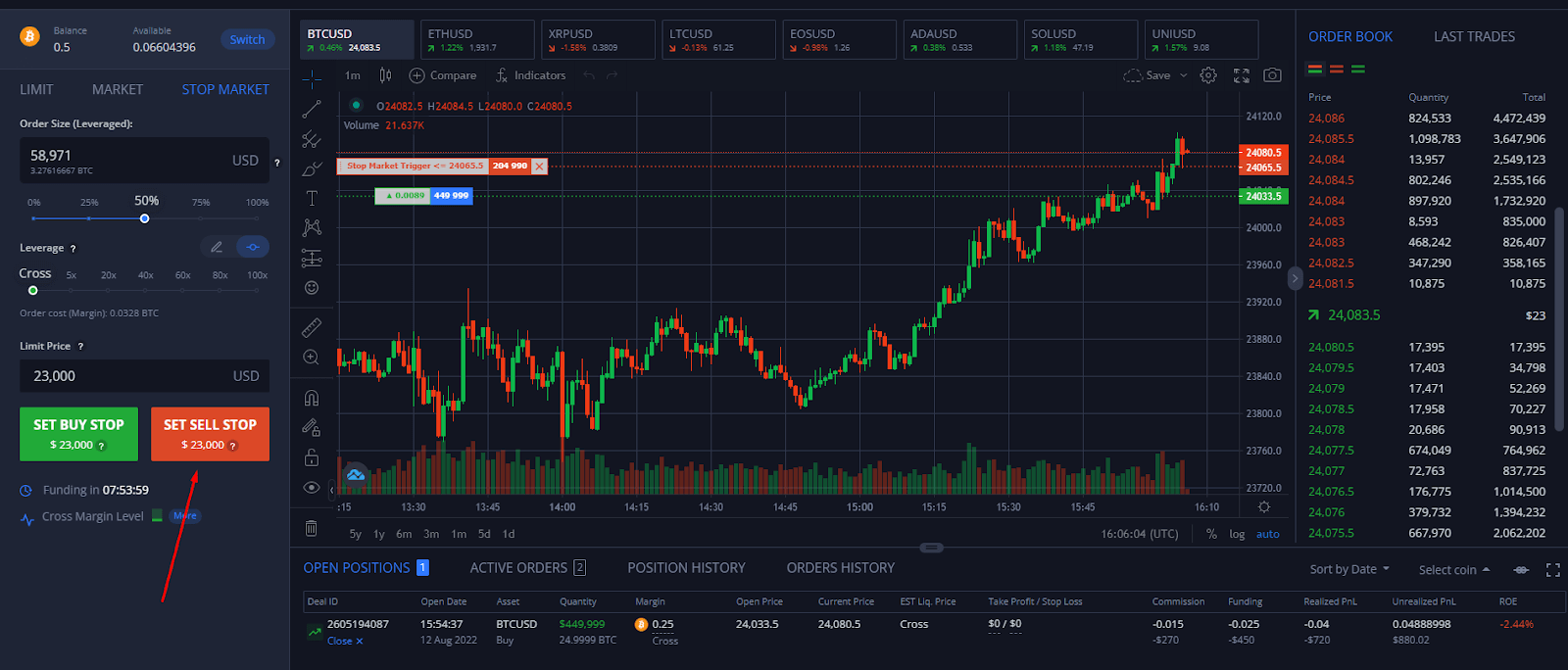

- Using a stop loss to avoid huge losses.

Stop loss helps you to have financial accountability and ensures that you do not get caught up completely in cases of extreme volatility. This is a major attribute that successful crypto traders incorporate and is an essential aspect of trading.

- Diversifying crypto investments.

- Market analyses.

Technical analysis

Technical analysis is an essential tip for crypto traders who choose to transact actively in the market because it helps to determine when to enter or exit transactions. Additionally, past charts, indicators, and data can help predict future digital asset performances.

Furthermore, you also need to understand the resistance and support levels in a crypto market trend. While a support level is the lowest point of a crypto’s value, the resistance level is the highest.

Technical analysis example:

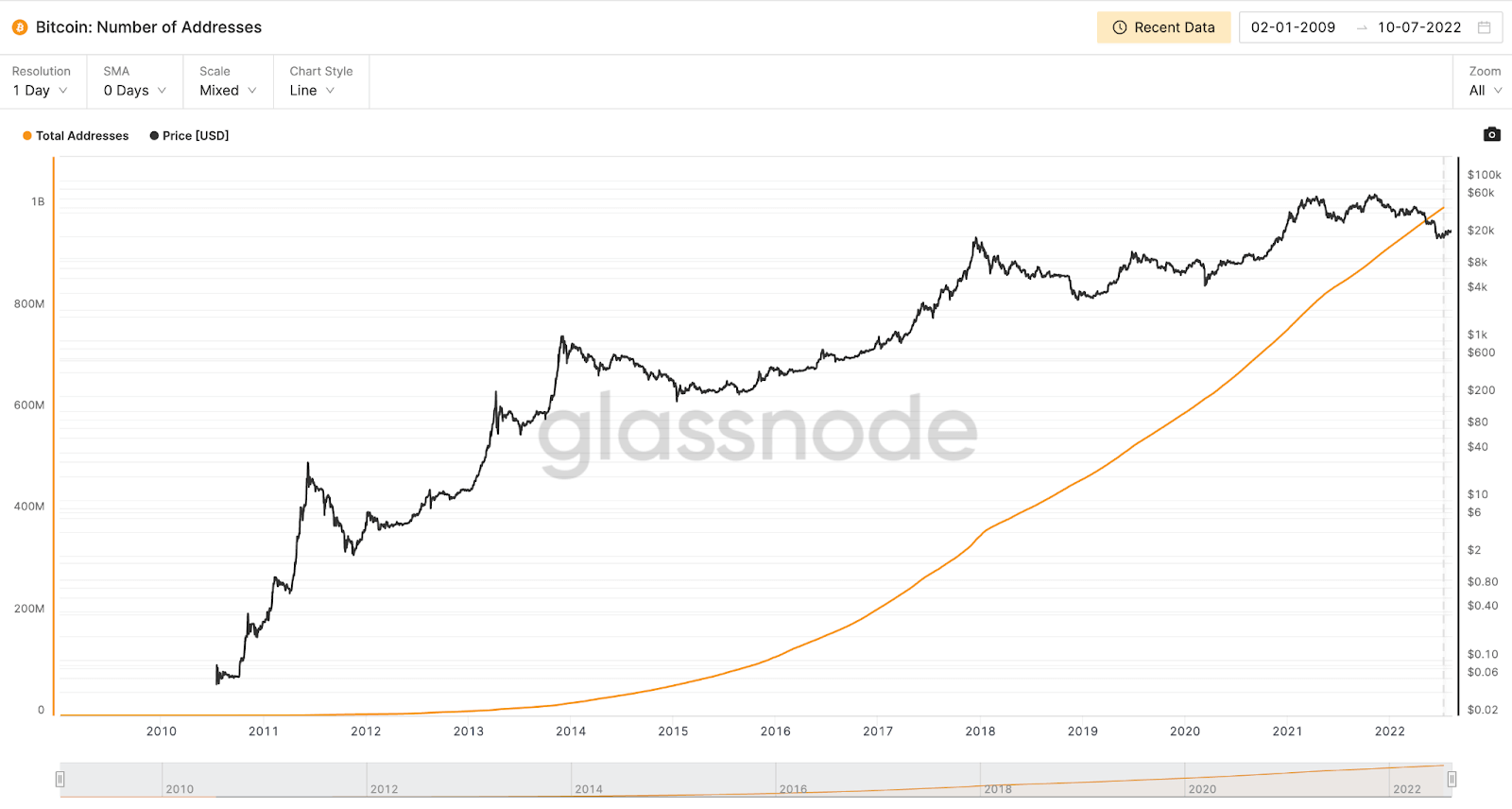

Fundamental analysis

Fundamental analysis is one of the major aspects that is required for crypto traders to understand. It combines different information including historical market movements, external influences such as regulation and industry trends.

News about a coin such as government regulations could impact the value of a token. For example in 2021, China banned Bitcoin mining and this led to a sharp decline in the value of BTC during this period.

Therefore smart traders are always up to date with the latest information and are equipped to leverage it to their advantage.

Fundamental analysis example:

News and community hype

Successful crypto traders keep track of information concerning their assets through community conversations, especially on social media. But unfortunately, information can turn the crypto market upside down because people may act based on the fear of the unknown.

For example, Ripple was one of the leading crypto assets after Bitcoin and Ethereum. However, the asset fell from grace when the U.S. Securities and Exchange Commission filed a lawsuit against the blockchain platform for a regulation breach.

Therefore, news and the community have a role in determining when it is profitable to enter or exit the crypto market.

Order types

Many leading cryptocurrency exchanges will not allow you to take on the market without the necessary tools. One important tool is the crypto trade order. To become a successful crypto trader, you need to know the different types of orders to prevent losses. Some of these orders include limit orders and “stop losses” orders.

Order type example:

While a limit order prevents you from overpaying for a digital currency, especially when there is an unexpected price surge, a stop losses order protects you from losing more money from your transitions.

Discipline and self-control

Successful traders are disciplined and patient. They know how to maintain their self-control. But unfortunately, most losses are attributed to greed and fear, especially among new investors. Because of impatience and greed, a trader can enter or exit the market at the wrong time, leading to loss.

Additionally, discipline allows you to grab rare opportunities during a market trend. While many traders like to follow the crowd, you could always stick to your trading pattern regardless of the rumors in the market.

Cryptocurrency Trading Risks

Cyber attacks

One of the main risks of trading cryptocurrencies is cyber attacks and fraud from hackers and scammers. Recently, the Solana blockchain, one of the most secure crypto platforms, suffered a massive hack from bad actors, with over 8,000 wallets losing their funds worth over $7 million.

Therefore, crypto traders should always try to utilize wallets and crypto exchanges with extensive KYC procedures and a modern online security protocol.

Volatile market

Many high-ranking individuals and organizations have spoken against crypto because of its unpredictable nature. Moreover, even governments are trying to restrict trading activities within their borders. Therefore, the market volatility poses a significant risk to crypto trading.

When the market change becomes negative, it affects the crypto value, including top assets like Bitcoin and Ethereum. Many crypto traders have lost their investments because of the market collapse. A recent example is Terra’s fall, which led to other assets battling the bear market.

FAQ

Here are some common questions about how to become a crypto trader.

How do I start trading crypto?

You need to start by researching the cryptocurrency you want to trade. Then, choose a trading strategy that suits you. Next, check out various charts and data to understand the market price movements. Then you should also install a crypto wallet and start trading crypto on a reputable exchange platform.

You can also use copy trading to practice how to place trades in the crypto market. Some platforms also allow new traders to use demo accounts

How much does a crypto trader make?

According to reports, crypto traders can make up to $100,000 per annum. Additionally, individuals working in the crypto industry could earn as high as $75,000 to $90,000 a year.

How can I become a certified crypto trader?

To become a certified crypto trader, you need to enroll in a professional crypto trading course where you will learn the basics of crypto trading and how to read and interpret trends and data. After passing the final exams at the end of your learning, you will earn a certificate of completion.

Can you get rich with crypto trading?

While many crypto traders have gotten rich from trading cryptocurrencies, others have also lost a significant amount of their crypto market investments. To become a successful crypto trader, you must follow the essential tips to avoid making wrong transactions.

How much money do you need to start trading crypto?

If you are a new crypto trader, it is advisable to start trading with a minimum amount of around $40 to $100 till you understand how the crypto market works. This is because you are still in your learning stage. Therefore, you can avoid loss by starting small.

How much does it cost to start trading crypto?

There are costs attached to every crypto transaction on trading platforms which are between 0% and 1.5% per trade. So when you make a transaction of $1,000, you could pay a fee between $0 to $15 depending on the crypto exchange.